Will ESG Sound the Death Knell on ‘Oil Age’

Synopsis: Some of the recent events at the world’s largest Oil & Gas companies such as ExxonMobil, Chevron, and Royal Dutch Shell is clear evidence of ESG’s (Environmental, Social and Governance) significant impact on the industry. Over the next few years, a) the Oil & Gas companies will increasingly be under pressure on ESG issues, b) conflicts between the board and senior management will rise, c) more shareholders will play the role of an opportunistic activist which will be bad for the ESG movement, d) the attractiveness of Oil & Gas companies for the investors will continue to decline, e) ESG filters will play a more important role in investment decisions, which will not favour the Oil & Gas companies, and, f) companies will have to bring reforms and ultimately pay more attention to Environmental issues. These reforms could be resisted by the Old guard, thus slowing down the progress they would make.

The Ups and Downs of the Oil & Gas Industry since Covid-19 Outbreak

The global financial markets were exceptionally volatile in 2020. The S&P 500 Index corrected more than 35%, only to shoot up by more than 60% because of exceptional performances by Tech and new-age companies. The NASDAQ Composite Index had an even better year with the Index almost doubling from its lows. The Coronavirus pandemic induced a knee-jerk reaction in the global financial markets. Similarly, most other assets, currencies and commodities also had a tumultuous and unexpected year. Let’s look at Gold. Despite a lukewarm second half because of the popular ‘risk-on’ trade, the year 2020 was a very good year for gold. In fact, it was one of the best yearly performance by gold over the past several decades and it came on the heels of a phenomenal run it had in 2019.

Despite all that was happening elsewhere, it was Crude Oil which had the most unexpected and bizarre year. Crude Oil prices saw the worst in 2020 and also recovered well. The Monday, 20th of April, 2020, will go down in the history books as one of the worst days for the Crude Oil Industry. The May US Oil futures contract went into negative territory for the first time in history. The immediate cause was the Coronavirus pandemic. Because of which the US reserves were full and there was simply no place to put the crude in and everybody was avoiding taking delivery of physical crude. Finally, the numbers were at minus $37.63 a barrel, a decline of $55.90 after setting a historic low of negative $40.32.

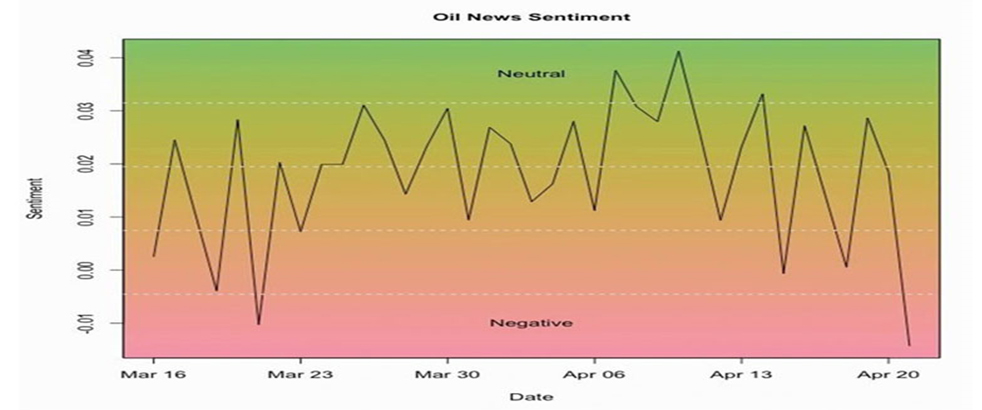

The most interesting part is that while all the fundamental reasons were offered after this event and the historic decline in Crude Oil prices was blamed on a 30% decline in the global Crude Oil demand and no consensus on possible production cuts by major exporting countries, the main reason was still the same as it is often observed in exceptional market movements: Negative Sentiment. This was visible on EMAlpha Oil News Sentiment tracker. As seen in this chart, this was at the lowest levels after the impact on sentiment seen during the dip in March because of expected supply glut as a result of price war between Russia and Saudi Arabia.

