Trouble in the EdTech paradise

Synopsis: Education Technology (EdTech) space has been one of the fastest-growing areas in many emerging markets, including China. However, the recent developments in the space haven’t been positive. Friday, 23rd July was a very bad day for the Chinese EdTech stocks as reports emerged that the Chinese Government is considering strict regulations to disallow the EdTech companies operating with a profit motive. Interestingly, most of the news coverage on the EdTech sector in China is focused on the fact that the Chinese companies may not be allowed to make profits or choose the location for their listing. But there are other constraints as well, such as issues on ethics and concerns on the business model. But, EdTech does not have a problem in China alone. In India, the most well-known name in the sector is Byju’s and it also has had issues that come under Sustainability parameters. These issues include work culture, allegations of false claims, lawsuits, questions on acquisitions, and profitability not being a priority.

Friday, 23rd July: Black Friday for Chinese EdTech stocks

Friday, 23rd July was a very bad day for the Chinese education stocks as reports emerged that the Chinese Government is considering regulation to disallow the EdTech companies to operate with a profit motive. The EdTech sector is worth more than USD 100 billion and reports indicate that this move will be disastrous for companies like TAL Education Group, New Oriental Education & Technology Group, Gaotu Techedu, and Koolearn Technology. Following this, the NYSE-listed stocks corrected 50%-60%, wiping off significant investor value.

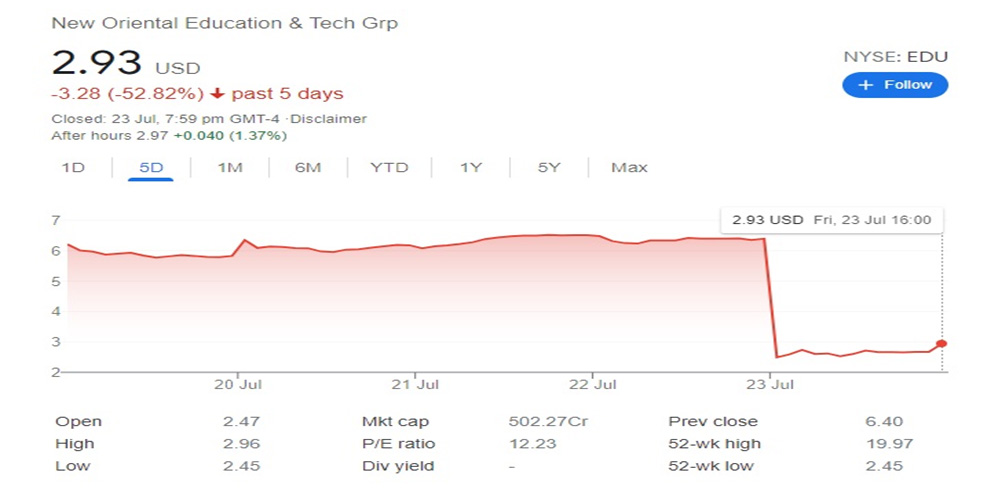

New Oriental Education & Technology Group Inc. or New Oriental, is a provider of private educational services in China. In the previous six months, New Oriental Education & Technology Group lost more than 80% of its value and the Friday correction was more than 50%.

Figure 1: New Oriental Education & Technology Group Stock Price Chart over last five days

Source: Google

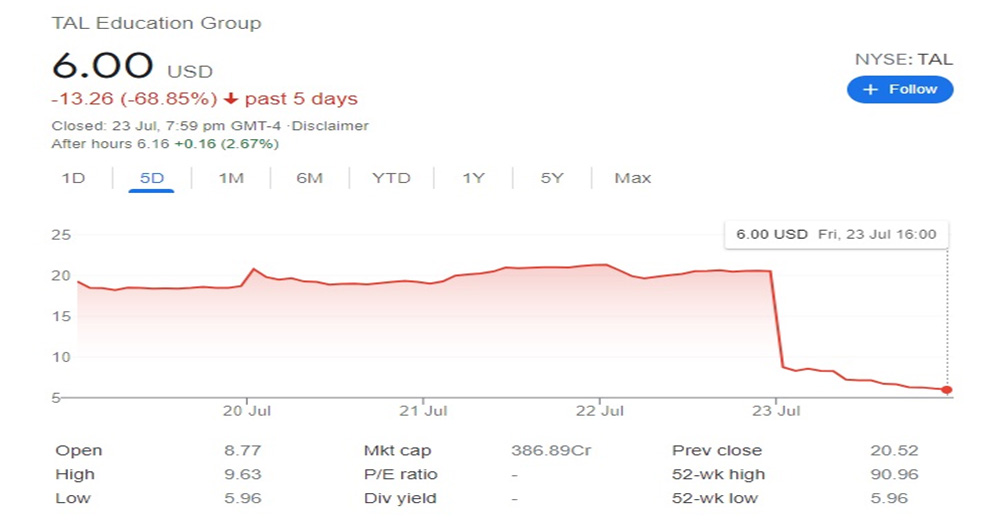

TAL Education Group offers after-school education for students in primary and secondary school. In the previous six months, TAL Education Group has lost more than 90% of its value and the Friday correction was more than 70%.

