Oil’s Historic Fall: Precipitated by Quickly Worsened Sentiment amid Demand Concerns

As we highlighted in our previous insight, the most bizarre price movement was in Oil Futures this week. As May WTI Futures traded in Negative, the historic fall in crude oil prices prompted us to investigate this issue further. In particular, how oil news sentiment fared around that time. But before that, a little bit of background.

In our 2nd March 2020 insight, we had discussed the sudden fall in Indian Equity Markets.On that day, in the last hour and a half, the NIFTY 50 Index lost more than 3% (Ok, Ok. It doesn’t look that big now after 3-4% intra-day moves have become normal in last few weeks. But remember, this was the first of March, before the exceptional market volatility had taken over the markets). The markets were in green and going strong but this move was completely unexpected and very quick.

But how did that happen on March 2nd in India Market? The fall was because of a news that two fresh cases of Coronavirus were detected in India. There was absolutely nothing else which could have explained such a drastic fall in NIFTY other than the news on Coronavirus. As we have seen, after Coronavirus has become a global issue, the market performance in several countries is strongly linked with local news flow and underlying sentiment on Coronavirus related developments.

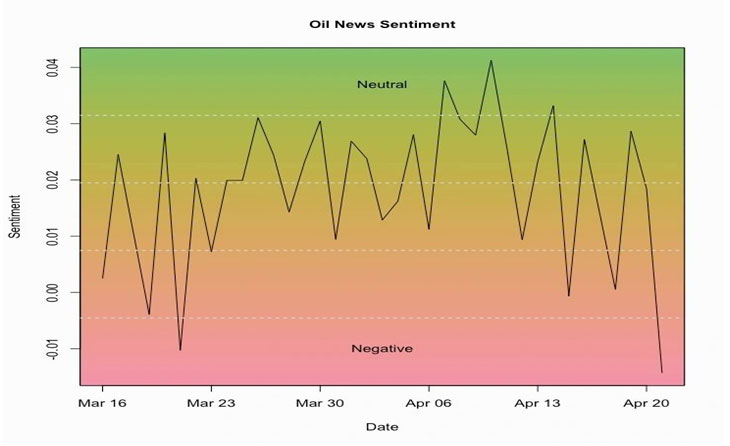

Now look at this in the context of the fall in crude oil. The Oil News sentiment plot shows how the oil sentiment has fallen to a level lower than what it was in mid-March when the Saudi-Russia talks broke down and oil price and stock market fell.

Fig. 1: EMAlpha Oil News Sentiment

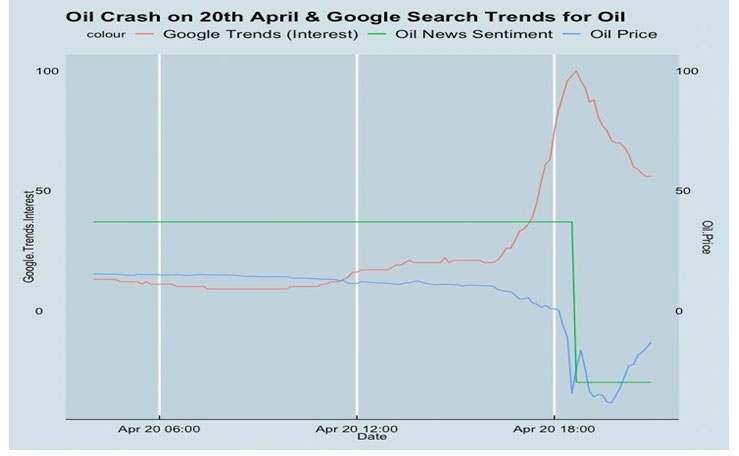

The second plot shows the oil price (WTI future) in blue line and Google Trends Search result for “oil” over the day of April 20th. What is interesting is that Google Trend starts moving sharply before the sharp fall in oil.

Fig. 2: Oil (WTI future) in blue and Google Trends Search result for “oil” on April 20th

As yet, we don’t have the hourly sentiment data on Oil for the entirety of April 20th. But it is possible that the sentiment might also have sharply fallen before the oil crash. To see if that may have been the case, what we have shown in the plot is a third line which just shows the change in daily Oil sentiment from positive to negative (see the green line which goes from positive to negative). This is basically the last two data points of the first Oil Sentiment plot. The point is that due to the oil crash, the EMAlpha Daily Oil Sentiment went from positive to negative. For people only interested in inference, this is it and the next paragraph is not needed. But you must read on, if you are interested in how we have rescaled these three things, a) Sentiment, b) Google Trends search result, and, c) Price.

For the ease of showing everything in the same plot, we have multiplied the Oil Sentiment by a factor of 2000. So in the first plot the Oil sentiment for 20th morning and 21st morning (US time) are 0.0185 and –0.0143. In the second plot, we have shown these two values as the green line as multiplied by a factor of 2000. So the Oil News Sentiment goes from 0.0185*2000 to -0.0143*2000 as one goes from left to right. So, we have rescaled the sentiment to show everything in the same plot. The bottom-line is that we see a clear collapse in sentiment around the time price crashed and this was also linked with the sudden spike in searches for ‘Oil’. It is too early to conclusively prove whether the spike in search was an indicator of crash or the price crash led to sudden surge. But this is an interesting occurrence and for sure, it can’t be just a coincidence. In the near future, we hope to look at some high frequency news sentiment data to tease out these relationships.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.