Sri Lanka: Diverging News Drives Diverging Stock Returns

Synopsis: This is a follow-up note to EMAlpha’s Insight, Sri Lankan Stock Market is on Fire: An Analysis on How the News Flow Is Driving the Blaze?, dated 30th January 2021. In January 2021, Sri Lanka was one of the best performing global markets with more than 30% return for the S&P Sri Lanka 20 Index (S&P SL 20) in just under a month. EMAlpha’s AI focused on and analysed unstructured data on the major stock constituents and found that this was triggered by, a) S&P SL 20 revision, as four out of the top five performers of the index were recent entrants, b) Covid-19 pandemic, courtesy of which some of these companies found themselves ‘at the right time and at the right place’, c) events like Restructuring (in case of LOLC Holdings) and Stock Splits (Dipped and Hayleys). We had mentioned that restructuring and Stock Splitting were not regular occurrences and hence, positive momentum was unlikely to sustain. Thus far, February has been terrible for the index as the S&P SL 20 Index has already corrected by 17%. While it is true that the outperformers of January mostly experienced the brunt of the correction, the answers for this stock price performance lies more in the macro developments and flows. And this is where EMAlpha’s AI makes all the difference. EMAlpha’s unstructured data analysis has proven to capture these developments well and that is a big advantage in understanding what turn the market would be taking going forward. Now what could be next? In smaller markets like Sri Lanka, the macro news flow impacts the stocks across the board and it is always much more likely that the recent outperformers would also be the ones who would suffer a little more when correction comes calling. Nevertheless, we expect March to be much less volatile than either January or February.

S&P Sri Lanka 20 Index: 30% Returns in January 2021

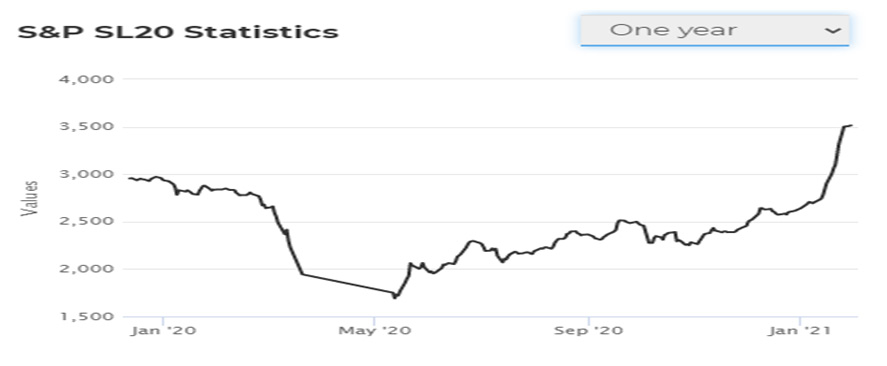

In the EMAlpha Insight, Sri Lankan Stock Market is on Fire: An Analysis on How the News Flow Is Driving the Blaze?, dated 30th January 2021, we discussed how Sri Lanka has been one of the best performing global markets in January with approximately 30% return over the course of less than a month. The S&P Sri Lanka 20 Index had closed at 2,638 on 31st December 2020 and was at 3,505 on 27th January 2021 i.e. a staggering 33% return in less than a month. We had posted the chart below in the insight, showing the index performance up to 27th January 2021.

Chart 1: S&P Sri Lanka 20 Index (One Year Performance) – As on 27th January 2021

Source: Colombo Stock Exchange (https://www.cse.lk/)

At the individual performance level of the S&P SL20 constituents, just 25% of the stocks actually contributed to the rally, heavily skewing the average index return.

In the order of their respective YTD stock price performance (as on 27th January 2021), these stocks are as follows:

| Lanka ORIX Leasing (LOLC Holdings) | 286.30% |

| Royal Ceramics Lanka PLC | 135.96% |

| Dipped Products PLC | 117.15% |

| Hayleys PLC | 95.65% |

| Expolanka Holdings PLC | 94.81% |

EMAlpha AI then focussed on and analysed information flow for all the 20 companies on a monthly basis, beginning January 2020 and ending January 2021. More emphasis was laid on the last three months (November 2020, December 2020 and January 2021) for the top 5 companies. We analysed the gathered data and found:

- Four of the top five performers had entered the Index in the last revision that happened in December 2020 and they had pushed the markets higher. These companies were: Royal Ceramics Lanka PLC, Dipped Products PLC, Hayleys PLC and Expolanka Holdings PLC.

