Norges Bank: World’s Biggest Sovereign Fund talks ESG in Real Estate

Synopsis: Norges Bank Investment Management (NBIM or popularly known as Norges Bank) has 12 trillion NOK or 1.4 trillion USD of Assets Under Management, which makes it the world’s largest sovereign wealth fund. Norges Bank invests in more than 9,000 companies and on average, the fund holds 1.4 percent of all the world’s listed companies while investing in more than 70 countries. Naturally, it invests across sectors and across multiple asset classes. However, a recent report highlighted the hidden ESG risks facing Norges Bank Investment Management, in terms of its real estate portfolio. Although NBIM screens companies for ESG compliance, that has been missing in its real estate holdings which account for around US $ 30 billion of its portfolio holdings, just a little more than 2% or materially insignificant. But the larger issue is perception related in terms of what the outside world thinks on how the Norges Bank invests and the process it follows. The firm was quick to revert, following the findings, and stated that it was looking at upgrading its strategy to inculcate ESG risks into its real estate investments. Coming from the world’s largest sovereign wealth fund, such a proactive response is very encouraging and inspiring for the ESG movement. Although ESG is now being incorporated by investors into their investment decisions, there still is a lack of clarity regarding the process. As the field is in its nascent stage, this lack of clarity isn’t surprising but rather a call for improvement on part of data vendors, companies, asset managers, and other stakeholders to separate the wheat from the chaff. While some may vouch for the huge significance of an overall ESG score, EMAlpha has regularly stressed the need for sector-specific disclosures. And with Norges Bank Investment Management coming out with a statement to address ESG risks in its real estate holdings, it is yet another proof that asset allocators and asset managers are also beginning to realize the necessity of sector-specific ESG performance.

Norges Bank Investment Management (NBIM)

Norges Bank Investment Management, established in 1998, is the asset management unit of the Norwegian central bank (Norges Bank) and it manages the Government Pension Fund Global, also known as the Norwegian oil fund. Counted among the world’s biggest wealth funds, the fund now owns almost 1.4% of all shares in the world’s listed companies. The fund has a market value of US $ 1.4 trillion. Christiana Figueres, former executive secretary of the United Nations Framework Convention on Climate Change said that “NBIM is a highly influential investor, and is recognized worldwide as a leader in corporate governance, transparent reporting, and active ownership”.

The fund has generated an annual return of 6.6% since 1998. Ever since the discovery and production of oil in the late-60s/early-70s, Norway’s economy has been hugely dependent on oil. It has also made Norway one of the wealthiest countries in the world. The oil and gas sector is Norway’s largest measured in terms of value-added, government revenues, investments, and export value. The Norges Bank Investment Management manages funds according to the management mandate laid down by the Ministry of Finance, Government of Norway. One of the features of the fund is that it is invested exclusively outside Norway to protect Norway’s economy.

NBIM Portfolio Distribution

The NBIM fund has traditionally invested in three areas:

- Equity

- Fixed Income

- Real Estate

In 2020, through an amendment to the management mandate, the fund began investing in a new area: Infrastructure for renewable energy.

