How the ESG funds have been doing this year?

Synopsis: While there have been record inflows (US$ 185.3 billion, as per Morningstar data) into the ESG (Environmental, Social and Governance) funds in the first three months of 2021, the real action lies somewhere else. On the back of huge developments at ExxonMobil, Royal Dutch Shell and many other companies, coupled with the admission, though in many cases reluctant, by several corporate groups for the undeniable need of a green and more sustainable future, ESG is shaping up for a long, long run. But how have the world’s largest ESG funds fared so far in 2021. Have they beaten the markets? Have they underperformed? Considering the amount of inflow, expectations of better returns have increased and do has the scrutiny. EMAlpha takes a look at the performance of some of these funds and what may be coming next?

ESG space is evolving very fast

Simply put, ESG can be defined as the non-financial, a mix of qualitative and quantitative facets concerning environment, social or governance issues that will have a tangible outcome on business performance. This is much like discovering new physics, when Einstein’s theory of gravity changed the Newtonian viewpoint of gravity. Fifty or even twenty or thirty years ago, nobody really cared how much coal was being dug out from underneath, nobody really cared if industries dumped harmful waste into the rivers they were based alongside. There were hues and cries and some regulations too but the overall outlay was dictated by these companies which only had profits as their motive, even if it came at the cost of the planet and the people.

But with increasing investor’s demand and awareness, the covid pandemic, and backed by newer, stronger regulations, such companies are being taken to task for their activities that could have damaging impact on the environment and society. About a decade ago, the ESG criteria were very basic and mostly negative screening based. The Oil companies, coal companies, cigarette, alcohol and gun companies were a big no for investors.

But ESG today is steered by investors and regulators who want increasingly granular and more specific disclosures on not just general topics like environment and society but on specifically categorised issues like carbon footprint, indirect involvement in deforestation, scope 1, 2, 3 emissions etc. The most encouraging factor is the involvement of large investors like pension funds in wanting more disclosures. The warrant of ESG requirement is greater disclosure and transparency over a wide spectrum. Case in point being the EU taxonomy.

A great deal of capital is flowing into ESG funds

The basic of every endeavour involving money is demand-supply equation. If there is a growing demand for a product, the prices will undoubtedly shoot up. The current huge demand for ESG investment has ensured that ESG funds be flooded with huge amount of capital. This will obviously push up the prices.

Figure 1: Illustration of demand-price relation

Source: EMAlpha

Over the past couple of years, sustainable investing has gained a lot of momentum. Prior to the Covid-19 pandemic, although ESG was talked about, it was like the plant in the corner of the office that didn’t get any sunshine. The pandemic was the straw that broke the camel’s back, so to say and gave ESG its due recognition. There were other factors too such as social unrest in the US in May of 2020, a lack of healthcare access for minorities affected by the pandemic, the Amazon rainforest fires, all acted as fuel to the surging fire of ESG.

But as is the case, when the lions go for hunting, the vultures hover in the sky. When it comes to ESG investment, there are those who are the ethical investors, the ones who really care about impact on society and environment and then there are those who are the opportunistic investors, the ones jumping on the latest market bandwagon for intentions of only profits. Whoever might the investor be, there is one thing that doesn’t lie and can’t be ignored: Data.

According to a Morningstar report, in the first three months of 2021, global inflows into ESG funds amounted to a record $ 185.3 billion, thus increasing the Assets Under Management (AUM) in sustainability focused funds to nearly $ 2 trillion. The record inflow is expected to continue throughout this year and the upcoming years as well.

With such huge amount of funds flowing into the red hot ESG theme, it becomes imperative to take a look at some of the largest ESG funds in the world and how they have fared so far in 2021.

Performance of the Largest ESG funds in the world so far in 2021

The following are the largest ESG funds in the world as compiled by MSCI:

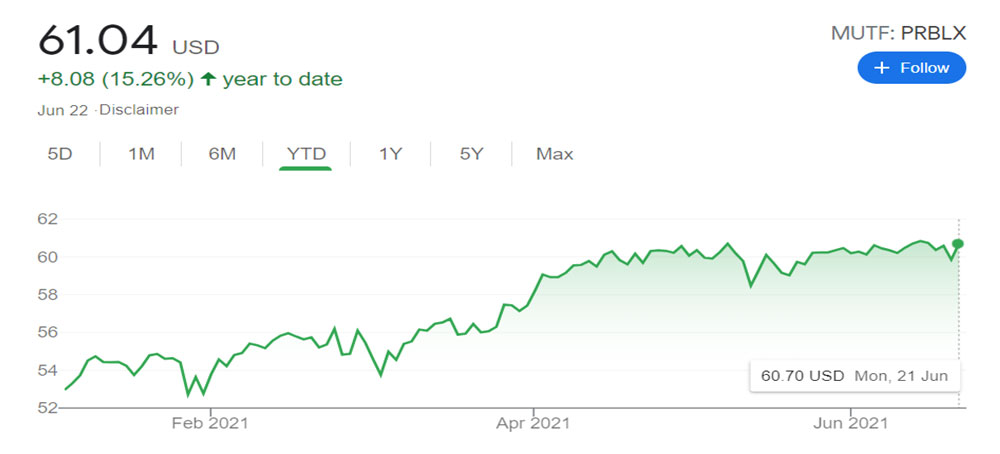

Parnassus Core Equity Fund

As described in its website, the Parnassus Core Equity Fund invests in large cap US companies that have long term competitive advantages and relevancy, quality management teams and positive performance on ESG criteria. It is an actively managed fund with assets of about $ 23 billion, according to MSCI’s research. Among its top holdings are Microsoft Corp (5.8%) and Alphabet Inc (4.8%), the parent company of Google. In 2020, the fund saw total flows of $ 686 million. The fund has gained 15.26% so far in 2021.

Figure 2: Year-to-date performance of Parnassus Core Equity Fund

Source: Google

iShares ESG Aware MSCI USA ETF

The Investment Objective as mentioned on its website states that the iShares ESG Aware MSCI USA ETF seeks to track the investment results of an index composed of U.S. companies that have positive environmental, social and governance characteristics as identified by the index provider while exhibiting risk and return characteristics similar to those of the parent index. It is an index-based ETF with $ 13 billion in assets, as reported by MSCI’s research. Among its top holdings are Apple (5.73%) and Microsoft (5.09%). In 2020, the ETF saw total flows in excess of $ 7 billion, by far the highest among the 20 largest ESG funds as reported by MSCI. The ETF has given returns of 14.5% so far in 2021.

Figure 3: Year-to-date performance of iShares ESG Aware MSCI USA ETF

Source: Google

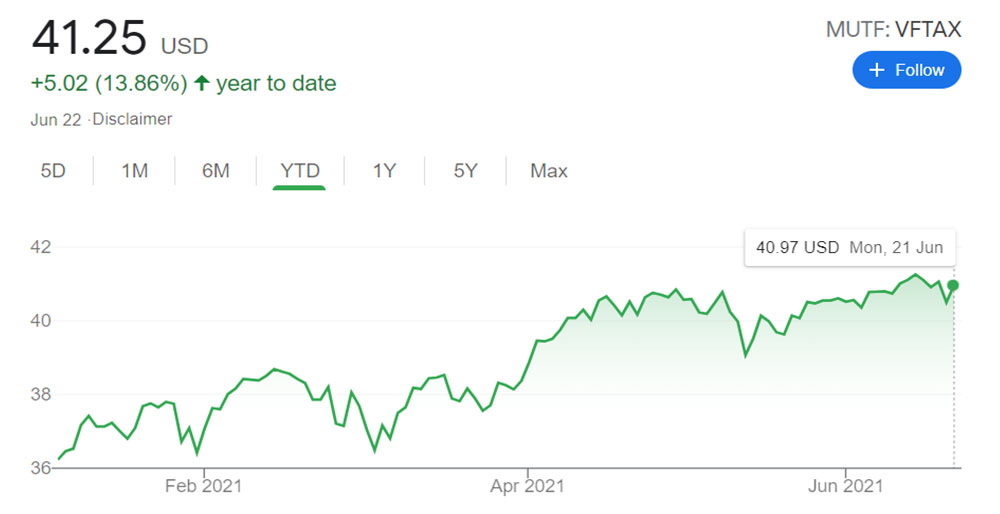

Vanguard FTSE Social Index Fund

Its website describes the index as market cap weighted index composed of large- and mid-capitalization stocks screened for ESG criteria. It excludes stocks dealing in industries like alcohol, tobacco, gambling etc. as well as those companies that do not meet standards of UN global compact principles. It is an index-based fund with $ 10.9 billion in assets, according to MSCI’s research. Just like the other two, it’s a tech heavy index with Apple, Microsoft and Alphabet comprising its largest holdings. In 2020, the fund saw inflows of $ 1.3 billion. The fund has registered gains of 13.9% thus far in 2021.

