AI in Finance: From Moving Averages to Generative AI

May 13, 2023

Finance is all about capturing changes. If you do well, you win, if not — you lose. Learn how AI significantly changes the game

Making predictions is hard. On the one hand, predicting something like stock price is extremely simple to conceptualize — you have a graph of a single variable, vs another variable: stock price vs time. All you want is to be able to accurately forecast the price at a certain time in the future.

But surprises are the norm in finance. When companies perform better than expected, their stock prices rise, and when they perform worse, company stock prices fall. Apart from regular earnings reports, surprises can occur every day for example during natural disasters or your favorite celebrity tweeting their heads off.

There are a number of ways you can attempt to predict prices. One commonly used method is ARIMA. ARIMA models attempt to predict stock prices without taking into account any information, apart from historical trends. ARIMA models can take into account the changing mean of a time series, seasonality, and a fixed variance.

The drawback with these models, however — is that they don’t take into account underlying factors that might cause something unexpected, that hasn’t yet occurred. Think about a once in 10 year incident like an economic bubble. An ARIMA model might predict stock prices to certain trends based on historical data — but the factors that make a bubble are unique, and depend much more on the current economic situation, rather than historic trends.

In an analysis, Harvard Business Review found that ARIMA performed the worst in forecasting , while financial experts performed better. You see — even though experts were wrong most of the time, on average they did well enough. The errors made by consensus economic forecasts were small enough to make them valuable for making decisions.

Forecasting models in finance have had a lot of criticisms — for example, failing to predict the financial crisis of 2007 and underplaying the inherent risks in complex financial assets. However, the relevance of AI might completely change things.

How Is Now Any Different?

Recent technological advances have made us very good in collecting data. And data is everywhere. There’s of course financial data on how markets are performing in near real-time, but there is also data about many surrounding events also in real-time.

News is all online — so that is captured. People reveal their true feelings on social media like Twitter, TikTok, Facebook, etc. And there are numerous other data sources so that we can have a pulse of modern society.

Already, we are seeing powerful signs of AI in multiple tasks to process this information. One classic type of problem that AI can handle — are problems related to Natural Language Processing (NLP). NLP amounts to extracting information from text data. One classic NLP task is sentiment analysis.

BlackRock uses sentiment analysis to extract over 5000 earnings transcripts every quarter, and more than 6000 reports from brokers everyday. The traditional approach is to have individuals read through reports by hand. AI automates this type of process at scale. This type of information is useful to folks like portfolio managers, to make informed decisions.

Envisioning the Financial Future With AI

So far, AI and language models have been limited in scope — to tasks like sentiment analysis, or predicting prices given historical trends, etc.

BlackRock uses Aladdin — a technological platform that unifies investment management across portfolios. They are able to mobilize data at an unprecedented scale. AI technologies convert data into valuable insights — like graphs of sentiments about the market. Analysts can view various graphs and trends, and choose investments that they think make sense.

While AI can be used to make various charts and metrics, what we are currently lacking is AI that basically takes all these types of information and makes decisions similar to what a financial expert might do. And this is where Generative AI (like ChatGPT, BloombergGPT, etc.) could play a game changing role!

World renowned quant finance professor Bryan Kelly says:

“generative AI tools like ChatGPT have allowed portfolio managers to process news or other financial documents more efficiently.”

We have already seen how models like ChatGPT can produce realistic outputs from complex user inputs, similar to having having an expert professional at the other end. In a similar vein, financial generative AI models might very soon be able to process complex information including market trends, trending news, press statements, sentiments, etc. and make decisions similar to the world’s best portfolio managers.

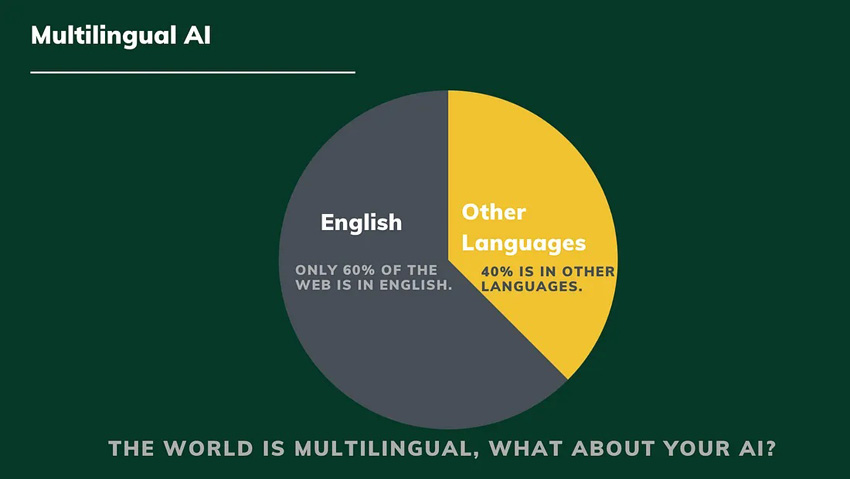

At EMAlpha, we are not just waiting for Generative AI to change finance, but actively leading the forefront of Multilingual-AI and finance. With almost half of the information on the web existing in non-English languages, and with non-English speaking populations in the world becoming internet users at an unprecedented rate, there is a real need for AI that can handle as many languages as possible. EMAlpha uses its proprietary Multilingual-AI to create sentiment, trend, and various categories of risk data and analytics for the financial markets.

Multilingual AI | EMAlpha

Macro, commodities, and emerging markets investors can use EMAlpha’s Multilingual-AI based data to better detect emerging trends and navigate ever-present risks in these markets. Without access to information which might only exist in local languages, AI has no transparency into the “on-the-ground” reality in many of these regions. One example is Chile — the world’s largest copper producer, whose news and local media outlets are predominantly Spanish. Multilingual-AI could reveal the root causes of Copper price variations in connection to local sentiments.

Think of Turkish elections, its trending stock market, and the Turkish language news media. Examples abound where investors would gain from access to such data. Finally, even though most of the generative AI seems to be focused on English language information, EMAlpha is focusing its efforts in developing its own Multilingual GPT, named EM-GPT, where EM stands for emerging markets. EM-GPT would allow investors to gain a window into data and information in emerging markets made accessible in a timely manner.