Brazil has so far outperformed the major EMs in a troubled year

Synopsis: Since the beginning of 2022, almost all the major markets have taken a tumble, primarily because of Russia-Ukraine tension and the subsequent invasion. However, countries were also fighting another battle on the economic front: rising inflation. Brazil was no exception either. With the country’s central bank recently increasing the Selic rate (benchmark interest rate) for the 10th consecutive time to a five-year high of 12.75%, the stress on Brazil’s economy is all poised to grow in the coming days. We estimate the benchmark interest rate to breach 13.5% by the year-end before cooling off. With soaring fuel prices, a fall in average real income, and uncertain global factors in play, 2022 would most probably be a dire year for Brazil.

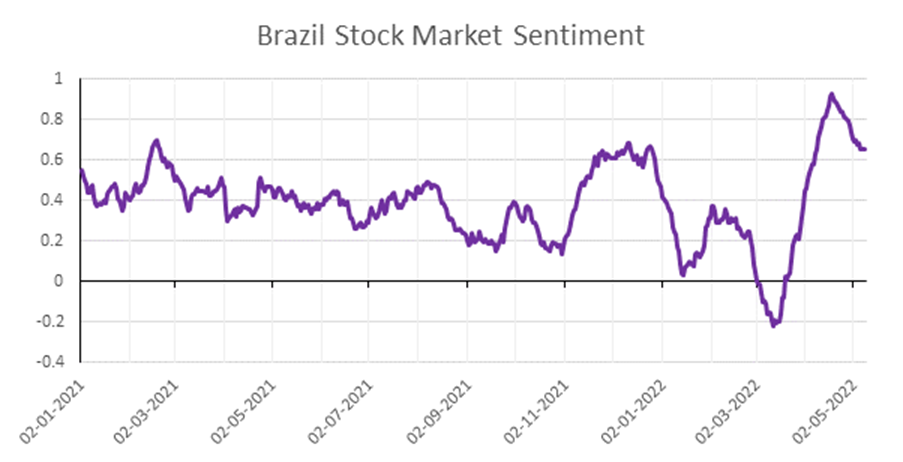

Source: EMAlpha

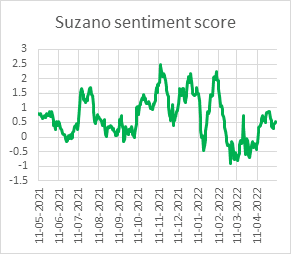

The Brazil stock market sentiment (a cumulative measure of the sentiment of iBovespa’s constituents) has fallen over the past year, hitting a bottom in mid-March. The sentiment was boosted in the last week of December 2021, owing to an 11.1% growth in retail sales during Christmas as compared to the same period in 2020.

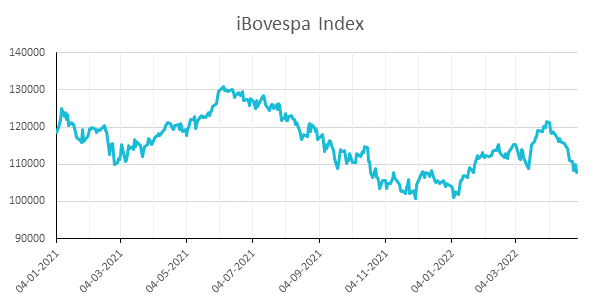

Source: Yahoo Finance

Brazil’s main index iBovespa has also been on a constant decline over the past year. However, for the year 2022, it has outperformed other major EM indices (see table below).

MSCI’s Emerging Market Index’s Top 5 EM Index Performance

One month |

YTD,2022 |

Six months |

One year |

|

iBovespa |

-11.84% |

-0.78% |

-4.17% |

-16.15% |

Shanghai Composite Index |

-4.81% |

-15.79% |

-13.57% |

-11.67% |

Nifty 50 |

-7.78% |

-8.28% |

-10.69% |

10.01% |

Kospi |

-2.79% |

-13.27% |

-12.68% |

-18.01% |

Taiwan Weighted Index |

-5.8% |

-12.39% |

-8.63% |

0.65% |

Source: Google (as on 12th May 2022)

