Asset Managers take Investor Activism further, the reason… ESG

Synopsis: Often, Blackrock has ‘top of the mind recall’ among global asset managers when it comes to espousing the ESG cause. Not just because of its size but also as a result of CEO, Larry Fink’s aggressive posture on Sustainability issues. However, there are many other asset managers taking a serious view on ESG matters. Putting its foot down on companies not complying with sustainability practices and disclosures, Legal & General Investment Management (LGIM) has recently ousted four companies from its funds: AIG, Industrial and Commercial Bank of China, PPL Corp and China Mengniu Dairy. Coming on the heels of the ExxonMobil episode, this is yet another major victory for the ESG space. Out of all the major global asset managers, LGIM has been the most vigilant when it comes to enforcing sustainability practices. While the covid pandemic acted as the catalyst for majority asset managers to seriously consider sustainability issues, LGIM had been laying the foundation much before that.

The ESG movement continues to gain momentum

EMAlpha hasn’t shied away from attributing the importance of ESG in the current investment world. Whether it be investors or regulators, there is an increasing demand for more transparency and more disclosures from companies. While the Covid-19 did certainly accelerate the process, the building blocks were being put into place well before that. But nonetheless, the world that we happen to reside in today finally seems to be acknowledging the need for sustainable business practices, failing which adequate repercussions are gradually being meted out. And if the recent ExxonMobil vs. Engine No. 1 case sheds any light, the ESG age has certainly begun. And hopping on the ride, media has also become very interested in ESG issues. But as they say, not all the relevant and important developments get equal media attention. Therefore, media attention may not be the right tool of measure.

On 15th June 2021, Legal & General Investment Management (LGIM), a major global investor and one of the biggest institutional asset managers in Europe with nearly $ 1.8 trillion under management dropped four US and Chinese companies from its funds for not meeting its ESG standards. LGIM divested stakes in AIG, PPL Corp, Industrial and Commercial bank of China and China Mengniu Dairy for failing to address climate risks under a stronger stewardship approach that LGIM had introduced in 2020. The four companies are to be dropped from actively-run LGIM funds that have assets totalling $ 80 billion. These four companies join a list of companies that remain on LGIM’s existing exclusion list and that have yet to take the substantive actions required to warrant re-instatement. The other companies on the list include China Construction Bank, MetLife, Japan Post, KEPCO, ExxonMobil, Rosneft, Sysco, Hormel and Loblaw.

In detail, the reasoning behind LGIM dropping the four companies

LGIM has built a climate assessment based on net zero commitment and which also happens to be industry-specific. For each industry, LGIM has very clear metrics and evaluation parameters to infer whether the companies meet LGIM’s sustainability standards and this evaluation plays a critical role in portfolio rebalancing and investment decisions.

In the case of AIG (American International Group) that operates in the finance and insurance sector and has a market cap of $ 44 billion, failure to disclose Scope 3 emissions associated with investments along with its supposed paucity as far as thermal coal coverage exclusion is concerned led to its exit from LGIM funds.

Figure 1: Share price of AIG over the past month

Source: Google

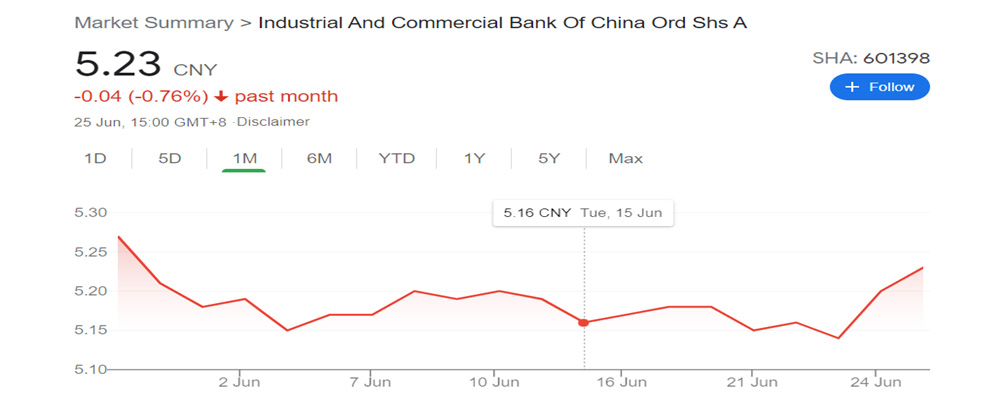

In the case of Industrial and Commercial Bank of China, one of the largest banks in China, failure in disclosure of Scope 3 emissions related to investments coupled with absence of specific policy related to coal led to its exit from LGIM funds. It is worth mentioning here that in a report by Global Witness, an international NGO, Industrial and Commercial Bank of China provided $ 3.66 billion of financing for major companies producing and trading forest-risk commodities between January 2013 and April 2020.

