What energy companies and ESG investors can learn from Ørsted?

Synopsis: Ørsted (formerly DONG Energy) is a Danish multinational power company and as of 2020, the company is one of the world’s largest developers of offshore wind power. Ørsted also offers its products and services in solar energy and storage, and renewable hydrogen. However, the thing that is captivating about the company, is its transformation from being one of the most carbon-intensive energy companies in Europe to being ranked as the world’s most sustainable energy company in the Corporate Knights Global 100 Index – three years in a row. And that too in a matter of a little more than a decade. It is obvious that the investors love the stock but it seems that the ‘low hanging fruit’ in terms of stock price returns has already been picked and from here on, it could very well be a grind. After a fantastic 2020, the year 2021 has not been that great for Ørsted. After a spectacular rise in its stock price, the company has delivered poor performances in the two quarters of 2021. There are also concerns about its future profitability as the capex plans continue to get grander. Based on EMAlpha’s AI-ML based analysis of news flow, we think there are several other interesting points that can be deduced, which are relevant for the sector, the companies, asset managers along with ESG and sustainability ecosystem. This insight talks about the five major inferences.

Ørsted: The world’s most sustainable energy company

Ørsted A/S (formerly DONG Energy) is a Danish multinational power company based in Fredericia, Denmark. It is the largest energy company in Denmark. As of 2020, the company is one of the world’s largest developers of offshore wind power. Ørsted also offers products and services in solar energy and storage, and renewable hydrogen.

In a matter of a couple of decades, it has transformed itself from being one of the most carbon-intensive energy companies in Europe to being ranked as the world’s most sustainable energy company in the Corporate Knights Global 100 Index – three years in a row. Ørsted has primarily focused on two major drivers for combating climate change in its transformation journey:

- Phasing out coal – The company’s business was originally based on fossil fuels, and it was one of the most coal-intensive energy companies in Europe. But the company shifted from the fossil fuel business and now focuses entirely on renewables. According to the company, they will completely phase out the use of coal in 2023.

- Offshore wind energy – Ørsted has a global leadership position in offshore wind and today, offshore wind is competitive on installation and running costs in comparison to coal- and gas-fired power plants. No wonder the offshore wind industry is a rapidly growing industry with a significant contribution to delivering green energy.

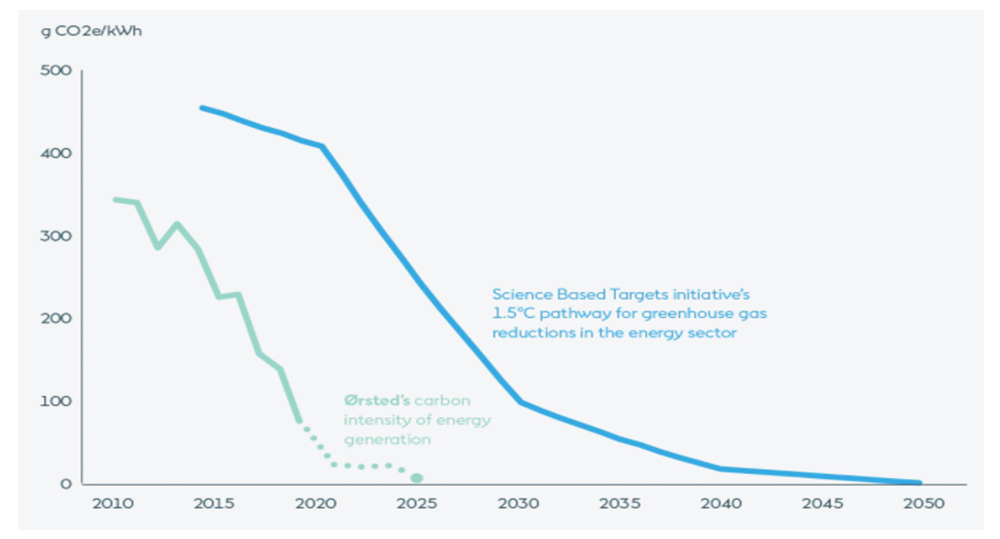

Ørsted is on track to be carbon-neutral in energy generation and operations by 2025. The company also talks about the fact that having eliminated the carbon emissions from energy production, it has progressed further on decarbonization and is committed to halving the carbon emissions from its wholesale buying and selling of natural gas and from the supply chain by 2032. Ørsted targets to achieve a net-zero carbon footprint by 2040, ten years ahead of the global target for net-zero emissions as required by climate science to limit global warming to 1.5°C.

