ICBC: World’s Largest Bank on the wrong side of ESG?

Synopsis: The asset managers are increasingly asserting themselves on sustainability and ESG issues. In the benign cases, many investment managers nudge the companies to behave more responsibly on environmental, social and governance issues and in more unpleasant situations, they impose their will by pushing for reconstitution of board. In our previous insight Asset Managers take investor activism further, the reason…ESG, we discussed Legal & General Investment Management dropping four companies from its funds over their failure to address sustainability issues. One of these companies was Industrial and Commercial Bank of China (ICBC). China anyway is not in the ESG good books of global investors and the banks fare even worse. In 2019, ICBC provided $ 4.18 billion worth of direct funding to the world’s top 30 coal power companies and was also the world’s leading coal underwriter over the past two years. With a history of these so-called ‘anti-environment’ investments and its dealing with many sectors related to deforestation, how does ICBC look to sustain in a future increasingly shaped by ESG issues? EMAlpha takes a deep look at ICBC and its operations to find some of these answers.

The ICBC: Industrial and Commercial Bank of China

With assets totalling almost US $ 5.1 trillion in 2020, Industrial and Commercial Bank of China (ICBC) sits on top of the list of world’s largest banks by assets. In terms of market capitalization, ICBC comes in at the third position, with a market cap of US $ 270 billion (as of April 30, 2021).

Figure 1: Share price of ICBC over the past year

Source: Google

China is changing and the link with recent developments at ICBC

Agricultural commodities such as soy and palm oil are known to be major drivers of global deforestation. In recent years, scrutiny on the cultivation of these commodities has increased and for right reasons. China is one of the world’s largest consumers of these commodities. There are also structural factors, such as the growth of the processed food industry in China being one of the main reasons behind the huge consumption of palm oil.

While China may be one of the largest consumers of these commodities, Chinese banks are among the biggest global financiers of companies involved in the production of forest risk commodities such as soy and palm oil. According to Global Witness, an international NGO founded in 1993, “Chinese banks are pouring billions into the agribusiness, propelling global deforestation while failing to take adequate measures to ensure that their money doesn’t contribute to environmental destruction”. It also states, “Chinese banks and investors provided over 22.5bn USD loans and underwriting from January 2013 to April 2020 to major companies producing and trading forest-risk commodities”.

During the afore mentioned time period, Industrial and Commercial Bank of China provided US $ 3.66 billion to major companies producing and trading forest risk commodities. To add insult to injury, in a Forest 500 ranking that assesses deforestation policies of 500 most influential companies and financial institutions dealing in forest risk commodity supply chains, ICBC was among the worst performing banks in the world, scoring 0 out of 100. Clearly, ICBC has done itself no favours by indulging in the financing of activities that have adverse effects on the environment.

ICBC and the Belt and Road Initiative

Since the launch of the Belt and Road Initiative (BRI) in 2013, China has provided over US $ 50 billion for financing of coal facilities across 150 countries. While domestically, China has been cutting down its air pollution levels by closing old coal facilities and subsidising the renewables sector following Xi Jinping’s call to slash coal consumption to 50% of the country’s total energy capacity by 2030, it has been financing coal projects overseas unabated. The funding across Africa, Eurasia and South America has, to a large extent, been provided by the Chinese banks. Critics argue that these banks are now being used for political and strategic manoeuvring by the Chinese Government.

The irony is that among all the Chinese banks, ICBC was the first to join the Task Force on Climate related Financial Disclosure (TCFD). ICBC hasn’t utilized the platform to strike out industries it wouldn’t finance. What makes things worse is that, Banking on Climate Change 2020 shows that the top four Chinese banks, including ICBC, have together financed fossil fuels with around US $ 240 billion in the four years since the adoption of Paris Agreement. When it comes to coal mining and power, the four Chinese banks lead the list, together making up 51% of financing to top 30 coal power companies globally from 2016-2019, and 67% of financing to top coal mining companies. In 2019, ICBC provided $ 4.18 billion worth of direct funding to the world’s top 30 coal power companies and was also the world’s leading coal underwriter over the past two years.

