Oil Sentiment has Already Hit Rock Bottom, But Will it Plunge even More?

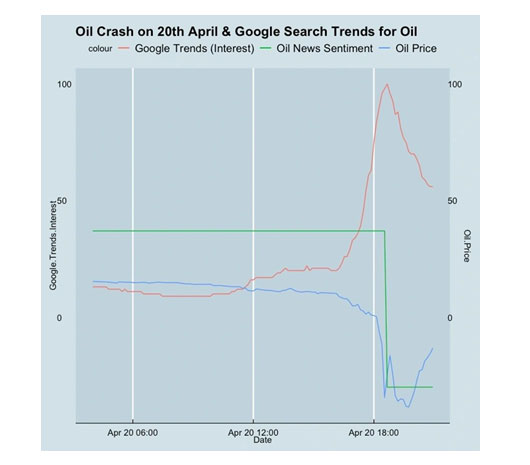

Monday, 20th April was a historic day for Crude Oil Industry. But, not in a good way. The May US oil futures contract went into negative territory for the first time in history. The reserves are full and there is simply no place to store more oil and almost everyone is avoiding taking delivery of physical crude. Eventually, the contract crashed to an unimaginable -$37.63 a barrel, a decline of $55.90 a barrel! Prices also set a historic low of -$40.32 during the day (Fig. 1).

But it is not just a storage problem. While that may be an issue for the May contract, the bigger and more fundamental and structural concern is on demand. The global oil demand is down more than 30% due to the corona virus pandemic and the lock down in several countries and the June contract also ended down 16% to $20.43 a barrel. While this is in positive territory, a 16% decline is huge and the prices are low in absolute terms as well.

There is limited visibility as of now on when the demand will recover and this is putting a huge pressure on producers who are still bickering on production cuts. For many of them, oil export is a significant part of their revenues and they can’t seem to easily agree on who needs to cut how much of production to bring back some stability in prices. The drop in demand and low crude prices actually made some of them more desperate in their attempts to increase production and gain market share.

Fig.1: April 20th: Intraday Oil Price (time in GMT), Google Trends Interest, and EMAlpha Oil Sentiment (Source: EMAlpha, Google).

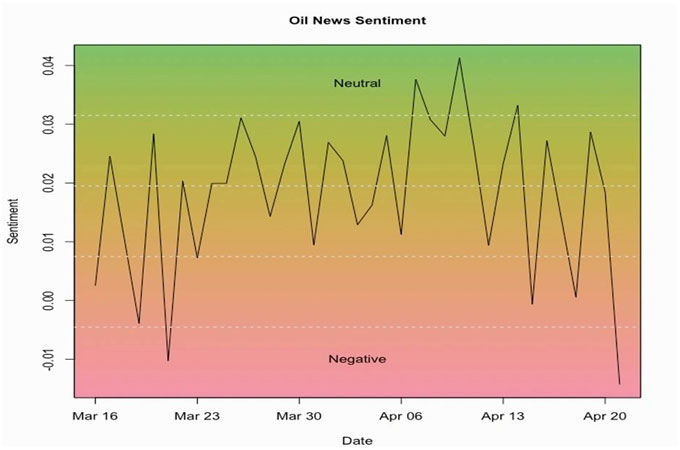

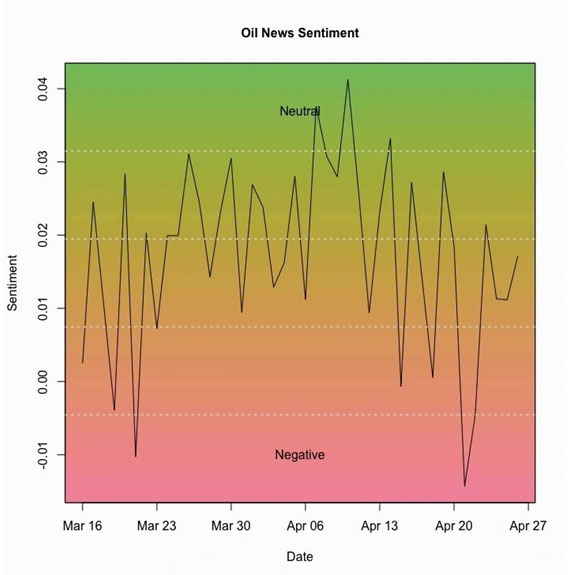

This is also visible on EMAlpha Oil News Sentiment tracker as well. While the market movements like Monday’s are related to specific reasons like storage issue, the general sentiment on the demand side is extremely negative. As you can notice from our oil sentiment chart (Fig. 2), this is at the lowest levels after the impact on sentiment seen during the dip in March because of supply glut expected as a result of the price war between Russia and Saudi Arabia.

