Cia Hering and its Multiple Suitors: The Proof is in the Pudding

Synopsis: With stores closed and social distancing in place, Cia Hering, one of the oldest companies in Brazil but predominantly a brick-and-mortar based business model, was a beaten down stock, trading at more than 30% below its pre pandemic levels. But that was until Arezzo came up with a merger offer. From the outset, it was very likely that Cia Hering would refuse the offer, given its robust digital growth. And that’s exactly what happened. However, what was interesting was the stock price reaction. Following the news of refusal, Cia Hering’s stock gained 28% while Arezzo gained 8%. But there was further twist in the tale. On 26th April, Brazilian apparel retailer Grupo de Moda Soma announced that it was in exclusive talks to acquire Cia Hering in a cash and share deal. The announcement came after Hering had, earlier this month, rejected an unsolicited tie-up offer from competitor Arezzo. Immediately, the stock price reacted for Cia Hering. EMAlpha-AI caught up on the local news flow and did the analysis to understand the major stock price drivers and implications. There are some questions that are of importance to investors such as, a) What does rejection of Arezzo’s offer mean for a beaten down stock like Cia Hering?, b) When the refusal was on the expected lines, why was the stock price reaction so positive for both the stocks?, c) What changed all of a sudden that Cia Hering became interested in Grupo de Moda Soma’s offer? EMAlpha’s AI allows investors to take a good grasp of these questions, thus helping their investment making decisions. As such, this is a classic case when the companies experiencing temporary business troubles become an attractive acquisition target and also, most of the times, these companies resist any such attempts of mergers and acquisitions. But all of this creates massive opportunity for investment managers. The news flow can be scanned for more such potential opportunities and EMAlpha does that efficiently.

A Tale of Two Companies: Cia Hering and Arezzo

Cia Hering, a brand also known as “The Basic of Brazil”, is a leading textile and retail clothing company, with a legacy spanning more than 140 years. With more than 800 retail stores in operation, it is a no-brainer that the company has gone through some tough times owing to the pandemic. Many of its stores closed down, employees were let go, and its kids brand was discontinued as the pandemic raged through Brazil. Although covid did leave its mark on the company, the company’s bad times didn’t necessarily begin with Covid-19. In fact, for the past 8 years the company, in spite of having a business model with good returns and positive cash generation, didn’t see much growth in revenues. Some of the news flow picked up by EMAlpha highlights these points:

- Mar 05, 2020 – Hering saw a drop in 4th quarter earnings: company projects larger investments in 2020: Link

- Mar 23, 2020 – Cia Hering decides to close its own stores and recommends the same for the chain: Link

- May 13, 2020 – Stores still closed at Cia Hering, 750 layoffs: Link

- Sept 03, 2020 – Credit Suisse cuts Hering’s target from R$32 to R$24. Recommendation is neutral: Link

- Sept 21, 2020 – Hering announces closure of activities in Rio Grande do Norte: Link

While the past years didn’t see a growth in revenue, the company’s financials, like many similar companies around the world, hit a rock bottom in 2020.

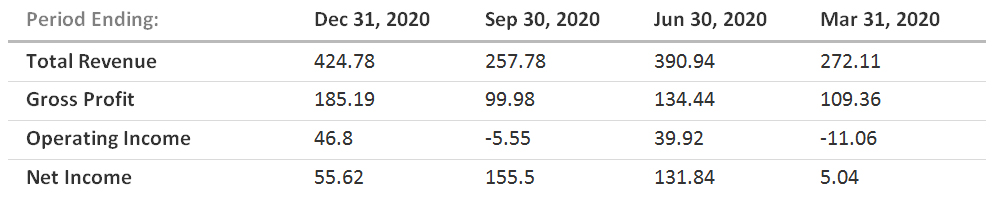

Figure 1- Income statement for 2020

Source- investing.com

The decline in net income for the period ending Dec 31, 2020 was attributed to reduction of net financial result of BRL 9 million, especially due to the lower interest rates and in addition to debt costs contracted in the first quarter of the year to form liquidity to go through the year in a smoother way, as detailed in the company’s earnings call: Link

As the pandemic swept through Brazil and social distancing norms were brought into place, Cia Hering started feeling the brunt. Its retail sales were the worst hit. Its stores were shut down for considerable amount of time last year, thus hampering the company’s revenue and profits.

