EU Taxonomy: Political Realities vs Positive Change

Synopsis: In our earlier insights on EU Taxonomy, we discussed how it will alter the playing field for companies and investment advisors in the EU and how Covid-19 played a key role in bringing about the regulation. Please refer EU Taxonomy: The Game Changer for Sustainability Reporting and Investment Advice and EU Taxonomy: How the Covid-19 Pandemic triggered the April 2021 Package. As it happens with any deal involving multiple stakeholders who hold contrasting viewpoints on several critical issues, developing a general consensus is the biggest challenge. This was the case with EU Taxonomy too. The EU member states had the onus of supporting their domestic industries and protecting their business interests and rightly so. However, the question is: Did ‘practical’ and ‘acceptable’ facet get precedence over what was ‘stringent’, ‘scientific’ and ‘effective’? On the basis of issues that EMAlpha-AI has picked up over the last few months, we look at the three most controversial topics to better analyse the supposed claim: Forestry, Nuclear Energy and Gas. We also look at how power politics influenced the EU Taxonomy. Although there is some unfair criticism, there is also a serious risk that the dilution of regulations under political pressure will delay the progress in climate change mitigation and protection of environment.

The EU’s Planned, Structured and Organized Fight against Climate Change

Among the global economic blocks, the EU has been the most proactive in dealing with challenges confronting the world today. It was comparatively easier to build political consensus in Europe because of the relatively low disparity in economic and cultural factors, along with a high level of sensitivity towards environmental issues. The immediate priority behind the EU’s efforts is to make Europe climate neutral by 2050 and hence, the European Commission has adopted a set of measures to help improve the flow of capital towards sustainable activities. A real difference can be made by enabling investors re-orient investments towards more sustainable technologies and businesses.

The European Commission is of the view that major public and private investments need to be directed towards environment friendly activities and businesses which can effectively combat climate change. This will not only reduce the negative impact on the environment but also help in making the financial system more sustainable. And this is where the EU Taxonomy plays an important role. The EU taxonomy is a classification system, establishing a list of environmentally sustainable economic activities. It is also an important enabler to scale up sustainable investment and to implement the European Green Deal. The EU Taxonomy will also help stakeholders develop an understanding of activities that make a substantial contribution towards mitigating the climate change impact.

Need for Political Consensus and EU Taxonomy

Achieving political nod for a proposal and building a political consensus is a challenging problem even when all the stars align. But the pot is further stirred when multiple countries are involved, each with a different definition and hence objective on how to best deal with climate change. The countries have to protect the local industries and also minimize the transition pain for the population while not falling short of their genuine claims.

This was the case with EU Taxonomy as well. The member states of the European Union had to strongly support their domestic industries and it was important for them to protect their business interest to the maximum possible extent. The political leadership also required to be cognizant of the domestic political compulsions due to internal political pressure.

Practical-and-Acceptable versus Scientific-and-Effective?

Since the announcement of EU Taxonomy’s April 2021 package, a number of topics are being seen as a political compromise between what was considered as science-backed evidence and what the EU member states wanted. This has created certain debates around EU taxonomy’s proposals.

The European Commission’s green taxonomy rule book introduces a labelling system for investment that will play a key role in directing the flow of investments towards sectors and companies which are classified as sustainable based on their operational activities. It covers many sectors including energy and forestry and collectively they account for almost 80% of greenhouse gas emissions of the EU. It is thus crucial that the classification remains stringent and effective for achieving the stated purpose of making Europe climate neutral by 2050.

However, for the deal to gain acceptance, the classification also needs to be feasible and practical. The question is: Did ‘practical’ and ‘acceptable’ facet enjoy precedence over ‘stringent’, ‘scientific’ and ‘effective’? While the criticism sounds fair in some cases, there is an underlying and undeniable fact that the EU Taxonomy rules need to be politically acceptable. Since many of the topics are politically sensitive for several countries, the regulation and EU Taxonomy proposals have to be based on an optimization process, balancing the scientific evidence, practicalities involved in implementation and the political acceptability.

EU Taxonomy’s Forestry Criteria

After the announcement of detailed proposals regarding what would classify as sustainable activity, there was a fair bit of controversy around EU taxonomy’s forestry criteria. Several activist groups and NGOs alleged that these rules were too weak and it was ironical that they had classified some of the extremely damaging activities such as industrial logging and burning of trees and crops as ‘sustainable’ investments. Some of these organizations also decided to suspend their participation in the European Commission’s Sustainable Finance Platform, in protest.