Figure 2: Share price of Industrial and Commercial Bank of China over the past month

Source: Google

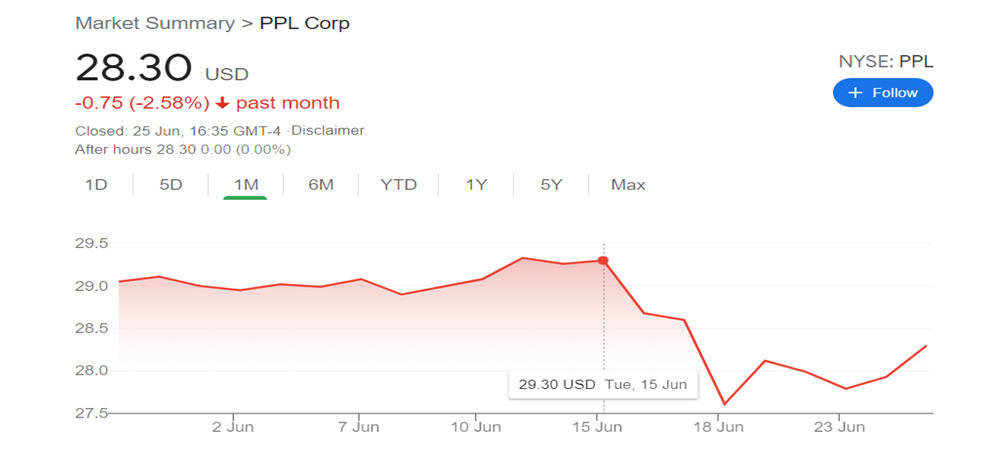

PPL Corporation, an American energy company with a market cap of $ 21.7 billion, lost its seating in the LGIM funds because for the utilities sector, LGIM wants companies to have a very specific phase out plan for coal power generation. Unfortunately PPL Corp didn’t have any such timeline.

Figure 3: Share price of PPL Corp over the past month

Source: Google

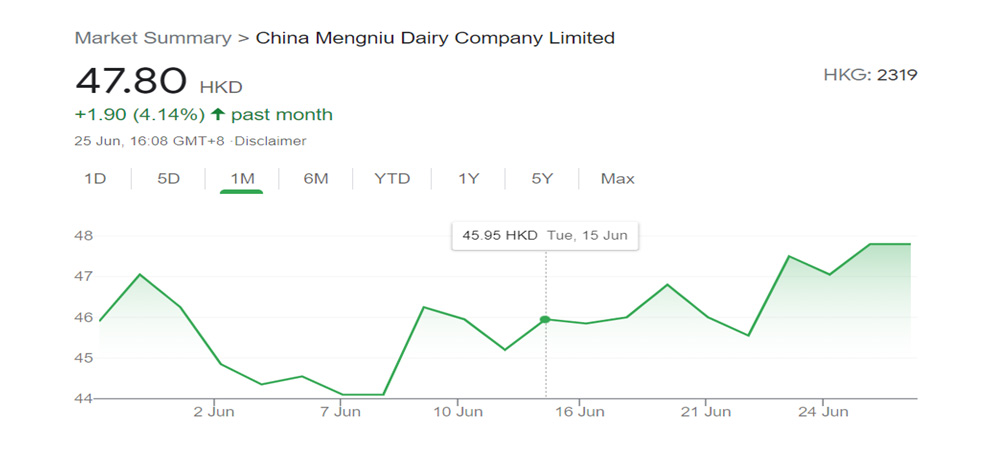

In the food sector, LGIM wanted companies to have a deforestation policy which China Mengniu Dairy, a leading manufacturer of dairy products in China, didn’t have. Apart from that, the dairy company wasn’t disclosing agricultural scope 3 emissions. These factors led to its exclusion from the LGIM funds.

