Dichotomy Between News and Reaction: Coronavirus Pandemic Getting worse, But Markets Getting Better

There are 6 things that we track continuously which we believe cover the market impact comprehensively. These are:

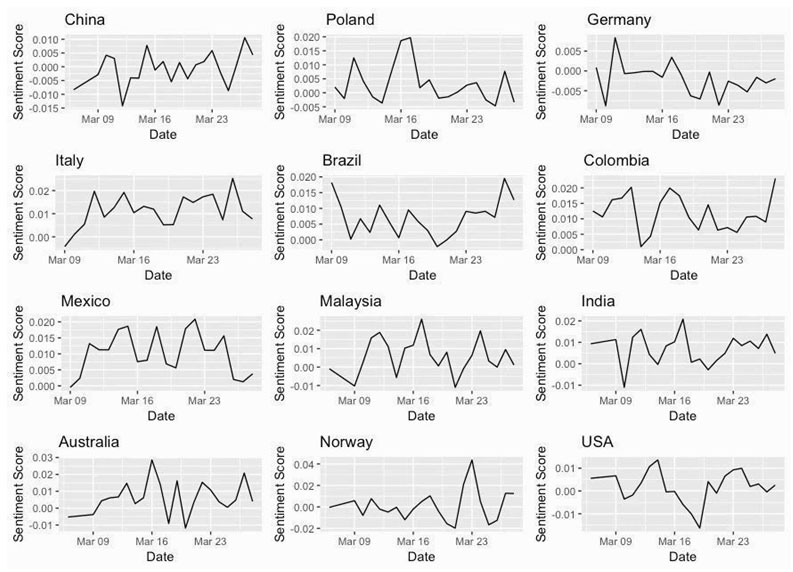

Coronavirus Country-by-Country Sentiment:

This is one of the most important charts because local market reaction depends much more on how Corona News Sentiment is evolving in that particular region or country. We track both English and local language news to track this sentiment.

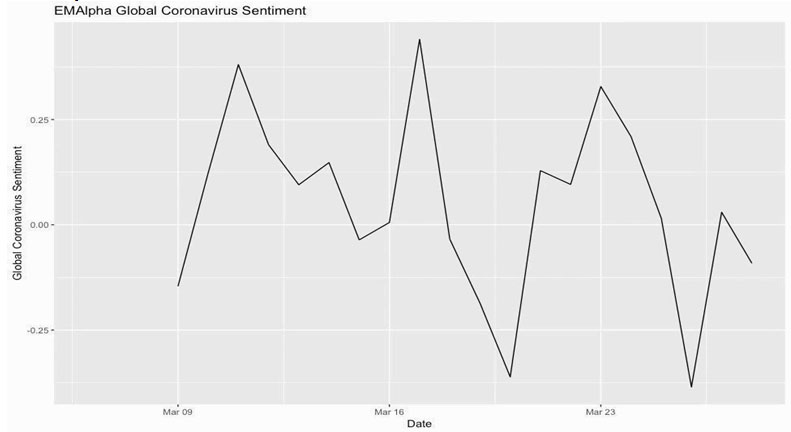

Global Coronavirus Sentiment:

The ebbs and flows of optimism and pessimism in global market sentiment on influence the growth of broad trends. The Global Coronavirus Sentiment helps make an educated assessment of how the global markets’ reactions might evolve.

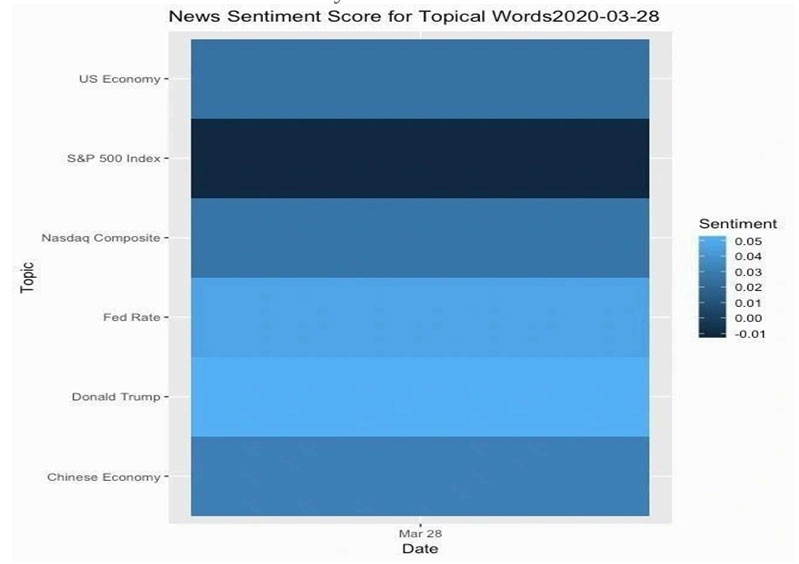

News Topic Sentiment:

Certain search terms help can help track news sentiments that can potentially evolve into major market themes. Current we track the terms “Donald Trump”, “Dow Jones Index”, “Fed Interest Rate”, “Nasdaq Composite”, “Chinese Economy” and “US Economy”.