There were concerns even before the release of the April 2021 package that the EU Taxonomy rules could get diluted, thus weakening the fight against climate change. In an open letter dated 31st March 2021, a group of scientists and environmental and consumer experts appointed to the EU Commission’s Platform on Sustainable Finance had expressed their deep concern: We and the organisations we represent feel about the contents of the draft climate Taxonomy Delegated Act which was leaked last week, and the process through which it was significantly and unacceptably weakened compared to the November version.

These scientists spoke specifically about the criteria for forestry, bioenergy, and fossil gas which they believed were in clear contradiction of climate science. They alleged that not only were the criteria weak but also counter-productive and labelling them as “sustainable” activities might cause significant harm to the climate and the environment. Under the new classification, the scientists feared that the Taxonomy would become a greenwashing tool instead of being a greenwashing annihilator, something that it was meant to be. But in the end, pressure from countries like Finland and Sweden was just too powerful for the EU to consider otherwise.

The controversy over Nuclear Power

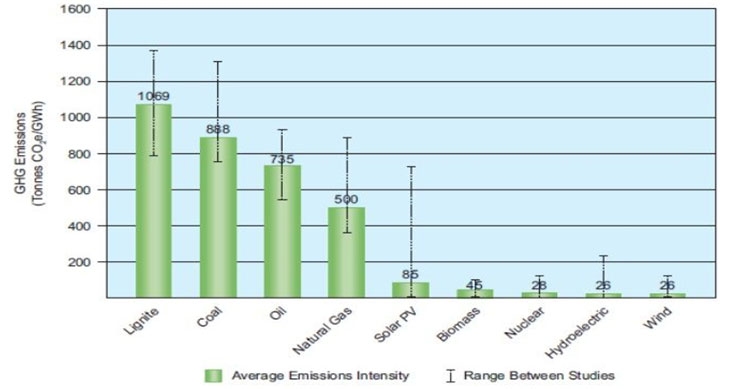

The topic of nuclear energy in the EU taxonomy was a much-debated subject throughout the negotiations on the Taxonomy Regulation. And, finally, the debate hit a dead end. The Technical Expert Group on Sustainable Finance did not provide a conclusive recommendation on nuclear energy and indicated that a further assessment of the ‘do no significant harm’ aspects of nuclear energy was necessary. The task of course, is not easy. For example, the following chart explains why the Sustainability discussions will find it really difficult to put ‘Nuclear Energy’ in a particular pre-defined bucket. Despite all the negative perceptions, Nuclear is still very competitive on GHG emissions.

Figure 1: GHG Emissions for Different Technologies

Source: Technical assessment – Nuclear with respect to ‘do no significant harm’ criteria of Regulation (EU) 2020/852 (‘Taxonomy Regulation’)

While the EU is showing strong global leadership in becoming climate-neutral by 2050, achieving the same also requires taking a call on Nuclear Power. The positive part is that the European Union is in no hurry to arrive at some hasty conclusions and wants to explore all possible aspects before taking a final call. Rest assured, doing so won’t be easy because some EU states are very strongly advocating that Nuclear Energy should be supported under the EU Taxonomy rules.

In March 2021, the leaders of seven European Union Member States wrote to the European Commission on the role of nuclear power in the EU climate and energy policy. The states argued that the path that was currently laid out to achieve the goal for the EU left little room for internal policy making which, naturally, were determined by country specific conditions. Because of this, every Member State should remain free to develop nuclear power or refrain from it.

The leaders including Mr Andrej Babiš (Prime Minister of the Czech Republic), Mr Emmanuel Macron (President of the French Republic), Mr Viktor Orban (Prime Minister of Hungary), Mr Mateusz Morawiecki (Prime Minister of the Republic of Poland), Mr Florin Cîțu (Prime Minister of Romania), Mr Igor Matovič (Prime Minister of the Slovak Republic) and Mr Janez Janša (Prime Minister of the Republic of Slovenia) supported Nuclear Power by highlighting;

- Nuclear Energy’s contribution to fighting climate change and hence, the need for a true level-playing field for nuclear power without excluding it from the EU climate and energy policies.

- A huge range of possibilities and yet unexploited synergies between nuclear energy and renewable technologies.