Figure 4: Share price of China Mengniu Dairy over the past month

Source: Google

As can be seen from the four charts above, the reports of exclusion from LGIM’s funds that came out on 15th June caused a reaction in the share price of AIG and PPL Corp (both US based companies). Whereas for Industrial and Commercial Bank of China and China Mengniu Dairy (both China based companies), the exclusion from LGIM funds hardly had any impact on their respective stock prices. This further gives credence to the fact that Emerging Markets are still lagging behind the Developed Markets when it comes to ESG related response. Please check our Insight “Is Data in Emerging Markets less valuable than in Developed Markets?”

EMAlpha has constantly focused on this aspect of ESG disclosures and assessment. That companies just come out with E, S and G scores isn’t sufficient enough. Companies must focus on disclosure of sector specific factors that could influence E, S and G scores. And these factors vary from sector to sector. For example: for a sector that isn’t energy intensive, such as the retail sector, the main environmental issue is packaging and not electricity. So committing to the usage of renewables for its energy purpose isn’t necessarily an efficient sustainable practice.

LGIM is setting the standards on Sustainability Practices

The steps that LGIM has taken over the years to incorporate and enforce sustainability practices into investment decisions clearly indicates the rising importance of ESG for asset managers. In October 2020, LGIM came out with its annual Climate Impact Pledge, first launched in 2016, that stated that companies falling short of LGIM’s sustainability standards would be subject to vote against and potential divestment from select funds. And this has been backed by an independent analysis that showcased LGIM being a top supporter of ‘climate critical’ shareholders resolution, in comparison to the world’s largest asset managers.

Long before Engine no 1’s victory over ExxonMobil, in June of 2019, LGIM dumped ExxonMobil from its Future World Funds, which was set up for clients wanting to express conviction on social, environmental and governance themes. LGIM stated in its report that ExxonMobil didn’t meet their key minimum requirements, including on emissions reporting and targets. LGIM also added that it would vote against ExxonMobil chairs for failing to confront the threats posed by climate change. Clearly, LGIM was ahead of the curve than most of the world’s largest asset management companies when it came to sustainability practices.

In a report by Majority Action, titled “CLIMATE IN THE BOARDROOM: How Asset Manager Voting Shaped Corporate Climate Action in 2020”, it was stated: “Legal & General Investment Management and PIMCO had the highest rate of voting against management-proposed director candidates in the energy, utility, banking and automotive sectors. Legal & General and PIMCO also supported all of the shareholder proposals analysed in this study, voting in favour of improved emissions disclosures and reduction plans, transparency regarding corporate political influence activity, and governance reforms to improve accountability to long-term shareholders. Legal & General and PIMCO are choosing to set and enforce policies to hold corporate boards accountable if climate-related concerns are not adequately addressed.”

The same report also stated the following regarding performance of asset managers on key climate shareholder resolutions in 2020:

“In 2020, Majority Action reviewed 36 climate critical shareholder resolutions. Of these, nine were directly related to the business and physical risks of climate change; nine proposed independent chairs at fossil fuel intensive and climate critical companies; and 18 were related to the political and lobbying activities of key companies. Across all 36 resolutions, Legal & General and PIMCO voted most consistently in favour. By contrast, BlackRock, Vanguard, and Fidelity demonstrated the lowest level of support for these resolutions, voting for them less than 20% of the time.”

While LGIM has taken companies to task for not meeting the required sustainability standards, it has also rewarded companies that have made progress on sustainability issues. For instance, on the same day that it dropped the four companies from its funds, LGIM reinstated Kroger, the American food retailer, into its investment list following improvements in its deforestation policies and disclosure, as well as efforts to promote plant-based products which have a lower climate impact. In 2020, LGIM announced that Japanese automaker Subaru – previously on its exclusion list – would be reinstated in its Future World funds following improvements in emission targets and disclosures.