Figure 1: EMAlpha Oil News Sentiment (March-April 2020)

Source: EMAlpha

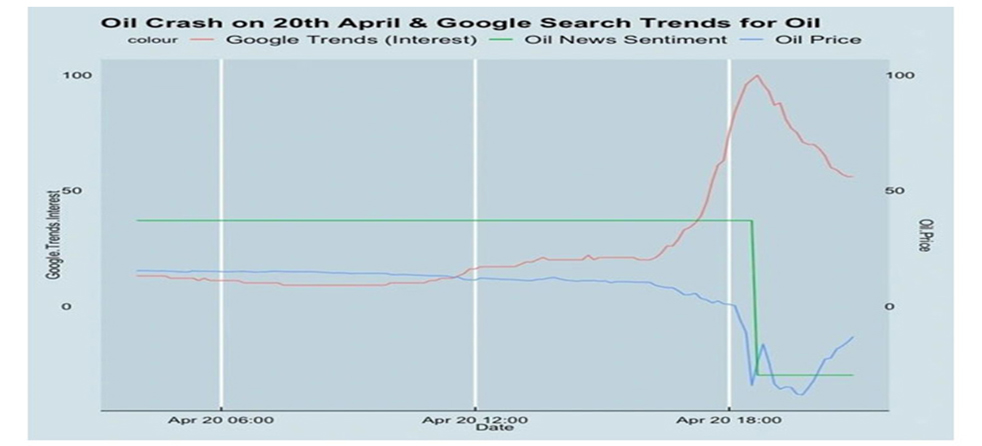

The second plot (Fig 2) shows the oil price (WTI future) in the blue line and Google Trends Search result for “oil” over the day of April 20th. What is interesting is that Google Trend starts moving sharply before the steep fall in oil.

Fig. 2: Oil (WTI future) in blue and Google Trends Search result for “Oil” on April 20th

Source: EMAlpha

We have shown in the plot a third line, which shows the change in daily Oil sentiment. As can be seen, it goes from positive to negative (see the green line which goes from positive to negative). This is basically the last two data points of the first Oil Sentiment plot. The point is that due to the oil crash, the EMAlpha daily Oil Sentiment went from positive to negative. The bottom-line is that we saw a clear collapse in sentiment around the time the price crashed and this was also linked with the sudden spike in searches for ‘Oil’.

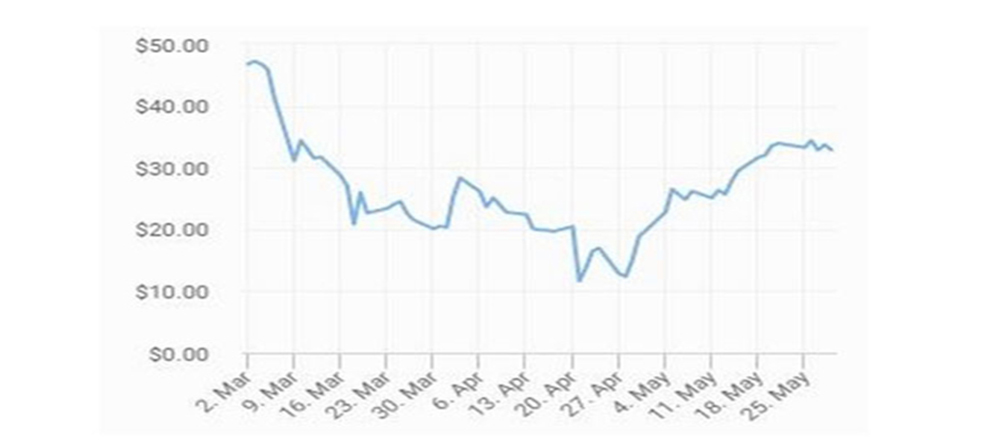

We had written back then that around the middle of May, WTI Crude price was starting to break out from a USD 25 per barrel price range to a higher range (Fig 3). But first, the price formed a base at that level. For more than ten days, the price was consistently above 30 dollars and it was fairly stable. An upward price movement is always important, but a fairly consistent and narrow range is equally relevant too.

Fig. 3: WTI Crude Price over March-May 2020

Source: EMAlpha

The broader message is that, unstructured data analysis does a good job in making price forecast. We had also highlighted on May 14, 2020, that the Oil Sentiment was having its ‘Break out’ moment around 10th of May and this change in oil news sentiment indicated that we were past the worst of the Coronavirus crisis and that things would get better from then on. This is exactly how it turned out to be. In the language which is better understood by data enthusiasts, if we were to do a back test for the Oil News Sentiment and Crude Prices, it would be near perfect.