- Two of these companies were direct beneficiaries of the Covid-19 pandemic (manufacturer of rubber gloves etc.): Hayleys PLC and Dipped Products (Dipped is a subsidiary of Hayleys). Another company, Expolanka Holdings, also witnessed exceptional tail winds because of the Covid-19 pandemic related exports to North America.

- Three companies had one-off events which increased investor interest and helped boost their stocks: LOLC Holdings had restructuring and consolidated all the finance companies under one umbrella company. Hayleys and Dipped had stock splits.

We had concluded then, due to the aforementioned reasons that had propelled the recent highs, that the positive momentum was unlikely to sustain. While we didn’t explicitly forecast market correction, we predicted subdued near term returns.

February 2021: Revisiting the Sri Lankan Market

The S&P Sri Lanka 20 Index closed at;

- 2,638 on 31st December 2020

- 3,505 on 27th January 2021

- 2,898 on 23rd February 2021

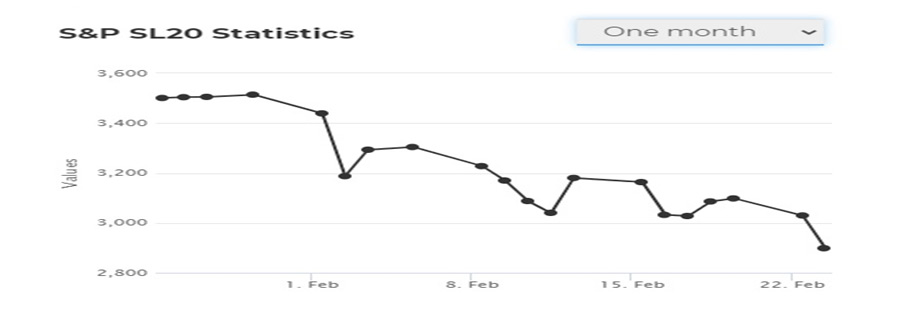

As can be inferred, the Index has corrected by more than 17% between 27th January 2021 and 23rd February 2021.

Chart 2: S&P Sri Lanka 20 Index (One Month Performance) – As on 23rd February 2021

Source: Colombo Stock Exchange (https://www.cse.lk/)

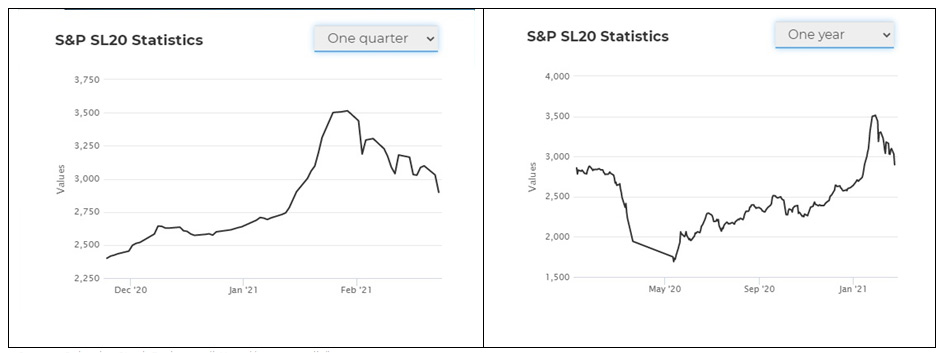

What is interesting to note is that the month of January had virtually no dips for S&P Sri Lanka 20 Index. However, February has been an altogether different story and the S&P Sri Lanka 20 Index chart for the quarter and for the year looks very distinct indeed.

Chart 3: S&P Sri Lanka 20 Index (One Quarter and One Year Performance) – As on 23rd February 2021

Source: Colombo Stock Exchange (https://www.cse.lk/)

What Goes Up must Come Down

When we look at the YTD performance of S&P Sri Lanka 20 Index constituents, we zoom in on two points: first, at the time of our previous insight (27th January 2021) and second, as of now (as on 23rd February 2021). This is where we find interesting observations. All the major gainers of January (Lanka ORIX Leasing or LOLC Holdings, Royal Ceramics Lanka PLC, Dipped Products PLC, Expolanka Holdings PLC and Hayleys PLC) are the stocks which corrected the most in February and count among the major losers of the month.

