Samsung and ESG: Is ‘Environmental’ going the ‘Governance’ way?

Synopsis: Samsung Electronics is an enigma for investors and asset managers. A company that is among the global leaders in consumer-facing technology, having constantly launched very successful products, it has a big blot on its governance track record. There have been several incidents in the past couple of decades that indicate that ‘old habits die hard’. The ESG issues facing Samsung were well covered in our previous insight “Samsung Electronics: Global Tech Giant is an ESG pygmy. Going a step further, EMAlpha dives into its recently released Sustainability Report. While Samsung made good work on its promise of going 100% renewable in the US, Europe, and China, its greenhouse gas (GHG) emissions increased to 3.2 tonnes CO₂e per 100 million KRW in 2020 compared to 3.1 tonnes CO₂e per 100 million KRW in 2019. While the company attributed the increase in GHG emissions to the expansion of its semiconductor operations, it remains to be seen if the company learns from its past ESG defaults and comes out as a proactive sustainability player, befitting a company of its size. The Governance parameters anyway pose a big challenge to Samsung in ESG evaluation and if the Environmental track record also deteriorates, it will add more complexity to ‘Sustainability at Samsung’.

Samsung’s Sustainability drive

“For decades, Samsung has been striving to incorporate environmental sustainability into every aspect of the semiconductor manufacturing process,” said Seong-dai Jang, senior vice president and head of DS Corporate Sustainability Management Office at Samsung Electronics following Samsung Electronics’ announcement that it had received the industry’s first Triple Standard for carbon, water, and waste by Carbon Trust on June 03, 2021.

The award was in recognition of Samsung’s efforts to reduce its environmental footprint. Over the past years, Samsung has increased its recycling of wastewater, it has reduced its wastewater sludge, and has completely converted to renewables in the US and China. This was a major achievement for a company (or rather, conglomerate is a better word here) that has been a major force in consumer technology products and was an important milestone in its journey of evolution towards developing a more sustainable business and its focus on ESG and Sustainability.

Key takeaways from Samsung’s Sustainability Report

Here are some key takeaways from Samsung Electronics’ 2021 Sustainability Report:

- Renewables: Samsung Electronics, in 2018, committed to source 100% renewable energy at all of their worksites in the United States, Europe, and China by 2020. And the company was able to achieve the feat.

- Eco-package- By using smaller and lighter packaging materials, the company made efforts to reduce the environmental effect of packaging, Samsung replaced product packaging with paper and recycled materials from plastics and vinyl.

- Recycled plastic- Samsung used 55.1 million pounds of recycled plastic within its CE division in 2020. The recycled plastic is used in the back cover of monitors, mobile chargers among others.