Historically, China has been a major producer of coal and as such its advocacy of coal is understandable. But as Xi Jinping announced China’s target of becoming carbon neutral by 2060, it undoubtedly won’t be a good image for the country if its banks continue financing projects that are environmentally damaging. Moreover the economics of coal, as researchers have pointed out, isn’t all that encouraging enough to warrant such huge investments. Not only is coal environmentally toxic, investments in coal power plants have provided increasingly diminishing returns. Some have suggested that China could save up to $400 billion if it phased out coal in line with the Paris Agreement. The increasing demand for renewables coupled with their fast-dropping cost and energy storage has made a few new solar and wind cheaper than existing coal.

For China to seek shade under the renewable umbrella, it becomes imperative that its banks take proactive measures to ensure their money doesn’t flow into environmentally unfriendly activities. And with the Chinese government currently in the process of revising its Commercial Banks Law, there is a crucial opportunity for the regulators to address these issues.

ICBC on the wrong side of Legal and General Investment Management

Many asset managers are increasingly becoming aware of the importance of ESG. Ever since the pandemic struck, asset managers such as BlackRock have been increasingly promoting sustainability as a core issue. But Legal and General, one of the largest asset managers in the world has been on the ESG cause long before the pandemic. It has been very vigilant on the ESG front, punishing companies that failed to comply with sustainability norms and rewarding companies that did.

As it turns out, on 15th June 2021, Legal and General Investment Management dropped four companies (including ICBC) from its funds for failing to comply with sustainability norms. ICBC’s failure in disclosure of Scope 3 emissions related to investments coupled with absence of specific policy related to coal led to its exit from LGIM funds. Please refer EMAlpha’s insight “Asset Managers take investor activism further, the reason…ESG”

EMAlpha’s ESG and Sentiment analysis of ICBC

Following its exit from the Legal & General funds, EMAlpha took a look at the sentiment and ESG score as capture by its AI.

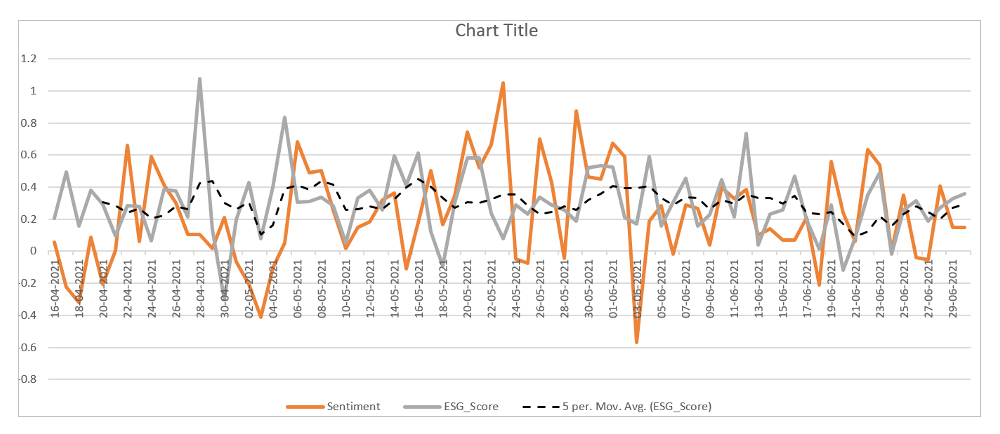

Figure 2: Sentiment and ESG chart of ICBC from 26th April 2021 to 30th June 2021

Source: EMAlpha

As can be seen above, following the report by Global Witness on 7th of June 2021, the local sentiment and ESG score dipped below the 5-day moving average, signalling negative turn of events related to ICBC. EMAlpha’s AI has sublimely captured these negative developments.

Figure 3: Share price of ICBC over the last six months

Source: Google

These negative developments didn’t have a significant impact on stock price for ICBC as after a steep fall in the month of April, the stock has stabilised around 5 CNY price. However, as compared to the benchmark, SSE Composite Index of the Shanghai Stock Exchange, it has still underperformed.