Table 1: The YTD Stock Price Performance of S&P SL20 Constituents (As on 27th January 2021 and 23rd February 2021)

| Stock Name | YTD Stock Price Performance (%) 27th January 2021 | TD Stock Price Performance (%) 23rd February 2021 | Numerical Difference (%) | |

1 |

Access Engineering |

21.05% |

-4.45% |

-25.50% |

2 |

Chevron Lubricants Lanka |

4.26% |

-6.39% |

-10.65% |

3 |

Commercial Bank of Ceylon |

23.11% |

6.30% |

-16.81% |

4 |

DFCC Bank PLC |

15.38% |

-5.38% |

-20.76% |

5 |

Dialog Axiata PLC |

4.03% |

3.23% |

-0.80% |

6 |

Dipped Products PLC |

117.15% |

43.27% |

-73.88% |

7 |

Distilleries Company of Sri Lanka PLC |

12.08% |

-2.00% |

-14.08% |

8 |

Expolanka Holdings PLC |

94.81% |

40.14% |

-54.67% |

9 |

Hatton National Bank |

16.50% |

5.02% |

-11.48% |

10 |

Hayleys PLC |

95.65% |

45.78% |

-49.87% |

11 |

Hemas |

-1.90% |

-19.50% |

-17.60% |

12 |

John Keells |

14.90% |

1.54% |

-13.36% |

13 |

Lanka ORIX Leasing (LOLC Holdings) |

286.30% |

162.96% |

-123.34% |

14 |

MelstaCorp PLC |

31.73% |

-9.04% |

-40.77% |

15 |

National Development Bank |

26.79% |

7.31% |

-19.48% |

16 |

People’s Leasing & Finance |

16.13% |

-2.42% |

-18.55% |

17 |

Royal Ceramics Lanka PLC |

135.96% |

57.72% |

-78.24% |

18 |

Sampath Bank |

21.01% |

11.59% |

-9.42% |

19 |

Teejay Lanka PLC |

19.69% |

7.61% |

-12.08% |

20 |

Tokyo Cement Company (LANKA) PLC |

11.97% |

-8.03% |

-20.00% |

Source: Colombo Stock Exchange (https://www.cse.lk/pages/indices/indices.component.html), https://www.investing.com/indices/sp-sri-lanka-20-components

EMAlpha AI’s analysis of the major news flow on the Index and the five Stocks

Over the last few weeks, EMAlpha AI analysed the news flow on S&P Sri Lanka 20 Index, and on the five stocks: Lanka ORIX Leasing or LOLC Holdings, Royal Ceramics Lanka PLC, Dipped Products PLC, Expolanka Holdings PLC and Hayleys PLC.

S&P Sri Lanka 20 Index

Most of the news flow has been negative and there are reports of selling by foreign investors. There have also been news of trading halts because of sharp decline in markets. The news flow is also not very positive on the broader economy and the speed of recovery.

- Stock market on slippery slope as 5% dip in S&P trigger trading halt, http://www.ft.lk/front-page/Stock-market-on-slippery-slope-as-5-dip-in-S-P-trigger-trading-halt/44-713707 , 24th February 2021

- Macro concerns weigh down stock market, http://www.ft.lk/front-page/Macro-concerns-weigh-down-stock-market/44-713680 , 23rd February 2021

- Negative investor sentiments in the wake of Geneva worries, https://island.lk/negative-investor-sentiments-in-the-wake-of-geneva-worries/ , 23rd February 2021

- CSE crash continues: Trading halted 4 times in 5 days, https://www.newsfirst.lk/2021/02/11/cse-crash-continues-trading-halted-4-times-in-5-days/ , 11th February 2021

- Stock market begins fresh week negative; YTD net foreign selling tops Rs. 10 bn mark, http://www.ft.lk/front-page/Stock-market-begins-fresh-week-negative-YTD-net-foreign-selling-tops-Rs-10-b-mark/44-712853 , 9th February 2021

- Sri Lanka’s Foreign Debt Crisis Could Get Critical in 2021, https://thediplomat.com/2021/02/sri-lankas-foreign-debt-crisis-could-get-critical-in-2021/ , 9th February 2021

- CEO’s have mixed outlook for Sri Lankas’s economy in 2021 , https://www.consultancy.asia/news/3911/ceos-have-mixed-outlook-for-sri-lankass-economy-in-2021 , 8th February 2021

Lanka ORIX Leasing or LOLC Holdings

The Q3 results were not that great and the quarterly performance wasn’t as good as the first half performance for the financial year.