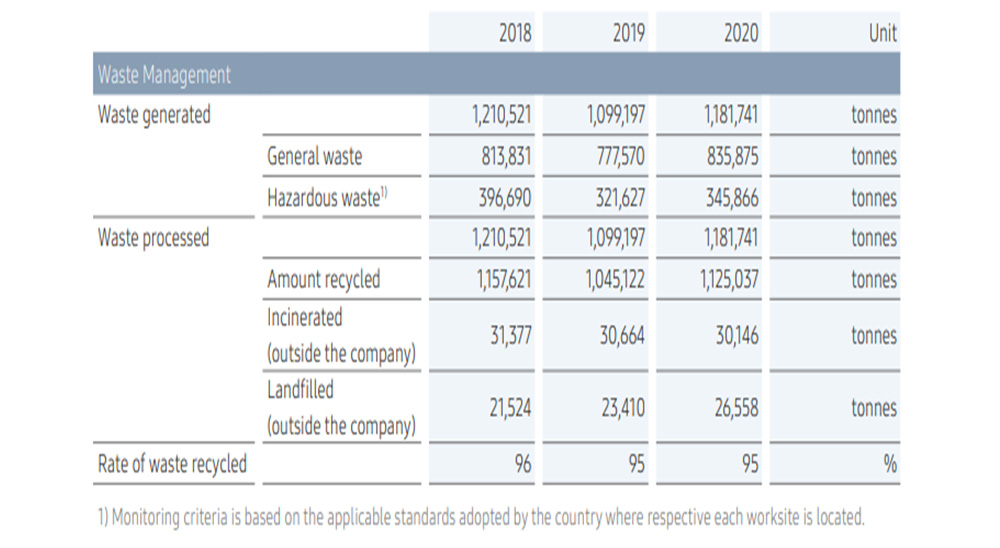

- Waste management- In 2020, Samsung achieved 95% of waste recycling rate (Figure 1). In the report, the company stated, “We will make continuous efforts to receive Zero-Waste to Landfill certification for all of our global manufacturing worksites.”

- Water management- By undertaking measures such as changing the process of control values, switching wastewater treatment methods, and optimizing operations, Samsung reduced an average of 4,953 tonnes of water each day at its semiconductor plants that have high water usage. In 2020, the company reused 70,181 thousand tonnes of water, a 1.2% increase compared to that of last year.

Read More: What is cooking in South Korea on ESG?

Figure 1: Samsung Electronics’ Waste Management

Source: Samsung Electronics Sustainability Report 2021

There is room for Improvement

While Samsung’s sustainability drive over the past year is commendable, there are still some areas where the behemoth needs to work on. As is known, the pandemic boosted sales of electronics at a rate never seen before. What this meant was that there was an increase in production and hence an increase in the quantity of associated GHG emissions.

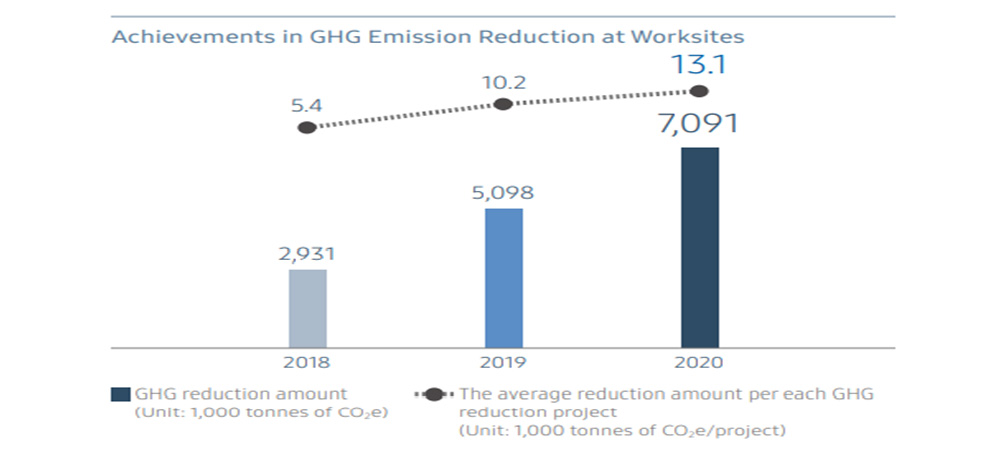

Figure 2: GHG Emission at Worksites Statistics

Source: Samsung Electronics Sustainability Report 2021

The company writes in the report, “In 2020, we implemented a total of 540 GHG reduction projects, including enhancing the efficiency of F-gases processing facilities, upgrading to high-efficiency equipment, and streamlining the manufacturing process. As a result, we reduced GHG emissions by a total of 7,091 thousand tonnes compared to the expected emission amount. This is an increase of 39% compared to the amount of GHG reduction achieved in 2019.”

Read More: Asset Managers are going ‘All in’ into ESG

While the company does mention that the amount of GHG reduction achieved in 2020 was 39% more than that achieved in 2019, the company also states that it reduced GHG emissions in 2020 as compared to the “expected emission amount”. The usage of “expected emission amount” does appear to be a cloak to make up for the increase in GHG emissions over the past year.

