Why Local News based Sentiment Analysis Matters and Can Machines See the Difference?

On news flow sentiment analysis, often the question is being asked: In this day and age of global interconnection, does local news matter anymore? Let us first look at two samples below:

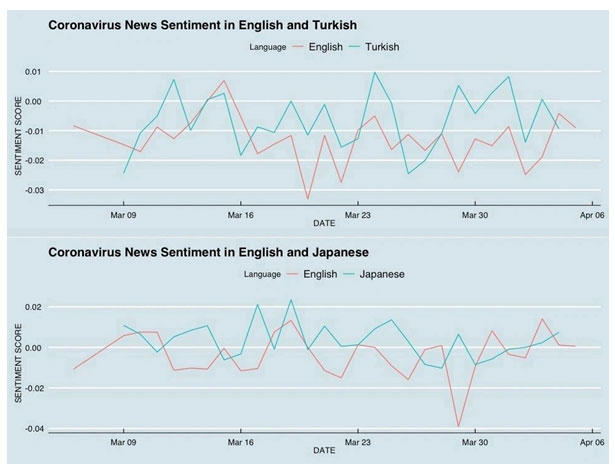

Fig.1: Average Coronavirus News Sentiment lower in English compared to Local Languages. (Source: EMAlpha local news sentiment analysis).

One of EMAlpha team members based out of India says:

I grew up in a small town in India and had access to newspapers in both English and Hindi – the local language. There were small local newspapers, that focused solely on news related to the city and its surroundings. And there were bigger national level newspapers – that were published in both English and Hindi. On the surface, the bigger newspapers seemed to be covering the same issues – be it in English or in Hindi. But I noticed that, while local newspapers were mostly focused on city news, even the national newspapers were very different in English and in Hindi. English language readers didn’t get to see the same news as the Hindi readers. Why? The reasons may be related to several things like perceived differences in their interest areas or even socio-economic indicators, but this was a fact that I noticed over and over again.

The situation has hardly changed. As readership became viewership, with readers moving from print to television, and later transformed into online consumption of news via digital media, the difference between English and Local Language did not go away entirely. In fact, the Netflixes and Amazons have realized that local content will be the backbone for them in any country. They have had to tweak their programs as per the audience taste. As recent trends from the content these companies are developing suggest, the difference in viewer’s profile makes a difference in what the viewer will like and what they will not. The content in English will not appeal that much to people who don’t understand the language so well, even after it has been dubbed in the local language or sub-titles are provided. No wonder, Netflix and Amazon both are investing heavily in ‘Hindi’ content in India.

Does all this really matter for the markets?

Anyone with experience watching business news in multiple languages for the same country will confirm that it is possible that the difference might actually matter. Our experience with news collection for different countries in different languages confirms this. English news and translated (from local language to English) news can be quite different. Issues, discussions, and views can look so different between the two that one begins to wonder if one is really looking at the news flow on the same subject. We have highlighted such divergence for countries like China, Japan and Turkey in our previous newsletters and blogs. When news flow is different, sentiment analysis will not be the same. So, there are situations when the sentiment analysis scores could be different.

Such difference can become even more pronounced during situations that are not normal, situations that display a departure from ‘business as usual’. And, indeed, we are observing this with Coronavirus related news flow. We are noticing that for several countries, including China, the news on the same topic (for example, the impact of COVID-19 on economy or the impact on stock market) is actually very different in different languages. Fig. 1 illustrates this for Turkey and Japan.

Some topics of discussion appear in local language media, but not in English media. Intuitively speaking, and a hunch which does get confirmed when one does a careful comparison, the English news media appears more sanitized. This reminds of a family discussing certain topics only within the four walls of their home, topics that they would prefer not discussing in front of neighbours.

All of this points to the difference between Sentiment Analysis, all conclusions drawn, on the basis of English and the local news media. The difference is not always small. It might be that an analysis becomes necessary to check what is the more important driver of sentiment: is it the English News Sentiment or the Local News Sentiment?

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.