TALK TO US

TALK TO US

TALK TO US

TALK TO US

PRODUCTS

Multilingual AI

40% of the information available on the web is in languages other than English. With EMAlpha’s Multilingual AI, investors gain the ability to track information in any language worldwide. This not only helps them mitigate risks but also enables them to stay updated on every major development. By harnessing the power of cutting-edge large language models, trained on meticulously curated information sources, EMAlpha delivers both standardized and tailored solutions, catering to diverse client use cases.

Multilingual LLM Knowledge Solutions

EMAlpha’s Multilingual Large Language Model (LLM) services encompass a comprehensive suite of knowledge discovery solutions designed to facilitate knowledge sharing, learning, knowledge capture and storage, strategy development, and collaboration. By harnessing the power of LLM technology, EMAlpha empowers individuals and organizations to unlock valuable insights and leverage knowledge effectively.

Emerging markets data

Information discovery is a big challenge in emerging markets due to the local language barrier. EMAlpha provides EM risk datasets with various underlying themes, thus providing extensive coverage of emerging market companies.

ESG data

With coverage of more than 55 countries and 15000+ companies, EMAlpha’s ESG data covers all the major frameworks such as SASB, TCFD, UNSDG etc. EMAlpha also provides sovereign ESG data, private companies’ ESG data, as well as AI-driven green bond scores.

Using multilingual NLP technology, EMAlpha extracts relevant data from over 50+ developed and emerging markets including US, UK, Japan, China, India, Brazil, and South Korea.

With climate change gaining priority, how are investors’ portfolios aligned with net-zero and climate goals?

How do company’s disclosures such as its sustainability report fare when assessed under a global framework? What does an ESG report convey?

With all the various ESG frameworks and jargon that are being used in the sustainability space, many companies are finding it confusing to report ardently on ESG.

Perform EM sentiment analysis for multiple companies. Check real time news flow to stay abreast of the latest happenings.

As the popularity of green bond has increased exponentially, it has become necessary to leverage technology to spot greenwashing and ensure that capital is invested in the aligned impact projects for the right reasons.

Who are we?

The EMAlpha team consists of members with diverse backgrounds and experience covering Emerging Markets, Portfolio Management, Trading, and Machine Learning.

The team consists of domain experts in emerging markets with significant experience in fundamental and quantitative analysis. A number of our team members have PhDs in finance and hard sciences and have spent considerable time applying machine learning methods to the markets. One team member has been a recipient of the Thomson Reuters’ Starmine Analyst Award for ‘Best Earnings Estimates’ and ‘Best Stock Picker’. Another member has published highly cited papers in Theoretical Physics. We believe that a strong team with diverse backgrounds helps us craft a multidimensional approach towards solving the data and investment problems in front of us.

INSIGHTS

General Election: India, the world's fifth largest and fastest-growing major economy, is undergoing a 44-day general election starting April 19, with nearly 970 million citizens eligible to vote.

Turkey's municipal elections are attracting attention due to significant political implications, with over 61 million voters across 81 provinces choosing among 34 parties...

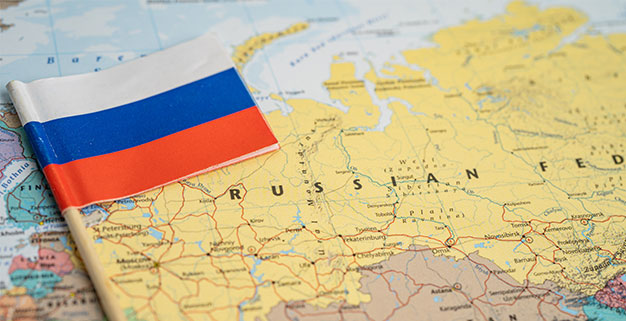

Despite sanctions branding Russia as "un-investable," fund managers still monitor Russia's economy...

Political Landscape: Defense Minister Prabowo Subianto leads in local polls ahead of Indonesia's elections, strategically choosing Jokowi's son as his running mate...

Political Dynamics in Pakistan: Imran Khan faces challenges after courts imposed fourteen- and ten-year prison sentences, while PTI grapples with setbacks...

DPP's presidency win and KMT's legislative majority highlight Taiwan's evolving political landscape...

India’s Q3 2023 GDP grows 7.6%, fueling a 6.5% full-year forecast with pre-election spending...

Amid the extensive discussion within public forums concerning the technical facets of Large Language Models (LLMs), encompassing both their applications and cost...

Argentina's economic decline over a decade heightens importance of 2023 elections...

Emerging markets lose 2023 gains due to higher rates, Fed changes, and climate risks...