The Global Chip Shortage: How to play it out in the Emerging Markets

Synopsis: The world is witnessing an unprecedented chip shortage that has forced many global car makers to temporarily halt their operations, delayed launch of Apple’s products, cancelled release of Samsung’s highly anticipated Galaxy Note smartphone and even made Sony’s PlayStation 5 a hard bet to catch. How did we get here? When Covid-19 hit the world, automakers, apprehensive of low demand, cut their chip orders. While the auto sales dwindled, the Smartphone, PC and consumer electronic industry saw a sharp rise in demand as people started buying more gadgets while they remained locked in their homes. As the months rolled on and lockdowns were lifted, the demand for cars rose sharper than the auto makers had anticipated. This huge demand but lack of supply has what caused this global chip shortage that we are witnessing today. EMAlpha took a deep dive into the prevailing scenario to find if there are any opportunities for investors to make the most out of this scenario. And sure enough, there indeed is. We found two companies that stand to gain handsomely courtesy the huge demand that has arose in semiconductors around the globe. They are Taiwan’s TSMC and South Korea’s SK Hynix. EMAlpha, utilising its AI and proprietary algorithm tries to figure out what their future prospects could be.

The Covid-19 Induced Global Chip Shortage

When Covid-19 hit the world in early 2020, a pall of gloom hung over the global economy and uncertainty ruled the day. The future was pretty much unchartered and countries and companies around the globe started swinging in the dark. The current chip shortage is the result of the unexpected ways in which the global industries’ demand has played out for the chips. Given below are the reasons as to why it happened as such:

- In the initial days of Coronavirus pandemic, the automakers cut their chip orders due to reduced demand as people around the world were locked down in their homes. But once lockdown norms started to ease, people no longer wanted to use public transport to move around. They wanted their own vehicles and understandably so. This resulted in a sharp rise in demand that the auto-makers hadn’t anticipated. They scrambled to the chip manufacturers to get the semiconductors that the cars required to function. Unfortunately, the chip manufacturers’ order books were packed and the auto-makers found themselves at the end of the queue.

- When people were locked in their homes and remote-working, the demand for gadgets like smartphones, gaming consoles, laptops increased steeply and they started flying off the shelves. Buoyed by this increase in demand, consumer electronics manufacturers stepped up their orders with chip manufacturers. This unprecedented electronics demand laid the foundation of what we now witness.

- Late last year, the U.S. placed restrictions on Semiconductor Manufacturing International (SMIC), the biggest semiconductor manufacturer in China, barring it from getting advanced chip manufacturing gear, and making it much harder to sell its finished products to companies with U.S. ties. Customers needed to shift their orders to competitors like TSMC which was already operating at hundred percent capacity.

Some of the interesting news flow related to the above were accessed by EMAlpha:

- Why there’s a chip shortage that’s hurting everything from Playstation 5 to Chevy Malibu: Link

- Trump’s China tech war backfires on automakers as chips run short: Link

The Global Semiconductor Industry

Before proceeding, it is important to take a quick look at how the global semiconductor industry is structured:

- Fabless semiconductor companies – These are the companies which design chips while outsourcing the manufacturing of the chips to foundries.

- Pure play foundries – These companies only manufacture chips that are designed by other companies (The Fabless).

- Integrated device manufacturers – Then there are a few companies like Intel who design, manufacture and sell their own chips.

This brings us to the all-important question: How do investors play out this global chip shortage? It is clear that the chip shortage has risen out of sudden demand for all things electronic. And keeping this in view, EMAlpha has shortlisted two companies that stand to gain handsomely over the coming months.

