Coronavirus Impact on Markets: Is Local News Sentiment Getting More Important?

The sharp downward market movements across the world in the previous week has removed any doubts about the kind of impact Corona Virus would have on the Investor Sentiment. In the initial response, most markets globally reacted in a predictable negative fashion. But this is slowly changing now. While markets from Japan to USA and from China to European markets such as Italy are under severe pressure, the role of local news flow and resulting sentiment is playing a more prominent role now. In this context, the performance of Indian Markets is clearly a stand out.

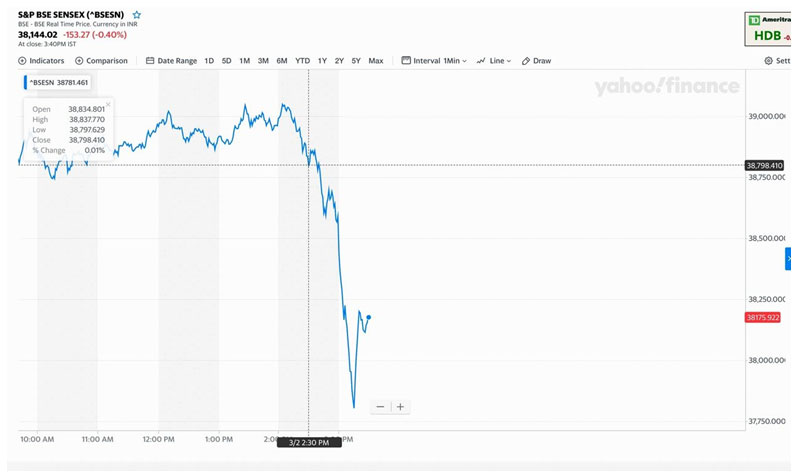

Just like the sharp fall on US markets on Thursday (27th February) followed by significant decline in major Asian markets on Friday (28th February), the major Index of Indian markets fell. The decline in NIFTY 50 was among the ‘Top 5 Steepest’ in last more than ten years with a fall of more than 3.5%, but the trend reversed today (Monday, 2nd March) morning. Just like recovery in major Asian markets, NIFTY 50 was also trading with a gain of 1.5% to 2.0% for most of the session today. There were different explanations offered such as, a) dead cat bounce, b) recovery in stocks with more global linkages such as Commodity companies, and, c) plain and simple, recovery aligned with other markets in the region.

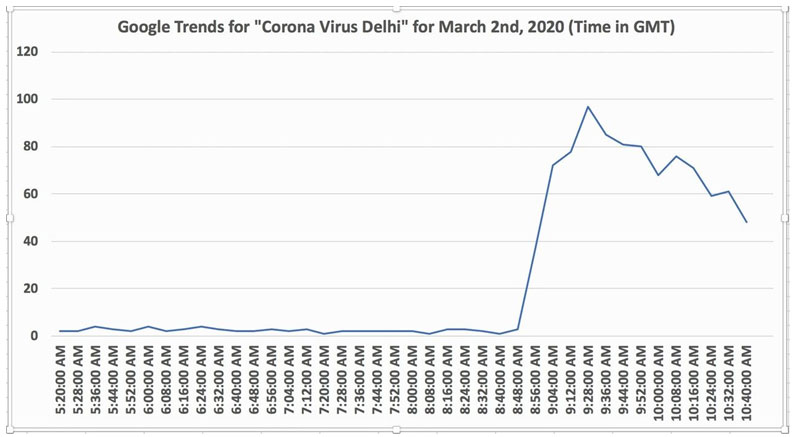

But all of this changed towards the end of the session. In last one and a half hours, the NIFTY 50 not only gave all its gains for the day but also closed 0.6% down. This was not the worse though, at one point the NIFTY 50 was down more than 1.3%. The other important broader market index in India is BSE Sensex and the performance of this was also similar to NIFTY 50. Thus, the intraday fall of 3% was only marginally better than Friday’s Indian market performance. Completely unexpected and very quick. But how did this happen. The news came that two fresh cases of Corona virus were detected in India.

(https://www.indiatoday.in/india/story/coronavirus-india-outbreak-fresh-case-news-update-delhi-telangana-1651586-2020-03-02 , https://www.livemint.com/news/india/coronavirus-update-two-cases-reported-from-delhi-telangana-11583139808115.html ).

There was absolutely nothing else which could have explained such a drastic fall in NIFTY and wiped out all the recovery in a matter of just about an hour. What are the implications:

- After the Corona virus has now become truly global, it is very likely that market to market performance will depend much more on local news flow and underlying sentiment on Corona virus related developments locally,

- The smaller markets and several Emerging Markets may perhaps get more impacted in percentage terms with the news flow compared to developed markets because of less diversified nature of local economies. Honestly, it is not looking very good on sentiment analysis done for virus related news flow.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.