Figure 1: Ørsted to be carbon neutral by 2025

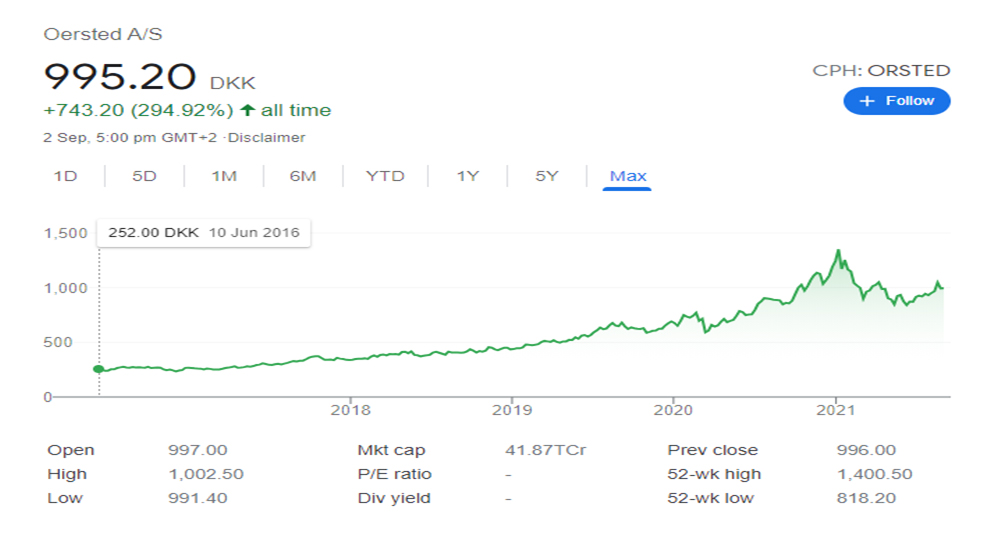

The market has rewarded the company well and the stock price has consistently done well since listing, as shown in the chart below.

Figure 2: Ørsted Stock price ever since listing

Source: Google

From Dansk Olie & Naturgas A/S to Ørsted

For the companies in the energy industry and for that matter, in any other polluting sector today, Ørsted should be an inspiration. If these companies think that they can’t pivot, there is perhaps a no better example than Ørsted. Most people today know Ørsted as a leader in sustainable energy. It has products and solutions for offshore and onshore wind farms, solar farms, energy storage facilities, and bioenergy plants. It also ranks as one of the world’s most sustainable energy companies across different surveys.

But the company wasn’t always sustainable. The company began as Dansk Olie & Naturgas A/S (Danish Oil and Natural Gas), or as DONG in 1973. In 2008, the company announced that it wanted to transform from being a fossil fuel-based to a renewable energy company, and began investing massively in the development and build-out of offshore wind farms in Denmark and abroad.

At the same time, they began converting their coal- and gas-fired power stations to sustainable biomass. They completely divested their oil and gas business in 2017 to focus entirely on green energy and on 30 October 2017, they change their name from Dansk Olie & Naturgas A/S (Danish Oil and Natural Gas or DONG) to Ørsted.

Ørsted explains the change in the name, “As we divested our oil and gas business in 2017 to focus entirely on green energy, we also bid farewell to DONG Energy. Our transformation has meant that we’ve become far too dedicated to renewables to have a name originating from Danish Oil and Natural Gas. It’s no longer descriptive of who we are, or who we want to be.”

