JBS SA: Forever mired in Controversies!

Synopsis: JBS SA, the world’s largest meat producer, is the latest victim of cyber-attack on a major company. Following the attack on 30th of May, operations were suspended across several of its locations in the United States. But thankfully the company resumed operations soon enough to not have a major dent in its books. Few days later, reports surfaced of the company having paid a ransom of $11 million to the perpetrators. While former employees blamed the attack on the company’s unwillingness to beef up its cyber-security, the company vehemently denied. JBS has, over the past years, repeatedly landed itself in controversy. Be it the deforestation of Amazon rainforests, insider trading by its owners or bribing Brazil’s politicians, JBS SA has been in the news for all the wrong reasons. In spite of all these, the company is still making profits and it still is the largest producer of meat in the world. But for how long?

JBS SA: The Company

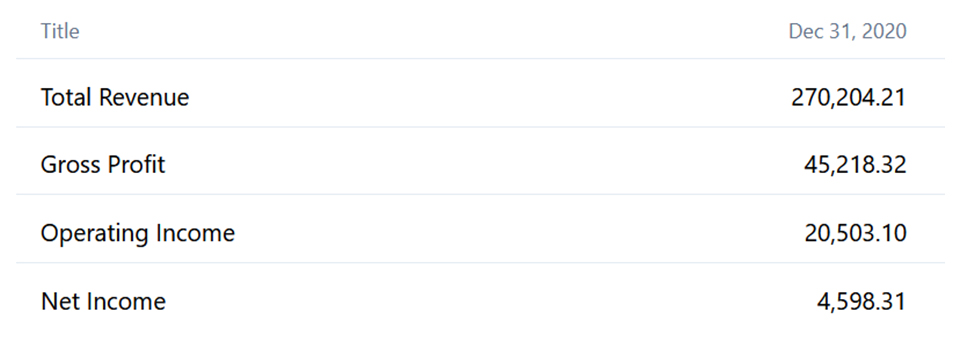

JBS, like other meatpacking companies in Brazil, is a family-owned business. It was started in 1953 in the city of Anapolis by Jose Batista Sobrinho. He began selling meat to the builders and contractors of that area who were building the new capital of Brasilia. Gradually, over the years, the company expanded into US and Australia through acquisitions and setting up of processing plants. In some way or other, the company currently operates in more than 150 countries around the world. The company has a market cap of around US $ 14.3 billion (as of 16th June 2021, market close). For the financial year 2020, JBS SA reported revenues of 270 billion Brazilian real (almost US $ 55 billion) and Net Income of 4.6 billion Brazilian real (almost US $ 920 million).

Figure 1: Financial statement of 2020 (all numbers are in million Brazilian Real)

Source: investing.com

The recent Cyber-attack

On May 30 2021, JBS released a statement saying that its Australian and North American units were hit by an organised cyber-attack on its information systems. The FBI blamed the attack on REvil, a Russian linked cyber gang. Although the attack shut down several of the company’s North American plants, the company managed to resume operations within days. Preliminary reports showed that the data of customers, suppliers and employees hadn’t been compromised.

Interestingly enough, a few days earlier, Colonial Pipeline, the largest pipeline system for refined oil products in the US was also the target of a cyber-attack. Although the Department of Justice recovered much of the ransom that the company had paid, hackers still managed to hold on to some.

Were there unaddressed loopholes in JBS’s cybersecurity

Once the news of the cyber-attack was made public, many former employees of JBS USA claimed that the company hadn’t taken cyber threats seriously and the company hadn’t invested adequately to strengthen its cyber security. They claimed that the company was mostly interested in profit making and didn’t consider cybersecurity to be a priority. JBS was quick to dismiss such claims, citing that JBS recovered quickly from the attack and lost less than one day’s worth of production. The truth lies somewhere in the middle as many Cybersecurity experts also say that the food companies, have traditionally not paid much attention to cybersecurity while diverting the money towards other areas, like acquiring new technology for increased production and better profitability.

Although that is well and good, what makes JBS particularly vulnerable is that in an analysis by security rating firm SecurityScorecard Inc., JBS ranked in the bottom 10th out of the 57251 companies in the food industry that were rated by the firm. The analysis was done days after the cyber-attack and used a series of publicly viewable cybersecurity metrics. This does give credence to claims by the former employees. In the days following the attack, as operations resumed, it was learnt that JBS had paid $11 million ransom in bitcoins to the Russian linked group REvil, the supposed perpetrators.

Stock Price Reaction

As can be seen, following the news of the cyber-attack on 1st of June, JBS stock price took a downward plunge. But, the stock price reaction was not very serious as such.

Figure 2: Stock price movement of JBS over the past month

Source: Google

A Long History of Controversies

It indeed is true that JBS is the world’s largest meat processing company but it also has a sort of dubious distinction attached to it. That it is controversy’s favourite child is public knowledge by now. Here’s a rundown of the various high profile controversies that the company and its owners have been embroiled in over the years:

The 2017 scandal involving President Temer

In 2017, Brazilian authorities started looking into corruption charges against Joesley Batista and Wesley Batista, the then respective chairman and CEO of JBS SA. The main allegations were that, over the years the Batista brothers had bribed Brazil’s politicians for business advantage. The brothers entered into a plea bargain deal with the authorities that gave them immunity from prosecution in exchange for information about how they bribed the politicians. Both admitted having bribed more than 1900 politicians.