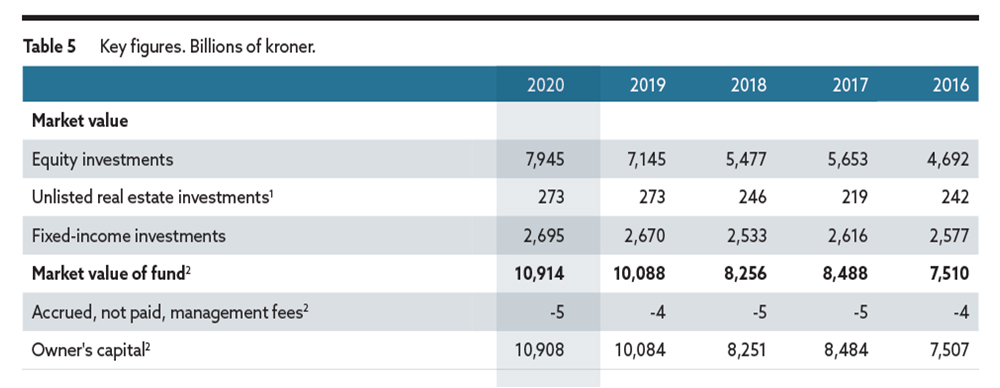

As of 2020, the fund’s equity investments stand at a little more than US $ 900 billion. Its fixed-income investments, as of 2020, amount to almost US $ 300 billion and the real estate investments work out to US $ 30 billion.

Figure 1: Fund holdings (billions of kroner)

Source: NBIM Government Pension Fund Global, Annual Report 2020

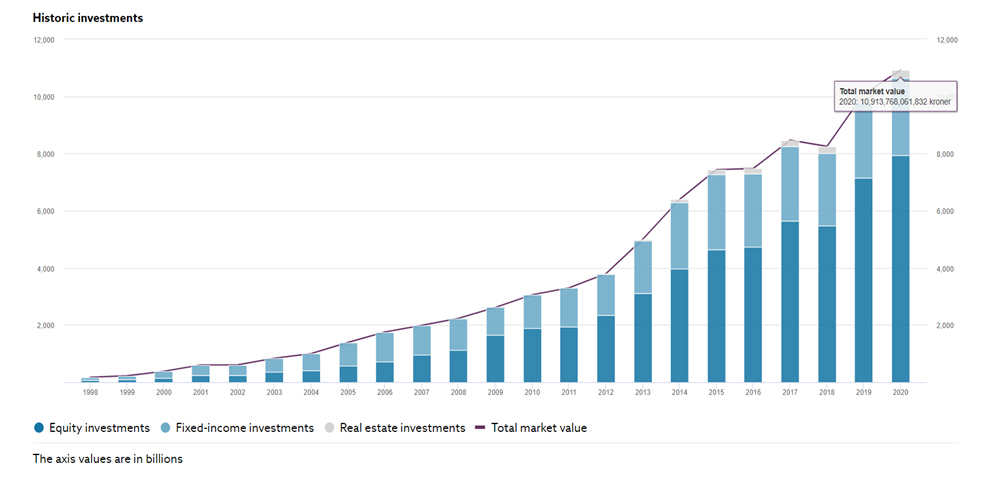

Figure 2: Market value over the years

Source: www.nbim.no

The recent brush with ESG

In a recent “government-commissioned report”, it was found that NBIM needed to identify the biggest climate risks and ensure that those risks are properly reflected in its portfolio. The report’s lead author Martin Skancke points out that the effects of climate change on industries other than oil are not properly understood. He also pointed out the less-understood impact of climate change on the real estate sector. With global warming, the shorelines are receding, thus making certain lucrative by-the-sea areas uninhabitable. Combine that with the increasing floods that various parts of the globe are witnessing and there are reasons to contest for inclusion of ESG in real estate investments.

To the fund’s credit, Mie Holstad, the chief real assets officer at Norges Bank Investment Management, proactively stated that the fund was working on a strategy modification to ensure that its US $ 30 billion real estate portfolio aligns with carbon neutrality goals mapped out in Paris Agreement. In her words, “What we’re working on now is a separate, improved sustainability strategy, which prepares us for net-zero as well as new laws and regulations surrounding carbon emissions”.

Being a founding signatory of PRI (Principles of Responsible Investment), NBIM has well-detailed policies around ESG investing. The fund screens companies for ESG risks before making a move. As such, it calls for action on part of the fund to include ESG assessment into the hitherto hidden risks posed by its real estate portfolio. Even though real estate forms a very small part of the fund’s holdings, nonetheless, any failure to implement ESG on one of its holdings (no matter the size) could have a cascading effect on the rest of the portfolio.