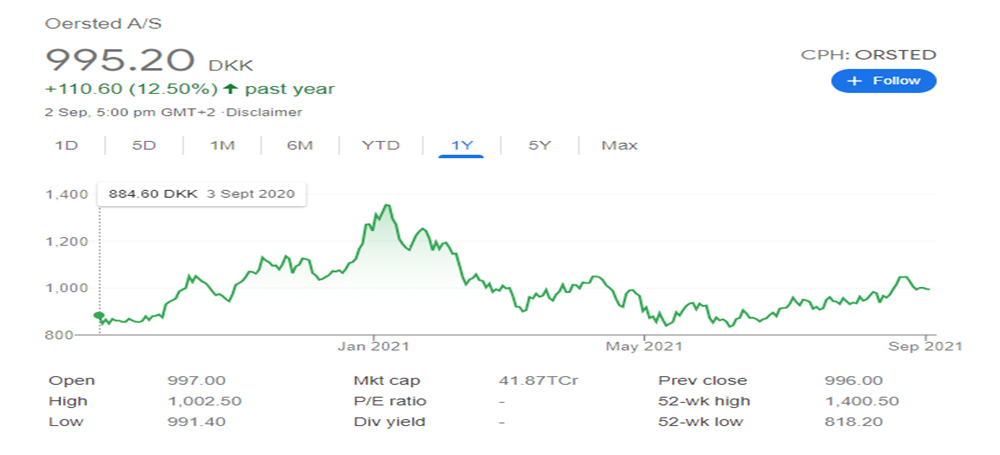

Over the last eighteen months, the world has seen a considerably higher interest in ESG and sustainability themes and renewable energy has also attracted significant investor interest. The Ørsted stock price over the last twelve months also reflects the interest.

Figure 3: Ørsted Stock price over the last year

Source: Google

A not so great 2021 thus far

After a fantastic 2020, the year 2021 has not been that great for the stock price. After a spectacular rise in stock price, the company, so far, has delivered poor performances in the two quarters of 2021. There are also concerns on future profitability as the capex plans continue to get grander.

The April-June quarter results of the company got impacted severely because of adverse weather conditions. On 12th August 2021, the company reported its financial results for the second quarter of the year 2021. In an interview with Financial Times, Mads Nipper, chief executive of Ørsted, said that the April-June quarter had been the third-worst quarter for wind in the past 22 years in the North Sea, where Ørsted has most of its wind farms. The lower wind speeds cost Ørsted DKr1.4bn ($220m) in lost EBITDA, the company said. However, the full-year EBITDA guidance will be maintained at the lower end, despite low wind speeds and cable protection issues.

In April 2021, chief financial officer Marianne Wiinholt confirmed that the damaged offshore wind cables cost Ørsted almost half a billion dollars. The CFO also said that the company will add additional layers of protective rocks on some cable routes and conduct further seabed investigations until 2023. However, there has been significant damage and repairing the damaged cables at already operating offshore wind farms or boosting inadequate protection systems elsewhere, will cost Ørsted about DKr3bn ($489m), according to the company.

The first-quarter results for Ørsted were not good as the profit halved on some one-off items and lower winds. In the first quarter of the last year, the company had booked extraordinary gains from a construction agreement related to transmission assets at the 1.4GW Hornsea 1 offshore wind project in the UK. So, the earnings before interest, taxes, depreciation, and amortization (EBITDA) went down 29% to DKr4.86bn ($792m) in 1Q 2021, compared to the same quarter in 2020. The wind speeds were also higher last year.

Figure 4: Ørsted Stock price YTD

Source: Google

To be fair, there was encouraging news too in terms of operations and progress in business, but it didn’t help much. For example, EMAlpha AI-ML picked up several major developments over the last few months, the prominent ones are as follows;

August 2021

- Ørsted signed Microsoft PPA, AEP, and Doral pen agreement for the 360MWdc Indiana project. Per the terms of Ørsted’s agreement, Microsoft will buy power from Ørsted’s 430 MWac Old 300 Solar Center in Fort Bend County, Texas, which is expected to come online in Q2 2022.

