Coronavirus Pandemic, News Sentiment and Where the Markets Are Going?

In this insight, we focus on three interrelated ideas:

a) From the recent Coronavirus driven reaction of Global Markets, it has become quite clear that Sentiment is a dominant driver of investor behaviour. In an age when the speed of news dissemination is at its peak, Market Sentiment requires careful consideration by investors.

b) The initial reaction of the markets to global shocks tends to be somewhat broad based as all markets react to the same overall shock. But as events evolve, local news flow sentiment also starts playing a significant role. High-profile cases lead to further deterioration in sentiment and more negative market reaction.

c) It is possible to use a systematic approach and use quantitative measures of sentiment to make investment decisions and, more importantly, this can lead to outperformance versus the broader market. The EMAlpha emerging markets model portfolio performance, focusing on India, has delivered significantly better returns versus the market index. More volatility has also meant more divergence.

Coronavirus, Sentiment and Markets

Over the last few weeks, Coronavirus has led to a worldwide scare. As of now, the death toll has already surpassed 10,000 and the number of infections worldwide has already reached 300,000. What makes matters worse is that the total number of confirmed cases may only be a small percentage of actual infections. As expected, this is affecting the global markets as well. There are several important aspects of how markets have reacted to these developments.

The first is that virus attacks are very much like terrorist attacks, they generate more coverage than other events with similar or even higher impact. The second is that the maximum negative impact has been outside China because of tough control measures in the country of origin for this virus. The third aspect is that sentiment plays a much more important role than the tangible impact of material developments. Whether the impact of Coronavirus is noise or signal or a bit of both, the related sentiment matters much more for markets.

We have been collecting Coronavirus related targeted news flow in a variety of languages. For a number of emerging market countries, most of the news flow is in local language and, hence, we focus on news collection in both the local language and in English. We then use natural language processing tools to extract the sentiment for each country. While this insight focuses on Coronavirus, the same tools can be applied to any topic to extract the related topic sentiment.

Phase 1: 10th January – 9th February

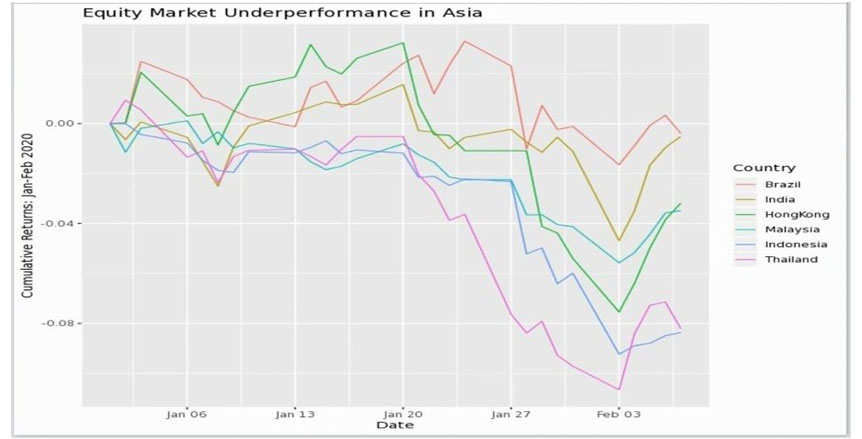

Till the second week of February, the impact on the markets had a local component as Asian markets close to China suffered more than the others and geographically distant markets remained shielded. Between 10th January and 9th February, as shown by the EMAlpha Sentiment Score, while the most severe Coronavirus cases were in its country of origin, China, the maximum market impact was felt in smaller neighboring countries, like Thailand. Fig. 1 shows the performance of equity markets in a few countries during this period, the behavior of equity markets was related to the number of Coronavirus cases.

Fig. 1: Equity Market performance (cumulative returns of stock indices) Jan-Feb 2020.

