Investment Management – The Final Frontier for Machines

The adoption rate of new technology is dependent on several factors which include the cost of technology, the ease of adoption, available infrastructure, cost of human effort to be replaced vs cost of technology, likely benefits for customers and the personal initiative of pioneers in the particular industry. When we talk about companies as a sub-set of an industry, the senior management and profitability matrices play a bigger role. As a result, there are huge variations in how quickly the technological innovations will bring change in an industry.

In an interesting coverage by ‘The Economist’, the influence of machines on stock markets is being discussed [1]. The publication talks about how the market is now run by computers, algorithms and passive managers. It talks about how machines are taking control of financial markets including elements with a high degree of subjectivity such as monitoring the economy and allocating capital. The numbers are astonishing. For example, the funds run by computers account for 35% of America’s stock market, 60% of institutional equity assets and 60% of trading activity.

The important thing is that the new age machines are not just taking over the work which used to be done by humans in the markets. For example, the said article says that the new artificial-intelligence programs are also writing their own investing rules without human input. These are relevant changes because finance has always been an area which can influence so many other industries as well because of its control on capital. It is clear that these numbers are going to get larger. When we speculate on how other markets will adopt these changes, there hardly is a debate. Once the changes begin in one market, they quickly spread to others.

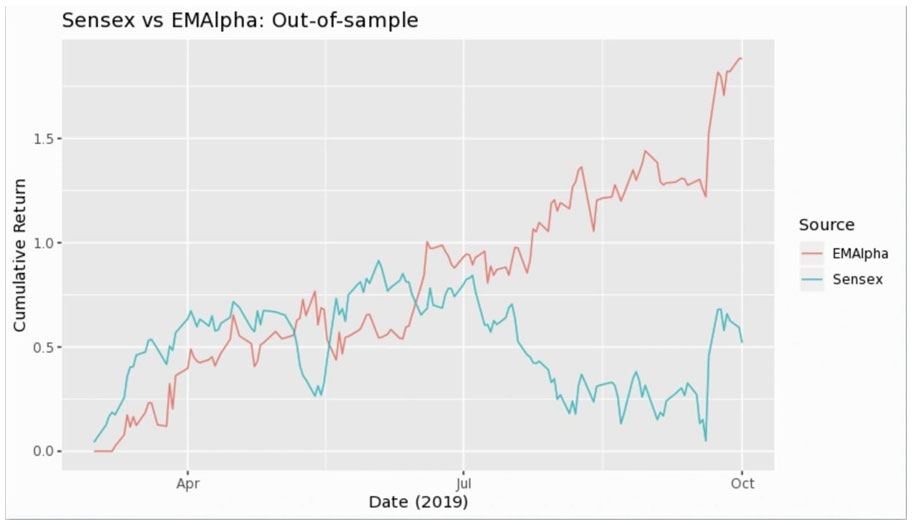

The writing is clear on the wall. There is need for more sophisticated data analytics, more advanced algorithms and use of Artificial Intelligence for generating superior investment returns. The impact of important business developments and sentiment in daily news flow is prominent factor in stock price movement. EMAlpha’s proprietary model which generates sentiment scores using our dictionary and the trades executed on the basis of those sentiment scores are beating markets. There are of course challenges in terms of what to include and what not to include when we look for the data sources and news, but there is no doubt that it works.

We have found a strong linkage between how the portfolio performance and its rebalancing on the basis of sentiment analysis. Thankfully, this linkage is not just strong but it is also positive, beating markets by a good enough margin. But does this mean that market gets just too much influenced by the news flow and stocks outperform when the sentiment is positive or underperform when the sentiment is negative. It may not be a surprise because that is how it should be but the interesting part is that market doesn’t adjust the stock prices immediately and there is enough time window available to execute on these trades.

It doesn’t just work when we carry out back tests. That was of course the background to see what we are doing. But real time scores followed by the real time trades lead to better investment decisions and better portfolio performance. And we fully agree with what ‘The Economist’ is highlighting. The Big Data and the AI wave is getting stronger and stronger in Finance and this may not reverse anytime soon.

[1] Masters of the universe: How machines are taking over Wall Street, The Economist, October 5th-11th, 2019.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.