1. Taiwan Semiconductor Manufacturing Company (TSMC)

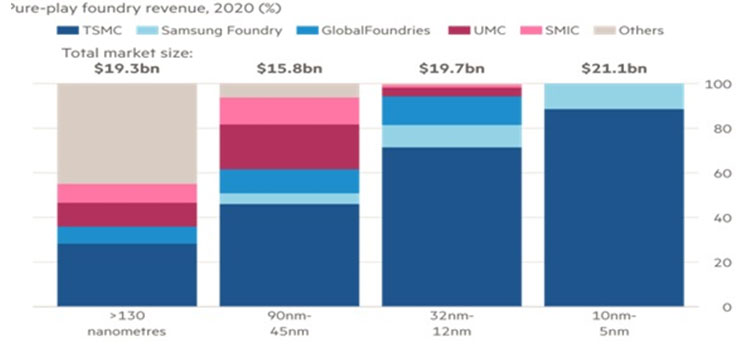

Forget about the Samsungs, the Intels and the Qualcoms of the world. The one company that has, for a very long time, been the unsung hero of the semiconductor manufacturing industry is TSMC: the largest contract chipmaker in the world. TSMC, which holds more than 50 percent share of the global market for pure-play foundry services, has mostly been under the radar because the chips it manufactures are designed and sold by giants like Apple, Nvidia etc. With the current global chip shortage, TSMC could very well be one of the most important company in the world today as tech and auto companies rush to it to fulfil their demand.

TSMC has a global capacity of about 13 million 300 mm equivalent wafers per year as of 2020, and makes chips for customers with process nodes from 2 micron to 5 nanometers. TSMC is the first foundry to provide 7 nanometer and 5 nanometer production capabilities with the latter being applied on the new Apple iPhone 12. With plans to set up a plant to build 3 nanometer chips in what is touted as “the world’s most advanced chip factory”, TSMC is well poised to carry its dominance into the future. One thing to be noted here is that in the 5 nanometer category, it’s only rival is Samsung which trails TSMC by a good margin.

Fig. 1: TSMC and the Global Pecking Order

Source: Bain/IC Insigts/Gartner

Over the past few months as the global chip shortage has played out, TSMC has seen its lights glow brighter. On 15th April 2021, it reported a Q1 net income of $4.98 billion. It also announced plans to invest $100 billion over the next three years to meet the soaring global demand.

Some news flow captured by EMAlpha are as follows:

- TSMC’s first quarter net profit rose 19%, beat analysts’ estimates: Link

- Taiwan’s TSMC plans $100 billion investment to meet demand: Link

- Taiwan’s TSMC 3 nm capacity booked through 2024: Link

- TSMC: How a Taiwanese chipmaker became a linchpin of the global economy: Link

Fig. 2: TSMC Stock Price over last one year

Source: Google

As can be seen, the stock price has doubled over the course of a year. It could be attributed largely to an increase in orders for its 7 nanometer and 5nm technology in 2020, amid strong demand worldwide for 5G applications and high-performance computing (HPC) devices. After touching a high of 673 TWD in 21st Jan 2021, the stock price has undergone a healthy consolidation over the past three months which could be setting it up for what could be a potential breakout. And with the order book that it commands currently, that won’t be a surprise.

2. SK Hynix

Sk Hynix is the 2nd largest memory chipmaker in the world producing DRAM and NAND flash memory chips. Owing to the covid-19 induced lockdown, the demand for computers, smartphones and servers used in data centres and by cloud service providers increased sharply. This has helped companies like Sk Hynix which makes DRAM and NAND memory chips that are extensively used in these products.

The trend for remote work and education has increased demand for computers which has benefited Sk Hynix by driving up demand for mobile memory chips. As a result, DRAM and NAND shipments both broke the company’s sales predictions for 1Q21, growing at 4 and 21 percent on year respectively. During the earnings call, SK Hynix forecasted a 20% demand growth in DRAM chips this year and mid 30% growth for NAND flash. It also plans to finish developing the fourth-generation 10-nanometer (1anm) DRAM technology using extreme ultraviolet (EUV) equipment within this year and begin mass production of the product

Some important news flow captured by EMAlpha:

- Sk Hynix reports a 53% jump in first quarter net profit: Link

- Sk Hynix lays out plan to expand 8-inch foundry business: Link

Fig. 3: SK Hynix Stock Price over last one year

Source: Google

Please refer our insight “Sk Hynix: From hopeless laggard to high flyer in months”, to know better about the events that led to the sharp rise of the stock price between November 2020 and February 2021. Now what has happened since the highs of Feb 25? The stock has undergone a consolidation over the past 70 days. With healthy Q1 profit, strong demand for its products and plans to expand its business, one can hope the consolidation soon snaps towards an upward trajectory.

What does the Stock Market reveal about the Semiconductor Industry?

We tried to understand the investor sentiment on the Semiconductor industry over the last few months to figure out if the recent consolidation phase is linked to the general softening of investor sentiment or is it a company specific issue with TSMC and SK Hynix. In many of these globally linked industries, the prevailing investor sentiment is shaped by broader outlook on fundamentals along with sector rotation from time to time. This is something akin to the massive preference for Tech stocks seen globally that began in March 2020 and continued for almost 8-10 months before there was rotation towards some other sectors like Banking etc. that picked the baton from there. So, the objective behind this exercise was to look at both absolute and relative performance in that context for Semiconductor industry in conjunction with the stock price performance of TSMC and SK Hynix.

