Carabao Group and The Butterfly Effect

Synopsis: Carabao Group, one of Thailand’s largest energy drink company, co-founded by a legendary Thai rock star, has seen its share price go downhill since Jan 2021. Carabao Group saw its stock price soar last year, doubling from March 2020 lows. Having dethroned Red Bull to become one of the largest energy drink corporation of Thailand, what then caused the stock price to dwindle from January 2021 onwards? Was it a below expectation fourth quarter earnings or is there something else? As scant as the news flow is, EMAlpha’s AI managed to snatch a few pieces of crucial information that could shed some light on the stock price movement. The most surprising part is that how the plans for a splinter league by some very popular European football clubs and the ensuing fans’ anger links to the Carabao stock price. The stock price of Carabao corrected in April as protests intensified against a rogue soccer league half way across the globe and that is a fascinating tale we discovered with EMAlpha AI.

Carabao Tawandang Company: A Brief History

Established in 2001, the Carabao Tawandang Company, also known as Carabao Group, manufactures and distributes energy drinks under the name “Carabao Dang” along with other beverages. The name “Carabao Dang” comes from the Group’s association with the band “Carabao”, combined with German Tawandang Brewery Restaurant and is marketed with the slogan “Carabao Dang: The Fighting Spirit.” The distribution network covers 180,000 retail shops in Thailand and it has become one of the country’s largest energy drinks brand, surpassing Red Bull. When it comes to the energy drink markets, Thailand is the largest in South East Asia and ranks fourth globally behind USA, China and UK. As such, it becomes imperative for EMAlpha to scour the Thai energy drink market for good opportunities for investors to benefit from.

Staying Pandemic Ready

The world that we are living in today has already adopted a “Before Covid, After Covid” viewpoint. The Market is no different either. Carabao, which already had its presence in China, Cambodia and few other neighbouring countries, took certain measures to focus on business resilience in the light of the pandemic:

- It increased the number of suppliers in China as a pre-emptive measure against raw material disruption in case of another disease outbreak.

- There were plans to introduce a new soft drink in March 2021 which could act as a key growth driver.

- The company was mulling a bigger push into Vietnam because of its large population and economic growth.

The border restrictions with Cambodia and Myanmar affected the product transportation to those markets and thus the sales. (Red Bull rival moves focus to Frontier markets from Thailand): Link

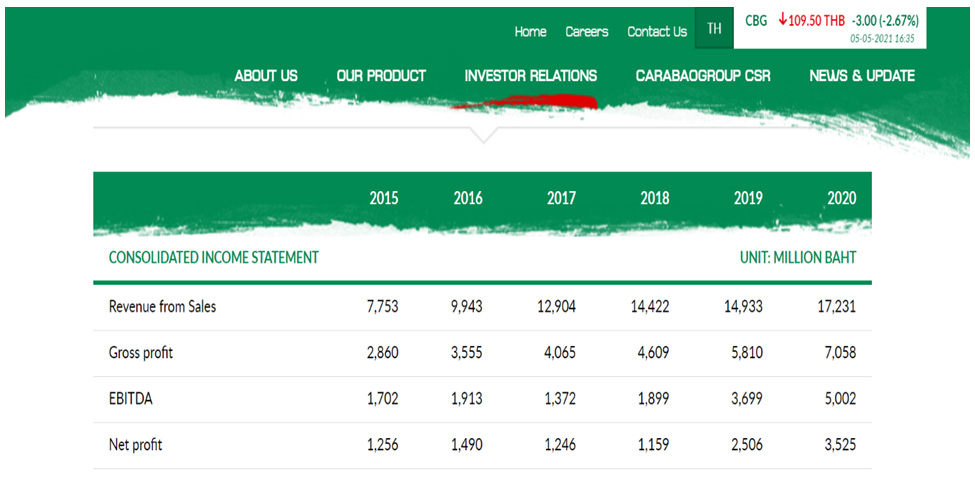

Figure 1: Carabao Group Annual Earnings Report

Source: www.carabaogroup.com

Although the pandemic did have an impact in the initial days due to halting of production and supply chain disruption, Carabao still posted a 40% increase in Net Profit on a year-on-year basis for 2020. The stock price too reflected this growth.

Figure 2: Carabao Group Stock Price over the last year

Source: Google

Carabao turning into a major Regional Player

Although Carabao commands a large portion of Thailand’s energy drinks market, 58% of its sales in 1Q 2020 were from CLMV countries: Cambodia, Laos, Myanmar and Vietnam as reported by the company. In 2Q2020, foreign sales rose by 27 per cent to Bt2.219 billion: 81 per cent or Bt1.8 billion of which came from Cambodia, Laos, Myanmar and Vietnam (CLMV) and 7 per cent from China. (Carabao shares up more than 5% on strong Q2 performance: Link)