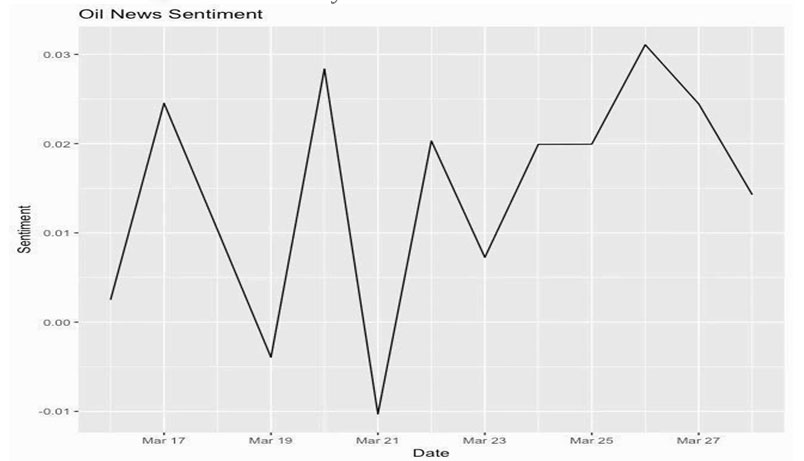

Crude Oil related News Sentiment:

Oil sentiment matters for any macro investor. One doesn’t have to look further than how a potential price war between Russia and Saudi Arabia sent shock waves for the global markets. Due to its importance, we track the oil sentiment as a separate standalone measure.

Coronavirus Sentiment Heat Map:

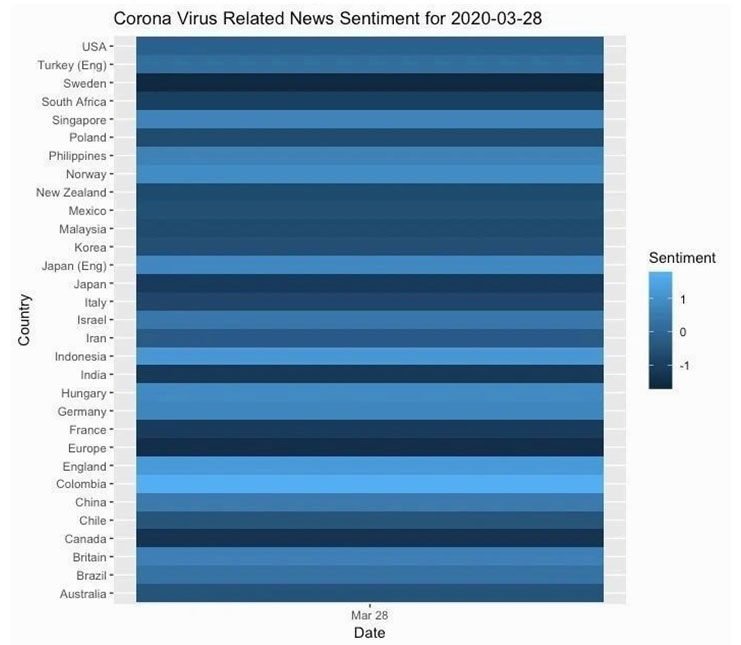

Just like most other things in life, relative scores matter much more than absolute scores in case of the Coronavirus news sentiment. When we do a country-by-country time series analysis for Coronavirus news sentiment, it is easier to see what is getting better and where the situation is deteriorating. This relative change on two scales, as compared to other countries and versus the immediate past, influence the market direction locally.

Coronavirus Numbers & Statistics:

These statistics help understand the gravity of the situation. Notwithstanding the massive stimulus by the United States Government, and the proactive stance of Central Banks across the world, the fundamental reason behind this crisis has not weakened. In fact, the statistics – as captured by the number of reported cases, or the growth rate of cases, or the per capita number of COVID-19 reports – keep getting worse. This implies that while the tug of war continues between government stimulus and the COVID-19 cases, volatility is here to stay.

Details and Inferences

With this context, the detailed discussion on these 6 measures is as follows.

Coronavirus Country Sentiment

The important takeaways;

- First the good news that there has been a marginal improvement in the US Corona sentiment. Though it is still not out of danger, there is some stability in the US sentiment score. This is mostly due to the $2.2 trillion stimulus bill signed last week. The other bright spots have been Germany, Norway and Colombia. There is marginal improvement in the sentiment score for Mexico as well.

