Emerging markets wobble in sync, but there’s a silver lining

Synopsis: Unless you have been living under a rock for the past few months, you would know that 2022 has not been great for global markets. The stubborn inflation worries had led to a serious pause and reversal on loose monetary policies which was followed by the Russia-Ukraine war, thus complicating the situation further. There is also a sector rotation at play and ‘Tech meltdown’ combined with ‘preference for commodities’ is also impacting the market. Amidst the volatility and gloom, it would have been unrealistic to expect that the emerging markets would have behaved any differently. All of this has gotten more serious with Fed’s unequivocal stand on rate hikes and policymakers’ preference shifting from growth to taming inflation. This is indeed the case and a subdued sentiment is reflected in investor response. Over the last few weeks, we have seen a serious decline in EMAlpha’s stock market sentiment for many countries including Brazil, China, India, Hong Kong, Malaysia, Taiwan, and Phillippines. However, the silver lining is that some other markets such as Indonesia, South Korea, Poland, and Thailand are showing remarkable resilience in their stock market sentiment.

Global markets are struggling and so are the EMs

The stock market sentiment of major EMs such as China, India, and Brazil remains negative and the market performance also conveys the same.

Brazil

Bovespa Index has delivered -10.1% return in the last one month and -0.4% in the last six months.

Chart 1: Brazil Stock Market Sentiment

Source: EMAlpha

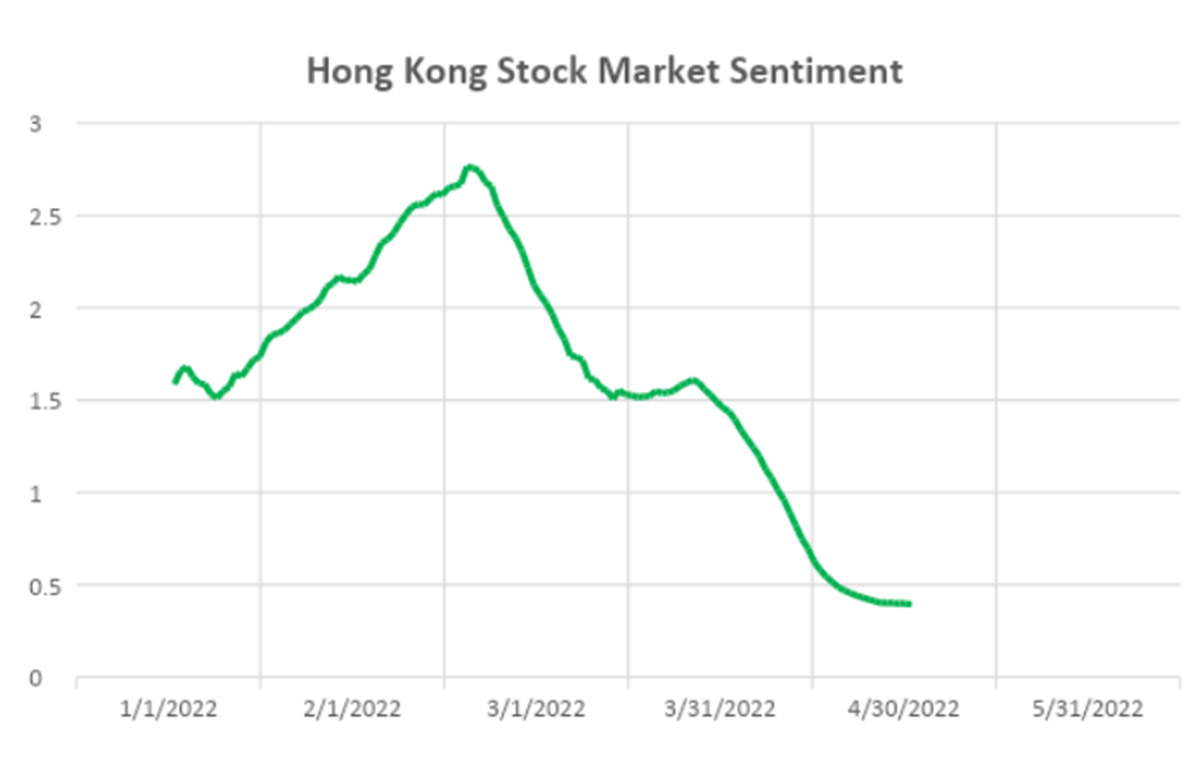

Hong Kong

Hang Seng Index has delivered -5.7% return in the last one month and -20.0% in the last six months.