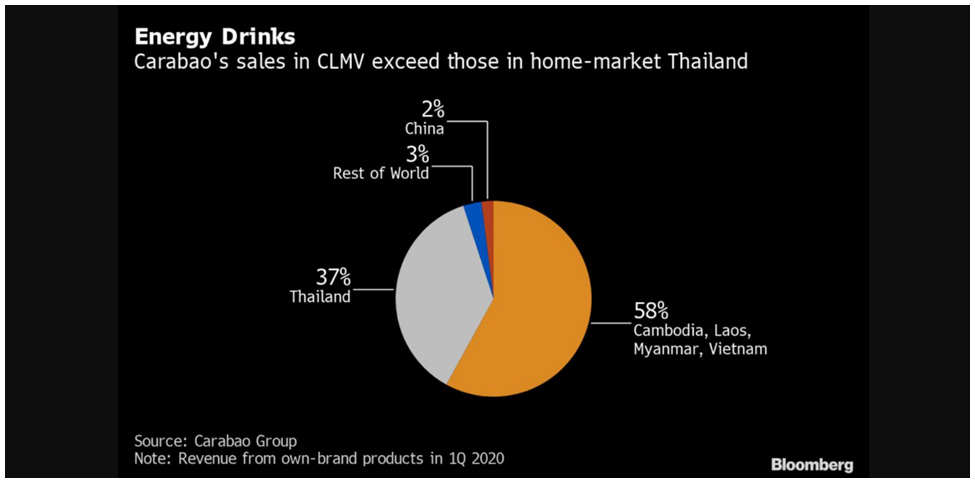

Figure 3: Carabao’s sales by geography in 1Q2020

Source: Bloomberg

It is thus evident that Carabao is turning out to be a regional juggernaut with aspirations stretching well beyond Thailand’s borders.

New Products in the pipeline

As Thailand recovers from the Covid-19 pandemic, the Government is exploring ideas to give the economy a boost. Going with the trend across the world, the Thai Government, in early 2021, approved the commercial growing and use of hemp and cannabis for consumer goods. Prominent beverage players, including Carabao, scrambled to cash-in on the high potential of cannabidiol (CBD) beverages. According to GlobalData’s 2020 market pulse survey, in Thailand, 71% respondents stated that they found food and drinks that contain Cannabidiol or CBD to be appealing. In the same survey, it was noted that CBD is more attractive to younger demographics, particularly in the 25-34 years age group. With a young demographic as the target audience, Thailand is expected to witness a slew of CBD beverages to be introduced in the second half of 2021, which has the potential to propel soft drinks consumption after the slump brought about by the Covid-19 pandemic.

On 20th April 2021, Carabao Group launched “Woody C+ Lock collagen mixed berry”, a vitamin C drink, powered by a 100-million-baht investment with the intent of shaking up the Vitamin C drink market and becoming the market leader in three years.

- Thailand’s beverage market set to bet big on CBD infused beverages, promising a much need post-covid boost: Link

- Carabao Group launches Woody C+ Lock Collagen Mixed Berry with 100 million baht investment: Link

It is clearly going to be a very busy year for the beverage industry and it only remains to be seen whether Carabao manages to capitalize on the opportunity or not.

What’s up with Carabao’s Stock Price

It is intriguing as to why the stock price has not reflected this optimism and why the general positive news flow has failed to excite investors on Carabao Group as can be seen below.

Figure 4: Carabao’s stock price YTD

Source: Google

Since touching a January high of 149 THB, the stock price has been on a consistent decline with the closing price being 112 THB as of 13th May, 2021. This comes on the back of launching of new products and planning to expand further into different territories. Why then, has the stock price behaved as such? With news flow very hard to come by on Carabao Group, EMAlpha had to wade through the bush to join the dots.

Missed 4Q2020 earnings

On 19th February 2021, Carabao Group released its 4Q2020 earnings report which missed market’s expectations by a significant margin. In its statement, Carabao Group said that in 4Q20, the export sales to CLMV fell by 15.2% from the corresponding period last year and softened by 12.5% from 3Q20 mainly due to lower demands from Cambodia because of the flood from heavy rainfall nationwide in October 2020. The stock price dropped by 3.3% to 134 THB on Monday, 22nd Feb 2021. (CBG falls 3% as 4Q20 earnings miss the market forecast due to lower exports to CLMV: Link)

The Breakaway European Super League Fiasco

In April 2021, while life continued as usual in the streets of Bangkok, a giant fiasco was taking shape halfway across the globe in Europe. We need to go back some years to get a good context of this. In 2016, Carabao signed a sponsorship deal with Chelsea, a top English football club, in order to get more eyeballs and establish itself as a global brand. In 2017, Carabao Group decided to sponsor a football tournament in England which came to be known as the Carabao cup.

Fast forwarding to April 2021, news came out on 19th April that the top football clubs across Europe were planning to start a breakaway league which was to be called the “European Super League” (ESL). There was immediate backlash from fans and critics alike with accusations of elitism and betrayal being thrown towards ESL and its founders. The ESL was dismissed by fans for disregarding the sport’s history and being nothing more than a cash grab for the participating clubs.