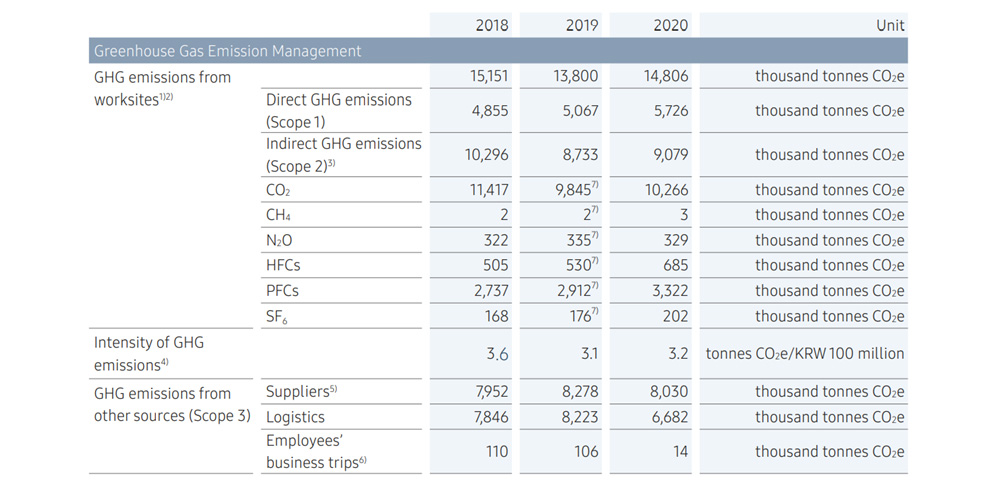

Figure 3: Scope 1, Scope 2, and Scope 3 emissions

Source: Samsung Electronics Sustainability Report 2021

Despite Samsung Electronics setting its 2020 emissions target at 1.55 tonnes CO₂e per 100 million KRW, the final tally went over by a good margin. Its Greenhouse Gas emissions for 2020 were 3.2 tonnes CO₂e per 100 million KRW. On a year-on-year basis, its GHG emissions rose by 5% in 2020.

The company attributed the increase in emissions to the expansion of operation of their new semiconductor production line and product output. It’s common knowledge by now that the world is facing an acute chip shortage and as such, Samsung wants to capitalize on the demand to the utmost possible extent.

While the Scope 1 and Scope 2 emissions increased in 2020, the Scope 3 emissions decreased over the year. The decrease is understandable as there were covid restrictions related to traveling. The reduction in emissions from 106 thousand tonnes CO₂e to 14 thousand tonnes CO₂e related to “Employees’ business trips” validates that.

Samsung Electronics also stated that the company’s operations in China, Europe, and the US were now fully powered by renewable energy sources, thus fulfilling its 2018 pledge. While that is laudable, Greenpeace (a non-governmental environmental organization) urged Samsung to go all renewable in South Korea and Vietnam, two of its biggest manufacturing hubs. South Korea and Vietnam constitute roughly 80% of the electronics maker’s energy use and as of now the energy systems in these two countries are powered by fossil fuels.

Granted, there are hurdles in the form of lobbies and government ministries resisting the transition to cleaner energy in South Korea, but Samsung could leverage its position in Vietnam where it is the biggest corporate employer and contributor to gross domestic product. Clearly, if Samsung keeps promoting itself as a renewable tech company while continuing to use fossil fuels in the majority of its production line, it will only be adding to its already troubled ESG scores.

Why South Korean chaebols are complex in their ESG track record

In Emerging Markets, evaluating a company on its ESG performance is a huge challenge for a variety of reasons such as lack of reliable data and complicated disclosures. Apart from that, there are also peculiarities like the complex ownership structure that has certain implications, which is a big issue in many EMs. The chaebol or conglomerate business structure of South Korea is an interesting case here.