- All available and future zero and low-emission technologies have to be treated equally within all policies, including taxonomy of sustainable investments.

- As low-emission baseload, Nuclear guarantees the continued renewable deployment to much higher penetration levels.

- Nuclear power seems a promising source of low-carbon hydrogen at an affordable price and can play an important role in energy sector integration.

- Nuclear power also generates a considerable number of stable, quality jobs, which will be important in the post-COVID recession.

The Ambiguity on Gas

The European Union’s (EU’s) Taxonomy announcement on April 21 also delayed decisions on gas. Before this, there was a technical evaluation of different industries to assess them for their environmental impact so that they could be classified accordingly. For the energy sector accounting for 22% of direct GHGs, it was always likely that some of these technologies would be keenly debated. Gas always had major support from France, Hungary, Poland, Romania, Czech Republic and the countries in eastern and southern Europe. In fact the advocacy of these countries for gas was so fierce that some of them even threatened to veto an earlier draft because it did not label gas as a “green” investment.

Therefore, in the April 2021 Package, the European Commission suggested that gas could be included in a “Complementary Delegated Act” to be adopted later in 2021 and further added that the inclusion of natural gas has been “subject to a technical assessment and public feedback”. It can only be speculated as to how much the pressure from some EU member states and lawmakers in the European Parliament impacted the decision, but postponement of a final decision on the status of gas is seen as a major setback for activists who vigorously campaigned against its inclusion as a ‘Green’ source of fuel and being treated as a sustainable, environment friendly business.

There were also reports that many large Oil companies were lobbying hard in getting the European Union to weaken the criteria for what qualifies as a sustainable energy source. There were also discussions on the emission threshold which are being seen as too liberal in some sections. On energy, the taxonomy defines two key thresholds:

- A low threshold of 100gCO2/kWh below which energy generation technologies are generally considered “sustainable”.

- A higher threshold, set at 270gCO2/kWh, determines energy technologies which are deemed to do “significant harm” to the environment.

While it is universally accepted that Coal is a fuel which needs to be phased out, that kind of general consensus is elusive for Gas. There are sound arguments about the impractically of switching the entire energy system to fully renewable sources overnight. The process needs to be gradual and resources need to be utilised to help in this transition. For many EU countries which are critically dependent on Gas, it becomes even more important to push their viewpoint. For example, if “phasing-out” coal is an immediate priority, Gas can help fill the vacuum in the interim. There are other challenges as well and some EU countries are of the view that irrespective of the final outcome, uncertainty is not good. Germany’s utilities suggest that the delay in deciding whether natural gas projects count as a sustainable investment or not, is bad for the country’s supply security and climate targets.

Is more detailed analysis and better Industry classification the answer?

The rapid developments in the EU Taxonomy and political pressure from member states mean that ‘one size fits all’ approach may not be the answer. While the European Commission needs to incorporate concerns of stakeholders, it may also look at other options like creating multiple time windows for a phase wise transition, allowing local industries some concessions instead of diluting the entire set of proposals or even offering financial support for the transition. Under the circumstances, there will also be a need for a solution which looks at a more detailed classification of industries and sectors.

Every cloud has a silver lining. In this case, there are solutions available for investors which can help them make sound decisions on how they want to prioritise their investments towards more sustainable businesses. At EMAlpha, we have always believed in the premise that for any product to work better for a client, ‘more power to user’ should always be the core principle we must adhere to. Hence, we have incorporated a Flexible Framework Management System that is based on EMAlpha’s proprietary technology that makes inferences framework agnostic.

This also offers a quick adaptation for the users (both companies and investment advisors). As such, the EMAlpha’s ESG and Sustainability offering is centred around addressing some of the most critical issues. The EMAlpha algorithms provide a choice for separate relevant frameworks and these can be used to review the performance more transparently. This not only helps the investment advisors but also make the clients understand the granular details better which in turn helps them understand their preferences better.

The bottom line is that Sustainability is as much about intent as it is about execution. For this balanced evaluation, having an understanding of the local factors is very crucial. A good track record (probably more driven by excellent performance in certain areas) may hide serious lapses elsewhere and the investors can only ignore them at their own peril. EMAlpha analysis meticulously incorporates this critical part of the evaluation jigsaw puzzle. This is possible because EMAlpha has transparent and attributable ESG dictionaries which provide complete clarity on why a particular company ends up with a certain score.