Figure 4: Year-to-date performance of Vanguard FTSE Social Index Fund

Source: Google

More or less, the three largest ESG funds have given similar returns so far in 2021. The primary reason could be investment in the same tech stocks.

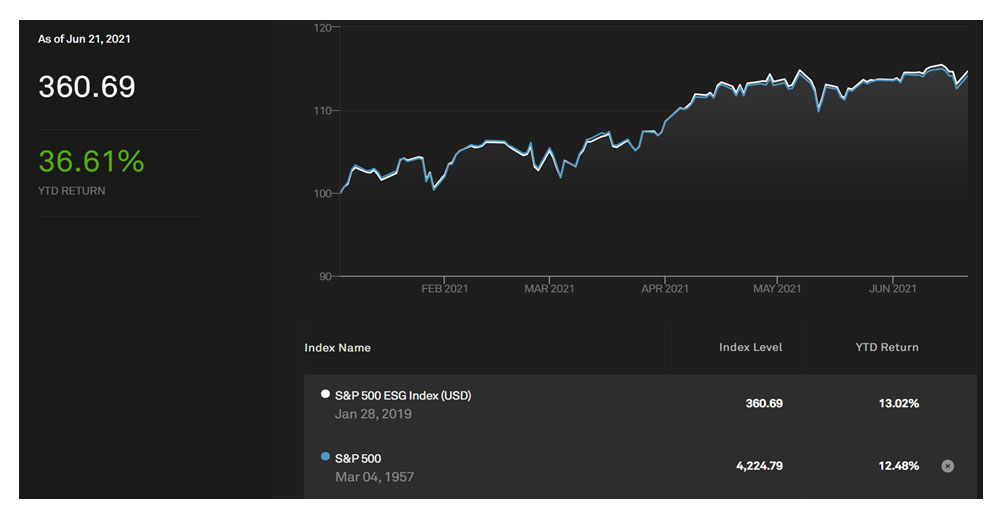

How does the S&P 500 ESG index compare with the broader index

The S&P 500 ESG Index is a broad-based, market-cap-weighted index designed to measure the performance of securities meeting sustainability criteria, while maintaining similar overall industry group weights as the S&P 500.

Figure 5: Year-to-date comparison of S&P 500 ESG index with S&P 500 index

Source: spglobal.com

The S&P 500 ESG index has only marginally outperformed the S&P 500 index thus far in 2021. This could act as fodder for critics questioning the huge capital that is being poured into ESG funds with expectations of extravagant returns. This might also push the narrative that ESG is nothing but a fad. While this could be a possible interpretation, it would still be unwise to count out ESG based on just six months of returns that mimics the broader index. After all, if the rise is perpendicular, the fall would be specu-la-ta-cular (speculate + spectacular). And moreover, Rome wasn’t built in a day.

The Hurdles that ESG has to overcome

ESG investing is still in its adolescence as the rules of the game are being created and morphed along the way. Challenges are a natural part of the system which if addressed properly makes the system much more efficient. For example, Greenwashing is something that does stand out. We have, however highlighted a few other challenges that we perceive are acting as hurdles in the progress of ESG space.

Lack of universality in ESG guidelines

There isn’t any one sovereign body to overlook all the happenings and developments in the ESG space. As such, much of the ESG related stuff appear random and out of place with no direction and no reason. It’s similar to a school without a principal to enforce the rules on the students.

ESG scores discrepancies

This is one of the most irritating and puzzling aspect of the space. When it comes to investment, investors need data. And that calls for quantifying things which were previously just abstract entities. Various ESG scoring institutions have glaringly different scores for the same companies. This confuses the investor who more than anything is looking for concrete data to base his or her investment on.

Intentions

The ESG space has turned into a push and pull battle between the ethical investors (who champion the ESG cause) and the opportunistic investors (who just see dollars in everything). Whether it be an ethical investor or an opportunistic investor, if there’s no profit in the game, the safe bet would be that there won’t be any players. After all, when poverty knocks at the door, love flies out of the window. But for an ethical investor, profit at the cost of principles isn’t acceptable. Whereas for the ruthless opportunistic investor, anything goes. It remains to be seen who gets to be in the driver seat in the long run.