The term Chaebol refers to a complex, conglomerate-type ownership structure that originated in South Korea in the 1960s, comprising of either a single large company or several groups of companies. Samsung, Hyundai, SK Group, and LG Group are among the biggest and most prominent chaebols. While they are doing well on the business front, there are several issues that can’t be ignored.

There are peculiarities associated with such an arrangement, such as their oversized influence and non-transparent relationship with politicians and government officials. Although South Korean firms are making good progress on Environmental and Social Issues, the record is not as elegant when it comes to Governance. The ‘chaebol way of doing business’, could be the culprit here.

With this in context, there are some important lessons for institutional investors that have surfaced from the latest developments in the ESG space in South Korea including, a) No two ESG scores are the same despite having the same headline figure. This shows that it is the composition that makes the difference and hence all three parameters need to be evaluated separately.

The complex ownership structure and political linkage of senior Government officials with the controlling group families and senior management in many of these enterprises make the situation more complicated. This way of functioning acts as a hurdle for analysts and institutional investors in figuring out the ultimate beneficiaries of this complicated ownership structure and the cross-linkages between companies, families, and individuals.

There are also concerns regarding unscrupulous actors such as how senior politicians help these companies and how in turn, the families pay them back. The likelihood of it happening is much higher when the government has more power to take policy decisions that could lead to a big change in the fortunes of business entities. This is what makes the companies from Emerging Markets much more prone to challenges emanating from poor corporate governance.

Chaebols and the infamous Samsung case of 2017

It is related to an influence-peddling scandal that cost the country’s president and Samsung’s top executive their jobs. In 2017, Samsung’s top executive was jailed as part of the scandal that toppled the chair of Park Geun-hye, South Korea’s president. This scandal reverberated across the global business media and these developments also led to a revaluation of the investment decisions process for many institutional investors.

As a result of this scandal, Jay Y. Lee, the head of the Samsung Group, was sentenced to five years in prison, after a court convicted him of bribing his way to greater control of the Samsung Empire that his family had founded. But Lee appealed the conviction and in early 2018, the Seoul High Court let him free after reducing and suspending the sentence, thus sparking public anger. But this wasn’t the first time that such an incident had occurred. In the past, business leaders, including Lee’s father, were convicted for corrupt behavior, only to be let off later.

Lee was accused of playing a role in the payment of tens of millions of dollars that Samsung made to benefit a close friend of deposed president Park. The Lotte retail group’s chairman was convicted in 2018 in another trial relating to Park and was handed a 30-month jail term. Eight months later, an appeals court suspended the term and released him. This also led to public outrage as protesters calling for the president’s ouster vented their anger at the conglomerates. Park was found guilty in 2018 of crimes ranging from bribery to coercion, abuse of power, leaking of state secrets and was sentenced to 24 years in prison.

The Achilles’ heel: Governance

EMAlpha’s AI-ML aided analysis tells us that while South Korean firms are making good progress on Environmental and Social Issues, the record is not that good on Governance. This is strange because many of their global competitors do exceedingly well in Governance evaluation, thus helping their overall ESG scores. This good performance in Governance, despite a relatively poor E and S performance, gets the investors to be more interested in them.

Across several sectors, the South Korean companies usually perform better than their global competitors on the E (Environmental) and S (Social) evaluation, but they lag on G (Governance). A simple explanation is that in recent times, there have been many South Korean companies that have focused on reducing carbon emission and that is what is helping the E scores. But that also pushes G lower in the priority order.

The scathing remarks from some critics point out structural issues such as the South Korean companies’ management style. For example, with most South Korean companies, the CEO holds absolute power in decision making and hence changes in their corporate governance system are difficult to bring about. Is legacy the reason behind this? The discussion on Chaebols earlier in this insight is clearly an indication that this may very well be the case.

How can EMAlpha help?

There is, undoubtedly, a profound ESG movement going all over the globe right now. From countries to asset managers, from millennial investors to the old school stalwarts, everybody’s counting on the ESG chip for a better future and a better return on investment. There is almost an undisputed global consensus that businesses must incorporate sustainability into their operations.