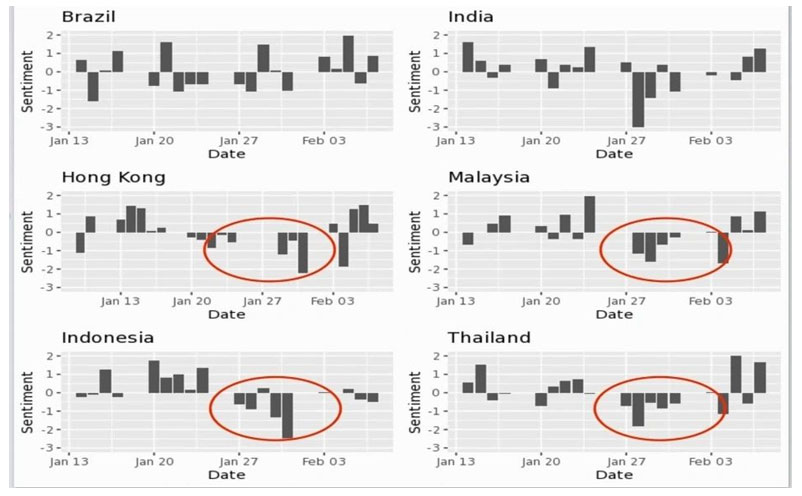

The following Fig. 2 shows the EMAlpha Sentiment Score for these countries during the same period (from mid-January till mid-February). The Sentiment Scores show a clear relationship between sentiment and market performance. For most countries, the Sentiment Scores went into negative territory, owing to the Coronavirus news flow over the last ten days of January. Geographical distance played a role as illustrated here by Brazil. Fig. 2 shows that the Brazilian sentiment was somewhat ok compared to the Asian countries. On the other hand, the sentiment for Thailand, Indonesia, Malaysia and Hong Kong stayed quite depressed during the Jan 20th – Jan 31st period.

Fig.2: Equity Market Sentiment (EMAlpha Sentiment Score) Jan-Feb 2020. Of the countries shown, Thailand saw the most depressed sentiment score during the same period when its equity market fell sharply. Brazil’s sentiment score was more contained and so was its stock index.

Phase 2: 10th February – 2nd March

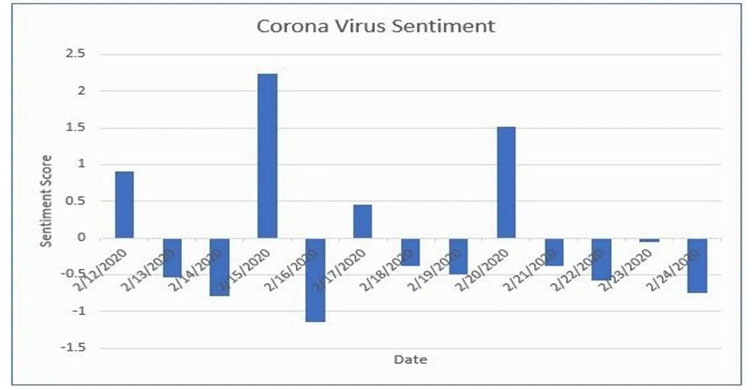

The next phase came from mid-February to February-end. The market impact became more global as sentiment turned more negative across the globe, as captured in Fig. 3 which shows the EMAlpha Coronavirus Sentiment.

Fig. 3: Global Coronavirus related sentiment as measured by EMAlpha.

