Lessons from Top Glove – Ignoring ESG could hurt…Really Bad!

Synopsis: Over the last twelve months, EMAlpha AI-ML has continuously analysed some of the emerging markets stocks showing volatile stock price movement due to ESG (Environmental, Social and Governance) issues. Top Glove, a Malaysian rubber glove manufacturer, has been a constant feature with a lot of negative news flow on ESG issues. In April, the stock delivered 25% plus returns, following which it struggled in May, with an 8% decline in stock price. The decline in June has been 9% so far. Last week, Top Glove was removed from three indices based on ESG factors, following the FTSE4Good Index Semi Annual Review. The US ban continues and there is no clarity on its Hong Kong IPO. All the while, the company has maintained good operating and financial performance. We think that the negative perception on ESG news flow will take time to dissolve and will continue to overshadow the positive business fundamentals, thus making it unlikely in the near term for the stock price to reach the peak seen in the last twelve months.

Top Glove: From investor’s favourite to a pariah, in just twelve months

EMAlpha AI-ML has had a special focus on some of the emerging markets stocks in which the stock price movement has been volatile over the last twelve months because of ESG related issues, and Top Glove has consistently featured in that list. In our two insights on Top Glove in February and May of this year, we had discussed the impact of ESG news flow on stock price movement of Top Glove, a Malaysian rubber glove manufacturer (Top Glove- News flow and Stock Price Performance Dichotomy, published 4th May 2021 and ESG Matters, Act Now or Repent Later: An Analysis of Top Glove, published 10th February 2021).

Top Glove is one of the global leaders in the rubber glove industry. As such naturally, the Covid-19 pandemic brought good times for the company. As on early February 2021, the stock’s 52-week high to 52-week low was 5.7x (stock’s 52-week high price was 9.77 MYR and its 52-week low was 1.71 MYR at Bursa Malaysia). But the stock price is currently more than 50% down from its peak. EMAlpha Machines have been collecting news flow on Top Glove very actively since January 2020 and the EMAlpha Research team has been analysing the data in more detail.

In 4Q 2020, there were reports that cramped dormitories for labourers led to over thousands of Covid-19 cases and there were also attempts to cover up the same. Naturally, there was backlash from Institutional Shareholders. And secondly, BlackRock, the world’s largest asset manager and a strong advocate of sustainable business practices, voted against the re-election of six independent directors at the Annual General Meeting on 6th January 2021. The ESG issues have been impacting the stock price performance ever since.

May and June have been bad for the Top Glove Stock

For Top Glove, April was one of the best months with the stock delivering more than 25% returns. However, the stock has suffered in May and June, performing very badly over this period.

- May 2021 – 8% decline

- June 2021 (As on 20th June 2021) – 9% decline

Fig. 1: Top Glove Stock Price over last six months

Source: Google

The decline in May and June came after a very good performance in April during which the stock delivered 25% plus returns. Another interesting feature is that the stock price movement was very consistent in April.

