Does ‘Economic Revival’ from Coronavirus Pandemic Depend on ‘Recklessness in Human Behavior’?

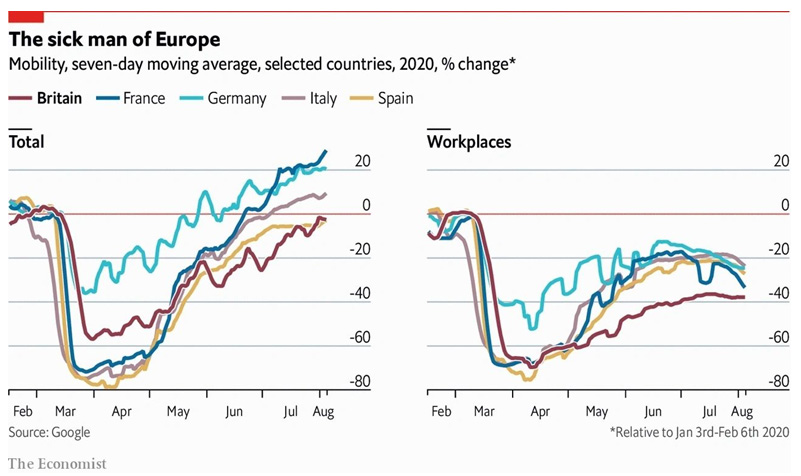

A recent article in The Economist mentions that Coronavirus fears are taking a heavy toll on Britain’s economy. One of the primary reasons is that despite largely similar infection rates, the people in the country are relatively slower to venture outside than the rest of Europe. For example, as per a survey, only a third of British professionals had returned to their offices, compared with around three-quarters of those on the continent. Compared with residents of other European cities, London’s workers are more likely still to be working remotely.

Fig. 1: Mobility and its linkage with recovery

If we compare the trends globally and if this conclusion is valid that ‘speed of revival’ depends on how ‘risk-taking’ people are, this most likely means a few things;

- What you call ‘recklessness’ may be bad for people’s health, but that is very good for recovery. Less ‘risk averse’ people are, faster the recovery would be. If you go by the reports that several people in USA are even against wearing a mask and get offended when reminded about the same, the recovery will be much faster in USA.

- More disciplined people are and more they listen to authorities, that will actually be bad for recovery. For example, expect Japan to recover much later. In comparison, the more outgoing people are and more they are interested in ‘sports events’, that could be helpful in recovery. For example, this may be the case in many countries in continental Europe and Australia.

- Many companies have actually reported that ‘Work from home’ has actually led to increased productivity or at least the ‘efficiency’ has not suffered much. That is bad for broader recovery. If the companies and other organizations have no incentive to get people back in their office physically, ‘work from home’ will continue for longer and that is also bad for recovery.

- Many tech giants such as Google have extended the ‘work from home’ till June next year and there are many reports that some of them may even remain permanently in ‘work from home’ mode, that is not actually good for recovery. The longer people remain in a changed ‘routine’ or ‘lifestyle’, more it is likely that may not return to the original ways, that will again be bad for recovery.

- The demographics could also play a big role. In general, the younger population is more likely to be more willing to travel and venture outside. Since they may indulge in more ‘high-risk behaviour’ typically, this should apply to their willingness to how quickly they can put the ‘Covid-19’ fears aside. This could help two of the most populous countries in the world, China and India.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.