Figure 2: TAL Education Group Stock Price Chart over last five days

Source: Google

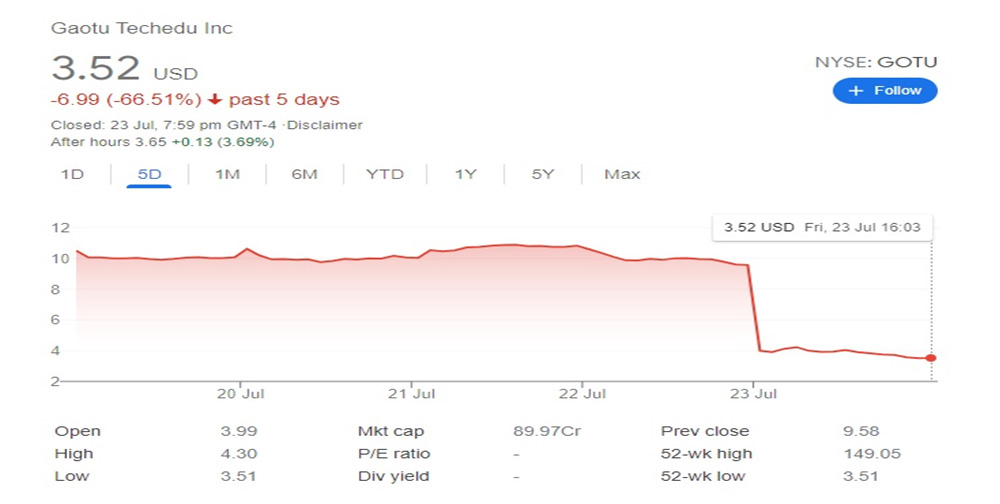

Gaotu Techedu is an exam preparation and tutoring company. In the previous six months, Gaotu Techedu has lost more than 95% of its value and the Friday correction was more than 60%.

Figure 3: Gaotu Techedu Stock Price Chart over last five days

Source: Google

Koolearn Technology Holding Ltd is a China-based company mainly engaged in the provision of online education courses. In the previous six months, Koolearn Technology has lost more than 75% of its value and the Friday correction was more than 28%.

Figure 4: Koolearn Technology Stock Price Chart over last five days

Source: Google

The signs were already ominous

The measures talked about in the latest news reports are draconian, but even the most optimistic sector watchers will not claim that they are entirely unexpected. The Chinese Government has already increased scrutiny on these firms. For example, a revision in China’s Minors Protection Law, which became effective from 1st June 2021, banned kindergarten and private tutoring institutions from teaching elementary-school courses to pre-school students. Two years ago, the Chinese Government made it compulsory for all foreign teachers to hold valid teaching credentials and also made it mandatory for companies to make public all certificates and work experience data.

Read More: Do Organizations pay more attention to ‘S’ in ESG Reporting: A critical evaluation of Alibaba Group https://www.emalpha.com/do-organizations-pay-more-attention-to-s-in-esg-reporting-a-critical-evaluation-of-alibaba-group/