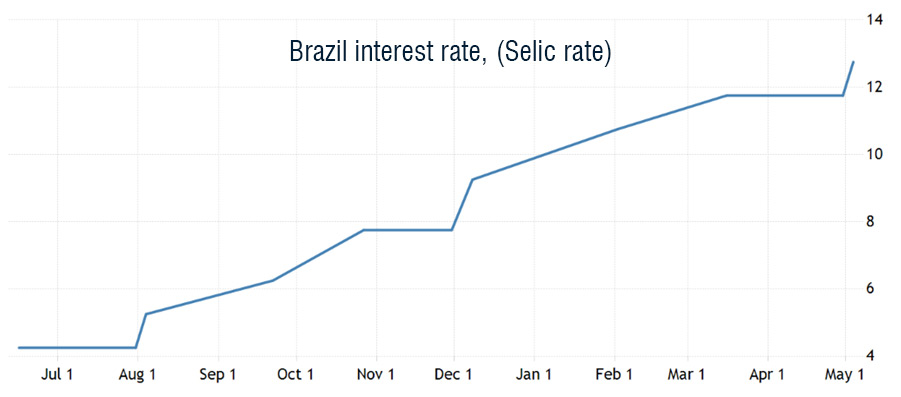

Source: tradingeconomics.com

To combat inflation, Brazil’s Central Bank increased the benchmark Selic rate to 12.75% on May 5. We expect the Selic rate to cross 13.5% this year.

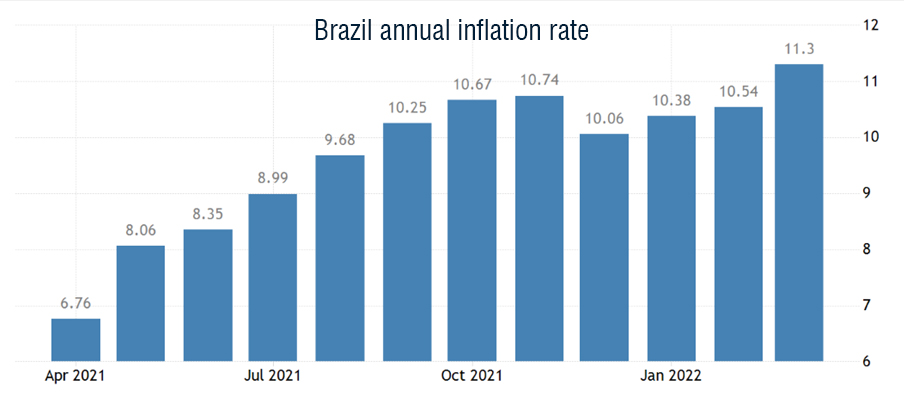

Source: tradingeconomics.com

Brazil has seen inflation go through the roof owing to rising oil prices, triggered by the Russia-Ukraine war. And with China, Brazil’s biggest trading partner, going for zero covid policy, Brazilian industries have been badly affected. According to data released by IBGE on 11th May, inflation increased to 12.13% in the 12 month period, the highest inflation for a one year period since October 2003.

Source: Brazilian Institute of Geography and Statistics (IBGE)

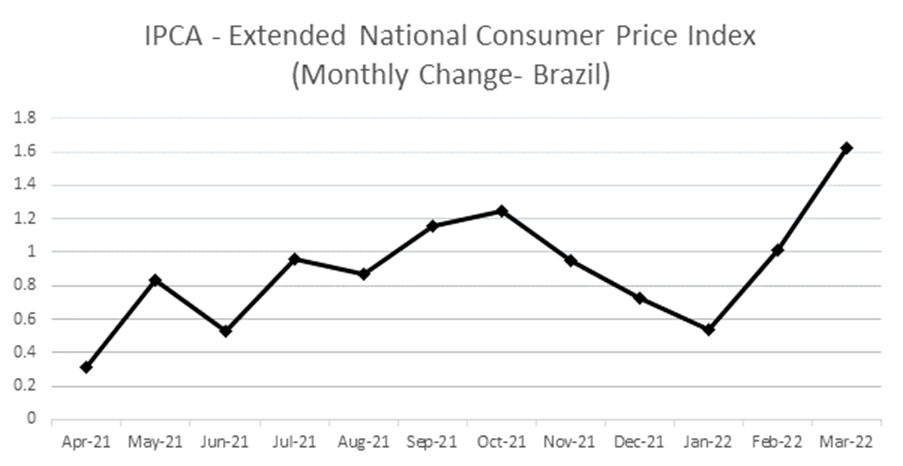

IPCA, which is the broad consumer price index and is considered to be the country’s inflation index increased 1.06% in April compared to March as per IBGE’s data released on 11th May.