Joesley Batista had secretly recorded President Temer admitting paying hush money to House speaker Eduardo Cunha, a corrupt politician who had been jailed. The day following the revelations of President Temer’s recordings, shares plunged more than 10%. Such was the impact that trading was briefly suspended. While the President denied all the charges, he had to face impeachment proceedings. This is a small indicator of the wide spread corruption existing in Brazil and involving businessmen and politicians.

2017 Insider Trading Charges

Following the plea bargain deal and the revelations of the secret recordings of President Temer, the Brazilian markets collapsed. It later came to light that the billionaire Batista brothers, in the weeks before the revelations, had sold a large number of the company’s shares. They were completely aware that once the recordings were made public, the markets would tumble. In normal circumstances, such kind of financial gains would amount to criminal charges. But because of the plea deal that the brothers had bargained for themselves, the authorities couldn’t arrest them.

However prosecutors managed to get an arrest warrant against the brothers by arguing that the Batista brother’s immunity deal made no mention of insider trading and that the Brazilian Securities and Exchange Commission, the regulator of the capital markets, was conducting an investigation against the brothers on charges of insider trading. The brothers had finally been outsmarted and were arrested.

Brazilian Development Bank (BNDES) charges

In 2009, the Brazilian Development Bank (BNDES) injected $2.8 billion into JBS which helped the company acquire the American chicken corporation, Pilgrim. In March of 2019, during their corruption investigations, Brazilian prosecutors filed charges against 12 people, including Joesley Batista. The authorities contended that JBS had bribed its way to cheap financing and investments from BNDES. BNDES had given large sums of money to companies like JBS that were looking to expand internationally. Charges against Batista didn’t bear any fruit because of his plea bargain deal.

The controversy related with Amazon rainforest

JBS has been dubbed as “The Amazon Destroyer” by environmentalists because of its continued usage of cattle, raised on deforested land. Following Bolsonaro’s ascend to office, deforestation in the Amazon has touched significant highs. Deforestation of the Amazon is rampant near slaughterhouses. In 2009, JBS signed the Cattle Moratorium with Greenpeace and pledged not to buy cattle raised on deforested land. Ever since, the company has mostly obtained its beef from ranchers involved in illegal deforestation and cattle laundering.

When the rules change, the cheaters change too. Laundering involves raising cattle on illegally deforested lands and then moving them out just in time to integrate with the supply chain, thus evading crime. Between 2013 and 2016, JBS sourced over 49,000 illegal cattle; half of them directly from embargoed pastures and the rest by three-way “laundering” transactions to disguise the source, according to the website onegreenplanet.org.

Meat Inspection Scandal of 2017

In March 2017, the federal police accused JBS and other big meat producers of bribing health inspectors to certify meat that was either rotten or tainted with salmonella. Following the raids conducted by the federal police on the meat producers, several countries including US, China and European Union banned meat imported from Brazil. This temporary ban caused significant loss to the company as was addressed in their March earnings call.

The $5.5 million settlement over firing of Muslim workers

As recently as May of 2021, JBS USA LLC reached a settlement to pay $5.5 million to settle a lawsuit filed by US Equal Employment Opportunity Commission (EEOC). The lawsuit accused the company of discrimination against Somali Muslim workers who were fired by the company because they sought longer prayer break during the month of Ramadan. Apart from the pay-out, the company also agreed to change its anti-discriminatory policies by adopting a ‘clear and simple definition of religious accommodation.

The above highlighted issues are just some instances of JBS finding itself on the wrong side of the law. There are many other instances where the company has run into trouble. While listing all of its irregularities would be akin to writing a book, the above-mentioned issues are enough to make an educated deduction. Fair to say, it’s high time for JBS to address and resolve its recurring issues.

Reaction to JBS’s Glaring Sustainability Issues

There’s no second thought on the fact that JBS has some glaring issues when it comes to ESG. ESG metrics are increasingly being used today by investors to carry out investment decisions. As such, companies and corporations around the world are adhering to ESG norms more swiftly than ever.

Given that JBS is the largest meat processing company in the world and the second largest producer of beef in the United States, any slip up will undoubtedly attract more media attention than desired. In that aspect, JBS has completely failed in presenting itself as a sustainable-friendly company. The above mentioned controversies clearly highlight this fact. But it still continues to be the world’s largest meat packing company and it still continues to rake in profits. The question here is: How long will the company sustain if it keeps continuing with its dirty practices?

It is an encouraging sign that funds and institutions around the globe are becoming cognizant of the issues lurking in JBS. In July 2020, Nordea Asset Management, the investment arm of Northern Europe’s largest financial services group, excluded JBS shares from its funds. The reason cited was the environmental track record of JBS and the company’s response to the covid-19 pandemic.

In the same month, Amnesty International while investigating illegalities in the Amazon found that illegally raised cattle in protected areas had entered the JBS supply chain. It added that the entire process of meat production in Brazil, from raising cattle to packaging beef, was responsible for the destruction of the Amazon forests and violation of human rights.

