Coal India Limited: Unearthing its ESG problems

Synopsis: Coal India Limited (market capitalization Rs 903.8 bn or around USD 12 bn) is the premier coal mining company in India with the Government of India being its majority shareholder. Its Initial Public Offer (IPO) remains one of the largest primary fundraisings in India. But since then, the stock has been a massive wealth destroyer for investors. The company’s disappointing business performance is one of the reasons why the stock has been an underperformer. However, one of the bigger problems facing Coal India Limited is ESG and in recent times, it has been a big drag on the stock. Coal India Limited is at the top of the list of the largest emitters that have not yet disclosed their GHG emissions and its emissions are also much higher than other companies. Around 90% of Coal India Limited’s production comes from open cast mines and there have been several studies highlighting the adverse environmental impact of open cast mining. While it is the environmental issues that get highlighted much more, Coal India Limited has issues with Social and Governance factors too. EMAlpha takes a detailed look at the ESG performance of Coal India Limited in this insight.

Coal India Limited: The largest producer of coal in the world

Coal India Limited is the premier coal mining company in India. The Government of India is the majority shareholder in the company and it has been a stock exchange-listed entity since 2010. According to the company, Coal India Limited is the single largest coal producer in the world and one of the largest corporate employers with an employee count of 272,445 (as of 1st April 2020). Coal India Limited has 352 mines (as of 1st April 2020), out of which 158 are underground, 174 opencast, and 20 mixed mines. However, most of the production comes from opencast mines only (Opencast or Open-pit mining is a surface mining technique of extracting minerals from the earth by removing overburden).

Coal India Limited produces more than 80% of India’s overall coal production in India where approximately 57% of primary commercial energy is coal-dependent. Hence, the company meets almost 40% of primary commercial energy requirements in India. Since the Union Government allocates coal reserves to the company and they are not sold at market prices, Coal India Limited has a huge cost advantage. Coal India Limited supplies coal at prices discounted to international prices because of this reason.

During 2020-21 (for the financial year FY21), Coal India Limited produced 596.2 MT of coal which was around 1% lower than production in FY20. The decline was primarily due to Covid-19 related disruption, lower demand for coal because of impact on end consumers, and disruptions in the supply chain. In FY21, the revenue of Coal India Limited was Rs 900.26 bn (around USD 12.5 bn) and EBITDA was Rs 208.35 bn (around USD 2.8 bn). The company had an EPS of Rs 20.61 per share. The current market capitalization of Coal India Limited is Rs 903.8 bn or around USD 12 bn.

Coal India Limited: The perennial underperformer

Coal India Limited’s Initial Public Offer (IPO) remains one of the largest fundraisings in India. The company had raised Rs 152 bn through its IPO in October 2010. The issue price was Rs 245 a share. However, this company has been a massive wealth destroyer for the investors since then.

Figure 1: Coal India Limited stock price since listing

Source: Google

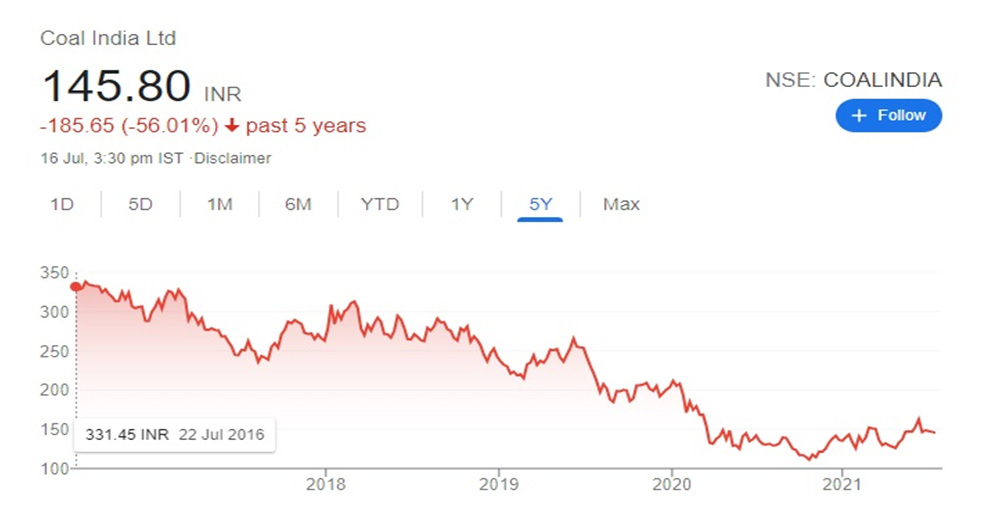

The stock price performance is even worse in the last five years’ timeframe. Coal India Limited has consistently disappointed investors and it has been one of the worst-performing stocks among index constituents.