- Dutch dietary supplements maker Royal DSM will be purchasing renewable electricity for its North American operations from a solar project that Ørsted A/S is currently developing in Texas. The companies have signed a power purchase agreement (PPA).

July 2021

- Offshore wind major Ørsted is teaming up with Falck Renewables and BlueFloat Energy to bid in Scotland’s upcoming leasing round with a project that will involve floating turbine technology.

- Ørsted submitted a bid to the Maryland Public Service Commission to develop Skipjack Wind 2, a proposed project of up to 760 megawatts in federal waters due east of Delaware’s beaches. The company’s Skipjack Wind 1, 120 megawatts, is in the development phase.

June 2021

- Ørsted said its 1,148-MW Ocean Wind 2 project has been selected by the New Jersey Board of Public Utilities (BPU) to get a 20-year offshore renewable energy certificate (OREC). Atlantic Shores Offshore Wind LLC and Denmark’s Ørsted both won awards in an offshore wind tender in New Jersey, securing a combined capacity of roughly 2.7 GW.

- Global offshore wind leader Ørsted is joining a consortium with renewable energy firms Fred. Olsen Renewables and Hafslund Eco to develop offshore wind in Norway and bid in upcoming award rounds.

May 2021

- Ørsted and Partners to Participate in Japan’s First Offshore Wind Auction. Ørsted, Japan Wind Development Co. (JWD), and Eurus Energy have formed a partnership with the aim of jointly developing offshore wind projects in the Akita Prefecture, Japan.

- Foundation Installation Starts at Ørsted’s Greater Changhua. OWF, Heerema Marine Contractors’ (HMC) vessel Aegir has started installing jacket foundations at Ørsted’s Greater Changhua offshore wind project site in Taiwan

April 2021

- Ørsted and Enefit link for huge cross-border offshore wind array. Danish giant and local utility aim to deliver 1-2GW project connecting Estonia and Latvia.

- Ørsted joins pensions giant for bid to build world’s first artificial energy island in the North Sea. Offshore wind giant and ATP hope to advance epic project linking up to 10GW with multiple nations.

What is the market worried about?

But the important point is that these issues are not new. For example, in October 2019, the Ørsted shares had suffered a decline on offshore wind production warning as the company had also said that the company may also recourse to job cuts. The company’s shares fell 8% soon after the release of a market update in which it warned that the actual output could be lower than anticipated.

The company confirmed that key production forecast models for its turbine fleet could underestimate the impact of several negative factors, and flagged a cost-reduction drive including job cuts. For example, the blockage effect relates to the slowing of wind as it approaches the turbine, while the wake effect is the impact of wake between and within wind farms.

According to the reports, Ørsted said an internal project to better understand long-term production variables “has led us to conclude that our current production forecasts underestimate the negative impact of two effects across our asset portfolio, the blockage effect and the wake effect”. This will mean a reduced performance which could impact profitability and returns on investment.

There are also concerns about the huge capex requirement. In June, the company announced that it would be ramping up its investment in renewables to 350 billion DKK by 2027 (or USD 57 billion by 2027), to become a global leader in green energy as the competition was increasing. Ørsted previously had a target of 200 billion DKK by 2025. The market reacted negatively to this development due to concerns about profitability and how the increased competition would impact the business.

A Reuters news article on this announcement highlights that it is not just the oil majors such as Total, BP, and Royal Dutch Shell that are investing heavily in renewables. Other companies have also joined the act. Europe’s biggest wind power generator Iberdrola earlier this year pledged to spend 150 billion euros (USD 182 billion) by 2030 to triple its renewable capacity and double its network assets.

There are also reports that the offshore wind pioneers are running into profitability challenges amid fierce competition and price pressure. Mads Nipper, chief executive of Ørsted, had told the Financial Times that delays to licensing decisions risk pushing up costs as competition for acreage increases. This is a direct effect of how competition is impacting companies like Ørsted and others in the renewables space.

