Jindal Steel & Power Ltd: Recurring Governance Woes

Synopsis: Jindal Steel & Power Ltd (JSPL) is an Indian company operating in the Steel, Power, and Mining sectors. Riding on the global upcycle of steel prices, JSPL turned profitable in FY21 after six long years, and that reflected in the stock price performance too. On 2nd May 2021, JSPL informed the Indian Exchanges about an Extraordinary General Meeting (EGM) of the company on 24th May, 2021 to approve the sale of Jindal Power Limited (a subsidiary of JSPL with 96.42% holding) to Worldone Pvt Ltd, a related entity wholly owned by chief shareholder Mr. Naveen Jindal. Questions were immediately raised, mostly on the valuation of the deal and a complete lack of transparency around the sale process. JSPL has never been viewed as a company with top notch corporate governance credibility considering its track record. But historical track record does matter and this is where EMAlpha’s AI-ML based algorithms can help in the news flow analysis to better understand the blind spots.

Jindal Steel & Power Ltd: The Indian Steel and Power Conglomerate

Jindal Steel & Power Ltd (JSPL) JSPL is an Indian company with a presence in the Steel, Power, and Mining sectors. Apart from its BUSINESSES and PRODUCTS, the company also prominently highlights SUSTAINABILITY and COMMUNITY on its homepage.

Figure 1: JSPL Website Home Page

Source: https://www.jindalsteelpower.com/

The buoyancy in the Steel sector helped JSPL in FY21 (1st April 2020 to 31st March 2021) deliver good results, in comparison to its performance over the last few years. JSPL ended FY21 with Consolidated EBITDA of 144.44 billion Indian rupees (INR) and the company reported a net profit (INR 55.27 billion) for the first time in 6 years. The company’s market cap is INR 415.86 billion (US $ 5.7 billion), as on 25th May 2021. This turnaround in profits is well reflected in the stock price performance.

Figure 2: JSPL Stock Price over previous five years

Source: Google

Announcement of a related party transaction

On 2nd May 2021, JSPL informed the Indian Stock Exchanges (NSE and BSE) about an Extraordinary General Meeting (EGM) of the company on 24th of May, 2021 to approve the sale of entire equity shareholding in Jindal Power Limited (a subsidiary of JSPL with 96.42% holding) to Worldone Private Limited, a Promoter Group company and a related party, for INR 30.15 bn. Worldone Private Ltd is wholly owned by chief shareholder of JSPL, Mr. Naveen Jindal. The deal also included the conversion of capital advances and deposits of INR 43.86 bn, made by JPL to JSPL, into unsecured debt. There was no immediate stock price reaction to these announcements.

Figure 3: JSPL Stock Price over previous six months

Source: Google

The Controversy around Power Business Valuation

On 20th May 2020, JSPL announced that it had deferred the EGM to a yet unannounced date after shareholders raised questions over the company’s plan to sell its power business, Jindal Power Ltd (JPL) to an entity wholly owned by Mr. Naveen Jindal. In its communication to the Stock Exchanges, the company admitted that a few investors had requested the company to examine and simplify certain terms around the Proposed Sale, before requiring them to consider resolutions in relation to the Proposed Sale and the company would as such require additional time to engage with the concerned parties for evaluating the same.

Later, JSPL also stated that the valuation for Jindal Power Ltd. was arrived at through a “competitive and comprehensive process”, including two independent valuations and inputs from potential bidders. In spite of that, the market feedback on the transaction was not very encouraging even though investors remained positive on JSPL’s core steel business. Questions were also raised from a few other quarters, including by shareholder advisory firm InGovern and proxy advisory firm Stakeholders Empowerment Services (SES) regarding the valuation of the deal and a complete lack of transparency around the sale process. On the issue of fair valuation, the estimates quoted in various media reports were in the range of INR 100 bn to INR 200 bn, three to seven times higher than JSPL’s official report of INR 30 bn. With increasing controversy, the stock price took the eventual hit.