Figure 4: SSE Composite Index over last six months

Source: Google

The hopes of redemption

Whether it be the growing impact of ESG on changing times or the pressure from the Chinese government itself, ICBC has gradually started to steer away from financing coal power activities. As recently as of 30th of June 2021, ICBC cancelled plans to fund a US $ 3 billion, 2800 MW Sengwa coal project in Zimbabwe. ICBC won’t also be funding the Lamu coal project in Kenya. Furthermore the beneficiary countries of the Belt and Road Initiative are increasingly demanding usage of renewables to power their economies. ICBC’s chief economist, Zhou Yueqiu, recently announced the bank’s intention to double its renewable energy investments in the next 10 years and also produce a road map to strategically phase out investment in coal.

It seems like ICBC is realising the futility of financing projects involved in deforestation, coal mining etc. As the times are changing, so has grown the need for sustainability. Global leaders and researchers are increasingly in unison of promoting a carbon neutral world, failing which the impact on the eco-system would be irreparable. The covid pandemic has acted as a catalyst to bring about the changes required to abate the irreparable damage. There are implications in the capital markets for companies which often find ESG headwinds extremely difficult to negotiate with.

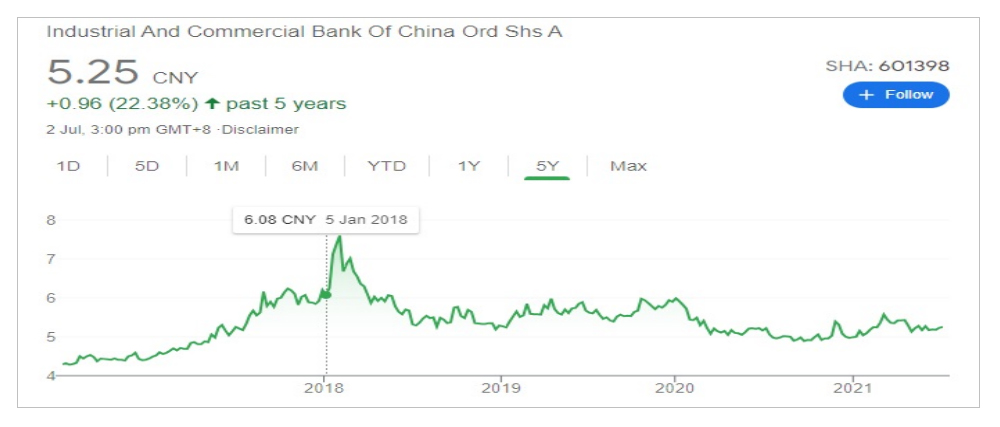

Figure 5: Share price of ICBC over the last five years

Source: Google

For example, ICBC’s stock price performance vis-à-vis SSE Composite Index of the Shanghai Stock Exchange since the beginning of 2018, a timeframe that coincides almost perfectly with the pick-up in ESG movement globally and as the global institutional asset managers started to incorporate this as an important investment filter.

Figure 6: SSE Composite Index over the last five years

Source: Google

The bloodline of all industries across the globe is finance. Just as a rear naked choke stops all the oxygen flow to the brain, if the finance is ceased, industries will be forced to comply. This is where investors are getting increasingly aware of where and how to invest their money. It’s time that banks such as ICBC joined the ESG bandwagon and contributed to this sea of change by changing their lending policy.

How EMAlpha can help investors

There is, undoubtedly, a profound ESG movement going all over the globe right now. From countries to asset managers, from millennial investors to the old school stalwarts, everybody’s counting on the ESG chip for a better future and a better return on investment. It is here that EMAlpha with its proprietary AI-ML techniques becomes useful for investors to gauge companies on the ESG front. As was the case with ICBC, the Global Witness report as well as its removal from Legal & General funds was sublimely captured by EMAlpha AI. But that’s just one of the facets of EMAlpha offerings.

