Is Saudi Aramco prepared for a ‘Renewable’ future: What do we know from the Company’s Reporting?

Saudi Aramco was the first trillion-dollar market cap company in the world and its IPO has been the biggest, as yet. It won’t be an exaggeration to state that Saudi Arabia is Aramco and Aramco is Saudi Arabia. Because there is no separate ESG or Sustainability report, Saudi Aramco’s Annual Report for 2019 is the most useful company disclosure for an ESG analysis of the company. On the basis of this analysis, EMAlpha Research team has drawn some clear conclusions: a) the ESG reporting needs to be more detailed, befitting a company of this size, b) there needs to be more balance between E, S and G in reporting. For example, the reporting on environment and climate change requires more information and data from the company, c) there are specific issues such as ‘succession planning’ which need to be addressed. Broadly speaking, there is not enough information which can shed light on the steps Saudi Aramco is taking to prepare itself for the future in which the world would be much less dependent on Oil.

How much does a company matter to a country? An interesting question indeed. For example, how important is Apple or Microsoft to the United States of America? Or, how much does Samsung matter to South Korea? Or, in that vein, how essential is the Taiwan Semiconductor Manufacturing Company (TSMC) for Taiwan? Of course, a lot and much more. Nevertheless, Apple is not USA and nor is it the other way around. Similarly, there is more to South Korea than Samsung and Taiwan is not all about just TSMC. But what if there were a company whose contribution to the nation surpassed all estimations and that too by a good mile.

There have been several such examples throughout history. For instance, there was a company from Europe which, at its peak, accounted for 70% of its country’s stock exchange market cap, contributed more than 20% of its exports and was responsible for as much as 4% of the country’s GDP. Talk about big! These are indeed mind-boggling numbers but hold on, there is more. The company accounted for more than 40% of corporate Research & Development (R&D) expense of the country and an almost 15% share in the corporate tax collected. Yes, we are talking about Nokia and Finland. The importance of Nokia to Finland can be inferred from the fact that the problems with Finland’s economy over the last decade, to a large extent, were attributed to the decline of Nokia.

Let’s consider other modern-day examples that are more current. Think of Saudi Aramco and its importance to Saudi Arabia. While it is well known that the Middle-Eastern Kingdom has an oil-based economy and for several decades now, the crude oil production, processing and refining has been under the control of the Government, yet the Saudi Aramco numbers still look astonishing. The Saudi Government controls the Oil sector through Saudi Aramco and its subsidiaries and the sector accounts for more than 80% of the state’s budget, more than 40% of the GDP and 90% plus of the Kingdom’s export earnings.

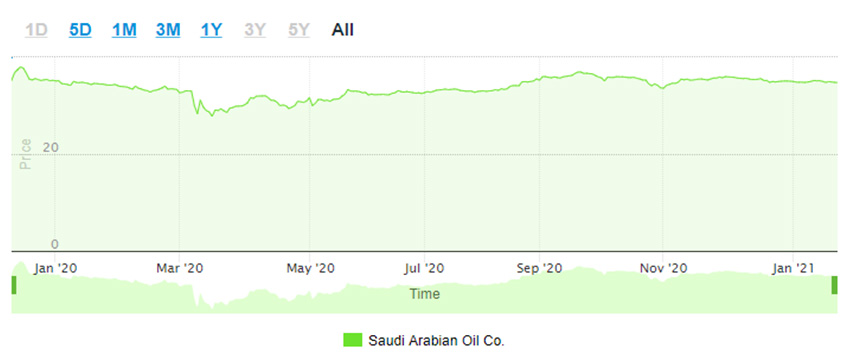

Hence, it is not a surprise that Saudi Aramco (officially, Saudi Arabian Oil Company) accounts for more than 75% of TADAWUL (Saudi Stock Exchange) market cap. The next one on the list is over 20x smaller and that company is also one of the subsidiaries of Aramco. Considering how the Crude Oil market has been in the year 2020 (please refer Crude Oil Prices In 2020: How Unstructured Data Analysis Handled This Exceptional Year…Not Too Badly! dated 12th January 2021), the stock price performance of Saudi Aramco has been fairly resilient, with a narrow range for highs and lows (52-wk high – SAR 37.15, 52-wk low- SAR 27.00).

Chart 1: Saudi Aramco Price Performance (12th December 2019 – 21st January 2021)

Source: Tadawul (https://www.tadawul.com.sa/)

While it is possible to argue that it is not easy to replace Oil as the most reliable and efficient source of energy for individuals and for purposes like transportation, even the strongest supporters of the premise ‘Oil will continue to remain relevant in the foreseeable future’ will concede that Oil, at best, is the ‘Fuel of 20th Century’ and certainly not the ‘most preferred choice for energy in the 21st Century’. While the most drastic decline in the per unit cost in the last couple of decades is of Solar Energy, the fact that the market cap of Tesla is almost equal to the next ten auto companies is a sign of changing times.

All this means is that Saudi Aramco must be paying a lot of attention to ‘business resilience’ and ‘sustainable model for operations’. In short, a future in which the company is thinking beyond Oil. Of course, it will be a challenging transformation and while it is true that the company got listed in late 2019 and that there is a learning curve when it comes to operational and financial reporting, the current state of disclosures on this count is far from being satisfactory. In terms of details the company shares on how it is preparing for a future where oil prices may remain subdued perennially and electric vehicles will become more popular, there is significant scope for improvement.