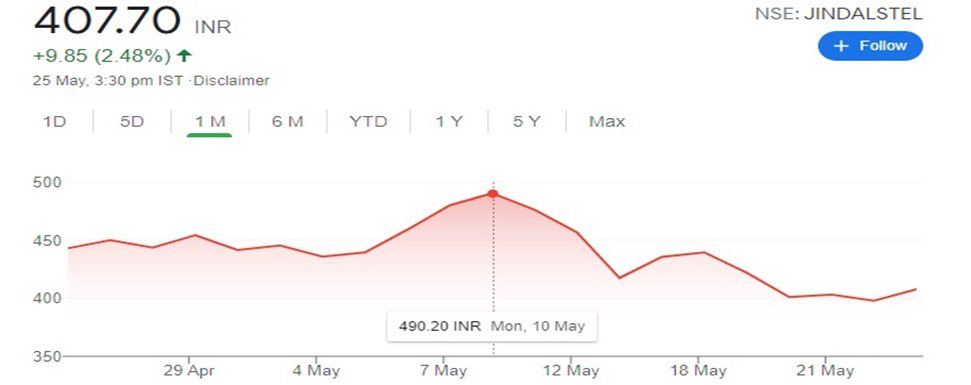

Figure 4: JSPL Stock Price over previous month

Source: Google

In recent weeks, JSPL has corrected almost 20% from its 10th May peak and the stock has also underperformed its Indian peers like Tata Steel and JSW Steel.

Figure 5: Tata Steel Stock Price over previous month

Source: Google

Figure 6: JSW Steel Stock Price over previous month

Source: Google

As can be seen from the charts, JSPL is the only stock in red over the previous month. While it is down 8%, Tata Steel is up 15% and JSW Steel is up 6%.

Did Market ignore the Controversy?

There are two ways to look at it. As the one-month stock price charts of JSPL and its peers, Tata Steel and JSW Steel reflect, the market didn’t completely ignore the issue. But considering that the issue was one of corporate governance and that the value of Jindal Power formed a significant part of overall JSPL’s valuation, one can’t help but ask: Should the stock have reacted more? That’s because even on relative performance, JSPL has always been more sensitive and volatile, as can be seen in Figure 2. On May 10th 2021, the JSPL stock was up almost 8x since its April 2020 lows and hence, it was natural that it would fall a little more when the sentiment weakened. So, it is fair that the market didn’t react as much as it could have in case of a serious governance issue.

The other side of the Equation

We, at EMAlpha, think a better explanation for the stock reaction could be that, for the broader markets and majority investors, JSPL has never been a company with top notch corporate governance credibility. Therefore, an announcement like the one on 2nd May, which involved a related party transaction seemingly more in favour of majority owners at the expense of minority shareholders didn’t come across as that big of a surprise. Yes, it was a negative development for investors but they knew what they were getting into when they bought into JSPL. You can’t expect to make an earthen pot and not have clay in your hands. With companies having a very good track record on Corporate Governance, such announcements would probably have had more impact. This is always the case when the extent of shock and surprise on a corporate action is dependent on what is expected from the owners and management.

Did JSPL track record offer any clues?

We think there is enough in JSPL’s past to understand the perceptions about its corporate governance track record:

- Mr. Naveen Jindal’s political affiliation – In 2004, Mr. Naveen Jindal contested the Parliamentary elections from the Kurukshetra constituency in Haryana on a Congress ticket. He won the seat comfortably and was re-elected in 2009. He lost the 2014 Lok Sabha election from the same constituency. His father, Late Mr. O P Jindal was also active in politics and was an elected representative from Haryana. Among his brothers, Mr. Naveen Jindal was the only one who had an interest in active politics.

- The Coal Block allocation controversy – In 2012, the Top Auditor of the Government, Comptroller and Auditor General (CAG) alleged in a report that irregularities in the allocation of coal leases caused a notional loss of INR 1.86 trillion to the Government and JSPL was named as one of the beneficiaries. Between 1996 and 2009, JSPL and its unit Jindal Power Ltd (JPL) were allotted nine coal fields translating into reserves of 2.59 billion tonnes, or 5.97% of the 43.35 billion tonnes allotted by the Centre.

- The extortion controversy between JSPL and ZEE Group – In 2012, Mr Naveen Jindal released a video recording of meetings with executives of Zee TV and claimed that Zee TV had tried to extort money from him. Mr Jindal claimed that the news channel told his company’s executives that if they did not spend INR 1 billion on advertising, the channel would run negative stories on allocation of coal blocks to his firm. Later, the media group also sent a defamation notice to Mr Jindal.

There were also controversies around JSPL related to forceful eviction of tribal people and villagers in the land acquisition process for setting up coal mines, power plants and steel manufacturing units. Between 2008 and 2010, there were also controversies around excessive profiteering by JSPL on sale of merchant power. It is clear that controversies and JSPL go cheek by jowl. Overall, it is fair to conclude that over the past ten to fifteen years, there have been quite a few controversies which could have signalled the investors about a chequered history on governance standards at JSPL. It goes without saying that the writing’s on the wall when it comes to JSPL’s governance. After all you don’t need a weatherman to know which way the wind blows.

