Impact of Coronavirus: Is ‘Timing the Markets’ Possible Using Sentiment Analysis?

In some of our previous insights, we had highlighted that how sentiment in news flow on US President, Donald Trump had quickly and significantly worsened. This is a sudden change because on 6th April, we wrote ‘Because markets are influenced by the sentiment for news flow around some very important and immensely popular key words, the results are important for market direction. The biggest positive jump is seen for US President, Donald Trump’.

But things have changed completely on news sentiment for Trump a week later. There was a sharp dip in sentiment in media coverage on Trump and the way he is handling the Corona crisis, both his ability and intent.This was peculiar for two reasons. The first is that in the past, US presidents have mostly benefitted from crisis and difficult situations have usually worked for them politically as well as from the media coverage point of view. It happened with FDR during Second World War, with JFK during Cuban Missile Crisis, with Bush Senior during First Gulf War (though he lost his re-election bid for different reasons i.e. poor record on economy which was brilliantly exploited by Bill Clinton) and with Bush Junior during 9/11 attacks.

The other is that the Corona crisis has helped majority Global leaders in getting a strong boost in their image. It has helped the President of France, Emmanuel Macron and also Japanese Prime Minister, Shinzo Abe. This is the situation elsewhere too. The crisis has not done anything to dent the image of Justin Trudeau in Canada, Narendra Modi in India or Boris Johnson in UK. Even Angela Merkel from Germany and Vladimir Putin from Russia also have not been doing too badly.

While it is true that we don’t know much about the impact on Xi Jinping, the President of China as it is too early to understand because of lack of credible data from the country. The only exception could be Jair Bolsonaro of Brazil because of his poor handling and more so because of his irresponsible media statements about the potential negative impact of Coronavirus as a health emergency. But overall, it is safe to say that Corona crisis may have been a health crisis or economic crisis, however it has not been a political crisis for most global leaders, at home for them so far.

Then why it is happening with Trump and why the Corona crisis is also a media crisis for him. While it is always easy to look at reasons with the benefit of hindsight, the inconsistent approach, underestimating the crisis and being in rush to lift the lockdown could have been the key factors in making Trump an easy media target and for this thought to resonate with common people. In short, the sentiment in news on Trump is negative because media has been highlighting that how Trump has failed to show true leadership and has been by and large evasive in his approach.

Why this is important for markets?

Two reasons,

a) How Trump is being in handling the Corona crisis is important for US markets over next few weeks,

b) though it is too early to talk about this and the core voter base of Trump may still remain unaffected, the negative news sentiment if it sustains may play a role in US presidential elections. The race will be close, there is no doubt and even a small swing could change the end result. Markets have been kind to Trump so far and if Biden gets elected, that may be a big negative for the US markets. Too early but an interesting scenario nonetheless.

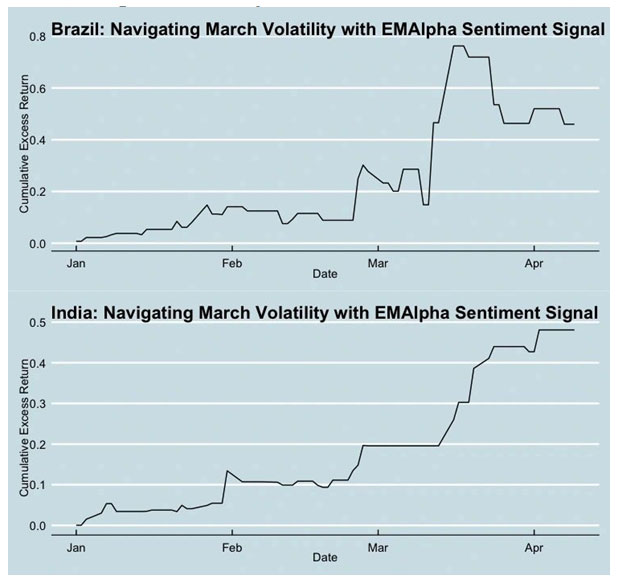

Fig.1: Cumulative YTD returns (over respective country equity benchmarks) for Brazil and India. Depending on the morning’s equity market sentiment signal, a long or short market position is assumed.

Coronavirus News Sentiment

We next do our weekly summary of our six Coronavirus related sentiment measures: 1) Coronavirus Country-by-Country Sentiment Time Series, 2) Coronavirus Aggregate Global Sentiment Time Series, 3) Daily Coronavirus Sentiment Heat Map for various Countries, 4) News Topic Sentiment for Key Words, 5) Crude Oil News Sentiment, and, 6) Aggregate India Equity Markets Sentiment.