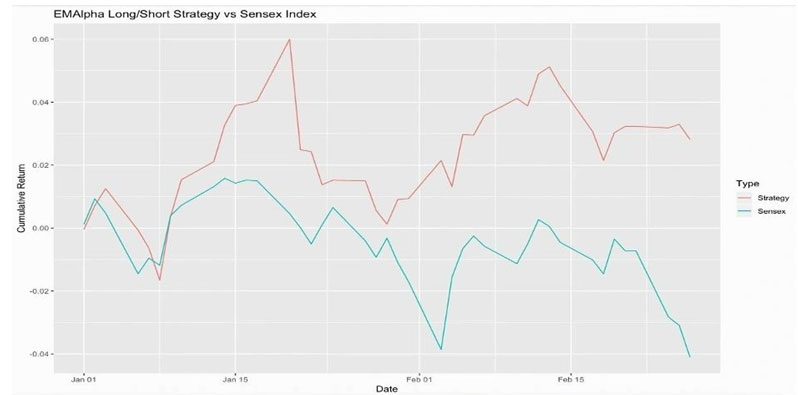

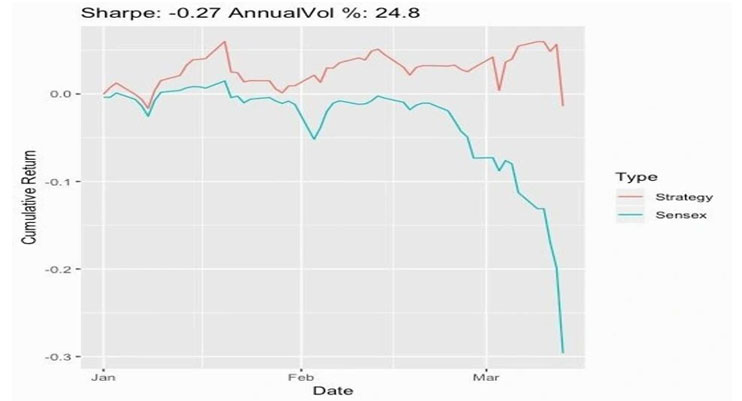

As reflected in the performance of the MSCI World Equity Index during this period, the negative sentiment directly fed the market capitulation. Both emerging and developed markets fell as Coronavirus spread in multiple regions beyond Asia – from Italy and Middle East to Brazil. It started to look more and more likely that the virus-related sentiment will drive the markets for some time. Market volatility spiked and a number of investment fund strategies started performing poorly against this backdrop. However, as EMAlpha monitored the market sentiment and used it as an input to its EM India strategy, the EMAlpha long/short model systematic equity strategy delivered +3% YTD return versus Sensex’s -4% YTD return. Fig. 4 shows the benchmark Sensex Index and the EMAlpha year-to-date returns. (https://emalpha.com/f/corona-virus-markets , 27th February 2020)

Fig. 4: Performance of the EMAlpha India Systematic Model Strategy and the Sensex Index on the 27th of February, 2020.

The Importance of Local News

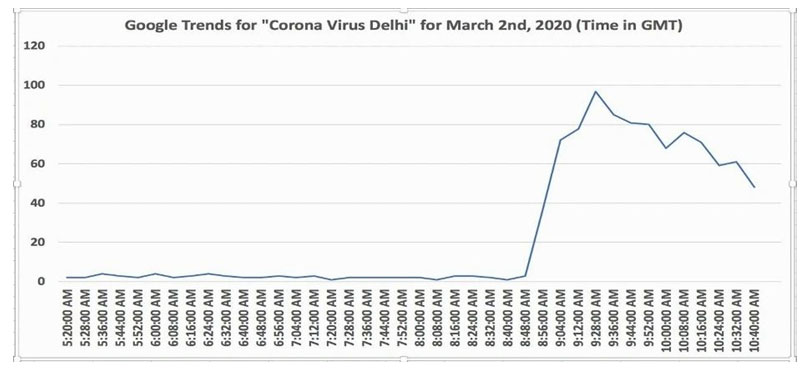

In the initial response, most markets reacted in a predictable negative fashion. But, this started changing from February end onwards. While markets from Japan to the USA and from China to Europe, were under severe pressure, the role of local news flow and resulting sentiment started playing a more prominent role at this point. There were specific examples of local sentiment leading to a divergence between the global and the local market behavior. The reaction of the Indian stock market on 2nd March illustrates this point. On the 27th of February, the US markets fell sharply, and the Asian markets followed suit on the 28th of February. The Indian stock market index, NIFTY 50, also fell and the decline in NIFTY 50 was amongst the ‘Top 5 Steepest’ over the previous decade with a fall of more than -3.5%. However, the trend reversed on Monday, the 2nd of March, morning. NIFTY 50, along with other Asian markets, was in a recovery phase, trading with a gain of +2.0% for most of the session. But all of this changed towards the end of the session. In the last 90 minutes, NIFTY 50 not only gave up all of its gains for the day but also closed -0.6% down. At one point, the NIFTY 50 was down more than -1.3%. Why did this happen? It turns out that a news item came out around 2 pm local time about two fresh cases of Coronavirus detected in India (Fig. 5).

Fig. 5: As shown by Google Trends results, news searches related to Coronavirus in India spiked. This led to Indian stock market’s negative performance while other Asian markets rallied

There was nothing else in the news which could have explained such a drastic fall in NIFTY and it wiped out all of the day’s recovery in a matter of an hour. After Coronavirus became a truly global worry, market to market performance was much more driven by local news flow and underlying sentiment related to local Coronavirus related developments. News flow started strongly impacting smaller emerging markets compared to developed markets because of the less diversified nature of local economies.