The Role of EMAlpha in helping Investors

For the stock price movement in JBS, we think ESG issues will remain relevant in the short to medium term. The investors need to be careful and watch out for major developments in the areas especially related with corporate governance. JBS, as a company, has too many skeletons in the closet for an investor’s liking. Its total discard of ESG norms could be the final nail in the coffin.

Although the issues that have been highlighted here shows the problems at JBS, it is not limited to one company alone. And these issues are not limited to companies as well. They run deep through the political system of Brazil, at times involving the President himself. One can argue that in spite of performing badly on ESG metrics, JBS still is the largest producer of meat in the world.

While that is true and valid, the bigger question is: How long can JBS be the numero uno if it continues with its practice of disregarding ESG norms? It is here that EMAlpha’s role as a pioneer in AI-ML, NLP technology comes into play for investors. The ESG issues have been a big driver of stock prices and especially in EMs, they matter even more, and the following is how EMAlpha can help investors:

- The news spread has become much faster with social media and internet. Some of the reports may be difficult to verify and their authenticity may be under a question mark, but they still influence the stock price movement. EMAlpha tracks this news flow and helps deciphering their impact on stock price movement.

- The local news flow collection picks up several important issues and the local language along with English news analysis can be tracked for important developments. The potential fallout of such events is usually better predicted using local news analysis. For example, the leaks in cybersecurity are the issues typically which appear in local news first.

- In many emerging markets, the trading patterns and ownership are highly opaque, and this is a big issue, and this often makes the stock prices volatile. EMAlpha product combines technology with domain expertise in picking up signals on the institutional investors in a stock. This is often very useful in predicting stock price movement.

References

- Cyber attack hits JBS meat works in North America and Australia https://finance.yahoo.com/news/cyber-attack-hits-jbs-meat-234602906.html (Accessed on 15th June 2021)

- US says ransomware attack on meatpacker JBS likely from Russia; cattle slaughter resuming https://www.straitstimes.com/world/united-states/us-says-ransomware-attack-on-meatpacker-jbs-likely-from-russia (Accessed on 15th June 2021)

- Largest meat producer getting back online after cyberattack https://apnews.com/article/jbs-sa-lifestyle-health-coronavirus-pandemic-technology-bf82114d3f54e5be2241bd5f9a0b2639 (Accessed on 15th June 2021)

- JBS rebuffed call to boost cyber spending, ex-employees say https://www.bloomberg.com/news/articles/2021-06-08/jbs-rebuffed-call-to-boost-cyber-spending-ex-employees-say (Accessed on 15th June 2021)

- JBS cyber attack raises question about preparedness https://www.farmprogress.com/business/jbs-cyber-attack-raises-questions-about-preparedness (Accessed on 15th June 2021)

- JBS pays ransom https://www.dtnpf.com/agriculture/web/ag/livestock/article/2021/06/14/jbs-sends-11-million-bitcoin-cyber (Accessed on 15th June 2021)

- Brazil’s President Michel Temer denies hush money claim https://www.bbc.com/news/world-latin-america-39957870 (Accessed on 16th June 2021)

- Brazil tycoon Wesley Batista held for ‘insider trading’ https://www.bbc.com/news/world-latin-america-41255817 (Accessed on 16th June 2021)

- Brazil’s stock market plunges after corruption claims https://www.bbc.com/news/business-39966855 (Accessed on 16th June 2021)

- The swashbuckling meat tycoons who nearly brought down a government https://www.theguardian.com/environment/2019/jul/02/swashbuckling-meat-tycoons-nearly-brought-down-a-government-brazil (Accessed on 16th June 2021)

- How the largest meat company is destroying the Amazon Rainforest https://www.onegreenplanet.org/environment/how-the-largest-meat-company-jbs-is-destroying-the-amazon-rainforest/ (Accessed on 16th June 2021)

- Brazil’s spoiled meat scandal widens worldwide https://money.cnn.com/2017/03/22/news/economy/brazil-meat-scandal/ (Accessed on 16th June 2021)

- JBS, world’s largest meat company, mired in multiple corruption scandals in Brazil https://www.kunc.org/2017-08-03/jbs-worlds-largest-meat-company-mired-in-multiple-corruption-scandals-in-brazil (Accessed on 16th June 2021)

- EEOC, JBS ink $5.5 million settlement over firing of Muslim workers https://www.reuters.com/business/legal/eeoc-jbs-ink-55-mln-settlement-over-firing-muslim-workers-2021-05-24/ (Accessed on 16th June 2021)

- Norwegian manager excludes JBS from its investment portfolio https://g1.globo.com/economia/agronegocios/noticia/2020/07/28/gestora-norueguesa-de-investimentos-exclui-jbs-de-sua-carteira-de-investimentos.ghtml (Accessed on 16th June 2021)

- Amnesty International links JBS to illegalities in the Amazon https://g1.globo.com/economia/agronegocios/noticia/2020/07/15/anistia-internacional-liga-jbs-a-ilegalidades-na-amazonia.ghtml (Accessed on 16th June 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.