Recession is trending, Could ‘People’s Worries’ Bring Bad News For the Economy?

Trends are powerful and often, they become self-fulfilling prophecies. The success of a song, story, or a play and how successful it will eventually become depends a lot on initial few reactions. If they are favourable, more people get attracted and that, in turn, brings in further interest from the people. And when something is seen as doing well, people with unfavourable view become silent and fans become more and more vocal. There is always a pressure on humans to conform to society and majority opinion does influence almost all of us. Most of us look for ‘approval’ from friends and peer groups, and this changes our thought process. We don’t want to be seen as someone who does not comply.

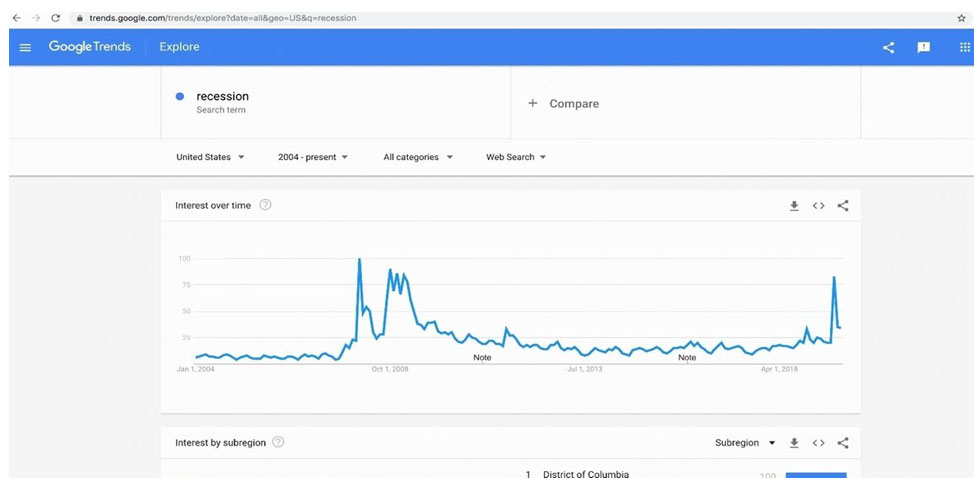

When we look at google trends, it is a fairly reliable indicator of what people are talking about, what they are feeling worried about and what their concerns are. The chart above shows the frequency of google search for the keyword “recession” from 2004 onward. It has hit the 2008-2009 levels recently. Of course, there has been a significant dip from the peak levels afterwards, but still the number of people searching for the word ‘recession’ remains at a higher level than observed in the past ten years. This is a significant change because such spikes could actually precede the real event.

Can this become the cause of recession? Just because people are searching for it, would the probability of a global recession in next twelve to eighteen months become higher than normal levels? We have seen that humans are not solely driven by hard data and they are not always 100% logical in their decisions. For them, sentiment plays a key role. If people are getting more concerned about possibilities of a recession (of course, we can debate over this inference drawn on the basis of more Google searches), the possibilities of them cutting down on consumption and getting more pessimistic about future outlook are more likely scenarios than them getting exuberant about near term future.

This is important for investment decisions because such large-scale events will impact all countries, all sectors and all the stocks. Effectively, no one is immune to these adverse developments. With more data points available on different facets of a company and better analytical tools available at their disposal for analysts and fund managers, both good and bad things can develop very quickly. Hence, the role of sentiment is of significant importance for money managers.

In some of our earlier posts, we have discussed how sentiment plays a big role in shaping our reality. If we apply the same principle here and see this situation, we will find that with each passing day, recession is becoming “overdue” if we track the frequency since the time of Great Depression. One doesn’t wish for it to happen soon but it is also a fact that the more it gets delayed, more painful it would become. If we can forecast its timing with reasonable accuracy, it can help us combat it. The effectiveness of remedial measures will depend on the timing. Too early, you waste them and too late, they become ineffective. Any indicator including Google Trends is welcome if it can help us in getting the timing right and that would be no mean task.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.