Why ESG matters in Real Estate

According to a 2019 State Street report titled “The rise of ESG in Real Estate”, it was mentioned that real estate properties, across the US, that were exposed to rising sea level were selling at 7% discount as compared to properties with lesser exposure. As mentioned above, ESG risks haven’t really been factored extensively into industries other than oil. That doesn’t mean that ESG doesn’t matter to those industries. If left unaddressed, ESG could be the chink in the armor for many of these companies. Real estate is one such sector that has yet to see any noticeable progress in ESG.

According to a report by Deloitte titled “The Impact of Social Good on Real Estate”, written by Francisco Da Cunha & Filipa Belchior Coimbra, “The application of ESG standards on real estate (notably by governments and developers in many developed countries) has shown that this asset class is also relevant when these guiding principles are being applied. Awareness is growing that real estate can have a significant social impact either through the form of rehabilitation of public spaces (indirectly attributing value to existing real estate), affordable housing, social housing, and care centers, or through an environmental focus investment on new buildings such as green buildings.”

Cities around the world account for about 73% of total GHG emissions. With growing awareness, these cities have begun adopting ESG measures into their infrastructure, such as the construction of green buildings by using eco-friendly materials or new tech, renewable energy sources for electricity, water management, waste disposal, etc… This has also led to the initiative called “Smart Cities” which manages cities’ infrastructure more efficiently through the use of technology. Dubai and Singapore are a few examples worth mentioning.

Dow Jones US Select Green REIT Index

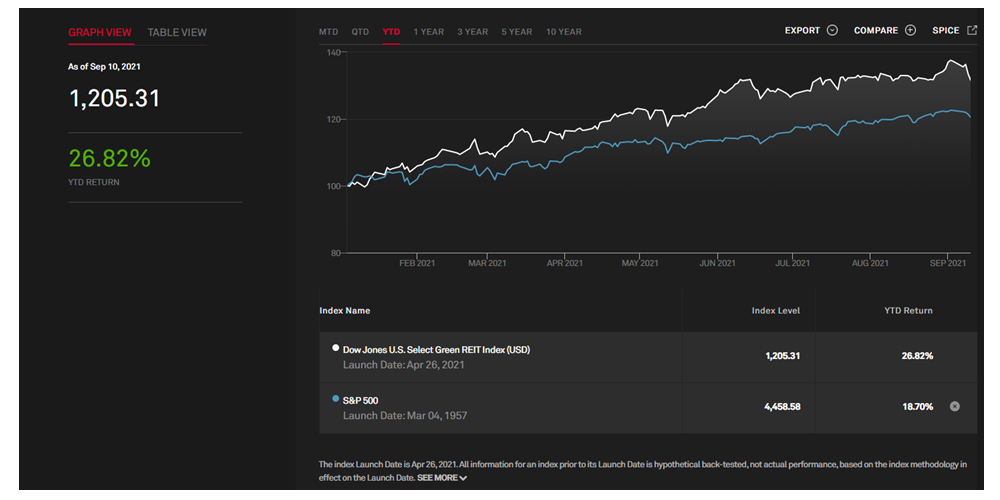

Figure 3: YTD comparison of Dow Jones US Select Green REIT and S&P 500

Source: spglobal.com

According to spglobal.com,

“The Dow Jones U.S. Select Green REIT Index is designed to measure the performance of publicly-traded real estate securities in the Dow Jones U.S. Select REIT that meet sustainability criteria. The index attempts to improve GRESB Total ESG scores exposure with respect to the underlying index by overweighting those companies with relatively high GRESB scores and underweighting those with lower or zero scores”.

The outperformance of the Dow Jones US Select Green REIT Index is evident. While S&P 500 has given 18.7% returns year-to-date, the Dow Jones US Select Green REIT Index has given 26.82% returns so far this year.