Lack of Transparency and Information

This is one of the biggest criticism of the ESG movement. The lack of information is a predicament for investors. Information discovery is a major challenge facing investors, especially in the emerging markets where ESG is soon catching up.

How does the future look for ESG reporting?

As the ESG space is evolving, more and more companies are producing ESG reports that aren’t just a few pages but are even hundred pages long. Investor’s awareness and involvement has ensured that companies publish a comprehensive report that includes tax-strategy, cyber-security, diversity etc., things that would matter for an investor. Companies are also giving forward guidance in terms of when they would be able to achieve their sustainable goals. Although terms like ‘before 2030’, ‘by 2050’ are being thrown around like breadcrumbs, there is no doubt that companies are getting serious on ESG issues.

The huge amounts of inflows pouring into ESG funds indicates that ESG isn’t just a flash in the pan. It will be around, bringing about changes not just in the business habits of the corporations but also in the living quality of the people of this planet. And that’s a big reminder of the kind of influence these funds could have. More important would be to have the right people propelling these funds: people who act not just on business interests but also on ethical principles. These behind-the-curtain people will undoubtedly be the bearer of great power. But remember, “With great power comes great responsibility”.

How EMAlpha can help investors address the ESG phenomenon

While the companies need to incorporate concerns of all their stakeholders, there will also be a need for a solution which looks at a more detailed classification for industries and sectors. At EMAlpha, we have incorporated a Flexible Framework Management System, based on EMAlpha’s proprietary technology making inferences framework agnostic. This also offers a quick adaptation for the users (both companies and investment advisors).

As such, the EMAlpha’s ESG and Sustainability offering is centred around addressing some of the most critical issues. The EMAlpha algorithms provide a choice for separate relevant frameworks and these can be used to review the performance more transparently. This not only helps the investment advisors but also make the clients understand the granular details better which in turn is helpful for them to understand their preferences better. To achieve this, we focus on the following;

- Go beyond the official reported version – The data source matters and there is a need to look beyond what the companies are reporting and what the official version is. Often, there are other sources as well for relevant information. They include the information disclosure as mandated by regulators and the EMAlpha algorithms scan through unstructured data to pick the unofficial information too.

- No two ESG scores are same despite same headline figure – It is the composition that makes a big difference and all the three parameters that make up ESG need to be evaluated separately. The EMAlpha algorithms provide separate scores for E, S and G so that an investor can review the sectoral performance more transparently. Over and above, a key feature of EMAlpha’s NLP algorithms is that the attribution analysis is fairly simple and straight forward.

- An ESG score without context and background is meaningless – The ESG is as much about intent as it is about execution. For this balanced evaluation, having an understanding of the local factors is very crucial. A very good ESG track record (probably more driven by excellent performance in E and/or S) may hide serious Governance related risks and the investors can only ignore them at their own peril. EMAlpha analysis meticulously incorporates this part of the ESG evaluation.

References

- Alphabet was the most widely held stock for the largest ESG funds. Here’s what else they own https://www.cnbc.com/2021/05/18/alphabet-was-the-most-widely-held-stock-for-the-largest-esg-funds.html (Accessed on 22nd June 2021)

- Parnassus core equity fund Investor shares https://www.parnassus.com/parnassus-mutual-funds/core-equity/full-holdings (Accessed on 22nd June 2021)

- There’s no hotter area on Wall street than ESG with sustainability focused funds nearing $ 2 trillion https://www.cnbc.com/2021/04/30/theres-no-hotter-area-on-wall-street-than-esg-with-sustainability-focused-funds-nearing-2-trillion.html (Accessed on 23rd June 2021)

- iShares ESG aware MSCI USA ETF https://www.ishares.com/us/products/286007/ishares-esg-aware-msci-usa-etf (Accessed on 23rd June 2021)

- Vanguard FTSE Social index fund admiral shares https://investor.vanguard.com/mutual-funds/profile/VFTAX (Accessed on 23rd June 2021)

- S&P 500 ESG Index https://www.spglobal.com/spdji/en/indices/esg/sp-500-esg-index/#overview (Accessed on 23rd June 2021)

- The top 20 largest ESG funds- under the hood https://www.msci.com/documents/1296102/24720517/Top-20-Largest-ESG-Funds.pdf (Accessed on 23rd June 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.