We have been looking closely at the company even before it became public and was only just preparing to get listed (Please refer to The Listing of Saudi Aramco: Messages Beyond Emerging Markets dated 9th February 2020 and Oil Sentiment has Conflicting Signals from IEA and Saudi Aramco Stock Price dated 16th May 2020). And, we were not really surprised at the news that previously, Saudi Aramco had omitted some carbon data in disclosures and that the company’s self-reported carbon footprint may nearly double from the earlier reported figures.

EMAlpha is also taking a deep dive on Saudi Aramco’s disclosures and we looked at their financial reporting in detail. What caught our immediate attention was that Saudi Aramco had not really published a separate Sustainability or ESG report. To be fair, there is a separate ESG section as a part of the Annual Report for 2019. But, in a 228 pages Annual Report, it is just about 21 pages long or put it another way, less than 10% of the total. There are other interesting results that were derived from Saudi Aramco’s Annual Report for 2019;

- The word ‘climate’ appears only 34 times while occurrence of ‘climate change’ is even more infrequent at 22 times in the Annual Report of Saudi Aramco for 2019. For ‘greenhouse gas’, there are 6 appearances.

- The word ‘environmental’ appears 92 times in the Annual Report and ‘environment’, 139 times. At EMAlpha, our research indicates that the word ‘environmental’ is a better choice than ‘environment’ while discussing issues like environment protection and the efforts the company is taking to mitigate climate change. That’s because the word ‘environment’ is used in different contexts too.

- The word ‘social’ appears 47 times and ‘society’, 11 times, along with ‘community’ that appears 18 times. Of the total 21 pages on ESG in the Annual Report of Saudi Aramco for 2019, there are 2 pages on Sustainability, 4 pages on Governance Framework, 6 on Environmental Stewardship and 8 on People and Communities. The first page is the ESG contents page and hence, can’t be included in either of these categories.

- The word ‘governance’ appears 84 times while ‘ethics’ appears 10 times. There are 7 appearances for ‘anti-bribery’ and 6 for ‘anti-corruption’. The word combination ‘corporate governance’ appears 32 times. There is a separate 20 pages section in the Annual Report of Saudi Aramco for 2019 on Corporate governance, but it is mostly about aspects which are necessary for compliance reasons such as details on Board of Directors, Senior Executives, Board structure and composition, Audit Committee report, Risk and HSE Committee report, Nomination Committee statement, Compensation Committee statement, Compensation and other interests and Governance, risk and compliance.

- In one of the most interesting search results for the Annual Report of Saudi Aramco for 2019, there are ZERO appearances for ‘succession’ and ‘succession planning’. How will investors react if they see that ‘succession’ is not even mentioned once? Is it that the company is only about ‘operating smoothly and efficiently’ and that there is no strategic vision needed and hence, the senior management continuity or proper succession planning doesn’t even matter?

Next, we did an analysis of the Annual Report of Saudi Aramco for 2019 using EMAlpha proprietary tools for ESG evaluation. This tool is based on a proprietary model of evaluating text for ‘E’, ‘S’ and ‘G’ issues separately. Not just on the sustainability or ESG reports, it can be applied to any text, any news or any source material to see how the coverage measures on these ‘E’, ‘S’ and ‘G’ evaluations. The positive scores mean a favourable tone on the selected parameter of either ‘E’, ‘S’ or ‘G’ and similarly, the negative scores will show the company in a poor light.

On the basis of analysis of Saudi Aramco’s Annual Report for 2019 using this EMAlpha proprietary tool for ESG evaluation, we found the following ESG scores;

E: -0.09

S: 1.53

G: -0.55

Similarly, when we carried out the analysis of just the ESG section in the Saudi Aramco’s Annual Report for 2019, we found the following ESG scores;

E: -0.26

S: 3.71

G: 0.42

This confirms our assessment that the ESG reports are usually focused much more on Social issues (please refer Do Organizations pay more attention to ‘S’ in ESG Reporting: A critical evaluation of Alibaba Group dated 20th January 2021) and Saudi Aramco is no exception to that. At EMAlpha, the ESG team is doing more research on why ‘Social’ gets more prominence as compared to Environmental or Governance issues. But on the basis of preliminary assessment, we find that very often, the ‘Social’ part is more prominent in ESG reports.

To look at specific cases in the context of ESG is a very intense yet interesting exercise and analysing the Saudi Aramco’s Annual Report for 2019 was a similar experience for the EMAlpha Research team. There are clear conclusions on the basis of this analysis: a) the ESG reporting needs to be more detailed, befitting a trillion-dollar market cap company (actually, it is close to a couple of trillion dollars), b) there needs to be more balance between E, S and G in reporting. For example, the reporting on environment and climate change requires more information and data from the company, c) there are specific issues like ‘succession planning’ which need to be addressed but broadly speaking, there is not enough information which can throw light on the steps Saudi Aramco is taking to prepare itself for the future in which the world would be much less dependent on Oil.

The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly. But, EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use.

EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.