How EMAlpha can help

The developments at Legal & General shines light on the colossal need of the hour: sector and industry specific ESG disclosures. EMAlpha has long stressed on the need to have sectorial related E, S and G disclosures. As highlighted above, sustainability challenges vary from industry to industry. Thus it becomes imperative to gauge companies on sustainability metrics that are exclusive to the concerned industry. It is here that EMAlpha with its proprietary algorithm and AI-ML techniques becomes a key tool for the investors.

The recent developments in which ESG and asset managers had an interplay, the results are very interesting and they have important lessons for the companies. These are also situations in which EMAlpha’s AI-ML analysis can help investors. For example, Can the local news flow collection pick up issues, earlier than the English media? Considering how important the Sustainability and ESG issues have become, the local language along with English news analysis can be tracked for the companies experiencing ESG issues.

Considering the sensitivities involved, especially when institutional investors have invested in the stock, the ESG issues could escalate quickly, thus impacting the stock price performance. In this, a regular analysis of social media (such as Reddit feed) can be used as an input before taking an investment decision. Hence, EMAlpha’s analysis of unstructured data becomes a key tool for investors. The unstructured data analysis in other geographies can also be used to assess the potential impact on some of the larger companies.

The takeaway from the decisions of LGIM and many other asset managers over the last few years emphasises the importance of ESG issues. It is also pertinent that predicting the behaviour of large institutional investors on the basis of trading information can help forecast the stock price impact. This is one of the key features of EMAlpha product as it combines technology with domain expertise. The news flow analysis provided by EMAlpha is useful in picking up the signals when the views change for institutional investors.

References

- LGIM steps up sustainability and governance efforts https://www.legalandgeneralgroup.com/media-centre/press-releases/lgim-steps-up-sustainability-and-governance-efforts/ (Accessed on 27th June 2021)

- LGIM divests AIG, other holdings for insufficient climate policies https://www.pionline.com/esg/lgim-divests-aig-other-holdings-insufficient-climate-policies (Accessed on 27th June 2021)

- LGIM renews pressure on companies to provide climate accountability and achieve net-zero emissions https://www.lgima.com/media/2021/climate-impact-pledge/ (Accessed on 27th June 2021)

- Climate in the boardroom https://static1.squarespace.com/static/5d4df99c531b6d0001b48264/t/5f6976e5f6b47e5e50c11430/1600747275103/MA_ClimateintheBoardroom_2020.pdf (Accessed on 27th June 2021)

- Legal & General unit shuns AIG, others https://www.insurancebusinessmag.com/uk/news/environmental/legal-and-general-unit-shuns-aig-others-257867.aspx (Accessed on 27th June 2021)

- Legal General IM ditches AIG and keeps Metlife on climate change exclusion list https://www.internationalinvestment.net/news/4032874/legal-im-ditches-aig-metlife-climate-change-exclusion-list (Accessed on 27th June 2021)

- LGIM commits to more stringent standards in annual Climate Impact Pledge https://www.internationalinvestment.net/news/4021713/lgim-commits-stringent-standards-annual-climate-impact-pledge (Accessed on 27th June 2021)

- L&G puts AIG on the naughty step over ‘insufficient’ climate change action https://news.sky.com/story/l-g-puts-aig-on-the-naughty-step-over-insufficient-climate-change-action-12333224 (Accessed on 27th June 2021)

- Chinese banks are pouring billions into destructive agribusiness linked to global deforestation https://www.globalwitness.org/en/press-releases/chinese-banks-are-pouring-billions-destructive-agribusiness-linked-global-deforestation/ (Accessed on 27th June 2021)

- Climate concerns triggers LGIM’s divestment from AIG, Commercial Bank of China https://www.fnlondon.com/articles/climate-concerns-triggers-lgims-divestment-from-aig-commercial-bank-of-china-20210615 (Accessed on 27th June 2021)

- China’s banks urged to stop funding global deforestation https://www.gtreview.com/news/asia/chinas-banks-urged-to-stop-funding-global-deforestation/ (Accessed on 27th June 2021)

- Investor LGIM dumps ExxonMobil from its Future World Funds https://www.reuters.com/article/us-climate-change-l-g-funds-idUSKCN1TL2ZV (Accessed on 27th June 2021)

- How Legal & General is holding companies accountable to ESG initiatives https://www.youtube.com/watch?v=925DVbtvhZg (Accessed on 27th June 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.