The uproar was so fierce that it threatened to spill over to the Carabao Cup final, which was to be held on 25th April, with reports of fans protest possibly impacting the final.

- Carabao enters the global market via Chelsea Football Club in a Principal Partnership Deal: Link

- Why is the League Cup called the Carabao Cup?: Link

- The rapid rise and fall of the European Super League: Link

- Carabao Cup final between Man City and Tottenham could be hit by fan protests: Link

Although it may appear very delusional to link the Carabao’s stock price decline with fans’ protest in England, that the stock price has undergone a sharp decline since 19th April (around 13%) does give some credence to this hypothesis. The lack of any other negative news around that time also supports our theory.

Figure 5: Carabao’s Stock Price over the past month

Source: Google

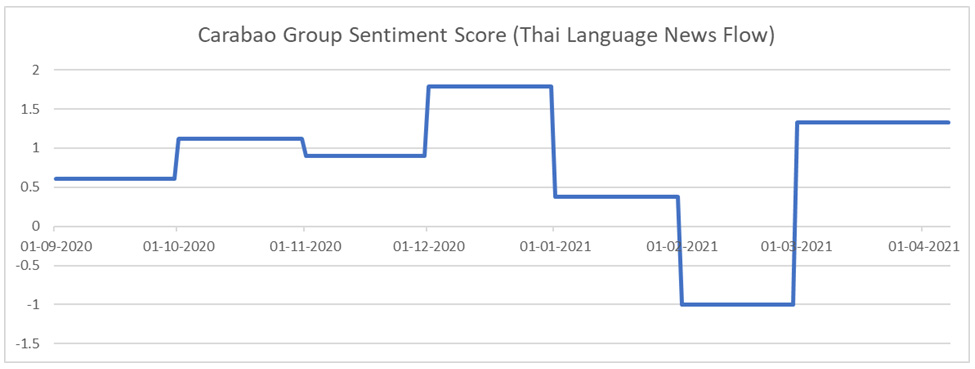

Local News Sentiment

The local language news flow on Carabao Group mostly focused on the Carabao football cup in England and the sports teams participating in it. It is absolutely clear that in many EMs, it is impossible to track a stock without tracking local news. Also, as can be seen from the sentiment graph, the sentiment scores are broadly in line with the price action.

Figure 6: EMAlpha’s local news sentiment score (Monthly)

Source: EMAlpha AI

What does the Future Hold for Carabao Group?

Carabao has done a very good job of marketing itself as a brand to reckon with. Although it is still in the nascent stages in the global arena and in comparison, with much larger global peers, nonetheless, the group is taking the right steps in the right direction. Be it Chelsea and Carabao cup sponsorship, or increasing sales in CLMV countries, Carabao Group is trudging the right trail. And with Thai government allowing CBD in beverages, that should also help. Furthermore, with the UK government easing lockdown restrictions, as it gets ready to face a sizzling summer, the soft drink sales are sure to go up with socialisation returning to normal. And that means more coins to Carabao’s coffer as it expands in the UK market and navigates 2021, both domestically and globally. (Summer soft drinks: Keep cool: Link)

How EMAlpha can help Investors

Carabao Group stock price movement is a strong manifestation of Butterfly effect. While that’s all well and good, the lack of news flow makes it very difficult for investors to capitalise on the same. It is here that EMAlpha, armed with its proprietary algorithm, makes it easier for investors to take the right call. Carabao has been one of the most interesting names from the perspective of stock price movement over 2020 and 2021 and it has been repeatedly picked up by EMAlpha AI. There are important takeaways from this:

- Can the local news flow collection pick up issues like what happens with sponsorships and brands, earlier than the English media for stocks where it is the most important? The local language along with English news analysis can be tracked for such issues. These issues could escalate quickly, thus impacting the stock price performance.

- EMAlpha’s analysis of unstructured data is a key tool for investors. The unstructured data analysis in other geographies can also be used to assess the potential impact on some of the larger companies. Case in point being what happens in UK and Europe and how it impacted the Carabao stock price.

- Predicting the behaviour of large institutional investors on the basis of trading information can help forecast the stock price impact. This is a key feature of EMAlpha product as it combines technology with domain expertise. The analysis by EMAlpha is useful in picking up signals when the views change for institutional investors.

References

- Energy drink market in Thailand https://blog.drinktec.com/non-alcoholic-beverages/energy-drink-market-in-thailand/ (Accessed on 11th May 2021)

- Carabao Group stepping up to become a global brand (https://docplayer.net/143292393-Carabao-group-stepping-up-to-become-global-brand-with-sponsorship-deal-with-england-s-chelsea-football-club.html (Accessed on 11th May 2021)

- https://investor.carabaogroup.com/financials.html (Accessed on 11th May 2021)

- https://www.carabaogroup.com/en/about/background#:~:text=Carabao%20Tawandang%20Company%20was%20established,incorporation%20was%20one%20million%20Baht (Accessed on 11th May 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.