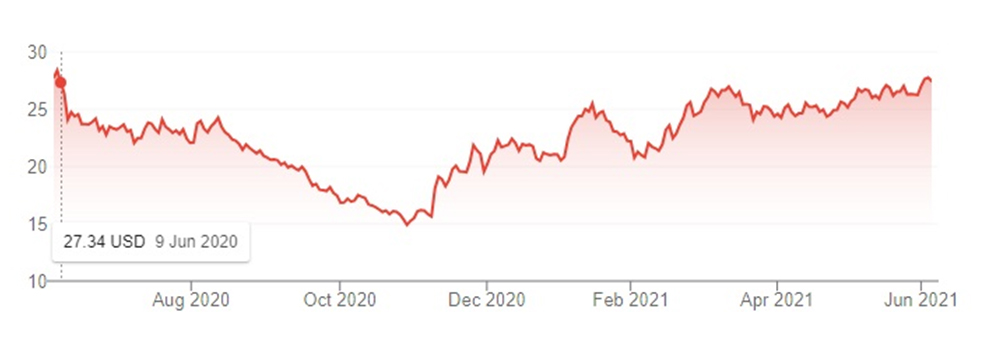

How things have changed in the last twelve months

Coronavirus pandemic and associated demand related concerns ensured that Crude Oil prices didn’t budge much from USD 35-40 levels till October 2020. But the picture has completely changed in the last six months. As the global economy emerged out of the pandemic, the recovery was faster than the most optimistic of estimates. The prices have almost doubled and just like other commodities such as Copper and Steel, the insatiable demand is threatening to take prices even higher. The way demand has been surging, especially in some of the major consumer markets after successful vaccination coverage for majority of their population, demand environment is looking increasingly supportive for strength in prices. While some of the claims are as outrageous as USD 300 per barrel, there is hardly anyone who will bet against the rising Oil prices.

Fig. 4: WTI Crude Futures at New York Mercantile Exchange

Source: CNBC

What is good for Oil may not be good for Oil Companies

Usually, high oil prices help the Oil & Gas industry. Previously ignored oil fields start attracting interest, the investment in better technology goes up to extract even the last drop of oil and in general, the industry becomes much more vibrant and replete with new activity. As a result, the Oil & Gas companies and Exploration & Production (E&P) companies specifically attract higher investor interest. But this has not been the case for most of these companies over the last six to eight months. While the stock prices are up a little but, the buzz is entirely missing. This is surprising, given that the Oil prices have almost doubled and the expectations are that they will increase further.

We have looked at the seven companies which are considered supermajors:

- Exxon Mobil Corporation

- Chevron Corporation

- BP plc

- Royal Dutch Shell Plc

- Total SE

- Eni SpA

- ConocoPhillips

- Saudi Aramco

Fig. 5: Exxon Mobil Corporation Stock Price over last one year

Source: Google

Fig. 6: Chevron Corporation Stock Price over last one year

Source: Google

Fig. 7: BP plc Stock Price over last one year

Source: Google

Fig. 8: Royal Dutch Shell Plc (RDSA) Stock Price over last one year

Source: Google

Fig. 9: Total SE Stock Price over last one year

Source: Google

Fig. 10: Eni SpA Stock Price over last one year

Source: Google

Fig. 11: ConocoPhillips Stock Price over last one year

Source: Google

Fig. 12: Saudi Aramco Stock Price over last one year

Source: Google

Are ESG issues responsible for lukewarm response from Investors?

The last few weeks have been very eventful for ESG (Environmental, Social and Governance) space, although it has not turned out to be that great for the Oil & Gas companies. Because of their contribution in Greenhouse Gas emissions and the role it plays in climate change and the negative impact it has on the environment, Big Oil has become a favourite and an easy target for Sustainability activists. In the last one month itself, there have been several important developments which indicate that ESG is increasingly becoming important for oil companies and they need to respond proactively.

ExxonMobil – In the last week of May, something unexpected happened which showed how important ESG has become for the corporate world. Going against the company management, the shareholders who had been pushing for a more proactive approach to climate change, scored a major victory. The Exxon management lost to a small hedge fund called Engine No. 1, which has just a 0.02% stake in Exxon. They got two board seats at ExxonMobil’s annual shareholder meeting and their proposal was backed by New York and California pension funds, two of the largest U.S. pension funds, and powerful asset management firms, including Blackrock and T Rowe Price. When the final votes were tallied, shareholders had elected a third director nominated by hedge fund Engine No. 1 to Exxon’s board. This was a major victory at one of the largest energy companies in the world.