Arezzo

Arezzo is a Brazil based company principally engaged in the footwear industry and specialising in the design, manufacture, development, molding and sale of women’s footwear, bags and accessories. While covid left its scar on many companies, Arezzo managed just fine in 2020, emerging relatively unscathed by making the necessary, big changes. Those adjustments, including putting its 6,000 store employees to work as digital sales associates, set it up for a strong start to 2021.

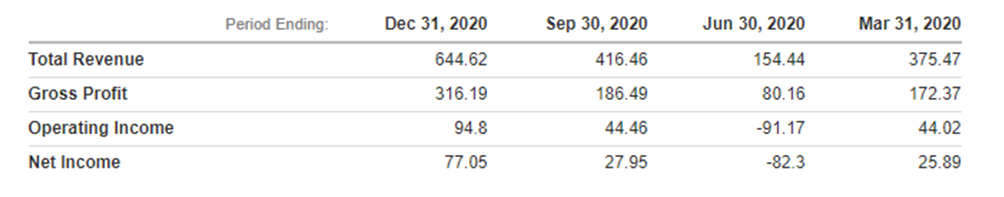

Figure 2: Income statement for 2020

Source- investing.com

As can be seen, Arezzo’s digital bet paid off. Its net income almost tripled for the period ending Dec 31, 2020. During the time, it also finished the acquisition of Rio based fashion group Reserva for 715BRD, the news of which was picked up by EMAlpha.

- Oct 23, 2020 – Arezzo (ARZZ3) announces purchase of the fashion group Reserva in operation of R $ 715 million: Link

Stock Price Movement

Figure 3 – Cia Hering Stock price comparison over the past one year

Source: Google

Figure 4 – Arezzo Stock price comparison over the past one year

Source: Google

As can be inferred from the figures above, while Cia Hering’s stock price showed erratic movement with uneven swings during the past year, Arezzo’s share price enjoyed a steady climb from March 2020’s lows.

Why the Discrepancy?

In spite of greater efforts to increase sales through digital channels, Cia Hering saw its net revenue drop 31% in 2020 compared to the previous year, given that 758 stores of the company were closed for several months in the wake of social isolation measures taken to contain the pandemic. Arezzo, on the other hand, which is more focused on women’s shoes, benefited from higher online sales, because of its swiftness in transforming the workforce into digital sales associates and influencers. It also benefited from exports with a drop in revenue of only 4%.

The two, it is worth mentioning, have recent trajectories that have followed opposite directions – until now when they finally meet. Years ago, Hering was worth R $ 7.5 billion and Arezzo was R $ 3.2 billion. Today, the situation has reversed: Arezzo is worth R $ 7.3 billion, while Hering is worth R $ 2.7 billion, considering 14th April 2021’s closing prices.

Arezzo made an offer that Hering refused

In October 2020, Arezzo made a move to acquire Rio based fashion group Reserva, a premium men’s clothing brand, for R $715 million. With this, in addition to footwear and bags, the Arezzo & Co group would start selling men’s, women’s and children’s fashion items, including clothing and accessories, with the possibility of expanding the company’s addressable market 3.5 times.

- Arezzo (ARZZ3) announces purchase of the fashion group Reserva in operation of R $ 715 million: Link

With this acquisition, Arezzo made its lofty ambitions to be a top player in the clothing segment, quite clear. And what better way to further feed the beast than by going after an industry leader, currently beaten down and trading at more than 30% below pre-pandemic levels.

- Hering returns to the spotlight after denying merger with Arezzo: what are the possible ways for companies: Link

The Offer and the Refusal

Figure 5- Cia Hering’s stock price from March 14, 2020-April 14, 2020

Source: Google

As can be seen from the above figure, the share price of Hering was trading flat for a month, closing at 17.1 BRL on 14th April 2021. But then Cia Hering disclosed on 14th April that it had rejected Arezzo’s unsolicited merger offer as the offer didn’t meet the interests of shareholders and the company itself.