Figure 2: Coal India Limited stock price over last five years

Source: Google

Coal India Limited’s massive ESG problem and stock price impact

Coal India Limited’s business performance has been disappointing and that is one of the reasons why the stock has been an underperformer. Apart from consistently missing production targets and its mine development plans, the company has also not done a great job on cost control. For a company that gets its resources for free as the mines get allotted to Coal India by the Government, Coal India has worked on a cost-plus model and the efficiency enhancement measures have not yielded desired results.

However, the ESG problem is much bigger for Coal India Ltd, and in recent times, that has been a big drag for the stock. There have been other factors involved but since late 2010 when it got listed, the stock price performance can be seen in two distinct phases: the first half (as shown in Figure 1) is when the business performance was more linked to stock price and the second half (as shown in Figure 2) when the ESG factors have played a big role.

There is, undoubtedly, a profound ESG movement going all over the globe right now. From countries to asset managers, from millennial investors to the old school stalwarts, everybody’s counting on the ESG chip for a better future and a better return on investment. The portfolio managers will need to ensure that their Assets Under Management (AUM) gets aligned with ESG benchmarks. This, as a result, has not been a great time for coal mining companies. Coal India Limited itself has not done a great job on ESG and has thus remained behind.

Environmental issues and Coal India Limited

According to The MSCI Net-Zero Tracker July 2021 edition, Coal India Limited is at the top of the list of The largest emitters that have not disclosed their greenhouse gas emissions, which shows the ten largest emitters based on MSCI emissions estimates that had not reported any of their greenhouse gas emissions as of May 31, 2021. What’s worse, Coal India Limited’s Total emissions (estimated in tonnes CO2e) is 1,020,007,692: almost five times larger than the next company on the list, SURGUTNEFTEGAZ PAO with 206,485,930. Interestingly, Coal India Limited’s emissions are higher than all the other nine companies combined which are as follows;

- COAL INDIA LIMITED – 1,020,007,692

- SURGUTNEFTEGAZ PAO – 206,485,930

- SHAANXI COAL INDUSTRY – 200,839,903

- CHINA STATE CONSTRUCTION ENGINEERING – 92,647,675

- SHAANXI COKING COAL GROUP – 82,534,966

- SDIC POWER HOLDINGS – 80,799,088

- PBF ENERGY – 77,406,962

- SHAANXI LUAN – 73,668,239

- GREENLAND HOLDINGS – 21,133,414

- ZHEJIANG CENTURY HUATONG GROUP – 5,384,905

Around 90% of Coal India Limited’s production comes from open cast mines. There have been several studies that highlight the adverse environmental impact of open cast mining. For example, Life cycle assessment of opencast coal mine production: a case study in Yimin mining area in China by Li Zhang, Jinman Wang, and Yu Feng says that opencast coal mining can lead to a large number of environmental problems, including air pollution, water pollution, and solid waste occupation.

There are other issues as well. For example, a few weeks ago, Coal India Limited Chairman and Managing Director Pramod Agarwal said that Coal transportation and evacuation causes far more damage to the environment as compared to coal production. Mr. Agarwal highlighted the company’s experience with lockdowns in India last year and said that during the last lockdown while the production was normal, there was reduced transportation and evacuation resulting in pollution decreasing substantially.

Social and Governance: No Less challenging

While it is the environmental issues that get highlighted much more, Coal India Limited has issues with Social and Governance factors too.

Social – During its production, transportation, and consumption, coal can cause significant damage to human health. It also has a serious negative impact on trees and crops. People living around mines and major consumption centers such as coal-based power areas face health issues due to the heavy concentration of small particles in the air. There have been higher than normal occurrences of breathing issues and diseases like Asthma.

There are also problems related to contract workers. Coal India Limited’s regular workforce has been declining as the company tries to control its massive fixed costs. Since the company is hiring more contract workers and these workers don’t get the same benefits as Coal India Limited’s regular full-time employees, there have been several reports on how these workers get exploited. From time to time, there have been incidents that highlight the pathetic working conditions for the contract workers employed by Coal India Limited.

Governance – Being a Government of India company, the chances of accounting frauds and other such misreporting practices are much lower, but that does not mean that governance is not an issue for Coal India Limited. The core issues are a lack of accountability, inefficient succession planning, and lack of continuity in the top management. For example, over the last ten years, Coal India Limited has not delivered even half of the annual production growth that it had committed to at the time of getting listed. The company keeps missing targets year after year on various performance measures.

There have also been cases of shareholder activism. Though the institutional investors understand that being a Government-owned company, Coal India Limited is being run with a deep ‘Social welfare’ motive, some investors have taken a more aggressive stance. For example, the UK-based hedge fund, The Children’s Investment Fund Management was a major critic of the government’s control in Coal India Limited’s functioning. The fund had bought 1.8% shares during the initial public offer in 2010 and after a bitter feud, completely exited in 2014. Primarily, TCI was critical of Coal India Limited’s decision to sell coal at subsidized rates to power companies under the fuel supply agreement.