- • But this is where the good news ends. Most other countries, such as Australia, Malaysia, India, Brazil, Poland and China, have shown further decline in news sentiment on Coronavirus. The most depressing news is from Italy. Despite being the worst affected country already, there is no sign absolutely that things are getting better here.

Fig. 1: Country by country sentiment score for select countries focusing on Coronavirus related news

EMAlpha Global Coronavirus Sentiment

The see-saw continues. After the sudden deterioration followed by a bit of recovery, things have started to go downhill once again. Global markets seemed be in a recovery phase last week. But on Friday, the US markets reflected the realization that Coronavirus is still not under control.

Fig. 2: A measure of the recent change in the Global News Sentiment for the Coronavirus

News Topic Sentiment

The news flow is not as negative on President Donald Trump as it was a few weeks ago. The sentiment is of optimism on steps taken by the Fed too. However, the bad news is from the markets. The sentiment score is negative for the stock market and the economy.

Fig. 3: News Sentiment for select topical search terms

Oil Sentiment

This is an interesting chart. The outlook for Oil is concerning on the basis of news flow sentiment. There are concerns on how much production the global markets can absorb and if we go by this prevailing sentiment, the demand is unlikely to pick up soon. That is bad news for Crude Oil prices too and that is bad news for the Global Markets. The only thing we can hope for is a turnaround in news sentiment but let us see how long that takes.

Fig. 4: Daily oil related News Sentiment

Coronavirus Sentiment Map

If you notice there is close connection between Fig 5 and Fig 1. But what is worrisome is the overall darker shade (more negative score as per the color code) of Fig 5. There are three important things to highlight here;

- Japan is still struggling and news sentiment remains negative on Coronavirus. Europe is also in the same category.

- One of the biggest sentiment declines in the recent days is from India as the number of Coronavirus cases increase.

- Overall, the differential in shades across countries has become narrower i.e. the news coverage indicates that Coronavirus is impacting everyone almost equally now (compared to previous few weeks).

Fig. 5: Coronavirus related News Sentiment Map. Updated daily.

Coronavirus Numbers & Statistics

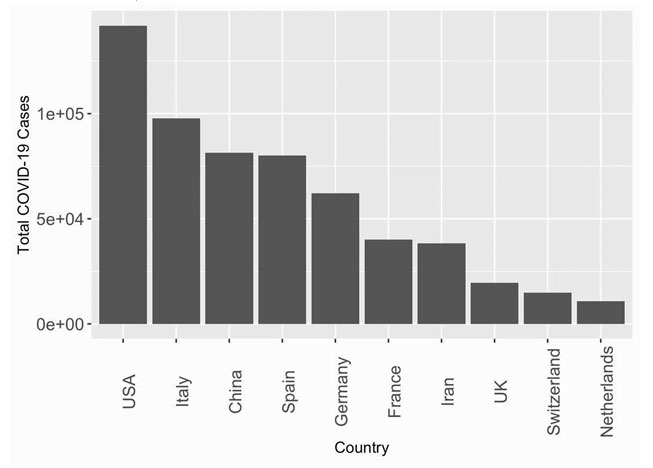

The numbers are increasing both for the reported cases and the number of deaths because of COVID. While the China COVID related new cases have decreased, numbers keep picking up in the rest of the world. It is interesting to see these numbers in different normalizations. First, looking at the top ten countries by the most reported number of cases, the US is now at the top. There has been a lot of negative news sentiment related to this.

Fig. 6: Top ten countries by the total number of reported Coronavirus COVID-19 cases.

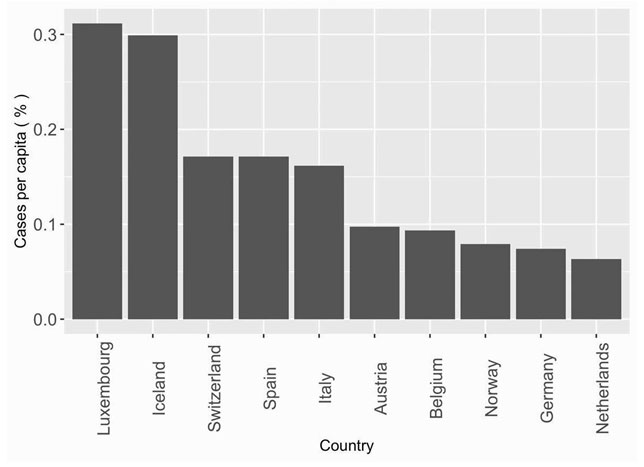

However, averaging the number of cases by the country’s population, and looking at the top ten countries by Coronavirus cases per capita, tells a different story. The US is not in the top ten list. We should point out that in showing these numbers we have applied a filter to include only those countries with more than 1000 reported cases.

Fig. 7: Top ten countries for Coronavirus reported cases per capita.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.