Brazil’s ESG Track Record: A Case Study on Structural Issues

Synopsis: The recent news of Brazil’s Supreme Court ordering investigation into Environment Minister Ricardo Salles, targeting a timber-trafficking ring allegedly involving him and other top officials in President Jair Bolsonaro’s government is the latest chapter in the problems plaguing Brazil when it comes to ESG. Be it the unprecedented destruction of Amazon rainforests and the alleged attempts of a cover-up or the failure of Brazilian start-up eco-system to include black founders, the lack of progress towards equality and sustainability could very well be a turn-off for international investors looking at Brazil. While it is well known that the Environmental (E) factor in ESG is the most scrutinised, investors have also started looking at Social (S) and Governance (G) factors before signing the cheque. EMAlpha, with its proprietary algorithm and technology helps investors analyse E, S and G scores separately and more transparently, thus benefitting investors who are looking to invest in Emerging Markets like Brazil.

The Government’s actions spoke softer than words

During the recently held climate change summit convened by US President Joe Biden, Brazil’s President Jair Bolsonaro pledged to end illegal deforestation in the country by 2030 and achieve carbon neutrality by 2050. Some joked that Bolsonaro’s understanding of ending illegal deforestation meant completely destroying the entire Amazon rainforest by 2030. It is well documented that the deforestation of Amazon has surged to its highest in more than a decade under Bolsonaro, who also has in the past famously threatened to pull out of Paris climate agreement. It thus didn’t come as a surprise, when Bolsonaro, less than 24 hours after the summit, slashed the environmental spending by more than 20% in contradiction to his pledge of doubling the budget for environmental enforcement. It hence becomes imperative for observers to raise questions regarding Brazil’s seriousness towards combating climate change, deforestation and various other environment related issues.

Where does Brazil stand on ESG

It is an irony that Brazil is one of the countries that most uses clean energy in the world, with 82% of its energy matrix being obtained from its hydroelectric plants, while at the same time it has to constantly deal with Amazon’s deforestation challenges. However, the other view on dominance of hydroelectric power may be more related with the geography of the country rather than the intent to protect environment. Because of abundant hydro resources and their suitable location for development, these sites could be easily used for setting up hydropower plants, thus giving Brazil its required clean energy.

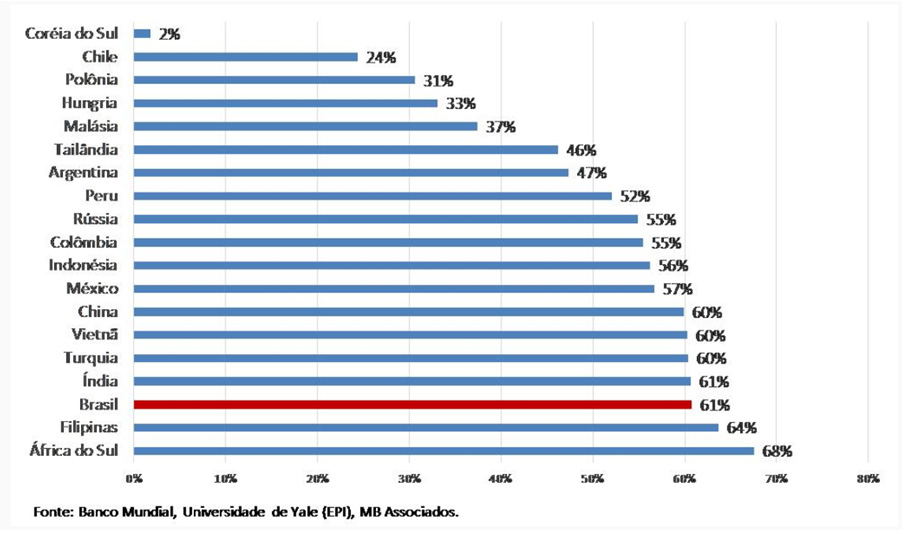

However, the broader track record, specifically on Environmental issues and on the ESG and Sustainability matters in general, isn’t that great for Brazil. For example, according to an exclusive survey of 19 countries by MB Associados that took into account criteria like environmental, social and governance, Brazil ranked as the third-worst country, with a score of 60% (the closer to 100%, the worse). Only the Philippines and South Africa performed worse, while South Korea (2%) and Chile (24%) were at the top.

Figure 1: Survey of 19 countries based on E, S and G

Source: MB Associados

The list highlights the ESG criteria (Environment, Social and Governance, in its acronym in English) and uses as criteria the environmental ranking of Yale University in the United States, the Gini index (an inequality meter), and World Bank data to map governance indicators such as political stability, government efficiency, and corruption control. While it is possible to question how these generic surveys and ESG assessments will be able to consider the local factors, they are still useful as one of the inputs.