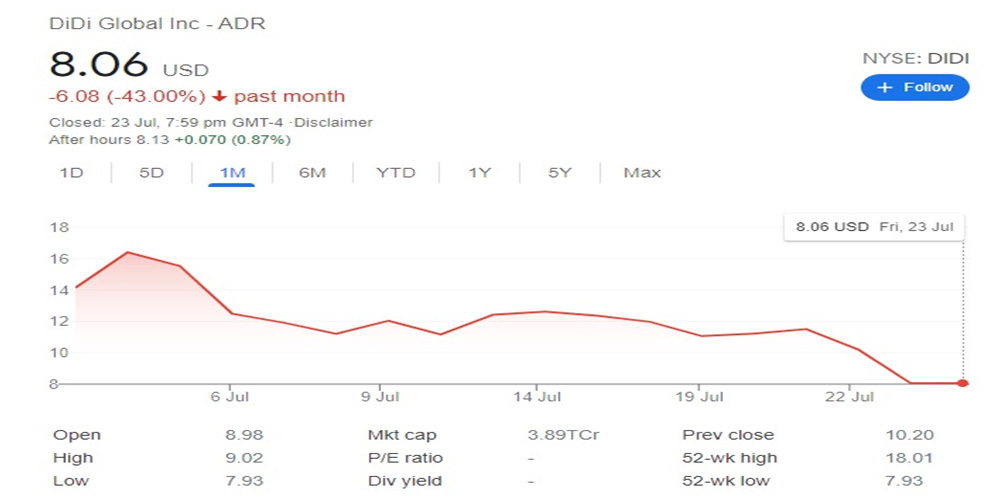

Then there are broader concerns on how the Chinese Government is treating the tech companies. It has been almost a year since the cancellation of the Ant Group’s IPO and Jack Ma of Alibaba group completely vanishing from public view. There have also been many other companies that have been facing increasing headwinds. More recently, the troubles for Didi (Didi Chuxing Technology Co.), a Chinese vehicle for hire company, which began immediately after listing are well documented.

Figure 5: Didi Stock Price Chart since listing

Source: Google

It is not just about profits or where these companies get listed

Most of the news coverage on the EdTech sector in China is focused on the fact that the Chinese EdTech companies may not be allowed to make profits or choose the locations for their listing. But there are other constraints as well which could fundamentally alter the structure of this industry. The news reports talk about major concerns such as that, apart from ‘no profits’, the EdTech companies may not be allowed to raise capital or go public. The prominent challenges could be:

- The listed firms may not be allowed to invest in or acquire education firms teaching school subjects

- In the EdTech space, there will be no permission for foreign capital to come in and what it effectively means is that the foreign listings may become a thing of the past.

Issues on ethics and concerns on the business model

For the Chinese Government, the explosive growth in the EdTech sector has also become a cause of concern. The biggest fear is that these firms are creating unnecessary pressure on parents to spend more on things that may not be needed. They adopt questionable tactics for boosting the enrolments and play to the ‘Fear of Missing Out’ or FOMO emotion. In essence, these firms give an unfair advantage to people with deep pockets and this goes against the spirit of ‘level playing field’.

It is likely that the local Chinese regulators may not allow;

- New platforms offering tutoring on the compulsory syllabus

- Vacation and weekend tutoring on school subjects

Not just listed entities, but there is an impact on investor sentiment on very large unlisted companies like Zuoyebang (an online education company that targets students in primary and high school) and Yuanfudao (Yuanfudao is an online live course platform servicing primary and secondary school students). These are big companies backed by large investors.

EdTech does not have a problem in China alone

In many developing countries, good professional education is a prerequisite for a decent career. Parents spend huge amounts of money to ensure that their kids get into good colleges. As a result, the EdTech space has seen huge growth. Take for case, India. The most well-known name in the space is Byju’s. It is an Indian EdTech company, headquartered in Bangalore. It was founded in 2011 by Byju Raveendran and Divya Gokulnath. As of June 2021, Byju’s is valued at $16.5 billion, making it one of the world’s most valuable EdTech companies.

But, Byju’s also has had issues that come under ESG or Sustainability parameters;

- Work culture – There have been times when internal telephone recordings by their employees were leaked in public, indicating a bad work culture.

- Allegations of false claims – There are several allegations and controversies around aggressive advertising and false claims.

- Lawsuits – Some of the acquisitions like WhiteHat Jr have a history of lawsuits and allegations of throttling dissent on social media platforms.

- Acquisitions – There has been a scorching pace of acquisitions and there are controversies that some of them are not aligned geographically or are not in tandem from the core business perspective.

- Profitability not a priority – There are allegations that Byju’s focus is on chasing growth and not that much on financial viability or profitability because of funding being pumped in.

How EMAlpha can help Asset Managers

There is, undoubtedly, a profound ESG movement going all over the globe right now. From countries to asset managers, from millennial investors to the old school stalwarts, everybody’s counting on the ESG chip for a better future and a better return on investment. Also, ESG is not applicable for listed entities alone and the portfolio managers will need to ensure that all their Assets Under Management (AUMs) get aligned. This includes private investments as well.

The Asset Managers need to have a clear picture of what the unlisted companies are doing on ESG and how they are preparing for a public issue. For example, EMAlpha’s proprietary AI-ML tools pick up increasing activity from the company in ESG communication. This could mean an impending IPO in the near term. The tools are also helpful in understanding the issues which are in focus. For example, large EdTech players like the Chinese companies and Byju’s are very much criticised over their social impact.

In general, EMAlpha with its proprietary AI-ML techniques becomes useful for investors to gauge companies on the ESG front. As we have discussed, the changes in perception on the ESG track record of a company and reactions from institutional investors have become an important driver of stock prices, and especially in cases where the volatility is high, it matters even more. From individual stocks to a portfolio, the complexity increases even more and EMAlpha AI-ML is a helpful tool for Asset Managers in evaluating progress for their portfolios and taking corrective measures, as and when required.