Is Coal India Limited on a reform path on ESG?

Coal India Limited is trying to reform and has been aggressively talking about its ESG focus. For example, in its latest update released for FY20-21 performance, almost one-third of the presentation is dedicated to the company’s ESG initiatives. For example, Coal India Limited has highlighted in this presentation that for the Environment,

- Coal evacuation and FMC projects will help reduce air pollution and environmental impact.

- ~100mn trees planted since inception over 40,000 ha. Planted 1.98mn saplings in FY21.

- Mine closure plan is an integral part of the project report for Coal mines.

- All opencast mines have commissioned effluent treatment plants.

- To become Net-Zero, it proposes to execute Solar Projects to generate 3 GW of solar energy.

Similarly, there have been initiatives highlighted in Social and Governance areas. But they are hardly enough for an organization of the size of Coal India Limited. Also globally, coal companies have a major image problem and it’s difficult to eradicate that negative perception. The ESG focused institutional asset managers have a negative view of energy companies, in general, and that is unlikely to change any time soon.

While the environmental problem is the same for coal companies across the globe, the issue is more challenging for the companies which own more open cast mines. There are also social issues because of the serious impact on people’s health, who live close to the mines. The ESG situation becomes even more difficult for Coal India Limited on governance factors. All of these make Coal India Limited’s problems much more complex and challenging to getting resolved in the near term. This implies that the ESG impact on the stock price of Coal India Limited will continue to persist.

How EMAlpha can help Asset Managers

The popularity of ESG among asset managers and the cases like Coal India Limited shines a light on the colossal need of the hour: sector and industry-specific ESG disclosures. EMAlpha has long stressed the need to have sectorial related E, S, and G disclosures. As highlighted above, sustainability challenges vary from industry to industry. Thus it becomes imperative to gauge companies on sustainability metrics that are exclusive to the concerned industry. It is here that EMAlpha with its proprietary algorithm and AI-ML techniques becomes a key tool for the investors.

The recent developments in which ESG and asset managers had an interplay are very interesting and they have important lessons for the companies. These are also situations in which EMAlpha’s AI-ML analysis can help investors. For example, Can the local news flow collection pick up issues, earlier than the English media? Considering how important the Sustainability and ESG issues have become, the local language along with English news analysis can be tracked for the companies experiencing ESG issues.

Considering the sensitivities involved, especially when institutional investors have invested in the stock, the ESG issues could escalate quickly, thus impacting the stock price performance. In such cases, a regular analysis of social media (such as Reddit feed) can be used as input before taking an investment decision. Hence, EMAlpha’s analysis of unstructured data becomes a key tool for investors. The unstructured data analysis in other geographies can also be used to assess the potential impact on some of the larger companies.

The stock price performance of Coal India Limited over the last few years emphasizes the importance of ESG issues. It is also pertinent that predicting the behaviour of large institutional investors based on trading information can help forecast the stock price impact. This is one of the key features of the EMAlpha product as it combines technology with domain expertise. The news flow analysis provided by EMAlpha is useful in picking up the signals when the views change for institutional investors.

References

- Coal India Limited: About the company https://www.coalindia.in/about-us/ (Accessed on 16th July 2021)

- Coal India Limited production for FY21 https://www.coalindia.in/media/documents/Production.pdf (Accessed on 16th July 2021)

- Coal India Limited provisional reports https://www.coalindia.in/performance/physical/ (Accessed on 16th July 2021)

- Coal India Limited – Corporate presentation https://www.bseindia.com/xml-data/corpfiling/AttachHis/a585e151-1750-4e94-a740-05588aa6f25a.pdf (Accessed on 16th July 2021)

- Coal India Ltd. makes a spectacular debut https://www.thehindu.com/business/companies/Coal-India-makes-spectacular-debut/article15675697.ece (Accessed on 16th July 2021)

- The MSCI Net-Zero Tracker July 2021 – A quarterly gauge of progress by the world’s public companies toward curbing climate risk https://www.msci.com/documents/1296102/26195050/MSCI-Net-Zero-Tracker.pdf (Accessed on 16th July 2021)

- Life cycle assessment of opencast coal mine production: a case study in Yimin mining area in China https://pubmed.ncbi.nlm.nih.gov/29307072/ (Accessed on 16th July 2021)

- Coal transportation and not production causes maximum damage to the environment: Coal India LImited Chairman Pramod Agarwal https://energy.economictimes.indiatimes.com/news/coal/coal-transportation-and-not-production-causes-maximum-damage-to-the-envt-coal-india-chairman-pramod-agarwal/83801926 (Accessed on 16th July 2021)

- TCI brings bitter dispute to end, exits Coal India Limited https://www.financialexpress.com/archive/tci-brings-bitter-dispute-to-end-exits-coal-india/1299464/ (Accessed on 16th July 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.