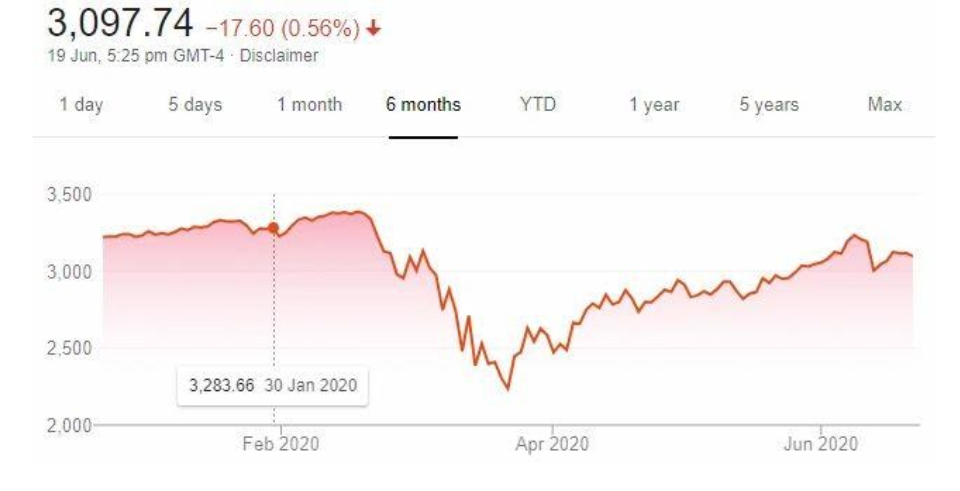

The first half of 2020 and especially the March and onwards period has been tumultuous for global markets. First there was a crash, then came the strong monetary policy response from Central Banks and large stimulus packages from the Government. Naturally, the smart recovery followed. And it was a recovery which was beyond imagination for everyone. Some people would say that the crash was a serious overreaction and some others would say that the recovery can’t be justified on the basis of fundamental reasons.

But one thing has been common about whatever has happened in the markets in this timeframe. It has been only and only about Coronavirus pandemic. The central theme has been that how COVID-19 has disrupted supply chains, how it is a double whammy in the form of both a health emergency and an economic crisis rolled into one. The real-time numbers and news related developments on how quickly the disease was spreading immediately led to market reactions across markets. Some of these things we have already spoken about in some of our previous insights.

In our insight on 13thApril 2020, we had written that how, for two major emerging equity markets: Brazil and India, Sentiment based Signals, constructed using Machine Translation and Sentiment Analysis on news flow in Portuguese, Hindi and English, can be used to trade the broad equity indices in these two countries. The use of these signals for trades was giving superior market returns in these markets locally. This was important because the Coronavirus pandemic news flow was a major influence on the news flow.

In our insight on 20thApril 2020, we had noted that the divergence between sentiment on Corona related parameters and market performance is primarily influenced by Fed action and stimulus packages. While the Coronavirus pandemic continued to hit economy, the market was looking elsewhere. For several months, Coronavirus pandemic news flow and underlying sentiment remained a major factor in the direction of markets globally.

But, is it true anymore? Is Coronavirus pandemic still the driving force for the markets? Or the markets have moved on. Surely, the numbers are getting worse in several parts of the world such as Brazil and India. But the shock and disbelief are now gone. The markets don’t react as before to worsening statistics in many countries. Agreed, the fears for second wave a week ago had hit the Oil and broader markets, but the impact was much lesser in quantum and it was temporary as well.

Fig. 1: S&P 500 over last six months (Source: Google)

When we juxtapose this with news sentiment on Coronavirus pandemic, the change does not seem to drive the markets any more. Can it reverse and can Coronavirus make a comeback or this victory is final for the markets? Only time will tell, but for the time being, it seems that Fed and other Central Banks have won a major battle. The jury is still out on whether the war is over but this is an important milestone nevertheless for Fed to be as rescuer of the last resort.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.