ESG Advisory

With all the various ESG frameworks and jargon that are being used in the sustainability space, many companies are finding it confusing to report ardently on ESG.

EMAlpha offers ESG advisory to assist companies in familiarising them with framework relevant disclosures and identifying gaps in their ESG initiatives and sustainability related communication.

Multiple frameworks covered

Real time ESG scores and benchmarking

Data-based approach

ESG domain expertise

Use-cases

By amalgamating domain expertise with technology, EMAlpha makes it easier for companies to comply with framework relevant disclosures and make their ESG initiatives more impactful.

Better understanding of frameworks

ESG Reporting

Use ESG scores to further improve reporting

Investor Relations solutions

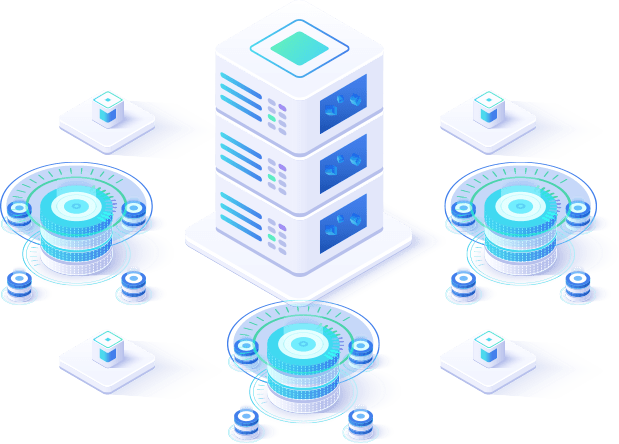

ESG Data

Using multilingual NLP technology, EMAlpha extracts relevant data from over 50+ developed and emerging markets including US, UK, Japan, China, India, Brazil, and South Korea. Information previously hidden in the local dialect is now accessible to investors, enabling them to take timely action.

Real time news tracking

50+ markets covered

Portfolio analysis

Framework specific analysis

Self-disclosure data and benchmarking

Real time news tracking

50+ markets covered

Portfolio analysis

Framework specific analysis

Self-disclosure data and benchmarking

Use-cases

Asset managers and fund managers looking to implement ESG filter in their investments can use EMAlpha’s ESG data for:

Investment decisions

Risk Management

Thematic ETFs