As EMAlpha always advocates that a broad brush ESG rating is much less useful for investors than granular details on E, S and G, it is important to look at the scores separately on Environmental, Social and Governance parameters. To understand more on this, please refer to our previous insights What is cooking in South Korea on ESG? and Is China getting rewarded by Sustainability-focused Global Investors for its progress on Environmental Issues? In terms of social and governance criteria, Brazil scored even worse in this survey, with 71% and 72% in these indicators, respectively. The country is only doing relatively better in compliance with environmental rules, with a score of 39%.

The Environment Conundrum

As mentioned earlier, Brazil derives 82% of its energy from clean sources which is one of the highest in the world. But nonetheless, it faces an immediate and dire threat when it comes to protecting the Amazon eco-system. Labelled as the “lungs of the world”, the Amazon rain forest, is being eaten away by illegal logging, mining and agribusiness. There have been reports of intentional burning of Amazon forests by vested businessmen to make way for agricultural land in order to produce meat. Case in point being, JBS, the world’s biggest meat company, which was alleged to have been buying cattle from indirect suppliers linked to serious environmental offences, deforestation and other crimes in the Amazon, four times in just over a year. Link

The latest entrant in the growing saga of Amazon rainforest exploitation happens to be Brazil’s environment minister Ricardo Salles. After Brazil’s Supreme Court ordered an investigation, police raided ministry offices, targeting a timber-trafficking ring allegedly involving Ricardo Salles and other top officials in President Jair Bolsonaro’s government. Following this, the Supreme Court suspended 10 officials from their posts and that included Eduardo Bim, the Head of the Brazilian environmental protection agency IBAMA. Link

It is clear that Brazil’s environmental issues run deep and these issues, in some way or the other, seem to stem from the big corporates and the government itself.

The Social Hurdle

Brazil, like other countries, is mostly scrutinised internationally on the Environment aspect. Domestically, however, many investors have started taking into account the Social aspect as well. Even though black or mixed-race Brazilians account for more than half of Brazil’s population, they occupy less than 5% of executive positions and 5% of seats as Directors on company boards. Though officially, the Brazilian companies have started taking steps to improving relations with local communities, there is still a very long way to go. And with a history of racism against the black population, it makes diversity initiatives all the more relevant.

In a study produced by Sao Paulo based innovator hub and accelerator BlackRocks in partnership with global consulting firm Bain & Company, it was found that Brazilian start-up eco-system failed to include black founders due to a set of practices currently in place. The study highlighted that racial diversity in the eco-system was non-existent or far from ideal. The worst part is that some of these issues have been around for a very long time. For example, an issue identified in the report is the lack of diversity in the teams selecting investment opportunities in Brazil. According to the survey, almost three-fourth of the teams focused on start-up investments employ only white professionals. Link

The Governance Glitch

Majority of Brazil’s environmental woes seem to emanate from within the offices of the government itself. The recent probe into the Environment Minister’s timber trafficking related claims highlights this well. Apart from that, the rampant deforestation of Amazon rainforest by illegal loggers and ranchers, who happen to be among President Bolsonaro’s staunchest supporters, does put a question mark on the government’s willingness to counter environmental issues.

The Issue of Greenwashing

When it comes to ESG measurement, Brazil is still in its infancy and has a long way to go. Lack of investor’s knowledge on the subject doesn’t help the situation as well. For many investors in Brazil, ESG corresponds to exclusion of arms companies. A few companies are taking advantage of this ignorance and trumpeting themselves as “green” when in truth, they are not.

For example Via Varejo, a Brazilian retailer, recently issued “Sustainable bond” to raise up to $180 million with commitment to increase use of renewables in their operations. This was seen as insufficient and inadequate because commitment to increasing use of renewables in a sector that isn’t very energy intensive while wanting to come out with a ‘sustainable’ label doesn’t make the company appear serious about ESG. Instead Via Varejo, if it really cared about ESG, could have committed to packaging recycling goals while measuring and cutting the intensity of greenhouse gas emissions when it came to deliveries. That’s because electricity isn’t the main environmental issue facing a retailer, packaging is. Link

Are Brazilian Institutions Stepping Up The Sustainability Standards?

While there is no doubt that Brazil hasn’t been an ideal ambassador of ESG, there are a few institutions within the country that have realised its importance and are taking the necessary steps to bring about changes required for economic growth as well as environmental and societal serenity.