For example, Equinor reduced its guided internal rate of return (IRR) for offshore wind from between 6% and 10% to between 4% and 8%. For its oil and gas projects, it projected an IRR of 30%, with a payback time of 1.5 years. While the capex plans are getting more aggressive and ambitious, it is very likely that fierce competition will negatively impact the profitability of projects and the future returns may be lower than expectations or the returns achieved in the past.

The key messages from Ørsted’s stock price performance

The first thing to note is that although Ørsted has underperformed, it is not the only company to do so. In general, the year so far has not been that great for renewable energy developers. It may not be an exact comparison but when we look at the stock price performance of some of the similar companies across the globe, we get a sense that the year 2021 has been a bit different for them as compared to the previous year, 2020. Two examples worth citing would be Iberdrola from Spain and RENOVA from Japan.

Iberdrola is a Spanish multinational electric utility company and as a result of a major focus on green energy, it now has a significant presence in renewables. According to the company, at the close of the first half of 2021, Iberdrola’s renewable installed capacity increased by 8.6 % to 35,537 MW, enabling the company to reach a total capacity of 55,822 MW worldwide (+5.1 %).

As of 30th June 2021, Iberdrola’s onshore wind power has reached 18,810 MW after growing 11%, and solar has almost doubled to more than 2,200 MW. In the first half of 2021, the Energy production increased to 82,901 GWh (+4.6 %), with a boost from renewables, which grew 14 %, an increase in solar production (+108.9 %), offshore wind (+17.4 %), and hydropower (+19.7 %).

Figure 5: Iberdrola Stock price YTD

Source: Google

RENOVA is a Japanese power company that is focusing on the large-scale and cost-efficient deployment of renewable energy. RENOVA is engaged exclusively in renewable energy. It sources, develops, finances, and operates renewable energy power plants including solar PV, biomass, wind, and geothermal. It is the first publicly listed pure-play renewable energy developer in Japan, it is also considered an industry leader in Japan, according to the company.

Figure 6: Renova Stock price YTD

Source: Google

The EMAlpha sentiment-based and ESG analysis proves that there is a strong link between stock price performance and these scores and based on EMAlpha’s AI-ML based analysis of news flow, we think the other key points are as follows;

- The global focus on ESG investing and sustainable finance across asset managers have certainly helped the renewable energy companies and associated technology providers. More money is flowing into ESG and the trend has grown stronger over the last 18-24 months. This has provided a big boost to renewables stocks.

- The fundamentals related to profitability and return on investments do matter and beyond a point, the global macro investing trends will not support the elevated stock prices. It is possible that the negative impact may be quantitatively different but the operating and financial performance will matter.

- Technology is getting better but it is also getting more complex. This may impact the performance delivery as there are more unknowns yet to be discovered. For example, Ørsted had said that their production forecasts underestimated the negative impact of the blockage effect and the wake effect, leading to a negative impact on overall performance.

- The competition is increasing and this will impact returns and the attractiveness of projects. It is interesting that the conventional fuels-based energy companies will try to diversify into renewables and focus more on these areas. This will lead to project and site availability for pureplay renewables. There is big money flowing and the returns may suffer for everyone.

- The asset managers are getting more assertive and they are pushing the energy and Oil & Gas companies to become more proactive in renewables. This will be another reason why the competition will increase in this space. But more importantly, the gap between good and bad on issues like climate change may narrow down and that means, more options for investors to pick and choose from, among the companies.

How EMAlpha’s analysis of Unstructured data can help Investors

Ørsted has been one of the most interesting names from a stock price movement perspective over 2020 and 2021 and it has been repeatedly picked up by EMAlpha AI-ML analysis. There are important takeaways in terms of how EMAlpha’s AI-ML analysis can help investors:

- Can the local news flow collection pick up issues like weather conditions and project profitability, earlier than the English media? Considering how important the Sustainability and ESG issues have become, the local language along with English news analysis can be tracked for the companies. Considering the sensitivities involved, especially when institutional investors have invested in the stock, this is a useful input.