How EMAlpha can help in such situations?

In India, JSPL has been one of the most intriguing companies from the perspective of stock price movement over 2020 and 2021. EMAlpha AI has repeatedly picked up the company for a number of reasons including turnaround in steel sector, excellent stock price performance since April 2020 and change in operating and financial results for the company as well as the recent controversy. Mentioned below are some important takeaways from the controversy:

- The historical track record matters and the AI-ML based EMAlpha algorithms can help in the news flow analysis to better understand the blind spots. Anyone who has tracked JSPL for long enough would not have been surprised at the controversy around Jindal Power’s sale by JSPL to majority owners.

- Can the local news flow collection pick up issues earlier than the English media? Considering how vocal some of the institutional investors have been on Sustainability and ESG issues, it is evident that these issues matter. The local language along with English news analysis can be tracked for the companies experiencing ESG related issues.

- Can regular analysis of social media be used as an input before taking an investment decision? Many of these issues which may impact price tend to appear very quickly on social media. It is here that EMAlpha’s analysis of unstructured data becomes a key tool for investors. The unstructured data analysis can also be used to assess the potential impact on some of the larger companies in a country where the activity levels are higher.

- Predicting the behaviour of majority owners on the basis of historical track record can help forecast the potential governance shocks. This is one of the key features of EMAlpha product as it combines technology with domain expertise. The news flow analysis provided by EMAlpha is useful in picking up the signals.

References

- JSPL FINANCIAL RESULTS FOR FOURTH QUARTER & FY 2020-21: Only Indian Steel Company with Net Debt Free Balance Sheet https://d2lptvt2jijg6f.cloudfront.net/jindalsteelpower/custom/1620881569_Press%20Release%204QFY21%20%26%20FY21.pdf (25th May 2021)

- NOTICE OF EXTRAORDINARY GENERAL MEETING OF THE COMPANY by Jindal Steel and Power Ltd. (JSPL) https://www.bseindia.com/xml-data/corpfiling/AttachHis/e61af78b-df51-4433-854e-ab93576ca738.pdf (25th May 2021)

- Investors force Jindals to revise terms of JPL selloff plan https://economictimes.indiatimes.com/markets/stocks/news/jspl-may-revise-terms-price-for-power-deal-after-some-investors-object/articleshow/82890519.cms (25th May 2021)

- Questioned by proxy advisory firm, JSPL defers EGM https://www.moneycontrol.com/news/business/companies/questioned-by-proxy-advisory-firm-jspl-defers-egm-for-related-party-power-deal-6932101.html (25th May 2021)

- JSPL selling subsidiary to promoter family at one-fourth of price https://www.thehindubusinessline.com/companies/jspl-selling-subsidiary-to-promoter-family-at-one-fourth-of-price-ingovern/article34628637.ece (25th May 2021)

- JSPL reviews terms of JPL sale amid calls for more clarity https://www.newindianexpress.com/business/2021/may/25/jspl-reviews-terms-of-jpl-sale-amid-calls-for-more-clarity-2307214.html (25th May 2021)

- Postponement Of Extraordinary General Meeting https://www.bseindia.com/xml-data/corpfiling/AttachHis/8c267419-6139-402a-85c7-b83ccca1d75a.pdf (25th May 2021)

- Naveen Jindal vs Zee: Senior journalists arrested over alleged extortion https://www.ndtv.com/india-news/naveen-jindal-vs-zee-senior-journalists-arrested-over-alleged-extortion-505787 (25th May 2021)

- JSPL cornered 6% of coal reserves doled out https://www.livemint.com/Companies/ZdR6iDBRYhm8bxfZhHPegJ/JSPL-cornered-6-of-coal-reserves-doled-out.html (25th May 2021)

- Jindal controversy: Why we need transparency on who owns and controls our mines https://scroll.in/article/681033/jindal-controversy-why-we-need-transparency-on-who-owns-and-controls-our-mines (25th May 2021)

- Police detain Adivasi protesters as President lays foundation stone for Jindal Power Plant of Jindal Steel and Power Ltd. https://www.thehindu.com/news/national/other-states/police-detain-adivasi-protesters-as-president-lays-foundation-for-jindal-power-plant/article4671126.ece (25th May 2021)

- Jindal Steel makes bloody attacks against Orissa villagers http://www.minesandcommunities.org/article.php?a=11471 (25th May 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.