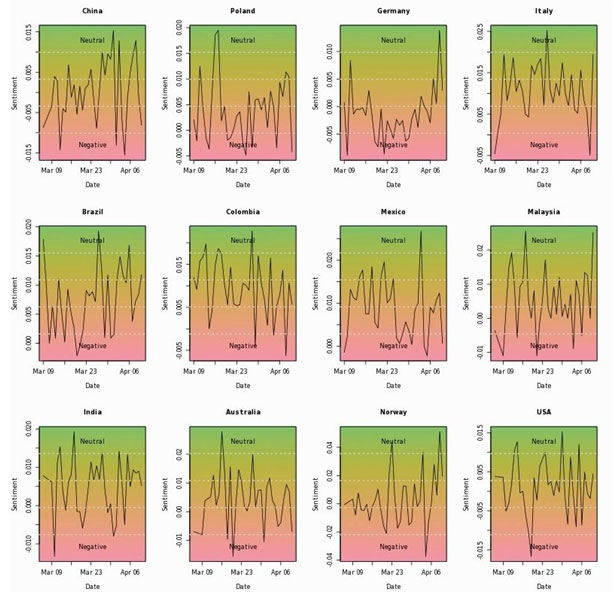

Coronavirus Country-by-Country Sentiment Time Series

This is an important chart because local market reaction depends much more on how the Coronavirus News Sentiment is evolving locally. This has improved considerably with only 8 out of 12 countries reflecting deterioration vs. 11 out of 12 countries that saw a decline last week. The good news: both the United States and Italy, the worst affected countries, show an improvement.

Fig. 2: Country by country sentiment score for select countries focusing on Coronavirus related news.

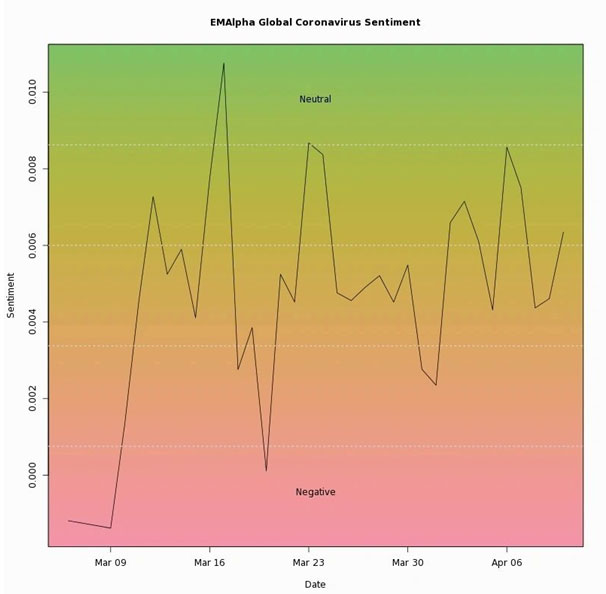

Coronavirus Aggregate Global Sentiment Time Series

The aggregate Global Sentiment on Coronavirus sentiment is also showing improvement. There is hope that things are stabilising. The global aggregate measure is also driven by improvements in certain key countries like the United States and Italy. Still, we are some distance away from the neutral sentiment territory.

Fig. 3: Aggregate Coronavirus Global Sentiment.

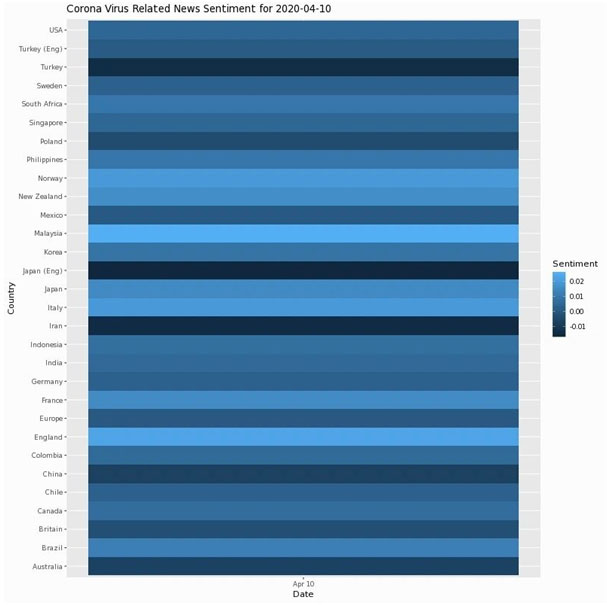

Daily Coronavirus Sentiment Heat Map for Countries

Sentiment has significantly improved for a number of European countries and the United States. China has seen a recent decline in the virus related news sentiment.