- Can regular analysis of social media be used as input before taking an investment decision? EMAlpha’s analysis of unstructured data becomes a key tool for investors. The unstructured data analysis in other geographies can also be used to assess the potential impact on some of the larger companies. Case in point being IBERDROLA or RENOVA or ReNew Power which are very similar to Ørsted.

- The changes in perception on ESG track record of a company or an asset manager and reactions from institutional investors have become an important driver of stock prices and especially in cases where the volatility is high, it matters even more. The EMAlpha sentiment and ESG scores prove that there is a strong link between stock price performance and these scores. This is helpful in investment decision making:

The news flow analysis and their impact assessment are very difficult to track and hence, it is a cumbersome exercise for asset managers if done without optimal help from machines. EMAlpha solves this problem for portfolio managers, at both portfolio and the company level. EMAlpha’s sophisticated AI-ML tools and proprietary analytical methods are based on deep domain expertise and unmatched technological prowess, helping the investors with the most effective and efficient input.

References

- Ørsted: About our name, From magnetism to offshore wind turbines https://Ørsted.com/en/about-us/about-Ørsted/about-our-name (2nd September 2021)

- Ørsted: About us, Our vision – and who we are https://Ørsted.com/en/about-us/about-Ørsted/our-vision-and-values (2nd September 2021)

- Ørsted maintains financial expectations, but “in the low end” https://www.4coffshore.com/news/%C3%B8rsted-maintains-financial-expectations2c-but-22in-the-low-end22-nid24008.html (2nd September 2021)

- Ørsted returns to profit as offshore wind part-sale outweighs low winds

- Earnings boosted by gain from sale of 50% in the Borssele 1&2 array but Danish utility warns full-year Ebitda may come in at lower end of guidance https://www.rechargenews.com/wind/Ørsted-returns-to-profit-as-offshore-wind-part-sale-outweighs-low-winds/2-1-1051076 (2nd September 2021)

- Renewables leader Ørsted hit by low wind speeds, World’s biggest offshore developer says ‘extraordinarily poor’ weather conditions will eat into profits https://www.ft.com/content/52c74f23-8bfc-44ac-bae8-663b369bd186 (2nd September 2021)

- P. Morgan Stick to Their Hold Rating for Ørsted A/S https://www.investing.com/news/jp-morgan-stick-to-their-hold-rating-for-Ørsted-as-2590085 (2nd September 2021)

- Damaged offshore wind cables to cost Ørsted half a billion dollars, will add additional layer of protective rocks on cable routes and conduct further seabed investigations until 2023 https://www.rechargenews.com/wind/damaged-offshore-wind-cables-to-cost-Ørsted-almost-half-a-billion-dollars-cfo/2-1-1002964 (2nd September 2021)

- Offshore wind giant Ørsted first quarter profit halves on one-offs and lower winds, CEO points to recent CfD awards in Poland and expanding operations https://www.rechargenews.com/wind/offshore-wind-giant-Ørsted-first-quarter-profit-halves-on-one-offs-and-lower-winds/2-1-1002606 (2nd September 2021)

- Ørsted shares plunge on offshore wind production warning, Danish giant warns of job cuts as it says production modelling may underestimate negatives https://www.rechargenews.com/wind/Ørsted-shares-plunge-on-offshore-wind-production-warning/2-1-696585 (2nd September 2021)

- Wind forecasts ‘biased’ as blockage ignored, warned DNV GL, Specific impact needs better understanding, says paper, as Totaro predicts industry will develop better modelling tools https://www.rechargenews.com/wind/wind-forecasts-biased-as-blockage-ignored-warned-dnv-gl/2-1-696914 (2nd September 2021)

- Wake deflection could boost wind farm output by 15%, study finds, Yawing front-of-farm turbines to “steer” flow toward the machines behind could mean a game-changing boost to power output from future wind developments, according to a pioneering new study https://www.rechargenews.com/wind/wake-deflection-could-boost-wind-farm-output-by-15-study-finds/1-1-1182828 (2nd September 2021)