On December 7, 2020, the Brazilian Securities and Exchange Commission (CVM) launched a consultation on proposed amendments to Normative Ruling 480/2009 aimed at, inter alia, increasing transparency by improving the quality of information disclosed by publicly-held companies on ESG aspects. Link

On April 26, 2021, the Central Bank of Brazil (BCB) launched a new public consultation (No. 86/2021, the “Consultation”) on a proposed regulation for mandatory disclosure of social, environmental, and climate risks by financial institutions. Climate-related risks must be disclosed in accordance with the TCFD Recommendations (“Recommendations”), including both physical and transition risks. As for environmental and social risks, the Consultation indicates that disclosure must be aligned with ESG criteria. Link

Earlier in the year, Brazil’s lower house approved a new regulatory framework for the natural gas sector, which although is not entirely clean but is better than fossil fuel. Under the bill, companies interested in distribution will need a simple authorization rather than a more complex concession contract. Link

How are Brazil’s Companies progressing on ESG?

As has been mentioned, Brazil is still in its nascent stage when it comes to ESG standards. The rules aren’t clear as of now and this is what is enabling many “non-green” companies to label themselves as “green”. It is on account of this ambiguity that state run oil giant Petrobras (that has been charged with corruption and numerous oil spills) finds a spot in “Carbon Efficient” index, run by B3, Brazil’s sole exchange operator.

Then there is the “Corporate Sustainability” index, also run by B3, which includes JBS, the world’s largest meatpacker which has been dubbed “Amazon destroyer” by environmentalists for failing to ensure its supply chain remains free from cattle that have been raised on deforested land. Then you have got Vale SA, a mining company, which was involved in two of the worst environment disasters in the history of Brazil: The January 2019 Brumadinho dam collapse and 2015 rupturing of Mariana dam.

While it may appear that ESG in Brazil is like an Arab in the ocean, the situation isn’t as dire as it seems. If there are companies that don’t have any real ESG merits, there are also companies that have met international criteria for environmental performance and sustainability:

Natura & Co, the cosmetics group, became the first public company to be accredited by the B Corp, which evaluates a firm’s relationship with the environment, employees, customers and community. Link

Brazilian electronics and furniture retailer Magazine Luiza and its leadership decided to initiate a new program to hire only black Brazilians for key leadership positions in the company. The company’s chairman Luiza Trajano said in an interview that she launched the trainee program after realising that the company’s leadership was composed entirely of white Brazilians. Link

Pulp and paper company Suzano became the first Emerging Market corporate borrower to issue debt that included a financial penalty for missing a carbon emissions target. Link

When it comes to ESG, Brazil is still juggling between companies who are true champions of ESG and companies who are using ESG as a smoke screen. The companies who use ESG as a smoke screen continue to receive investments because even though they have ESG issues, they also have positives. These companies may be a good short term bet but the future could very well be ESG. And everyone wants the future. Nobody wants to invest in a company of yesteryears. Nobody wants to drive a car in the lane of the past.

How EMAlpha Can Help Investors

Brazil has the potential to be the leader of the global sustainable agenda and the awareness of the importance of ESG has already reached companies, society and the financial market. It would only take the political will and integrated action on the part of the government for this agenda to move forward effectively. It is here that EMAlpha can help investors looking at ESG as signposts for investments. EMAlpha’s proprietary algorithm generates E, S and G scores separately thus allowing transparency.

For ESG, when we talk about the Governance issues in EMs, the political patronage angle is talked about only in hush-hush tone and the Global Institutional Investors often need to figure that out on their own. That’s why tracking local news is so important for them to ensure that they can sense the difference between what the companies are reporting and what they are actually doing. For ESG, the AI-ML based monitoring system is extremely useful in tracking these events and that makes a big difference in portfolio performance.

References

- Reputation fears propel surge of ESG investment in Brazil (https://www.ft.com/content/7ac277f2-b0e7-4cd8-b60a-bdb03c7092f4)

- Brazil is late on the ESG agenda (https://www.spacemoney.com.br/entrevistas/brasil-esta-atrasado-na-agenda-esg-e-concorrentes-exploram-essa/165720/)

- Brazil is among worst in ranking of countries based on environmental, social and anti-corruption indicators (https://www1.folha.uol.com.br/internacional/en/world/2021/05/brazil-is-among-worst-in-ranking-of-countries-based-on-environmental-social-and-anti-corruption-indicators.shtml)

- The risks of not taking the ESG criteria seriously (https://exame.com/blog/sergio-vale/os-riscos-de-nao-se-levar-a-serio-os-criterios-esg/)

- Everything you need to know about the fires in the Amazon (https://www.theverge.com/2019/8/28/20836891/amazon-fires-brazil-bolsonaro-rainforest-deforestation-analysis-effects)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.