Fig. 2: EMAlpha Oil Sentiment hit all time low on April 20th.

Should we equate this with what could happen in global economy and other financial markets worldwide? No. Not really, at least immediately. One is that the May Futures in negative territory was more related to specific challenge associated with how to take delivery when there is no storage. Second, the impact on oil demand is already factored in to some extent and markets are not pricing in a big recovery in short term. Third, for some countries which are net importers like India and China, it will be a mixed impact with some positives along with negatives.

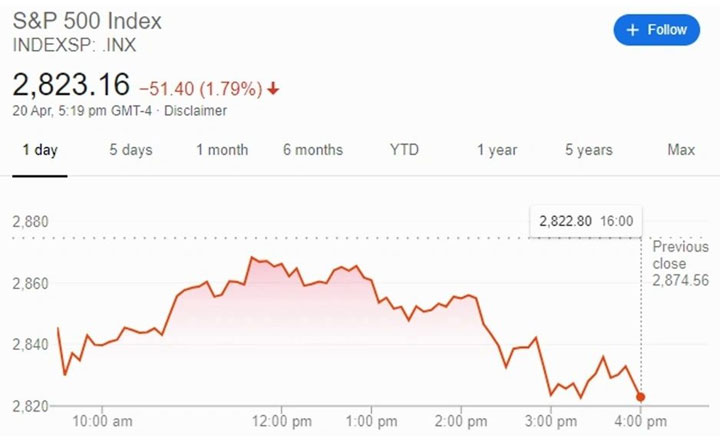

There are two more charts which will support what we are saying. The first is Saudi Aramco’s stock price. The biggest and most profitable Oil Company in the world is under stress but either because of very low liquidity or less market focus on what happens in next few months, the stock price is largely doing fine. The other is S&P 500. It fell following then oil crash, but considering whatever has been happening on volatility in the markets over the last few months, the fall was by no means exceptional. This implies that markets are less worried and the concern is limited to oil only. But, it is surely interesting and we need to keep an eye on this.

Fig. 3a: Saudi Arabian Oil Co., April 20th.

Fig. 3b: S&P 500, April 20th.

As the May WTI Futures traded in Negative, the historic fall in crude oil prices prompted us to investigate this issue further. In particular, how oil news sentiment fared around that time.

Coronavirus News Sentiment

After the discussion on Oil and Sentiment Analysis on News flow, the summary of our five Coronavirus related sentiment measures is as follows;

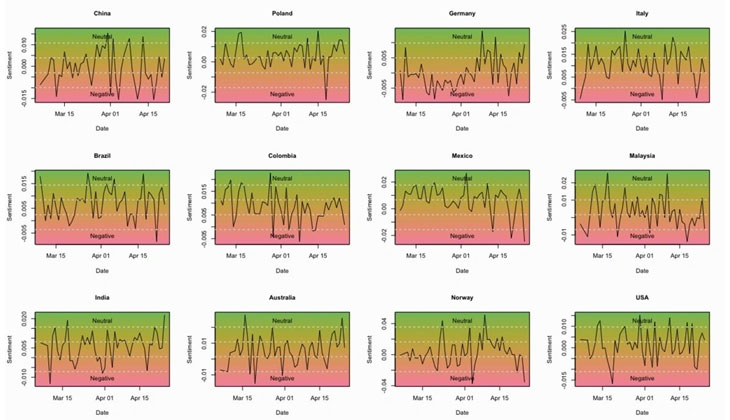

Coronavirus Country-by-Country Sentiment Time Series

This is an important chart because local market reaction depends much more on how the Coronavirus News Sentiment is evolving locally. This has improved over the last week as the number of new cases and deaths has plateaued. A number of countries such as the US, Italy, Australia, India and China are showing sentiment improvement.

Fig. 4: Country by country sentiment score for select countries focusing on Coronavirus related news.