Phase 3: 3rd March – Present

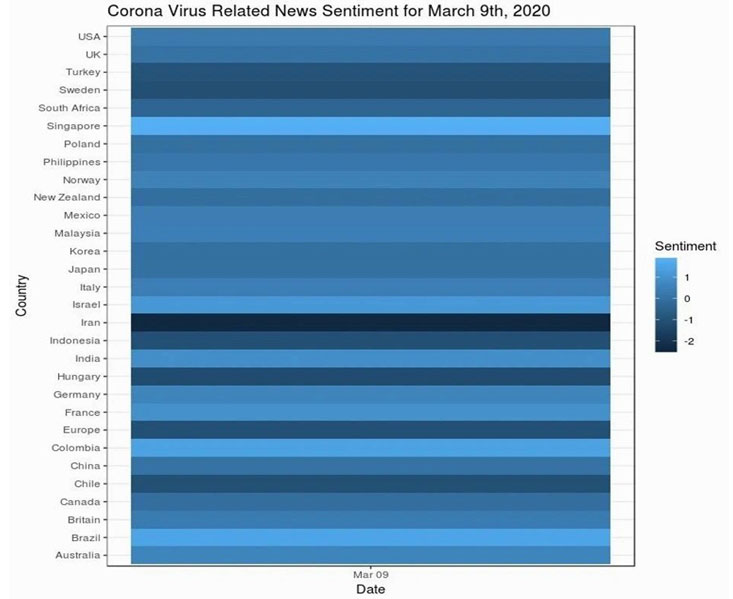

On March 9th, the VIX Index, a widely monitored gauge of market volatility, shot up to levels not seen since the subprime crisis almost ten years ago. While the immediate reason was the breakdown of oil negotiations between Russia and Saudi Arabia, the stage was already set for such a big market move by the recent developments in the spread of the Coronavirus. Fig. 6 shows the Coronavirus related news sentiment on March 9th for a number of countries.

Fig. 6: EMAlpha Coronavirus Sentiment Scores for March 9th, 2020.

A few interesting observations are in order before we discuss the country by country market impact of news and the underlying news sentiment shown in Fig. 6.

- The sentiment score is much more balanced (neither too bad nor too good) if the amount of news captured is reasonably large. This sounds intuitively correct as well. China is a good example of this. The score is not too negative because the news items are large in numbers.

- If most of the news is not local, the likelihood of a more negative sentiment score is higher. In the case of Iran, we clearly see this. Most of the news on Coronavirus for Iran came from sources which were not local.

- There are also cases where the news search for a country leads to the capture of news flow which doesn’t directly relate to the country. This influences the final sentiment score. When we do the searches for Turkey, the news flow is mostly about other countries such as Italy and USA. In fact the news flow is that so far there are no cases of Corona in Turkey. Still, the sentiment is negative.

- Political factors play a role. For example, during this period, the concern in the US was that President Trump was not dealing with the Corona problem earnestly. A large part of news flow was focused on this trend. It influenced the final sentiment score because negative developments tend to get more coverage.

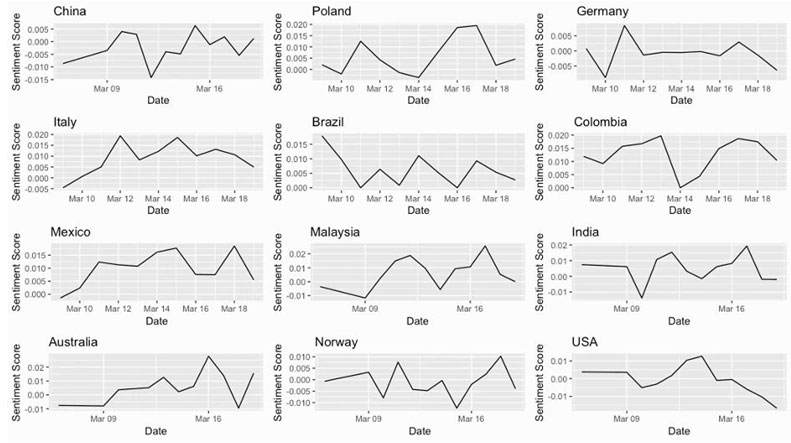

There are some clear takeaways on how the local country by country sentiment on Coronavirus news flow has evolved and how it is linked to the performance of local stock markets.