It is estimated that 40% of all global carbon emissions are driven by the construction and operation of buildings. This magnifies the importance of ESG in real estate by multiple times and calls for further scrutiny of the sector.

The process of portfolio exclusion decision at NBIM

The exclusion from an investment portfolio due to ESG investing filters has become a more regular occurrence over the last eighteen months and the largest funds of the world are taking a lead in this. Some of the funds will talk about it a lot more than others while some will do it without any noise.

But this is a phenomenon that is rather difficult to miss. So, when Norges Bank Investment Management decided to exclude four companies from the Government Pension Fund Global at the beginning of this month, the reaction was subdued. The markets expect these things to happen.

Norges Bank decided to exclude Elco Ltd, Ashtrom Group Ltd, and Electra Ltd due to unacceptable risk based on the companies’ activities associated with Israeli settlements on the West Bank. Also, Oil & Natural Gas Corp Ltd from India was excluded because of the company’s ties to groups that seriously violate human rights in South Sudan.

What is more interesting is the time lag between the recommendation to exclude from the Council on Ethics at Norges Banks and the final decision. For the first three companies, the decision was based on recommendations on 15th March 2021. In the case of Oil & Natural Gas Corp, the decision is based on a recommendation on 8th January 2021.

But that is for a reason. Norges Bank explains “The Executive Board is satisfied that the exclusion criteria have been fulfilled. Before deciding to exclude a company, Norges Bank shall consider whether the use of other measures, including the exercise of ownership rights, maybe better suited. The Executive Board concludes that it is not appropriate to use other measures in these cases.“

For the funds and their asset managers, between a hasty outright exclusion at one end and an endless process of engagement at the other, what Norges Bank Investment Management has done seems like a more sensible approach.

Think, analyze and then decide. In some cases, the engagement may not yield results. But asset managers must look at the companies individually and not just on the basis of which sector is good and which sector is bad. And when nothing else works, excluding the company must be exercised.

How EMAlpha can help?

Investors are increasingly integrating ESG into their investment decisions. While this is a positive step for the ESG movement, the investors have to tread with added caution. ESG as a term encompasses a wide spectrum of metrics. The real value lies not in the wider coverage but rather in the specific, more granular coverage. For instance, Amazon. While the company has very good “environmental” credentials, the story is much different when it comes to its “social” credentials. The company has courted numerous controversies over the years regarding its warehouse working conditions. If an investor goes solely by the overall ESG score of Amazon, they would be downplaying the critical risks posed by the company’s lack of “social” credentials. The same goes for Tesla as well. While Tesla scores big in the “environmental” aspect due to its line of business of producing electric cars, the company didn’t use to fare well on the “governance” front. Although that is gradually changing, it is something that an investor must keep an eye out for.

It thus is clear that an investor mustn’t get swayed away by the goodie-looking overall ESG score. Rather the investor must go deep and look for the sector-specific disclosures and granular details concerning the company. Factors that affect the ESG scores of a rubber manufacturing company may not be the same as those that affect an FMCG company. Hence, it becomes prudent to discern ESG scores using a sector-specific lens.

On the basis of AI-ML based analysis of the available news flow on ESG ratings and data products providers and our interaction with the sustainable finance ecosystem, we think it is clear that a) very few people need readymade ratings, and more people want quality data, b) different clients need different pitch and for that solid background research is necessary, and c) because of conflict of interest, ratings are not advisable to be offered by everyone nor are they for all the asset managers unless they know how to use them and what is going on in the process.

At EMAlpha, we have incorporated a Flexible Framework Management System, based on EMAlpha’s proprietary technology making inferences framework agnostic. This also offers a quick adaptation for the users (asset managers, companies, and investment advisors). As such, the EMAlpha’s ESG and Sustainability offering is centred around addressing some of the most critical issues.