Chevron – In the last week of May, at Chevron’s shareholder meeting, a majority of them backed a proposal for the firm to substantially reduce its Scope 3 emissions in the medium and long term. There were also reports in the first week of June which stated that Chevron’s CEO had signalled that the company would consider selling its 20% stake in a Canadian oil sands mine to meet green goals. In a separate development, Chevron also said that they had suspended some payments from a gas joint venture that would have reached Myanmar’s military rulers. The military government had seized power on February 1, 2021 after a coup in the South Asian nation.

Royal Dutch Shell – Towards the end of May, a court in the Netherlands ruled that Shell must cut its CO2 emissions by 45% by 2030 compared to 2019 levels. The verdict also said that the Shell group was responsible for its own and its suppliers’ CO2 emissions. After the ruling, a Shell spokesperson said that they would appeal against the disappointing court decision.

Total – Total has also suspended some payments from a gas joint venture that would have reached Myanmar’s military rulers. The military government had seized power on February 1, 2021 after a coup in the South Asian nation. Total and Chevron, at the meeting of the Moattama Gas Transportation Company voted to suspend all cash distributions. Total is the biggest shareholder with 31.24 per cent, while Chevron holds 28 per cent.

ConocoPhillips – In the second week of May, a majority of shareholders at ConocoPhillips voted in favour of setting Scope 3 targets, which take into account greenhouse gas emissions from customers using the fuel they have purchased. The shareholder measure passed by 58% while the company opposed the resolution. ConocoPhillips has also outlined its net-zero 2050 goals for Scope 1 emissions.

Big Oil: An easy target of Environmental Activists

We are not sympathetic towards Oil & Gas companies and we do believe that many of these companies have done their best to maintain a status quo. The ‘business as usual’ suits them the best and they have tried hard to continue with their utter disregard for critical ESG issues.

But we also think that ESG and Big Oil is a complex relationship. There are several issues where simplistic explanations are offered, which assume that by solving the problem of pollution caused by the Oil & Gas companies, the challenge of emission control can be handled. These issues include;

- Without any proper transition plan, can the world survive without Oil and are the currently proposed transition plans feasible?

- In the case of Big Oil, are the stakeholders focusing too much on the Environmental part and ignoring Social and Governance issues?

- Are all the Oil & Gas companies in the wrong and are they not doing enough to cut down emissions, thus making it unfeasible to arrive at real solutions?

- Is the problem of Oil & Gas companies related with their communication and did they get the messaging wrong on ESG issues?

- Why should only Oil & Gas companies be the target when some other industries don’t come under the limelight? For example, are the lenders (Banks and Financial Institutions) who fund these projects, not responsible?

The way forward

All of a sudden, the ESG activity levels in the Oil & Gas space have suddenly gone up. However, it is also true that many of them waited for far too long before treating these climate change issues in a proactive manner and hence it doesn’t come as a surprise that the broader perception has decisively turned against them. There are also serious cases of Greenwashing against them as there have been reports highlighting how oil and gas firms have been using their commercials to greenwash their image. There are also allegations that they are trying to project an amplified image of their commitment to climate change and their product offerings in clean energy.

There have also been cases of misrepresentation and incorrect reporting. For example, there were several reports in January 2021 highlighting how Saudi Aramco understated its Carbon Footprint by up to 50% as Aramco’s accounting for greenhouse gas was incomplete. The company excluded emissions generated from many of its refineries. If all such facilities were included, Aramco’s self-reported carbon footprint would double. So, the bottom-line is that while it is true that some of the criticism of Big Oil is unfair and that they have been made a scapegoat, a significant share of the blame needs to be shared by the Oil Companies themselves.

Hence, the recent events are very important for ESG’s impact on the Oil & Gas Industry. Some of these developments, especially the ones at ExxonMobil and Royal Dutch Shell are landmark events in the real sense. Over the next few years, we expect;

- The Oil & Gas companies will increasingly be under pressure on ESG issues and the criticism will be more regular, vocal and intense.

- The political changes will also play a big role. For example, we can surely expect Big Oil to come under serious pressure with Democrats being in power in the USA.

- The management of these companies won’t give up that easily and the conflicts between the board and senior management will rise.

