Coronavirus Pandemic and How Sentiment is Impacting the Emerging Markets?

In our previous blog post, we talked about the recent developments related to Corona Virus and related news flow. The impact on the markets seems to have a local component as Asian markets close to China have suffered more than others. Geographically distant markets have remained shielded. Let us look at how the EMAlpha Sentiment Score has evolved over the last month for some of these emerging countries and the performance of their equity markets.

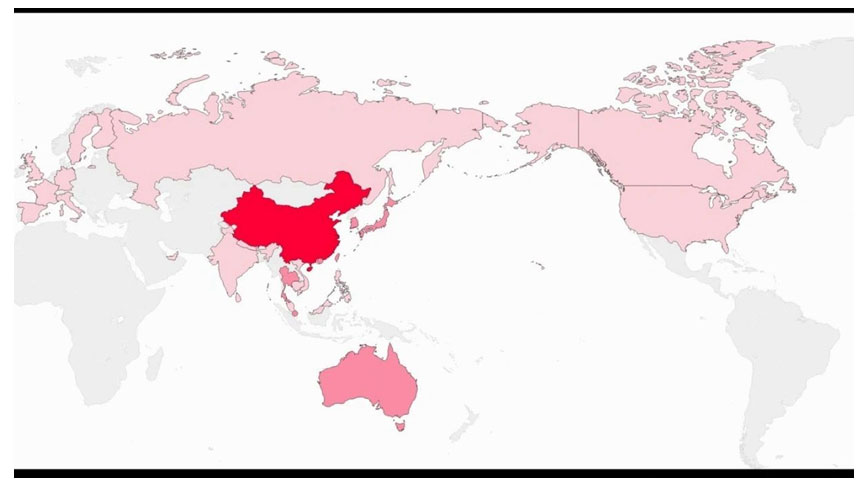

Fig. 1 shows the severity of Corona Virus cases by region. The first cases were found in China where the virus has continued to spread. A number of cases have also been found in various other countries. As we mentioned in the prior blog, while the most severe Corona Virus cases have been in its country of origin, China, the maximum market impact has been in smaller neighbouring countries, like Thailand.

Fig.1: Number of Corona Virus cases by region. Darker color implies a higher number. Source: Bloomberg (https://www.bloomberg.com/news/articles/2020-02-08/coronavirus-death-toll-rises-to-805-passing-sars-virus-update).

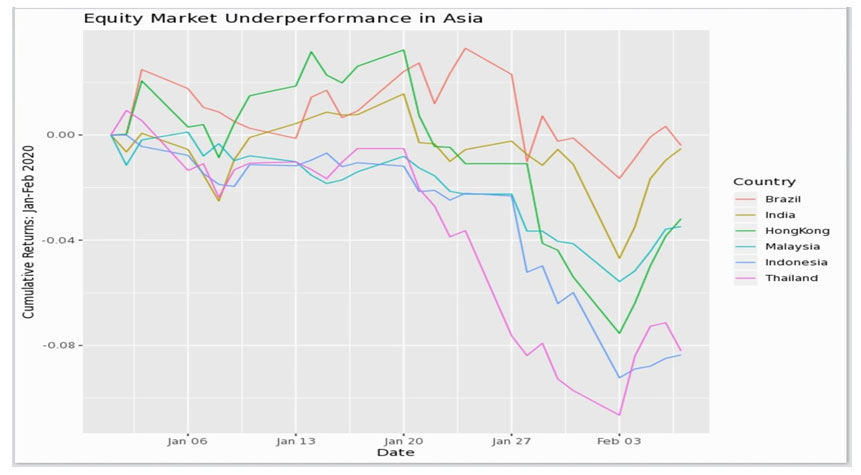

Fig. 2 shows the performance of equity markets in some of China’s neighbouring countries which have seen a high number of Corona Virus cases. For comparison, we have also included India and Brazil. India borders China, but has seen a relatively small number of Corona Virus cases. Brazil has not seen any cases yet. Fig. 2 shows that, outside China, the behaviour of equity markets over the last few weeks seems to be related to the number of Coronavirus cases.

Fig.2: Equity Market performance (cumulative returns of stock indices) Jan-Feb 2020. Is there a relation between Coronavirus and the market performance?

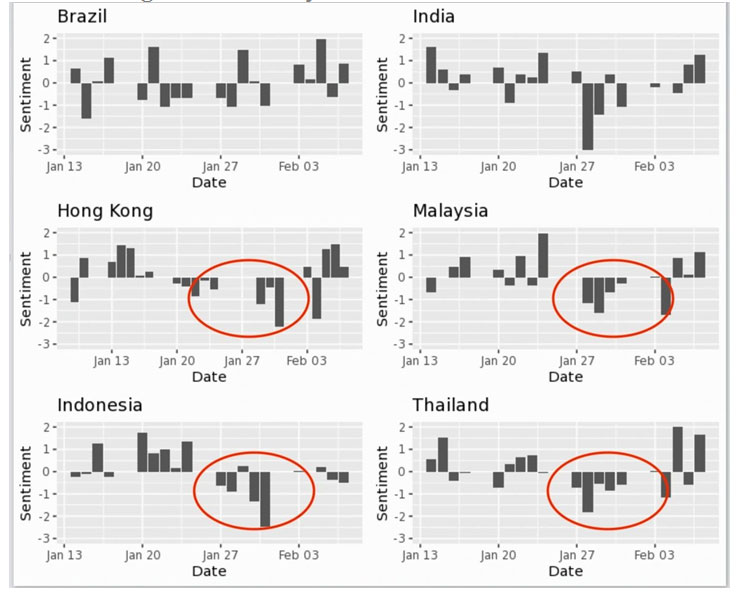

Fig. 3 shows the EMAlpha Sentiment Score for these countries over the last few weeks. The Sentiment Scores show a clear relationship between sentiment and market performance. For most countries, the Sentiment Scores went into the negative territory, owing the Corona Virus news flow, in the last 10 days of January. Brazil was an exception though. Fig. 3 shows that the Brazilian sentiment was somewhat ok compared to the Asian countries. On the other hand, the sentiment for Thailand, Indonesia, Malaysia and Hong Kong stayed quite depressed in the Jan 20th – Jan 31st period. India also saw a streak of negative sentiment around the same period, but it was related to its union budget announcement made on January 25th, and the Indian market staged a quick rebound over the next couple of d

Fig.3: Equity Market Sentiment (EMAlpha Sentiment Score) Jan-Feb 2020: Of the countries shown, Thailand saw the most depressed sentiment score during the same period when its equity market fell sharply. Brazil’s sentiment score was more contained and so was its stock index.

Overall, the news sentiment from Corona Virus played a major role in the market performance over the last month. While some markets such as Hungary and Turkey (not shown here) saw market moves that were idiosyncratic in nature and not related to the virus, it is fair to say that a number of economies, especially those close to the Corona Virus epicentre, were heavily driven by sentiment.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.