The EMAlpha algorithms provide a choice for separate relevant frameworks and these can be used to review the performance more transparently. This not only helps the investment advisors but also makes the clients understand the granular details better which in turn is helpful for them to understand their preferences better. To achieve this, we focus on the following;

- Go beyond the official reported version – The data source matters and there is a need to look beyond what the companies are reporting and what the official version is. It is essential to rely on the company-reported data because other sources might not be collating as much information. Although often, there are other sources as well for environment-related information. They include the information disclosure as mandated by regulators and the EMAlpha algorithms scan through unstructured data to pick the unofficial information too.

- No two ESG scores are the same despite the same headline figure – It is the composition that makes a big difference and all the three parameters that make up ESG need to be evaluated separately. The EMAlpha algorithms provide separate scores for E, S, and G so that an investor can review the sectoral performance more transparently. Over and above, a key feature of EMAlpha’s NLP algorithms is that the attribution analysis is fairly simple and straightforward.

- An ESG score without context and background is meaningless – The ESG is as much about intent as it is about execution. For this balanced evaluation, having an understanding of the local factors is very crucial. A very good ESG track record (probably more driven by excellent performance in E and/or S) may hide serious Governance related risks and the investors can only ignore them at their own peril. EMAlpha analysis meticulously incorporates this critical part of the ESG evaluation jigsaw puzzle.

References

- Funds Holding $10 Trillion Are Told Their ESG Goals Fall Short https://www.bloomberg.com/news/articles/2021-08-28/funds-holding-10-trillion-are-told-their-esg-goals-fall-short (Accessed on 11th September 2021)

- About the fund https://www.nbim.no/en/the-fund/about-the-fund/ (Accessed on 11th September 2021)

- Top 5 Sovereign Wealth Funds https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/top-5-sovereign-wealth-funds/ (Accessed on 11th September 2021)

- Government Pension Fund Global / Norges Bank Investment Management https://www.top1000funds.com/asset_owner/government-pension-fund-global-norges-bank-investment-management/ (Accessed on 11th September 2021)

- Investments https://www.nbim.no/en/the-fund/investments/#/2020 (Accessed on 11th September 2021)

- The Impact of Social Good on Real Estate https://www2.deloitte.com/ce/en/pages/real-estate/articles/the-impact-of-social-good-on-real-estate.html (Accessed on 11th September 2021)

- Rise of ESG (Environmental, Social and Governance in the real estate sector https://www.statestreet.com/content/dam/statestreet/documents/Articles/TheRiseofESGinRealEstate.pdf (Accessed on 11th September 2021)

- World’s biggest wealth fund steps up ESG focus in real estate https://www.bloomberg.com/news/articles/2021-09-06/world-s-biggest-wealth-fund-steps-up-esg-focus-in-real-estate (Accessed on 11th September 2021)

- Banks’ Hidden ESG Risks Exposed in Norway Wealth-Fund Review https://www.bloomberg.com/news/articles/2021-08-22/banks-hidden-esg-risks-exposed-in-norway-wealth-fund-review (Accessed on 11th September 2021)

- Talking Points: adding ESG transparency to real estate https://www.spglobal.com/spdji/en/documents/education/education-talking-points-adding-esg-transparency-to-real-estate.pdf (Accessed on 11th September 2021)

- Climate risk and the petroleum fund https://www.regjeringen.no/contentassets/fb49a0e957324d7caadb625c6ec4490c/no/pdfs/r-0655-b-klimarisiko-og-oljefondet.pdf (Accessed on 11th September 2021)

- Decisions on exclusion. Norges Bank has decided to exclude four companies from the Government Pension Fund Global. https://www.nbim.no/en/the-fund/news-list/2021/decisions-on-exclusion/ (Accessed on 12th September 2021)

- Norway wealth fund drops ONGC from portfolio over South Sudan business https://www.livemint.com/market/stock-market-news/norway-wealth-fund-drops-ongc-from-portfolio-over-south-sudan-business-11630659948172.html (Accessed on 12th September 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.