Fig. 2: Top Glove Stock Price in April

Source: Google

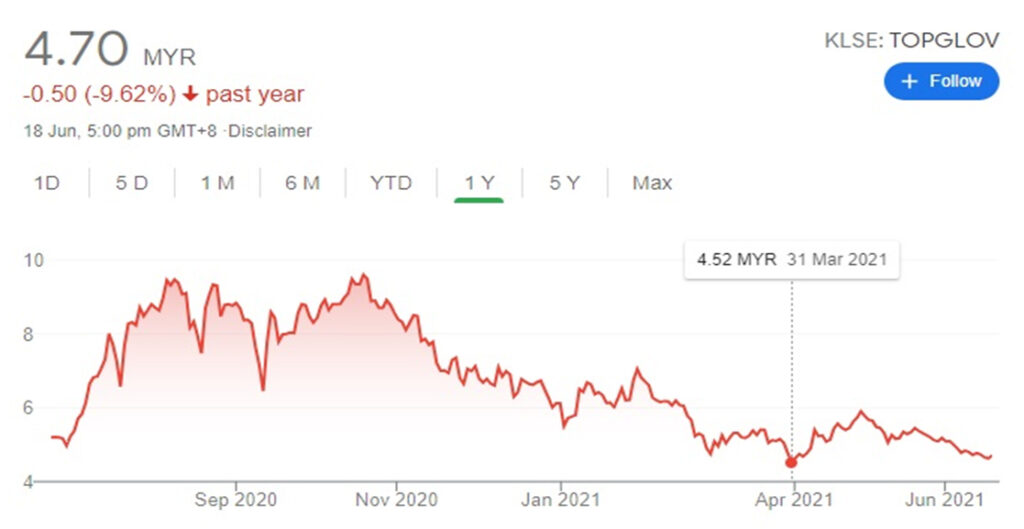

Because of the persistent troubles with global exports and a poor ESG track record, Top Gove has been in the red on the basis of its twelve months performance.

Fig. 3: Top Glove Stock Price over last twelve months

Source: Google

Top Gove’s stock price performance in 2020 and 2021 has been characteristically different from its stock price movement up until 2019.

Fig. 4: Top Glove Stock Price over last five years

Source: Google

What does the recent news flow imply?

One of the biggest and most important negative developments was that Top Glove Corporation was removed from three indices based on ESG factors, following the FTSE4Good Index Semi Annual Review. Top Glove has been removed from the FTSE4Good Bursa Malaysia Index, Asean 5 and Emerging Markets Index. In a media statement, Bursa Malaysia announced deletion of Top Glove from the FTSE4Good Bursa Malaysia Index.

The recent ESG related news flow has been negative for the Top Glove stock. But what deteriorated the situation further was the widespread media coverage that comprised of scathing articles in several leading global media companies, including print and electronic media.

- 18th June 2021 – Nikkei ASIA published an article, Top Glove faces ESG reckoning on forced-labor allegations: Shareholders call for action following US import ban and COVID-19 outbreak. The article highlighted that for the six months through February, net profit was up 22x on year to 5.22 bn ringgit ($ 1.27 bn) while sales went up 315% to 10.12 bn ringgit. Now, the company has to work on satisfying stakeholders in a post-pandemic world.

- 17th June 2021 – Financial Times published an article, US import ban bursts Top Glove bubble: Fortunes of Malaysian PPE maker slide after forced labour allegations and vaccine rollout.

- 15th June 2021 – EdgeMarkets published, Fund managers shy away from glove stocks even as analysts keep ‘buy’ call, highlighting that while some analysts are maintaining their “buy” call on glove stocks, fund managers have turned cautious on the sector.

- 10th June 2021 – EdgeMarkets published, Analysts cut earnings forecasts for Top Glove after imputing lower glove ASPs, highlighting that the analysts have now factored in lower average selling prices (ASPs) moving forward. The cut was steep for the year ending August 2021 but it was even more drastic for the next year.

- 9th June 2021 – Reuters published, Malaysia’s Top Glove waits for U.S. Customs to verify remedial labour action, highlighting that Top Glove which has a U.S. import ban over concerns about forced labour, is waiting for US customs authorities to verify action it has taken on workers’ recruitment fees. However, there is no clarity as to when U.S. customs would lift the ban.

- 1st June 2021 – CNBC published, Top Glove’s $1 billion Hong Kong listing delayed amid U.S. import ban problems, sources say: highlighting that Top Glove Corporation’s plan to list in Hong Kong to raise up to $1 billion has been delayed, according to Reuters’ sources. Top Glove, which is already listed in Kuala Lumpur and Singapore, had cut down the size of share sale in late April announcing that it would sell 793.5 million shares in the listing, half of what the company had proposed in its application to the Hong Kong Stock Exchange in February.

- 29th May 2021 – The Straits Times published, US probes two Malaysian glove makers over forced labour allegations: Report, highlighting that the United States is investigating Malaysian glove makers Hartalega Holdings and a unit of Supermax Corp over allegations of forced labour.