- Cia Hering refuses Arezzo’s merger offer: Link

Figure 6- Cia Hering’s stock price rises following news of Arezzo’s failed merger offer

Source: Google

Following the news, Cia Hering’s stock touched a high of 22.36 BRL on the 15th of April, registering more than 28% gains within a day.

News flow captured by EMALpha-AI:

- Cia Hering shoots more than 28% after rejecting Arezzo’s offer: Link

- Ibovespa flirts with 121000 points, Hering fires: Link

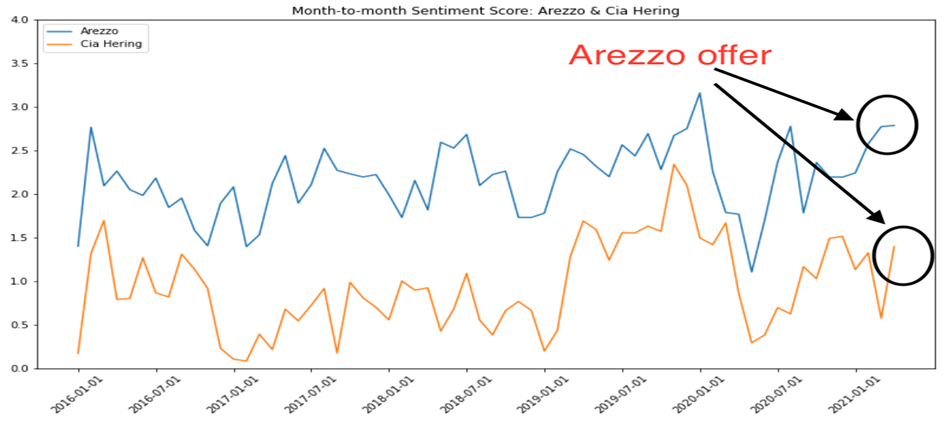

Figure 7 – EMAlpha AI captured local news sentiment scores for Arezzo and Cia Hering

Source: EMAlpha AI

Local news sentiment

Figure 6 shows the local language news (in Portuguese) based sentiment scores for Arezzo and Cia Hering over a 5 year period, from 2016 to 2021. What is not shown in the figure is the English news based sentiment scores for the two companies, which isn’t very informative due to very low information content in English news media for Brazil. Cia Hering’s score tends to be volatile and comparatively bearish due to the company’s struggles over this time period. In comparison, the sentiment for Arezzo has been strong and less volatile. The last data points in the two sentiment time series show the month of April. This is when Arezzo made its offer. As one can see, the sentiment for Cia Hering immediately shot up, in line with the price action. However, the sentiment for Arezzo was somewhat contained, again in line with its own price action.

Why did Hering refuse Arezzo’s offer?

It’s clear that while Arezzo came out pretty much unscathed from the pandemic, Hering on the other hand, wasn’t as fortunate. Its sales had dropped along with revenue and net income. And furthermore it was trading at more than 30% below its pre-pandemic levels. And moreover, Arezzo had overtaken it in terms of market cap and that too by a good margin. Why then would Hering refuse Arezzo’s offer? EMAlpha took a deep dive into the situation:

On March 03, 2021 Cia Hering released their 4Q20 earnings report. Their profit had dropped 12% for the same period as compared to the previous year. The company also announced an investment of 131 million real in 2021, touting it as its “largest investment in history”. The funds would be used in technology, systems restructuring, digital platforms and modernization of the industrial and logistics park.

The retail sector is undergoing a profound transformation, with measures of social isolation encouraging the performance of better structured e-commerce operations in the country. According to Cia Hering, the company aims to “revise its matrix of suppliers and modernize the production process to consolidate an agile and integrated chain with expanded use of data and technology”, in order to reduce the time of arrival at the launch stores and improve the supply of stores.

According to the company, while the sale of physical stores fell 11.6% in the quarter, to 115.6 million reais, sales of the online channel rose 230.6%, to 70.7 million. The company’s Executive director of Business Thiago Hering in the con call stated, “We also had our journey to expand the contact points with the customer, changing the statics of our platform, the look and feel, both on our website and our social media accounts and also with the launch of our app in November which had 38,000 downloads in the first 30 days with an exponential growth in its share in our total sales.”