Fig. 4: Coronavirus related News Sentiment Heat Map

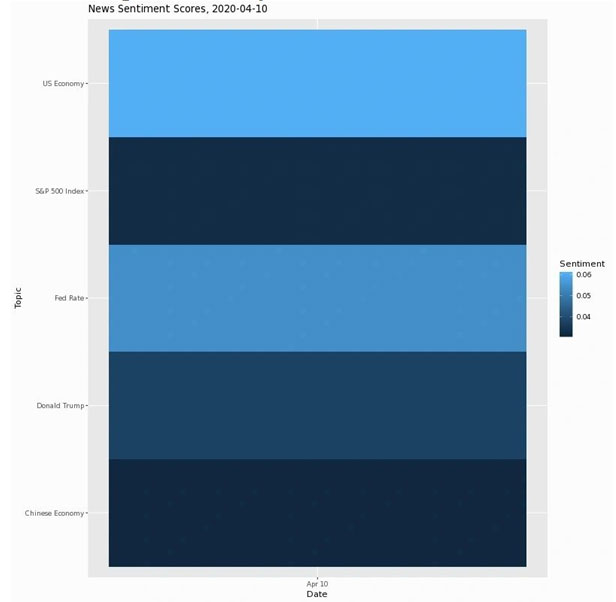

News Sentiment for Topical Keywords

Because markets are influenced by the sentiment for news flow around some important and popular keywords, the results can be important for the market direction. There is a very high level of pessimism around Chinese economy but the biggest positive jump is seen for the US economy, which is good news.

Fig. 5: News Sentiment for select topical search terms

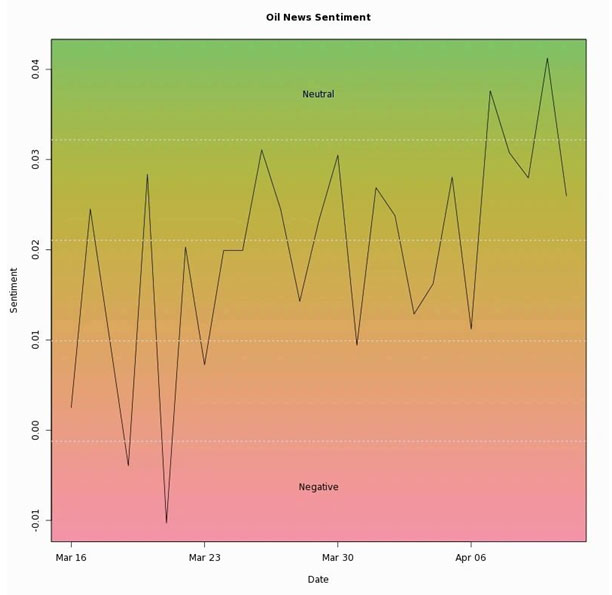

Crude Oil News Sentiment

The markets are still hopeful that the Russia-Saudi deal will help but the news that some countries may not join this effort has come as a dampener.

Fig. 6: Daily oil related News Sentiment

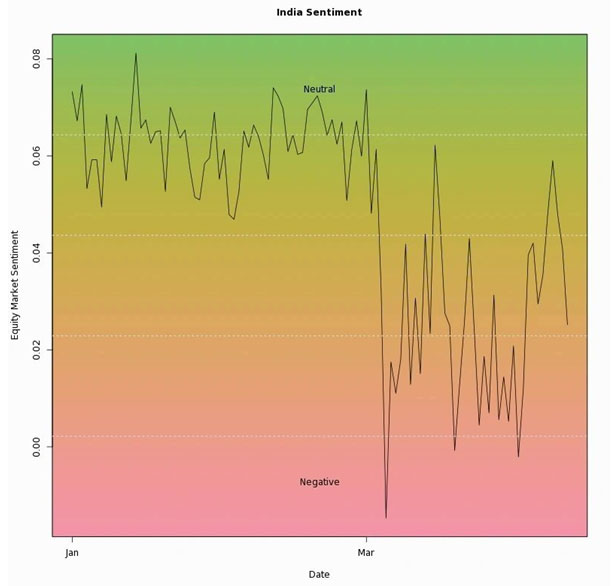

Aggregate India Equity Market Sentiment

This is a puzzle. The major market indices went up more than 10% for India though the aggregate market sentiment has deteriorated considerably. May be the fundamental news is still bad for India, but global liquidity push is propelling the market higher. As we have discussed in the first part of this newsletter, the aggregate market sentiment has proven to be quite helpful in navigating the market volatility for India, so this measure is signaling a lower India market over the next few days.

Fig. 7: India Equity Market Sentiment Signal.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.