EURO Gaining Strength over USD: What it Means for Emerging Markets?

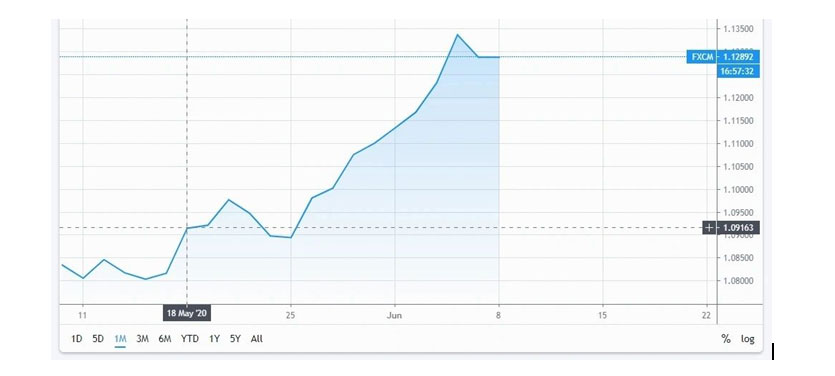

The deep impact of Coronavirus pandemic on Europe was not a good omen for EURO as well and the currency was under serious pressure. Between 9th and 20th March, it lost ~7% against USD. Though there was a brief recovery in the following week, the Euro remained between 1.08 and 1.10 USD for most of April and first half of May. But this has changed in last fortnight and especially after 18th May (Fig. 1).

Fig. 1: EURUSD Forex Chart

On that day (18th May), Germany and France proposed a Recovery Fund, giving the EU more capacity to deal with this unprecedented shock. The immediate help is necessary to help those suffering most from the economic shock caused by COVID-19. The Angela Merkel and Emmanuel Macron proposal is important for two reasons. In near term, it helps in recovery because there is a plan to create an additional EUR500bn of EUR spending power, via an EU level borrowing.

However much more importantly, it gives enhanced visibility on the faith the more powerful countries have in the future of European Union. After the exit of United Kingdom from EU, the political leadership of Germany and France has more responsibility to pull the relatively weaker countries out of this quagmire and both Merkel and Macron have not disappointed. Naturally, it is good for Euro if the people are much more optimistic on the sustainability of economic union in Europe.

Ideally, a weaker USD is good news for Emerging Markets (EMs) currencies too. But the situation is less straight forward in this case. For the individual EM currency’s exchange rate movement will be more dependent on local economic issues these countries will face due to COVID-19. Some of them have announced generous economic packages and that will put pressure on fiscal deficit numbers, some have been impacted because of transport linkage disruption and because of their dependence of exports and some have local economies in peril because tourism has been badly affected.

Some countries would even prefer a stronger dollar because then their exports become more competitive. But this is an interesting development for the Emerging countries and overall, should not hurt them. Let us see how much more EU leaders can deliver and how much that will help the EU countries. There is some reluctance from a few of them to support a big package but when the bigger ones are showing intent, there is a likelihood that they will come around. As such, the benefits from these steps for EU are far higher compared to costs associated and a strong EU is not bad news for the financial markets in EMs too.

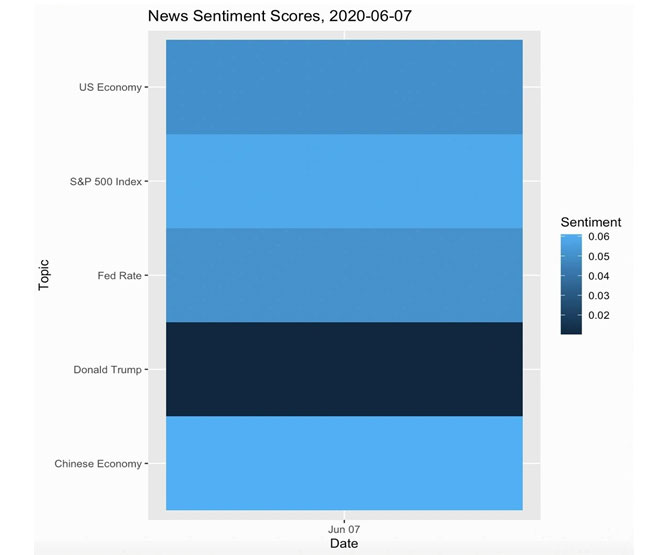

Another interesting angle to explore is that how does this link with overall market sentiment? When we look at the “topical sentiment” scores (Fig. 2), it clearly emphasizes the point that EURUSD and weak dollar have sent the overall sentiment soaring. As expected, Trump sentiment is very negative. But, for the first time that we have seen, the rest of the sentiments are all bright!

Fig. 2: EMAlpha “News topical sentiment”

Coming back to EURUSD, you may argue that this might not be the only reason but when you see a hugely positive sentiment for “S&P 500 Index” and corroborates this with underlying news, this surely has been an important factor.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.