- ‘Baltic leader’: Ørsted and Enefit link for huge cross-border offshore wind array, Danish giant and local utility aim to deliver 1-2GW project connecting Estonia and Latvia https://www.rechargenews.com/wind/baltic-leader-Ørsted-and-enefit-link-for-huge-cross-border-offshore-wind-array/2-1-1000929 (2nd September 2021)

- Ørsted joins pensions giant for bid to build world’s first artificial energy island in North Sea, Offshore wind giant and ATP hope to advance project linking up to 10GW with multiple nations https://www.rechargenews.com/wind/Ørsted-joins-pensions-giant-for-bid-to-build-worlds-first-artificial-energy-island-in-north-sea/2-1-999427 (2nd September 2021)

- Ørsted and Partners to Participate in Japan’s First Offshore Wind Auction, Ørsted, Japan Wind Development Co. (JWD), and Eurus Energy have formed a partnership with the aim of jointly developing offshore wind projects in the Akita Prefecture https://www.offshorewind.biz/2021/05/19/Ørsted-and-partners-to-participate-in-japans-first-offshore-wind-auction/ (2nd September 2021)

- Foundation Installation Starts at Ørsted’s Greater Changhua OWF, Heerema Marine Contractors’ (HMC) vessel Aegir has started installing jacket foundations at Ørsted’s Greater Changhua offshore wind project site in Taiwan https://www.offshorewind.biz/2021/05/05/foundation-installation-starts-at-Ørsteds-greater-changhua-owf/ (2nd September 2021)

- Ørsted plans $57 bln drive to be No.1 in green energy https://www.reuters.com/business/energy/Ørsted-plans-57-bln-drive-be-green-energy-major-2021-06-02/ (2nd September 2021)

- Ørsted signs Microsoft PPA, AEP and Doral pen agreement for 360MWdc Indiana project https://www.pv-tech.org/us-round-up-Ørsted-signs-microsoft-ppa-aep-and-doral-pen-agreement-for-360mwdc-indiana-project/ (2nd September 2021)

- Ørsted, inks PPA with Royal DSM for Texas solar project https://renewablesnow.com/news/rsted-inks-ppa-with-royal-dsm-for-texas-solar-project-749969/ (2nd September 2021)

- Equinor and Ørsted see green ambitions hit profitability headwinds, Offshore wind pioneers running into profitability challenges amid competition and price pressures https://www.upstreamonline.com/energy-transition/equinor-and-Ørsted-see-green-energy-ambitions-hit-profitability-headwinds/2-1-1031016 (2nd September 2021)

- Offshore wind major Ørsted (ØRSTED.CO) is teaming up with Falck Renewables (FKR.MI) and BlueFloat Energy to bid in Scotland’s upcoming leasing round with a project that will involve floating turbine technology https://www.reuters.com/business/energy/Ørsted-forms-partnership-bid-scotland-offshore-wind-leasing-round-2021-07-08/ (2nd September 2021)

- Ørsted submits bid for more wind turbines, Skipjack Wind 2 would be roughly six times larger than Skipjack Wind 1 https://www.capegazette.com/article/%C3%B8rsted-submits-bid-more-wind-turbines/224248 (2nd September 2021)

- Atlantic Shores, Ørsted bag 2.7 GW in New Jersey offshore wind tender https://renewablesnow.com/news/atlantic-shores-rsted-bag-27-gw-in-new-jersey-offshore-wind-tender-746162/ (2nd September 2021)

- Ørsted joins local consortium for Norwegian offshore wind bids https://www.reuters.com/business/energy/Ørsted-joins-local-consortium-norwegian-offshore-wind-bids-2021-06-09/ (2nd September 2021)

- Iberdrola Facilities map and main operational data https://www.iberdrola.com/about-us/figures/main-operational-data (2nd September 2021)

- RENOVA CEO message to shareholders and investors https://www.renovainc.com/en/ir/message/ (2nd September 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.