Chart 2: Hong Kong Stock Market Sentiment

Source: EMAlpha

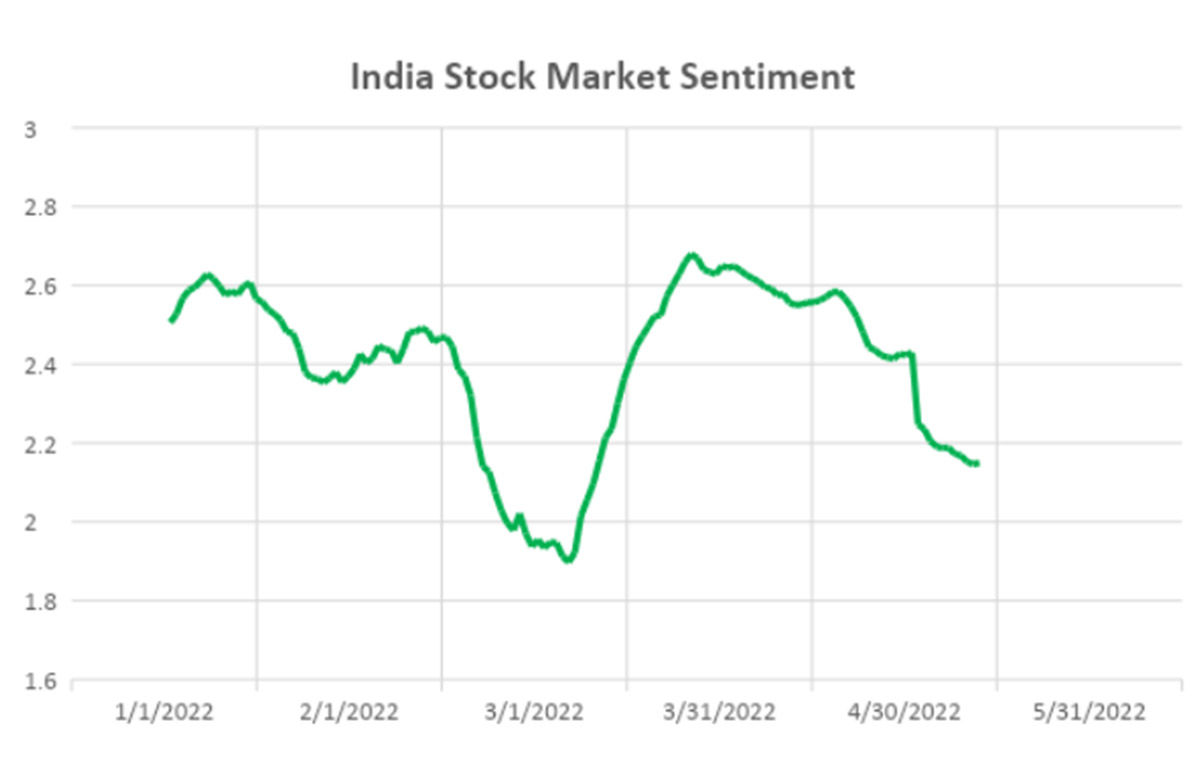

India

NIFTY has delivered -7.8% return in the last one month and -9.5% in the last six months.