It is also interesting to note here that EMAlpha believes that it is never enough to focus just on official or company-reported information for a holistic ESG analysis. Hence, this analysis was done mostly based on what is available from public sources. EMAlpha AI-ML has used 100% information from sources that are not official. For the ESG analysis, the information source will make a big difference in drawing the right inferences from the perspective of asset managers.

References

- Chinese education stocks plunge as Beijing reportedly wants to turn tutoring companies into non-profits https://markets.businessinsider.com/news/stocks/tal-edu-gotu-stock-price-tutoring-companies-non-profit-baba-2021-7 (Accessed on 24th July 2021)

- China Considers Turning Tutoring Companies Into Non-Profits https://www.bloomberg.com/news/articles/2021-07-23/china-is-said-to-mull-turning-tutoring-firms-into-non-profits?sref=GUP2BhaG (Accessed on 24th July 2021)

- China’s expected edtech clampdown may chill a key startup sector https://techcrunch.com/2021/07/23/chinas-expected-edtech-clampdown-may-chill-a-key-startup-sector/ (Accessed on 24th July 2021)

- New regulation sets off wave of job chaos in Chinese edtech sector https://technode.com/2021/06/02/new-regulation-sets-off-wave-of-job-chaos-in-chinese-edtech-sector/ (Accessed on 24th July 2021)

- Where is China’s edtech sector heading after the crackdown? https://kr-asia.com/where-is-chinas-edtech-sector-heading-after-the-crackdown (Accessed on 24th July 2021)

- US-listed China tech stocks continue to fall; Alibaba, Baidu, DIDI, others in losses https://www.financialexpress.com/investing-abroad/featured-stories/us-listed-china-tech-stocks-continue-to-fall-alibaba-baidu-didi-others-in-losses/2294707/ (Accessed on 24th July 2021)

- Chinese EdTech Firms Tank On Report China Wants Them Non-profit https://finance.yahoo.com/news/chinese-edtech-firms-tank-report-103810526.html (Accessed on 24th July 2021)

- Zuoyebang is an online education startup that provides educational products and services to students in primary and high school https://techcrunch.com/2020/12/28/chinese-online-education-app-zuoyebang-raises-1-6-billion-from-investors-including-alibaba/ (Accessed on 24th July 2021)

- Chinese live tutoring app Yuanfudao is now worth $15.5 billion https://techcrunch.com/2020/10/22/chinese-live-tutoring-app-yuanfudao-is-now-worth-15-5-billion/ (Accessed on 24th July 2021)

- At $16.5 bn, Byju’s most valuable startup in India after raising $350 mn https://www.business-standard.com/article/companies/valuing-16-4-bn-byju-s-most-valuable-startup-in-india-11th-in-the-world-121061201069_1.html (Accessed on 24th July 2021)

- Why Byju’s Work Culture is all over the News https://startuptalky.com/byjus-work-culture/ (Accessed on 24th July 2021)

- Ever since its acquisition by Byju’s, WhiteHat Jr has been in the news for all the wrong reasons. Critics of the ed-tech platform claim their voices are being silenced on the internet. https://scroll.in/article/979338/ever-since-its-acquisition-by-byjus-whitehat-jr-has-been-in-the-news-for-all-the-wrong-reasons (Accessed on 24th July 2021)

- WhiteHat Jr Controversy: Delhi HC Asks Pradeep Poonia to Take Down Tweets in Defamation Case https://thewire.in/law/delhi-hc-pradeep-poonia-whitehat-defamation (Accessed on 24th July 2021)

- WhiteHat Jr Founder Files Rs 20 Crore Lawsuit Against Critic Who Publicly Slammed Company https://www.india.com/business/whitehat-jr-founder-files-rs-20-crore-lawsuit-against-pradeep-poonia-publicly-slammed-byjus-4219363/ (Accessed on 24th July 2021)

- Why Byju-WhiteHatJr’s ad blitz is angering parents, educators & all else https://www.educationworld.in/why-byju-whitehatjrs-ad-blitz-is-angering-parents-educators-all-else/ (Accessed on 24th July 2021)

- Why are some people furious with Byju’s WhiteHat Jr? https://www.freepressjournal.in/viral/why-are-some-people-furious-with-byjus-whitehat-jr (Accessed on 24th July 2021)

- Why BYJU’S did not meet $150-million net profit target in FY21 https://www.thehindubusinessline.com/companies/why-byjus-did-not-meet-150-million-net-profit-target-in-fy21/article34323074.ece (Accessed on 24th July 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.