As per IBGE, IPCA – Extended National Consumer Price Index – measures the change in the cost of living of families with an average income of 1 to 40 minimum wages.

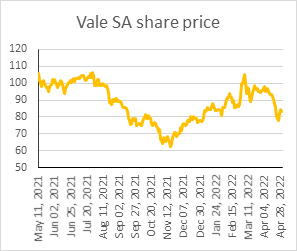

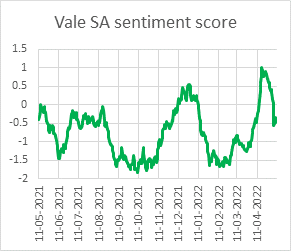

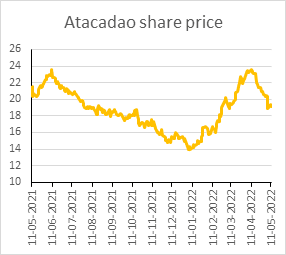

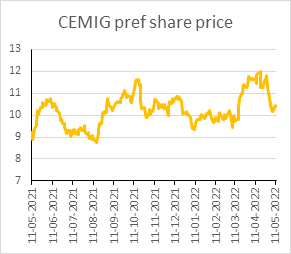

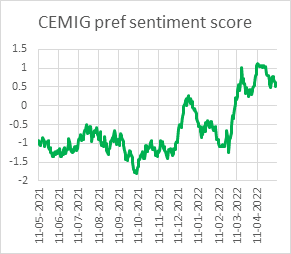

Brazil stocks and their sentiment

Source: investing.com

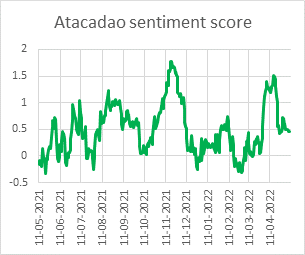

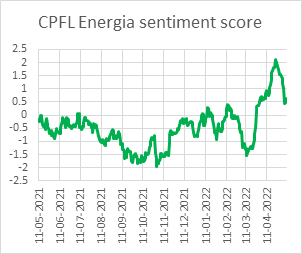

Source: EMAlpha

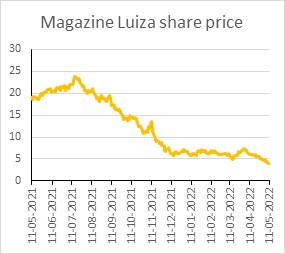

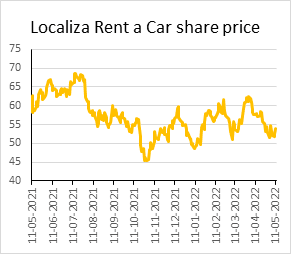

Source: Yahoo Finance

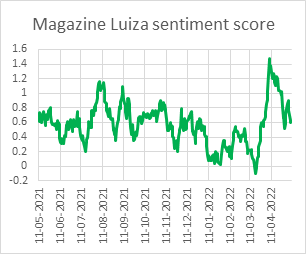

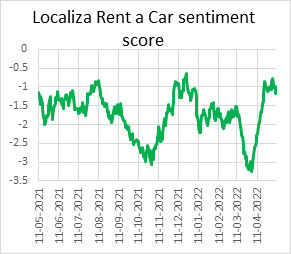

Source: EMAlpha

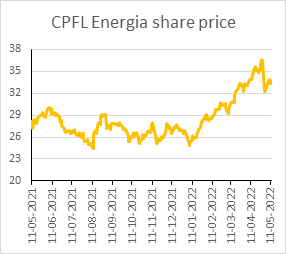

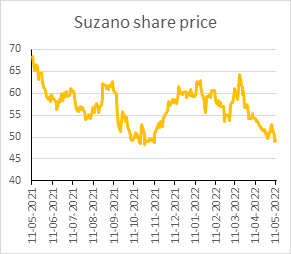

Source: Yahoo Finance

Source: EMAlpha

Source: Yahoo Finance

Source: EMAlpha

Source: Yahoo Finance

Source: EMAlpha

Source: Yahoo Finance

Source: EMAlpha

Source: Yahoo Finance

Source: EMAlpha

Brazil- 2022 timeline

January 2022

Global developments

- US Fed says interest rates could be hiked soon

- Russia-Ukraine situation remains tense

Local developments

- Petrobras shares increase after Brent touched $ 90 for the first time in seven years