- 28th May 2021 – The EdgeMarkets published, Canada probes forced labour claims in Malaysian palm oil, glove-making industries, highlighting that Employment and Social Development Canada told Reuters in an email that its Labour Programme was “actively researching a number of forced labour allegations in different countries and sectors, including palm oil and glove manufacturing in Malaysia”.

Things would have been worse for Top Glove had it not been for the business performance which has been robust. The capacity growth continues and the financial performance has been very good. Also, there are some reports which mention that the impact on selling prices for its products will not be as severe as feared.

- 11th June 2021 – The Straits Times reported that Top Glove Q3 profit soared almost six times to $655m as it reported a net profit of RM2.04 billion (S$655 million) for the third quarter ended May 31, almost six times the amount of RM 347.9 million in the previous year. Sales revenue for the third quarter rose to RM4.16 billion, nearly 2.5 times the RM 1.69 billion for the preceding year.

- 4th June 2021 – The EdgeMarkets published, Top Glove’s annual glove production capacity hits 100 billion pieces, highlighting that Top Glove which is already the world’s largest rubber glove manufacturer by production capacity, increased its annual glove production capacity further to 100 billion pieces as of June 2021. Global demand remains resilient as glove usage continues to rise, driven by the pandemic, it added.

What does the future reckon for Top Glove?

ESG based investment theme has become very popular and the number of investment managers following ESG for their decisions on portfolio construction and rebalancing is increasing. We expect Top Glove to remain under pressure in the near term on ESG related challenges. On business fundamentals for the sector, the covid vaccination has progressed at a very good rate in many countries and the situation has also improved. Even in some of the most affected countries like the USA, the pandemic is not being seen as a big threat anymore. We think that the news flow rightly suggests that there is concern on selling prices for the sector.

In the case of Top Glove, the past fifteen months have been a tumultuous period. In the third quarter of 2020, investor sentiment improved significantly as the company started to deliver excellent operating and financial performance. It didn’t come as a surprise that August and September were the months when sentiment was at its peak. However, the negative news flow such as poor living conditions for workers which appeared in October and November hurt the stock badly. There was also backlash from Institutional Shareholders. The stock has not been able to recoup its losses so far.

Following a significant correction, there was some stability and consolidation in the stock price in the first quarter of 2021, but the overall trend has remained weak. We think that the negative perception, especially on the ESG front will take time to dissolve and hence it is unlikely, in the near term, that the stock price will reach the peak seen in the last twelve months. We don’t expect this to happen in 2021 at least. We also think that ESG issues will continue to overshadow the news on business fundamentals for Top Glove and hence, ESG news flow will remain the primary driver of stock price performance.

How EMAlpha’s analysis of Unstructured data can help Investors

Top Glove has been one of the most interesting names from stock price movement perspective over 2020 and 2021 and it has been repeatedly picked up by EMAlpha AI-ML analysis. There are important takeaways in terms of how EMAlpha’s AI-ML analysis can help investors:

- Can the local news flow collection pick up issues like the condition of workers, earlier than the English media? Considering how important the Sustainability and ESG issues have become, the local language along with English news analysis can be tracked for the companies experiencing ESG issues. Considering the sensitivities involved, especially when institutional investors have invested in the stock, these issues could escalate quickly, thus impacting the stock price performance.

- Can regular analysis of social media (such as Reddit feed) be used as an input before taking an investment decision? EMAlpha’s analysis of unstructured data becomes a key tool for investors. The unstructured data analysis in other geographies can also be used to assess the potential impact on some of the larger companies. Case in point being Top Glove from Malaysia which is very similar to Supermax from Malaysia and Dipped Products of Sri Lanka, in terms of the opportunity that was created because of the Covid-19 pandemic.

- Predicting the behaviour of large institutional investors on the basis of trading information can help forecast the stock price impact. This is one of the key features of EMAlpha product as it combines technology with domain expertise. The news flow analysis provided by EMAlpha is useful in picking up the signals when the views change for institutional investors.