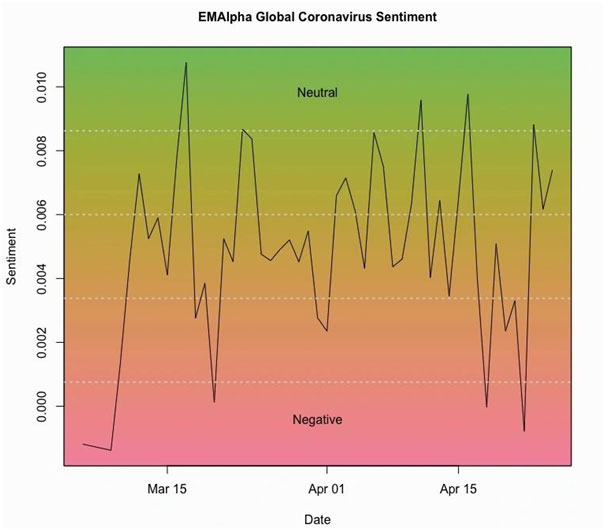

Coronavirus Aggregate Global Sentiment Time Series

The aggregate Global Sentiment on Coronavirus sentiment has improved quite a bit. This has coincided with a number of countries starting to discuss a gradual reopening of their economies as the number of new Coronavirus patients drops.

Fig. 5: Aggregate Coronavirus Global Sentiment.

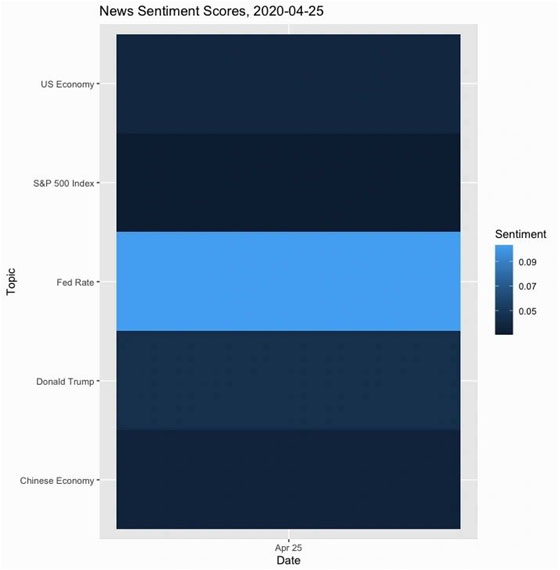

News Sentiment for Topical Keywords

Because markets are influenced by the sentiment for news flow around some very important and immensely popular keywords, the results are important for market direction. The news sentiment is in deep negative territory for the US President, Donald Trump. His recent Coronavirus briefings fiasco most certainly has been a big contributor to this negative sentiment. The US economy sentiment has also been quite negative notwithstanding the fact that the US stock market did not really take much of a beating as oil fell.

Fig. 6: News Sentiment for select topical search terms

Crude Oil News Sentiment

As we discussed above, the EMAlpha oil news sentiment hit all time low on April 20th. It has, however, recovered quite a bit since last Monday as the oil price quickly rebounded back to its Monday morning level. A high level of oil price volatility should be expected in the coming weeks.

Fig. 7: Daily oil related News Sentiment

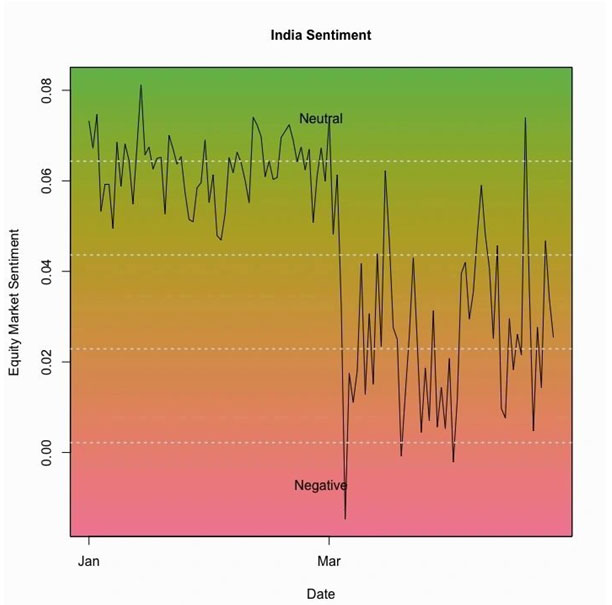

Aggregate India Equity Market Sentiment

Even though there were a few positive movements in the Indian equity market, Facebook decided to invest $5.7 billion in Reliance Jio last week, the overall sentiment is still low. The EMAlpha sentiment score for Indian market continues to struggle.

Fig. 8: India Equity Market Sentiment Signal.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.