- JKH back on top; LOLC still holding on to 3rd place, http://www.dailymirror.lk/business-news/JKH-back-on-top-LOLC-still-holding-on-to-3rd-place/273-205959 , 17th February 2021

- LOLC Group records Rs. 4 b 3Q profit, Rs. 45 b for 9 months, http://www.ft.lk/front-page/LOLC-Group-records-Rs-4-b-3Q-profit-Rs-45-b-for-9-months/44-713243 , 16th February 2021

Royal Ceramics Lanka PLC

Nothing significant on the company.

Dipped Products PLC

The news flow remains positive on the demand for its products.

- Dipped Products on a tear as pandemic boosts demand for rubber gloves, http://www.dailymirror.lk/business-news/Dipped-Products-on-a-tear-as-pandemic-boosts-demand-for-rubber-gloves/273-206219 , 20th February 2021

Expolanka Holdings PLC

The results were good and the news flow has largely been positive.

- Expolanka upholds stable growth; records Rs 57.8 billion Revenue and Rs 4.5 billion PAT during Q3, http://www.colombopage.com/archive_21A/Jan30_1611978896CH.php , 30th January 2021

- Sri Lankan shares end higher as industrial stocks gain, https://www.reuters.com/article/sri-lanka-markets-close-idUSL4N2KB3DO , 5th February 2021

Hayleys PLC

The news flow ranges between neutral to negative.

- Hayleys’ group-listed shares underperform post-split as stakeholders vary on causes, http://www.ft.lk/front-page/Hayleys-group-listed-shares-underperform-post-split-as-stakeholders-vary-on-causes/44-713275 , 17th February 2021

- Hayleys Group subsidiaries’ shares highest traded at CSE, https://island.lk/hayleys-group-subsidiaries-shares-highest-traded-at-cse/ , 9th February 2021

Conclusion

The Sri Lankan market is taking a breather after an exceptional run of S&P SL 20 Index in the month of January 2021. The situation got aggravated because of two reasons: a) some macro-economic concerns appearing on the horizon, b) some profit booking by foreign investors. The stock specific news flow can’t be blamed except for a few cases. This also gets confirmed because there is not even a single stock, out of the total twenty, which has gained during this period. In smaller frontier market indices, this is the usual trend whereas timing matters the most on the broader markets.

What could be next? Over the past twelve months, the market performance for Sri Lanka has largely been in line with most of the other global financial markets. In smaller markets like Sri Lanka, the macro news flow impacts the stocks across the board and it is always much more likely that the recent outperformers would be the ones to correct a little more. Nevertheless, we expect March to be much less volatile than either January or February. The market has corrected significantly in February, but there has surely been some resistance to this correction because some of the companies which we have discussed here, are extremely well-placed when it comes to their business fundamentals.

How EMAlpha can help investors on Sri Lanka?

Macro economy related news flow has been the major market driver and has been a good predictor of where the market would move. For Sri Lanka, some of the themes captured by EMAlpha’s analysis are:

- It is possible for the market to go up because of a few stocks but while coming down, these will be the stocks that tend to correct more even when there is no strong underlying reason for the same. When the news flow on the macro economy is negative for these smaller markets, the indices will correct and the recency effect will also play a role. EMAlpha AI captures these macro events.

- The news analysis can be tracked for the companies experiencing tailwinds in order to make an assessment on the chances of their inclusion in the S&P SL20 during the next revision. They are potentially going to do better when it comes to their stock price performance. This was the case with most of the stocks of the S&P SL 20 which experienced more volatility in January and February.

- The unstructured data analysis in other geographies can also be used to assess the potential impact on some of the larger companies in Sri Lanka. Case in point being Top Glove from Malaysia which is very similar to Dipped Products in terms of the opportunity that was created because of the Covid-19 pandemic. In addition, structurally sound stories under the circumstances like Expolanka tend to do better and EMAlpha AI captures that perfectly.

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should see ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.