Market and Coronavirus Pandemic News: Shifting Pendulum Between Optimism and Pessimism

The divergence between sentiment on Coronavirus news flow related parameters and market performance has baffled the market analysts and observers. This week as well was very good for S&P 500 (it has now gained more than 25% in less than a month) and more or less, this is the situation elsewhere too. Most markets are up at least 15-20% and we are now far away from the lows of March.

Fig. 1: The performance plat for S&P 500 over last one month (Source: Google)

But this is only half the story. The on-ground situation on Corona seems to be telling something very different. On Global Coronavirus news sentiment and country-by-country Corona sentiment, things continue to deteriorate. Except for a few exceptions like USA and China, most countries are struggling to contain infections and the statistics are plummeting. Similarly, the global Corona sentiment has deteriorated sharply this week.

Why the market does not seem to be perturbed. There could be multiple reasons including,

a) it had corrected much more than it should have,

b) Fed is injecting so much liquidity in the system and that is driving the markets,

c) the Corona news is already priced in and things have actually improved in worst affected countries such as China, Spain and Italy. Whatever it may be, but deteriorating news sentiment on Corona has not made much impact on markets.

The details and Inferences from Corona and News Sentiment

The discussion on the SIX parameters is as follows:

1) Coronavirus Country-by-Country Sentiment Time Series

2) Coronavirus Aggregate Global Sentiment Time Series

3) Daily Coronavirus Sentiment Heat Map for Countries

4) News Topic Sentiment for Key Words

5) Crude Oil News Sentiment and

6) Aggregate India Equity Markets Sentiment.

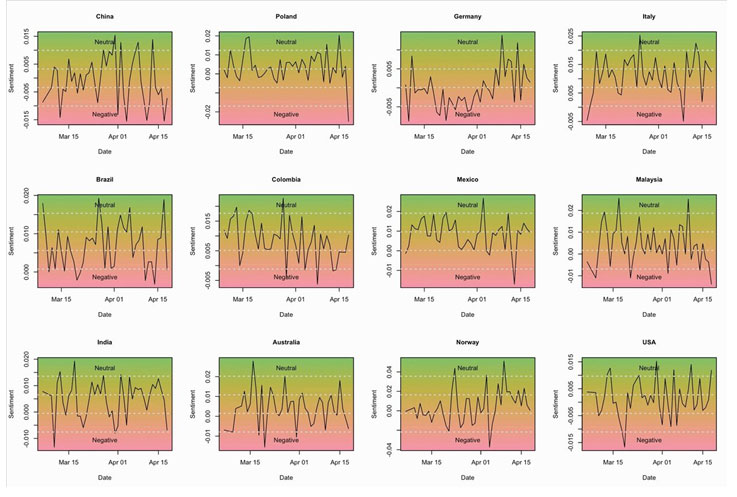

Coronavirus Country-by-Country Sentiment Time Series

This is one of the most important charts because market reaction locally depends much more on how Corona News Sentiment is evolving locally. This has deteriorated a bit vs. last week and this week 9/12 countries reflecting deterioration vs. 8/12 countries last week. The good news; both USA and China, the most important affected countries show a considerable improvement.

Fig. 2: Country by country sentiment score for select countries focusing on Coronavirus related news

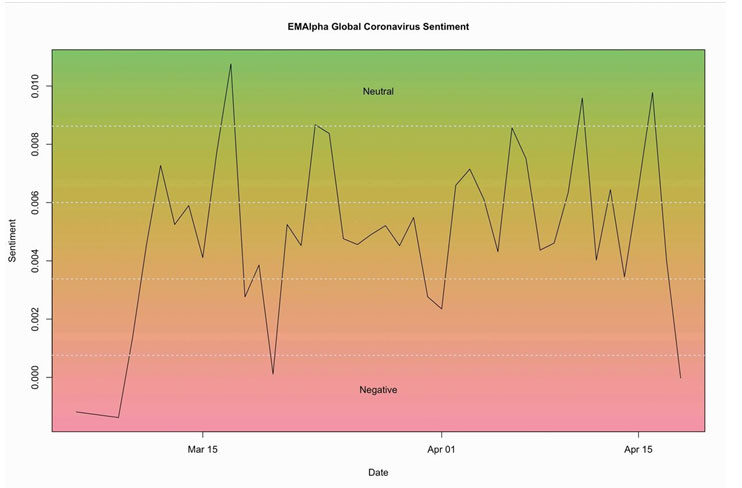

Coronavirus Aggregate Global Sentiment Time Series

The aggregate Global Sentiment on Coronavirus sentiment has deteriorated sharply as there are talks about ‘W’ shaped infection trajectory and next wave. This deterioration is at odds with improvement in USA and China. The more important takeaway is that the deterioration is rather sharp and Global Corona sentiment is at the lowest level seen in more than a month. This is not good news.

