Indonesia Election: Political Dynamics and Economic Impact

Synopsis:

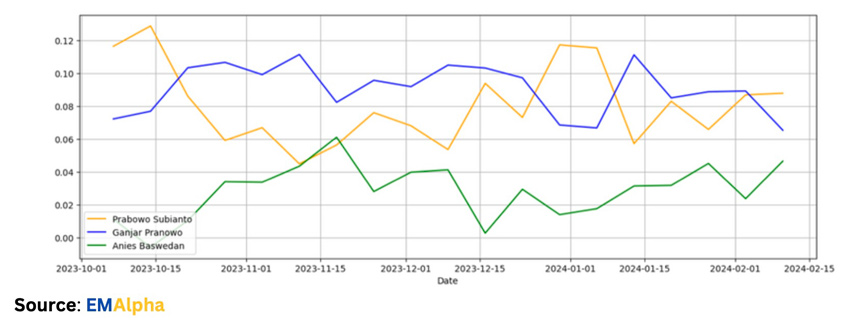

Political Landscape: Defense Minister Prabowo Subianto leads in local polls ahead of Indonesia’s elections, strategically choosing Jokowi’s son as his running mate. However, EMAlpha’s AI-driven sentiment data points to a significant possibility of run-off.

Economic Transformation: Indonesia has shifted from being one of “the fragile five” economies in 2013 to boasting a current account surplus and maintaining a positive trade balance for 44 consecutive months. Fiscal discipline has been evident, with the fiscal deficit reduced to its lowest level since 2011, standing at 1.65 percent of GDP last year.

Investor Confidence: Notwithstanding the short term election-related market volatility, Indonesia is in a good position. Stable inflation at 2.6 percent has attracted portfolio inflows, with foreign investors now holding about 20 percent of local bonds following over USD 2 billion in purchases in late 2023. The equity market has experienced significant growth, with the local stock exchange index rising by 6.1 percent in 2023, accompanied by a surge in market capitalization to nearly USD 757 billion.

Market Dynamics: While the equity market saw positive growth, share price rises have stalled due to pre-election jitters, impacting the currency and leading to cautious investor sentiment in the short term. In the short-term, investors should carefully consider the possibility of a run-off scenario.

The Covid-19 Induced Global Chip Shortage

When Covid-19 hit the world in early 2020, a pall of gloom hung over the global economy and uncertainty ruled the day. The future was pretty much unchartered and countries and companies around the globe started swinging in the dark. The current chip shortage is the result of the unexpected ways in which the global industries’ demand has played out for the chips.

To download the case study,

- Please enter your name

- Please enter your email id

By clicking on “Submit and download”, you agree to receive future insights from EMAlpha.

Download the case study