As we have discussed, the changes in perception on ESG track record of a company and reactions from institutional investors have become an important driver of stock prices and especially in cases where the volatility is high, it matters even more. The EMAlpha sentiment and ESG scores have been reasonably accurate and there is a strong linkage between stock price performance and these scores. This is helpful for institutional asset managers in their decision making and this is how EMAlpha can help the investors:

- The news spread has become much faster with social media and internet. Some of the reports may be difficult to immediately verify and their authenticity may also be questioned, but they still influence the stock price movement. EMAlpha tracks news flow and helps in deciphering their impact on stock price movement.

- The news flow analysis and their impact assessment are very difficult to track and hence, it is a cumbersome exercise for asset managers, if done without an optimal help from machines. EMAlpha solves this problem for portfolio managers, at both portfolio and the company level.

- EMAlpha’s sophisticated AI-ML tools and proprietary analytical methods are based on deep domain expertise and unmatched technological prowess, helping the investors with the most effective and efficient input.

- The local news flow collection picks up several important issues and the local language along with English news analysis can be tracked for important developments. The potential fallout of such events is usually better predicted using local news analysis.

- In emerging markets, the ownership of some stocks is highly opaque, and this is a big issue. This also often makes the stock prices volatile. EMAlpha products pick up these important signals on the institutional investors of a stock.

References

- Largest banks globally as of December 2020, by assets https://www.statista.com/statistics/269845/largest-banks-in-the-world-by-total-assets/ (Accessed on 02nd July 2021)

- World’s top banks by market capitalization 2021 https://www.advratings.com/banking/worlds-top-banks-by-market-cap (Accessed on 02nd July 2021)

- China, the second largest palm oil importer lags in NDPE commitments , transparency https://chainreactionresearch.com/report/china-the-second-largest-palm-oil-importer-lags-in-ndpe-commitments-transparency/ (Accessed on 03rd July 2021)

- Chinese banks are pouring billions into destructive agribusiness linked to global deforestation https://www.globalwitness.org/en/press-releases/chinese-banks-are-pouring-billions-destructive-agribusiness-linked-global-deforestation/ (Accessed on 03rd July 2021)

- Under the spotlight: Chinese banks’ risky agribusiness portfolio https://www.globalwitness.org/en/campaigns/forests/under-spotlight-chinese-banks-risky-agribusiness-portfolio/ (Accessed on 03rd July 2021)

- Forest 500 company rankings https://forest500.org/rankings/financial-institutions (Accessed on 03rd July 2021)

- How the world’s largest bank could-and should- become a leader in green finance https://fortune.com/2021/06/29/icbc-worlds-largest-bank-green-finance-climate-action-china/ (Accessed on 03rd July 2021)

- China’s banks urged to stop funding global deforestation https://www.gtreview.com/news/asia/chinas-banks-urged-to-stop-funding-global-deforestation/ (Accessed on 03rd July 2021)

- Biggest China bank walks away from $ 3 billion Zimbabwe coal plan https://www.engineeringnews.co.za/article/biggest-china-bank-walks-away-from-3bn-zimbabwe-coal-plan-2021-06-30/rep_id:4136 (Accessed on 03rd July 2021)

- The belt and road’s decarbonisation dilemma https://qz.com/1760615/china-quits-coal-at-home-but-promotes-the-fossil-fuel-in-developing-countries/ (Accessed on 03rd July 2021)

- Will China continue to bank on coal https://chinadialogue.net/en/energy/will-china-continue-to-bank-on-coal/ (Accessed on 03rd July 2021)

- China finances most coal plants built today- it’s a climate problem and why US-China talks are essential https://theconversation.com/china-finances-most-coal-plants-built-today-its-a-climate-problem-and-why-us-china-talks-are-essential-161332 (Accessed on 03rd July 2021)

- Banking on climate change, fossil fuel finance report 2020 https://theconversation.com/china-finances-most-coal-plants-built-today-its-a-climate-problem-and-why-us-china-talks-are-essential-161332 (Accessed on 03rd July 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.