Chart 3: India Stock Market Sentiment

Source: EMAlpha

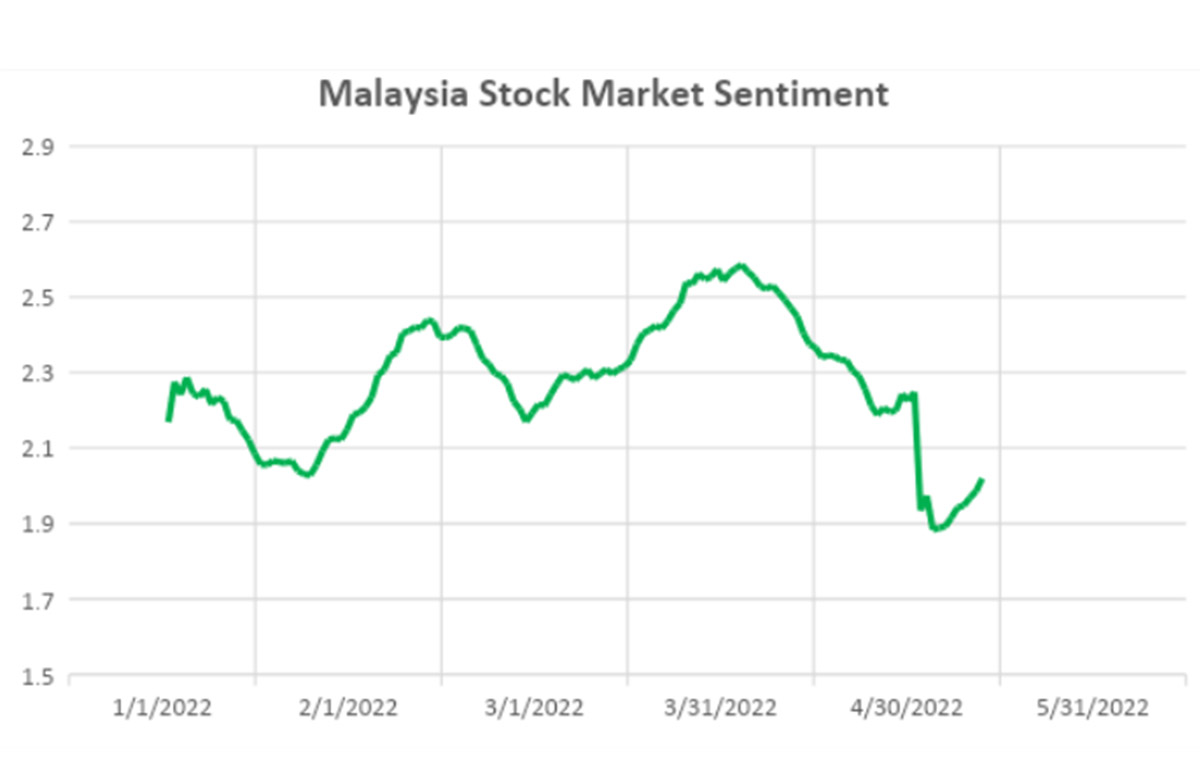

Malaysia

The KLSE Index has delivered -4.7% return in the last one month and -0.6% in the last six months.

Chart 4: Malaysia Stock Market Sentiment

Source: EMAlpha

Phillippines

PSEi index has delivered -3.0% return in the last one month and -9.2% in the last six months.

Chart 5: Philippines Stock Market Sentiment

Source: EMAlpha

Taiwan

Taiwan Capitalized Weighted Stock Index has delivered -5.9% return in the last one month and -8.6% in the last six months.

Chart 6: Taiwan Stock Market Sentiment

Source: EMAlpha

China

SSE Composite Index has delivered -5.2% return in the last one month and -14.0% in the last six months.

Chart 6: China Stock Market Sentiment

The silver lining

Indonesia

IDX Composite has delivered -4.1% return in the last one month and 3.4% in the last six months

Chart 8: Indonesia Stock Market Sentiment

Source: EMAlpha

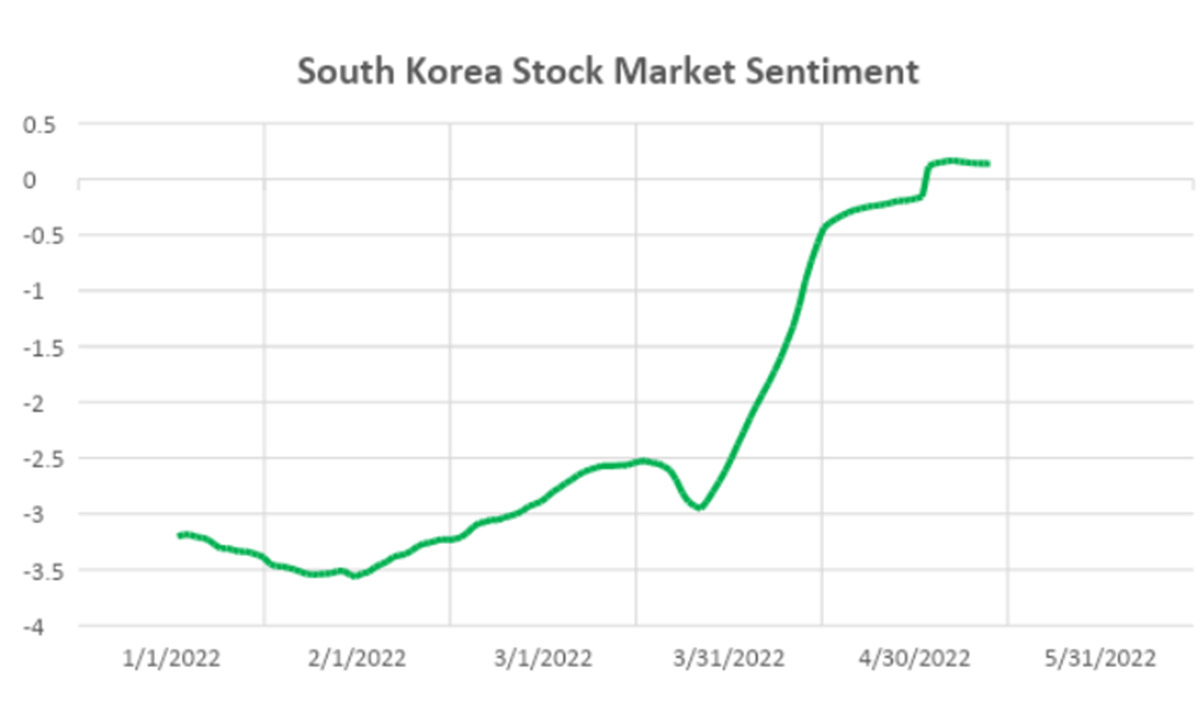

South Korea

KOSPI has delivered -3.1% return in the last one month and -10.9% in the last six months.

Chart 9: South Korea Stock Market Sentiment

Source: EMAlpha

Poland

WIG20 Index has delivered -18.3% return in the last one month and -27.6% in the last six months.

Chart 10: Poland Stock Market Sentiment

Source: EMAlpha

Thailand

SET Index has delivered -4.6% return in the last one month and -1.7% in the last six months.

Chart 11: Thailand Stock Market Sentiment

Source: EMAlpha

Research Team, EMAlpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.