- IPCA 15, a preview of Brazil’s official inflation was at 0.58% in January compared to 0.78% in December 2021

- Brazilian Institute of Geography and Statistics report showed a fall in unemployment in the Nov 2021 quarter along with a 4.5% fall in the average real income

- According to the Central Bank, the consolidated public sector recorded a primary surplus of R$ 64.7 billion in 2021

February 2022

Global developments

The US and the West heave sanctions on Russia following its invasion of Ukraine

Brent goes over $ 90

Local developments

Unemployment drops in December 2021 but the income also shrinks

As per data released by the Brazilian Institute of Economics of Fundação Getúlio Vargas, the Industry Confidence Index (ICI) dropped 1.7 points in February, to 96.7 points, reaching the lowest level since July 2020

Discussions in Congress continued about introducing a new package for granting credit to small and medium-sized companies and micro-entrepreneurs

March 2022

Global developments

Oil prices

Russia-Ukraine war

US Fed’s aggressive plans to contain inflation

China covid surge and plans of lockdown

Local developments

Strike by central bank employees delays release of Focus survey data among others

Selic rate was raised from 10.75% per year to 11.75% per year

April 2022

Global developments

US Fed’s Powell signals acceleration in interest rate hike

China covid lockdown

Local developments

Data shows official inflation rose much more than expected in March

Increasing chances of raising the basic interest rate (Selic) to beyond 13% in 2022

Rising tension between President Jair Bolsonaro and the Supreme court over pardon granted by Bolsonaro to deputy Daniel Silveira

May 2022

Global developments

President of the European Commission, Ursula von der Leyen, announces that European countries plan to stop buying oil from Russia within six months

US fed announces 0.5% interest rate hike

Oil trades to the north of $ 100

Local developments

Selic rate increased to 12.75% on May 4th

IPCA- 15, a preview of Brazil’s official inflation, was 1.73% in April

IPCA increased 1.06% in April compared to March

References

- https://g1.globo.com/economia/noticia/2021/12/27/vendas-do-varejo-no-natal-crescem-111-diz-indicador-da-cielo.ghtml (12/27/2021)

- https://g1.globo.com/economia/noticia/2022/01/31/setor-publico-tem-superavit-de-r-647-bilhoes-em-2021-primeiro-resultado-positivo-em-oito-anos.ghtml (01/31/2022)

- https://g1.globo.com/economia/noticia/2022/01/26/ipca-15-previa-da-inflacao-fica-em-058percent-em-janeiro.ghtml (01/26/2022)

- https://g1.globo.com/economia/noticia/2022/02/22/bovespa.ghtml (02/22/2022)

- https://g1.globo.com/economia/noticia/2022/02/24/desemprego-cai-para-111percent-em-dezembro-aponta-ibge.ghtml (02/24/2022)

- https://g1.globo.com/economia/noticia/2022/02/24/bovespa.ghtml (02/24/2022)

- https://g1.globo.com/economia/noticia/2022/02/24/fgv-registra-a-7a-queda-consecutiva-no-indice-de-confianca-da-industria.ghtml (02/24/2022)

- https://g1.globo.com/economia/noticia/2022/03/22/copom-aponta-que-conflito-entre-russia-e-ucrania-pode-resultar-em-pressao-prolongada-sobre-a-inflacao.ghtml (03/22/2022)

- https://www.infomoney.com.br/minhas-financas/na-vespera-de-greve-700-comissionados-do-banco-central-deixam-cargos-e-campos-neto-tira-miniferias/ (03/31/2022)

- https://g1.globo.com/economia/noticia/2022/04/11/bovespa.ghtml (04/11/2022)

- https://www.reuters.com/world/americas/brazils-inflation-tops-forecasts-with-sharpest-rise-march-28-years-2022-04-08/ (04/08/2022)

- https://g1.globo.com/economia/noticia/2022/05/04/copom-se-reune-nesta-quarta-feira-mercado-preve-10a-alta-seguida-da-selic-para-1275percent.ghtml (05/04/2022)

- https://www.infomoney.com.br/economia/ipca-abril-106/ (05/11/2022)

- https://g1.globo.com/economia/noticia/2022/05/11/ipca-inflacao-fica-em-106percent-em-abril.ghtml (05/11/2022)