The digital transition undertaken by Cia Hering has been in the news over the past year:

- August 14, 2020 – Cia Hering believes in more growth of e-commerce after the pandemic: Link

- March 05, 2021 – Hering’s e-commerce grows 230.6% in 4Q20: Link

It is clear from the above points that in spite of the losses incurred, Cia Hering sees value in its digital transformation journey. It wants to remain focused on its digital transformation journey and see to it that it reaches its meaningful destination. As such the offer that was put forward by Arezzo wasn’t good enough for them to negotiate and they rejected the proposal.

On Arezzo’s part, they did nothing wrong. After all they struck when the iron was hot. Considering the value of Hering’s asset and the low price that it currently is trading in, Arezzo took the right initiative with their offer.

Why did the stock price move so much?

Cia Hering was trading at a big discount to its pre-pandemic levels. The stock was a beaten down stock, with the company reporting dismal earnings. As such, interest shown by a peer in merging with the company lit up investor’s sentiment. Arezzo’s proposal showed that there is still great value in Hering, in spite of the pandemic’s toll. That’s what propelled the share price of Cia Hering to such levels. Some of the important news flow on this is given below;

- Hering returns to the spotlight after denying merger with Arezzo: Link

- Together Cia Hering and Arezzo gain R$1.4 billion in market value in one day: Link

- Arezzo has money to spend and wants to grow. Is buying Hering worth it: Link

The three scenarios that could play out now

After Cia Hering refused Arezzo’s offer, we were expecting these three possibilities;

- Arezzo would try again with a bigger offer on the table. However since Cia Hering had refused the offer once, it wasn’t certain if they would entertain the offer even if it was at a better and more attractive price.

- Considering the interest shown in Hering, there was a possibility that a foreign player, like Zara, could enter the market and propose an M&A with Cia Hering. It is clear that Hering is a highly sought after asset.

- For the time being, there would be truce and no further acquisition offers.

The latest in the Cia Hering saga

On 26th April, Brazilian apparel retailer Grupo de Moda Soma announced that it is in exclusive talks to acquire Cia Hering in a cash and share deal. The deal values Hering at 5.3 billion reais ($969.7 million), with a premium of 43.5% over 23rd April (Friday) closing share price. The announcement comes after Hering earlier this month rejected an unsolicited tie-up offer from competitor Arezzo.

- Brazil’s Grupo Soma in exclusive talks to acquire Cia Hering: Link

- Brazil’s Soma in talks to acquire Cia Hering: Link

- Brazil’s Soma in talks to acquire Cia Hering for $967 million: Link

The Friday (23rd April) closing was 22.62 BRL for Cia Hering and the stock opened at 30.00 BRL on Monday morning, up 32.6%. This price was still at a discount to what Soma was ready to pay. But what happened afterwards is even more interesting. The stock price has steadily declined and as we write this (4pm GMT, 28th April 2021), the stock price is down 11% from its Monday peak. Are there any hiccups expected? At least the stock price is telling us that.

Figure 8 – Cia Hering Stock Price Reaction

Source: Google

How EMAlpha can help in some of these situations?

The rapid developments as captured in the news flow and conflicting viewpoints on such events is an opportunity for investment managers. The EMAlpha’s offering is centred around addressing some of these very critical issues as follows;

- The companies experiencing business troubles often become an attractive acquisition target and also, most of the times, they resist any incoming offers. The news flow can be scanned for more such potential opportunities and EMAlpha does that efficiently.

- Because the local news flow collection picks up issues earlier than the English media, it is very useful to do regular analysis of social media and use it as an input before taking an investment decision. It is here that EMAlpha’s analysis of unstructured data becomes a much-needed tool for investors to spot these trends quickly.

- The local language along with English news analysis can be tracked for the companies experiencing business issues. For countries like Brazil, most local news flow is in the local language and a multilingual NLP approach helps find intelligence. The unstructured data analysis in other geographies can also be used to assess potential impact on other geographies.

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.