While the ESG deliberation is appreciable, one can’t deny the challenges facing the ESG movement. Be it greenwashing, lack of proper metrics, frameworks, or quality of ESG information, ESG still has plenty of hurdles to overcome for it to be a sustainable investment instrument. It is here that EMAlpha with its proprietary AI-ML techniques becomes a much-needed tool for investors.

- Go beyond the official reported version – The data source matters and there is a need to look beyond what the companies are reporting and what the official version is. It is essential to rely on the company-reported data because other sources might not be collating as much information. Although often, there are other sources as well for environment-related information. They include the information disclosure as mandated by regulators and the EMAlpha algorithms scan through unstructured data to pick the unofficial information too.

- No two ESG scores are the same despite the same headline figure – It is the composition that makes a big difference and all the three parameters that constitute ESG need to be evaluated separately. The EMAlpha algorithms provide separate scores for E, S, and G so that an investor can review the sectoral performance more transparently. Over and above, a key feature of EMAlpha’s NLP algorithms is that the attribution analysis is fairly simple.

- An ESG score without context and background is meaningless – The ESG is as much about intent as it is about execution. For this balanced evaluation, having an understanding of the local factors is very crucial. A very good ESG track record (probably more driven by excellent performance in E and/or S) may hide serious Governance related risks and the investors can only ignore them at their peril. EMAlpha analysis meticulously incorporates this critical part of the ESG evaluation jigsaw puzzle.

References

- Samsung reports boosted global recycling collection https://resource-recycling.com/e-scrap/2021/07/09/samsung-reports-boosted-global-recycling-collection/ (Accessed on 09th August 2021)

- Samsung carbon emissions rise despite 100% renewable energy in China, Europe, the US https://www.zdnet.com/article/samsung-carbon-emissions-rise-despite-shift-to-100-renewable-energy-in-china-europe-and-the-us/ (Accessed on 09th August 2021)

- Samsung Electronics Sustainability report 2021 https://images.samsung.com/is/content/samsung/assets/global/our-values/resource/2021_Sustainability_Report.pdf (Accessed on 09th August 2021)

- Lee Jae Yong: Samsung heir gets prison term for bribery scandal https://www.bbc.com/news/business-55674712 (Accessed on 09th August 2021)

- Samsung heir Jae Y Lee sentenced to 2 1/2 years in prison for bribery and embezzlement https://edition.cnn.com/2021/01/18/business/samsung-jay-y-lee-prison-sentence-intl-hnk/index.html (Accessed on 09th August 2021)

- Samsung Elec sits idly on $ 182 billion cash hoard as invest put on hold over leadership void https://pulsenews.co.kr/view.php?sc=30800021&year=2021&no=701839 (Accessed on 09th August 2021)

- Samsung Electronics expects 53% increase in operating profit https://www.wsj.com/articles/samsung-electronics-expects-53-increase-in-operating-profit-11625617363 (Accessed on 09th August 2021)

- Samsung Electronics historical data https://www.investing.com/equities/samsung-electronics-co-ltd-historical-data (Accessed on 09th August 2021)

- Samsung Electronics shares hit year’s second-lowest mark http://www.koreaherald.com/view.php?ud=20210720000949 (Accessed on 09th August 2021)

- Samsung urged to use 100% green energy in South Korea and Vietnam https://asia.nikkei.com/Spotlight/Environment/Climate-Change/Samsung-urged-to-use-100-green-energy-in-South-Korea-and-Vietnam (Accessed on 09th August 2021)

- KCGS downgrades ESG scores of Samsung, SKT and LGD http://www.koreaherald.com/view.php?ud=20210406000851 (Accessed on 09th August 2021)

- Over a dozen major companies downgraded in ESG ratings https://m.koreatimes.co.kr/pages/312139.html?gosh (Accessed on 09th August 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.