- On a time series basis for individual countries, one notices significant fluctuations in Coronavirus sentiment. In some cases (of which the USA is the most prominent), the news flow sentiment deteriorated rapidly.

- The same is the case with Canada for which the Coronavirus news flow sentiment deteriorated sharply. But the reasons were perhaps different than the US. In Canada, this could be because of a high-profile case of infection (the Prime Minister’s wife).

- The huge market volatility was linked with the rapid deterioration in Coronavirus related sentiment on one side and the efforts behind policy announcements on the other. If left to Coronavirus alone, things could have been much worse.

- India is an interesting case because after the ‘V’ shape recovery in sentiment, the news flow deteriorated but at a rate which was not rapid.

- The variance between countries on a day to day basis continues. For example, Japan was the country with the most negative sentiment on the basis of news flow for 14th March, while things looked much better for South Korea, Chile and Brazil.

All of this leads to the question: Can sentiment analysis be used to navigate market volatility? In our opinion, the answer is in the affirmative. As shown below, the EMAlpha model portfolio incorporating Coronavirus sentiment has done significantly better versus its benchmark BSE Sensex Index.

Fig. 7: Performance of the EMAlpha India Systematic Model Strategy and the Sensex Index on the 17th of March, 2020.

Coronavirus has had a severe impact on global health and the world economy. Are we anywhere close to the bottom? Is the worst over for the markets? For a number of developed and emerging countries, EMAlpha’s Coronavirus related Sentiment Scores continue to move lower. Assuming that these concerns will continue to be negative for the markets, a reasonable assumption for the present, the scores seem to indicate that the global markets may not stabilize any time soon (Fig. 8).

Fig. 8: Global Coronavirus related sentiment, 18th March, 2020.

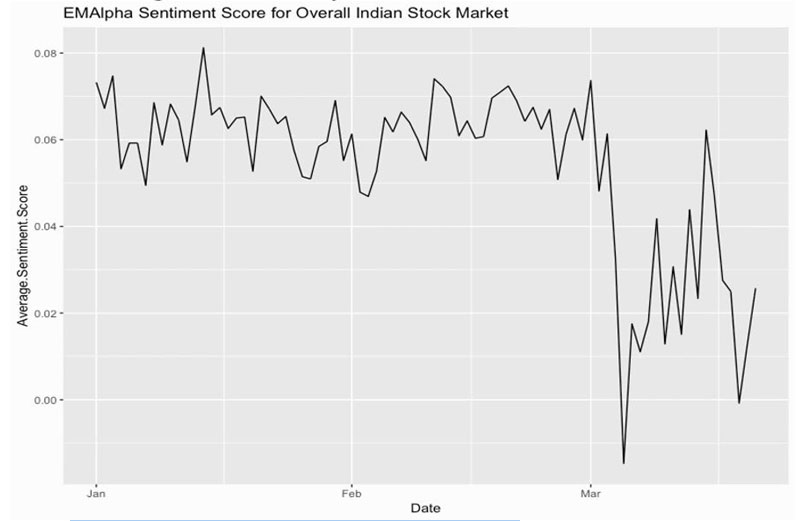

India’s markets continue to swing wildly and, as shown in Fig. 9, the important takeaway is that the cumulative market sentiment is still bearish which may not help in immediate market recovery.

Fig. 9: EMAlpha Sentiment Score for Indian Stock Market, 17th March, 2020.

The news flow sentiment has, as of yet, not bottomed universally as indicated by the country-by-country EMAlpha Sentiment Scores. This is the primary reason why we think time is not ripe yet for market re-entry. The world is currently in the ‘HEALTH EMERGENCY RESPONSE’ phase, and only when things stabilize here, is an assessment of ‘ECONOMIC DAMAGE’ even possible. This assessment is going to be a critical input for the extent and the timeline for possible recovery.

Research Team

EM Alpha LLC

For more EMAlphainsights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data on Emerging Markets for better investment decisions, please send us an email at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious.Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.