References

- NGOs walk out on EU green finance group over forestry, bioenergy rules https://www.euractiv.com/section/energy-environment/news/ngos-walk-out-on-eu-green-finance-group-over-forestry-bioenergy-rules/ (Accessed on 9th May 2021)

- EU legislation to prevent greenwashing becomes ultimate greenwashing tool- BirdLife suspends activities in Commission Platform on Sustainable Finance https://www.birdlife.org/europe-and-central-asia/news/eu-taxonomy-greenwashing-ngos-walk-out-platform-sustainable-finance_21April2021 (Accessed on 9th May 2021)

- An open letter to the European Commission sent by Civil society organisations and scientists on 31st March 2021 https://www.birdlife.org/sites/default/files/joint_letter_eu_commission_platform_sustainable_finance_taxonomy_greenwashing_31march2021.pdf (Accessed on 9th May 2021)

- Last minute EU taxonomy changes water down sustainability criteria for waste, NGOs say, changes made since a draft leaked last week have weakened criteria on waste management. https://www.euractiv.com/section/circular-materials/news/last-minute-eu-taxonomy-changes-water-down-sustainability-criteria-for-waste-ngos-say/ (Accessed on 9th May 2021)

- E.U. Ignores Science-Based Advice, Labels Gas As Green In Sustainable Taxonomy Proposal https://www.greenqueen.com.hk/e-u-ignores-science-based-advice-labels-gas-as-green-isustainable-taxonomy-proposal/ (Accessed on 9th May 2021)

- Farming giants lobby EU to weaken proposed biofuel standards https://unearthed.greenpeace.org/2021/04/20/eu-lobby-biofuel-biomass-bioenergy-renewable-sustainable-climate/ (Accessed on 9th May 2021)

- Do countries need a system to distinguish ‘green’ from ‘greenwash’? https://www.thenationalnews.com/opinion/comment/do-countries-need-a-system-to-distinguish-green-from-greenwash-1.1212072 (Accessed on 9th May 2021)

- MEP Canfin: The French hard line on nuclear is a dead end, the hard line is defended by France over the inclusion of nuclear power in the green finance taxonomy. https://www.euractiv.com/section/energy-environment/interview/mep-canfin-the-french-hard-line-on-nuclear-is-a-dead-end/ (Accessed on 9th May 2021)

- Draft EU taxonomy sparks discord over gas, nuclear future https://www.montelnews.com/en/story/draft-eu-taxonomy-sparks-discord-over-gas-nuclear-future/1207136 (Accessed on 9th May 2021)

- NGOs demand place for nuclear in EU Taxonomy https://world-nuclear-news.org/Articles/NGOs-demand-place-for-nuclear-in-EU-Taxonomy (Accessed on 9th May 2021)

- Message: 7 EU leaders urge support for nuclear https://world-nuclear-news.org/Articles/Message-Nuclear-is-green-energy,-say-7-EU-leaders (Accessed on 10th May 2021)

- Reprieve for Nuclear, Gas in EU’s Sustainable Finance Taxonomy Rules https://www.powermag.com/reprieve-for-nuclear-gas-in-eus-sustainable-finance-taxonomy-rules/ (Accessed on 11th May 2021)

- EU spells out criteria for green investment in new ‘taxonomy’ rules https://www.euractiv.com/section/energy-environment/news/eu-spells-out-criteria-for-green-investment-in-new-taxonomy-rules/ (Accessed on 11th May 2021)

- BP “lobbying to weaken” EU green investment: watchdog https://energy.economictimes.indiatimes.com/news/oil-and-gas/bp-lobbying-to-weaken-eu-green-investment-watchdog/82172362 (Accessed on 11th May 2021)

- Natural gas bashing is trendy, but is it constructive? https://www.euractiv.com/section/energy-environment/opinion/natural-gas-bashing-is-trendy-but-is-it-constructive/ (Accessed on 11th May 2021)

- EU indecision over gas as green imperils supply security: German Utilities https://www.cleanenergywire.org/news/eu-indecision-over-gas-green-investment-imperils-supply-security-german-utilities (Accessed on 11th May 2021)

- Sustainable Finance and EU Taxonomy: Commission takes further steps to channel money towards sustainable activities https://ec.europa.eu/commission/presscorner/detail/en/IP_21_1804 (Accessed on 11th May 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.