References

- Top Glove ousted from three ESG-related indexes in latest review https://www.straitstimes.com/business/companies-markets/top-glove-ousted-from-three-esg-related-indices-in-latest-review (Accessed on 20th June 2021)

- Top Glove removed from three ESG-related indices in latest review https://www.straitstimes.com/business/companies-markets/top-glove-removed-from-three-esg-related-indices-in-latest-review (Accessed on 20th June 2021)

- Top Glove ousted from three ESG-related indices in latest review https://www.cnbc.com/2021/06/01/malaysias-top-glove-to-delay-1-billion-hong-kong-listing-reuters-sources.html (Accessed on 20th June 2021)

- US import ban bursts Top Glove bubble: The Fortunes of Malaysian PPE maker slide. https://www.ft.com/content/1f0634c0-8916-442b-a06a-ecde5507d2ea (Accessed on 20th June 2021)

- Top Glove faces ESG reckoning on forced-labor allegations: Shareholders call for action following US import ban and COVID-19 outbreak https://asia.nikkei.com/Business/Companies/Top-Glove-faces-ESG-reckoning-on-forced-labor-allegations (Accessed on 20th June 2021)

- Analysts cut earnings forecasts for Top Glove after imputing lower glove ASPs https://www.theedgemarkets.com/article/analysts-cut-earnings-forecasts-top-glove-after-imputing-lower-glove-asps (Accessed on 20th June 2021)

- Fund managers shy away from glove stocks even as analysts keep ‘buy’ call https://www.theedgemarkets.com/article/fund-managers-turn-cautious-about-glove-counters-even-analysts-maintain-buy-call (Accessed on 20th June 2021)

- Malaysia’s Top Glove waits for U.S. Customs to verify remedial labour action https://www.reuters.com/world/asia-pacific/malaysias-top-glove-posts-near-6-fold-jump-q3-profit-pandemic-demand-2021-06-09/ (Accessed on 20th June 2021)

- Malaysia’s Top Glove waiting for U.S. Customs verification of forced labour remedial efforts https://www.reuters.com/article/malaysia-top-glove-idUSK7N2JI017 (Accessed on 20th June 2021)

- Top Glove’s $1 billion Hong Kong listing delayed amid U.S. import ban problems, sources say https://www.cnbc.com/2021/06/01/malaysias-top-glove-to-delay-1-billion-hong-kong-listing-reuters-sources.html (Accessed on 20th June 2021)

- US probes two Malaysian glove makers over forced labour allegations: Report https://www.straitstimes.com/asia/se-asia/us-probes-two-malaysian-glove-makers-over-forced-labour-allegations-report (Accessed on 20th June 2021)

- Canada probes forced labour claims in Malaysian palm oil, glove-making industries https://www.theedgemarkets.com/article/canada-probes-forced-labour-claims-malaysian-palm-oil-glovemaking-industries%C2%A0 (Accessed on 20th June 2021)

- Top Glove’s annual glove production capacity hits 100 billion pieces https://www.theedgemarkets.com/article/top-gloves-annual-glove-production-capacity-hits-100-billion-pieces (Accessed on 20th June 2021)

- Top Glove Q3 profit soars almost six times to $655m https://www.straitstimes.com/business/companies-markets/top-glove-q3-profit-soars-almost-six-times-to-655m (Accessed on 20th June 2021)

- Sri Lankan Stock Market is on Fire: An Analysis on How the News Flow Is Driving the Blaze? https://www.emalpha.com/sri-lankan-stock-market-is-on-fire-an-analysis-on-how-the-news-flow-is-driving-the-blaze/ (Accessed on 20th June 2021)

- Sri Lanka: Diverging News Drives Diverging Stock Returns https://www.emalpha.com/sri-lanka-diverging-news-drives-diverging-stock-returns/ (Accessed on 20th June 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.