- More shareholders will pay the role of an activist and some of them may not even have ESG matters as their priority. In short, these shareholders would be opportunistic activists and that would be bad for the ESG movement.

- For the investors, the attractiveness of Oil & Gas companies as an investment choice will continue to diminish. As ESG filters start playing a more important role in investment decisions, the trend will go against Oil & Gas companies.

- The companies will undergo reforms and will pay more attention to Environmental issues but not without resistance from the old guard. This friction will slow down the progress the companies would make.

How EMAlpha can help

Investors can’t afford to ignore ESG related developments in Oil & Gas companies as this will be an important influence on stock prices in the sector. They also need to make their assessment before issues escalate and reach the point of no return. How can this be achieved and how EMAlpha can help the investors in this process:

- There is no sector in which all companies are good or all the companies are evil and this applies to Oil & Gas industry too. There needs to be a formal objective evaluation of the companies in a sector and this exercise will help investors in figuring out what will work as an investment and what will not. Over the next three to five years, ESG performance will lead to significant divergence in stock price returns in the Oil & Gas space.

- The local news flow collection picks up several important issues like what’s happening with local regulators or in the court cases, much faster than the English media. How are investigations and cases going, will be material for many stocks. The local language along with English news analysis can be tracked for such issues. The potential fallout of such events is usually better predicted using local news analysis.

- Some of the global investors have become more vocal on ESG issues. Predicting the behaviour of large institutional investors on the basis of where they stand on issues like climate change and emissions is useful because it can help forecast the stock price impact. EMAlpha product combines technology with domain expertise. The analysis by EMAlpha is useful in picking up signals on the views of institutional investors.

References

- Exxon CEO Is Dealt Stinging Setback at Hands of New Activist https://www.bloomberg.com/news/articles/2021-05-26/tiny-exxon-investor-notches-climate-win-with-two-board-seats (Accessed on 5th June 2021)

- A Watershed Day For Exxon, Activists And ESG https://chiefexecutive.net/a-watershed-day-for-exxon-activists-and-esg/ (Accessed on 5th June 2021)

- Engine No. 1 extends gains with a third seat on Exxon board https://www.reuters.com/business/energy/engine-no-1-win-third-seat-exxon-board-based-preliminary-results-2021-06-02/ (Accessed on 5th June 2021)

- Exxon director calls activist campaign, ESG pressures a ‘tidal wave’ https://www.reuters.com/business/sustainable-business/exxon-director-calls-activist-campaign-esg-pressures-tidal-wave-speech-2021-06-02/ (Accessed on 5th June 2021)

- Straggling on climate change no longer an option—Big Oil faces its reckoning https://fortune.com/2021/05/27/big-oil-climate-change-reckoning/ (Accessed on 5th June 2021)

- Exxon, Chevron, Shell: Death By ESG https://seekingalpha.com/article/4431884-exxon-chevron-shell-death-by-esg (Accessed on 5th June 2021)

- Chevron open to sale of Canadian oil sands stake to meet green goals https://www.worldoil.com/news/2021/6/3/chevron-open-to-sale-of-canadian-oil-sands-stake-to-meet-green-goals (Accessed on 5th June 2021)

- Shell: Netherlands court orders oil giant to cut emissions https://www.bbc.com/news/world-europe-57257982 (Accessed on 5th June 2021)

- Myanmar: Fossil giants Total and Chevron stop junta payments https://www.telegraphindia.com/world/myanmar-fossil-giants-total-and-chevron-stop-junta-payments/cid/1816959 (Accessed on 5th June 2021)

- Conoco shareholders back proposal to set Scope 3 targets https://www.reuters.com/business/environment/conocophillips-shareholders-back-proposal-set-scope-3-targets-2021-05-11/ (Accessed on 5th June 2021)

- Big Oil Faces Backlash For ‘Greenwashing’ https://in.news.yahoo.com/big-oil-faces-backlash-greenwashing-190000762.html (Accessed on 5th June 2021), https://www.nytimes.com/2021/03/25/business/media/climate-ad-agencies-fossil-fuels.html (Accessed on 5th June 2021)

- Saudi Oil Giant Understates Carbon Footprint by Up to 50% https://www.bloombergquint.com/business/how-much-does-aramco-pollute-missing-emissions-might-double-carbon-footprint (Accessed on 5th June 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.