Fig. 3: Aggregate Coronavirus related news Sentiment

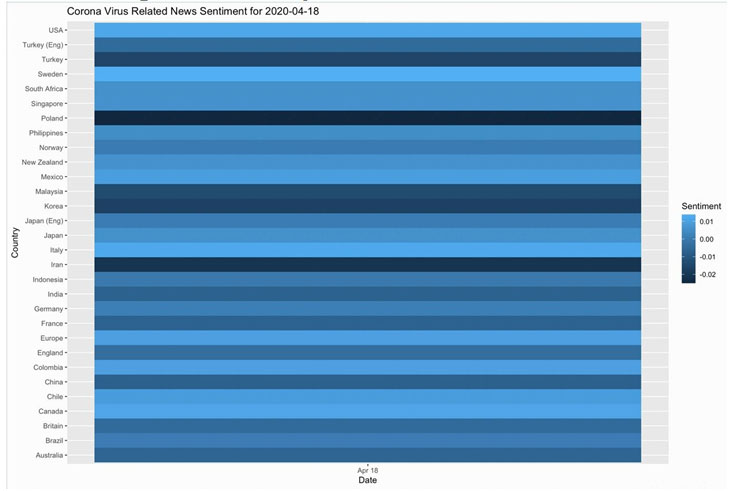

Daily Coronavirus Sentiment Heat Map for Countries

The sentiment has got better in Canada, China and Sweden. But things don’t look that good in India, Iran, Korea and Poland. There is a dichotomy here as the Heat Map on an aggregate basis looks in general better than how it looked last week while as we discussed previously, the Global Coronavirus sentiment has deteriorated sharply and on country by country basis, there has been a worsening of sentiment. We have no idea why this should be the case.

Fig. 4: Coronavirus related News Sentiment Heat Map

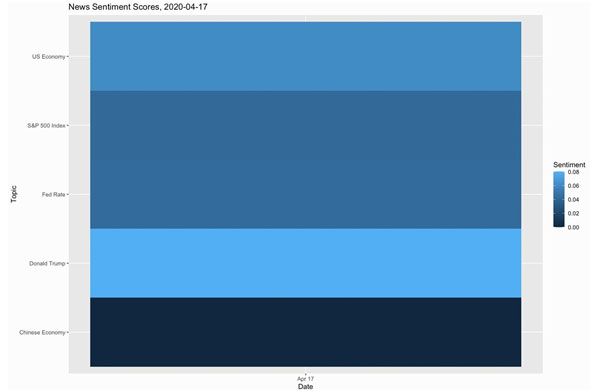

News Topic Sentiment for Key Words

Because markets are influenced by the sentiment for news flow around some very important and immensely popular key words, the results are important for market direction. There is a very high level of pessimism around Chinese economy and the situation is almost the same on this as last week. The big swing continues to be on news sentiment around US President, Donald Trump. The sentiment on Trump continues to swing from one extreme to another week after week and this time, there has been an improvement.

Fig. 5: News Sentiment for select topical search terms

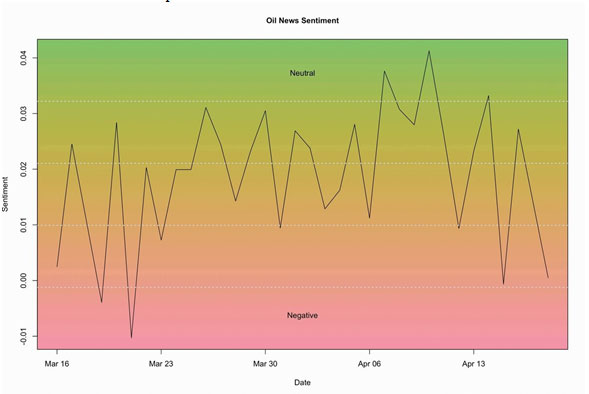

Crude Oil News Sentiment

The markets are negative on demand environment as reports from multiple countries continue to come how consumption and demand have fallen off the cliff.

Fig. 6: Daily oil related News Sentiment

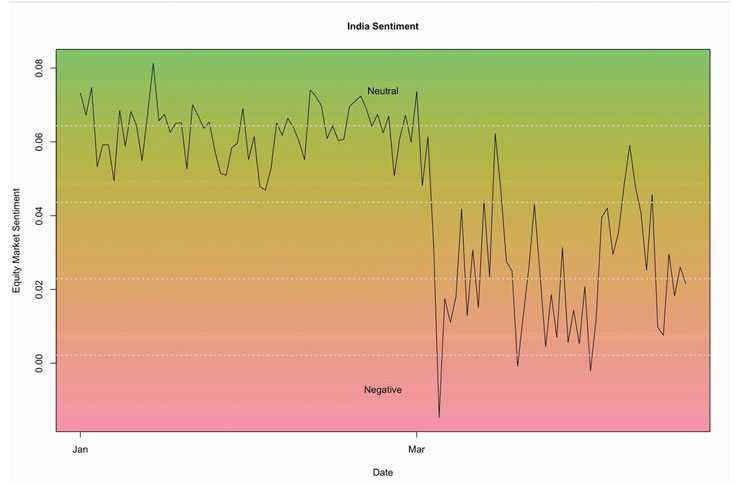

Aggregate India Equity Markets Sentiment

This is now operating in a narrow bad and in-line with this change, the market has become much less volatile. Overall, we don’t think the change in India Market Sentiment is significant this week.

Fig. 7: Aggregate India Equity Markets Sentiment

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.