SPDR S&P Semiconductor ETF – The S&P Semiconductor Select Industry Index is an equal-weighted index that draws constituents from the semiconductors segment of the S&P TMI.

Fig. 4: YTD performance of SPDR S&P Semiconductor ETF

Source: Google

As shown in the chart above, the YTD performance of SPDR S&P Semiconductor ETF has been mixed and the consolidation phase is clearly visible. This looks very different from how the SPDR S&P Semiconductor ETF performed during March – December phase in 2020.

Fig. 5: Five year performance of SPDR S&P Semiconductor ETF

Source: Google

KraneShares CICC China 5G & Semiconductor Index ETF (KFVG) – We also looked at KraneShares CICC China 5G & Semiconductor Index ETF (KFVG) that measures performance of the CICC China 5G and Semiconductor Leaders Index. The Index is designed to track the performance of companies engaged in the 5G and semiconductor related businesses, including 5G equipment, semiconductors, electronic components and big data centres.

Fig. 6: KraneShares CICC China 5G & Semiconductor Index ETF (KFVG)

Source: https://www.investing.com/etfs/kfvg

We can deduce that for both TSMC and SK Hynix, the consolidation phase visible from January 2021 onwards is to some extent linked to sector sentiment and the relative performance would look better for both of these stocks.

Where things could get a little dicey?

The fundamentals are robust for both TSMC and SK Hynix and we are confident that after the current phase of consolidation, the best times will be waiting for both of the companies. However, we need to bear one thing in mind. Usually, the market looks forward by at least three to six months and in some cases even longer. Now, why is it that the stock prices have behaved the way they have in the last 3-4 months? Has the shortage concern peaked? As the chip shortage is all over the business and even mainstream media, there is hectic activity to sort this situation out. Does it mean that the stock prices are conveying that the best is behind them? This is something that is a little difficult to explain as in why the stocks have not moved up in the past few months.

EMAlpha news flow analysis sheds some light on this. Most of the news flow since January 2021 has focused on how auto companies have been struggling with chip shortage. But there are also reports indicating that this situation is unlikely to ease out in the near term. For example, “Chip shortage will last beyond 2022 as demand far outstrips supply”, the Intel chief has said. He is also realistic about when the semiconductor shortage would abate. “We can’t build fabs overnight, it takes a couple of years to get built up.” Link

That’s alright. But the challenge now is that the issue has become political. There are reports that the Biden administration is working to address the global semiconductor shortage and is identifying choke points in supply chains and discussing an immediate path forward with businesses and trading partners and for the longer term, they are looking at strategies to avoid bottlenecks.

Please refer:

- Biden team pledges aggressive steps to address chip shortage: Link

- Chip shortage spreads, hurting sales at Apple and Samsung: Link

So, there could be investor concerns on two fronts,

a) The knee jerk reaction from US administration could be negative for manufacturers not based in USA and that may have impacted the stock price performance of TSMC and SK Hynix since January,

b) With more long-term measures, which although will take a couple of years to show results, the supply would increase significantly, creating a supply-glut and that wouldn’t bode well for the global manufacturers.

These are the concerns which may have possibly impacted the sentiment.

It is pertinent to add here that TSMC is working on diversifying its manufacturing and adding USA into its list of manufacturing locations. TSMC plans on opening six new manufacturing plants in the U.S with the first plant being based in Arizona and whose construction is expected to begin shortly. Please refer to the important news flow picked by EMAlpha-AI on US expansion plans of TSMC:

a) TSMC eyeing expansion of planned Arizona plant: Link

b) TSMC hires 250 employees destined for Arizona site: Link

c) TSMC says can catch up with auto chip demand by end June: Link

d) Taiwan foundry TSMC approves US$2.89 billion for capacity expansion in ‘mature technology’ amid chip shortage: Link

References

- https://www.spglobal.com/ratings/en/research/articles/210420-global-chip-shortage-engulfs-a-growing-list-of-tech-players-11918868 (Accessed on 2nd May 2021)

- https://en.yna.co.kr/view/AEN20210428002251320 (Accessed on 2nd May 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.