Amazon and ESG: Nondescript issue could boil up bad for the company

Synopsis: In 2019, Amazon, to bring more transparency to its brand, decided to release its carbon footprint stemming from its massive operations. In the same year, it also co-founded The Climate Pledge – a commitment to be net-zero carbon across all of its business by 2040. Both were noble initiatives. However, in its recently released 2020 sustainability report, the company has reported an increase in its carbon emissions over 2019 due to the business boom brought about by the pandemic. There was also a less publicized report of how Amazon’s employees’ 401(k) retirement funds were being invested in unsustainable activities such as the fossil fuel industry and military weapons industry. Amazon has to nip it in the bud when it comes to its carbon emissions and 401(k) disclosures if it has to champion sustainability values. Being a leader in many of the businesses Amazon is in, the company has more responsibility to move in the direction of sustainability. For asset managers, these issues are very important as ESG is increasingly getting factored in the stock price. With Jeff Bezos stepping down as the CEO of Amazon, it remains to be seen how the company will approach the major sustainability issues in the coming days. The recent ExxonMobil vs Engine No 1 case shows that even the giants can’t get leeway if they default on ESG. As such, for Amazon, it is necessary to address these issues.

Amazon: The Biggest of the Big

Coming out scathed yet striving, Amazon is one of the few success stories of the dot com bubble burst. With a market capitalization of US $ 1.8 trillion, Amazon has seen its riches manifold in the last 20 years. Growing from a book store to one of the largest e-commerce companies in the world, Amazon and Jeff Bezos are drawing a similar line as Alexander, the Great in terms of expansion. What’s more, Amazon’s successful transition to cloud computing with its AWS has ensured that the company stands up to the test of changing times. Its share price (as of 29th July 2021) was US $ 3599.92 and its P/E, at a staggering 68x. For a company of its size, the stakes are high and considering its track record, the market always expects more from such behemoths.

Fig 1: Amazon’s share price over the past 5 years

Source: Google

2019 Climate Pledge

Realizing the need to be sustainable in its business operations, in 2019, Amazon co-founded The Climate Pledge—a commitment to be net-zero carbon across all of its business by 2040. Since then the pledge already has had more than one hundred signatories, spread across 16 countries. For a company the size of Amazon (dubbed as the 2nd largest retailer on the planet), it is natural that there will be extra scrutiny on its environmental impact. Because of its fast shipping, packaging, and delivery logistics, Amazon has been criticized in the past for not taking care of its carbon footprint. As such its decision to start the Climate Pledge led many to believe that transparency would now be the company’s virtue. The signatories to the pledge had to agree to the following:

- Regular Reporting

- Carbon elimination

- Credible offsets

The climate pledge commitment isn’t legally binding and is more of a gentleman’s agreement. Following this, Amazon announced two funds: The Climate Pledge Fund and The Right Now Climate Fund to reduce carbon emissions, conserve forests, and all in all, support sustainability.

Appreciable steps towards sustainability

In its 2020 Sustainability Report, released in June 2021, Amazon revealed that it derived 65% of its power usage from renewables in 2020, up from 42% in 2019. It has around 232 solar and wind projects all across the globe. Regarding its plan to switch to electric vehicles for delivery purposes, Amazon deployed the first of the 1,00,000 electric vehicles that it had ordered from EV maker Rivian. The report also revealed Amazon’s multiple involvements in sustainable start-ups, funds, initiatives, etc.

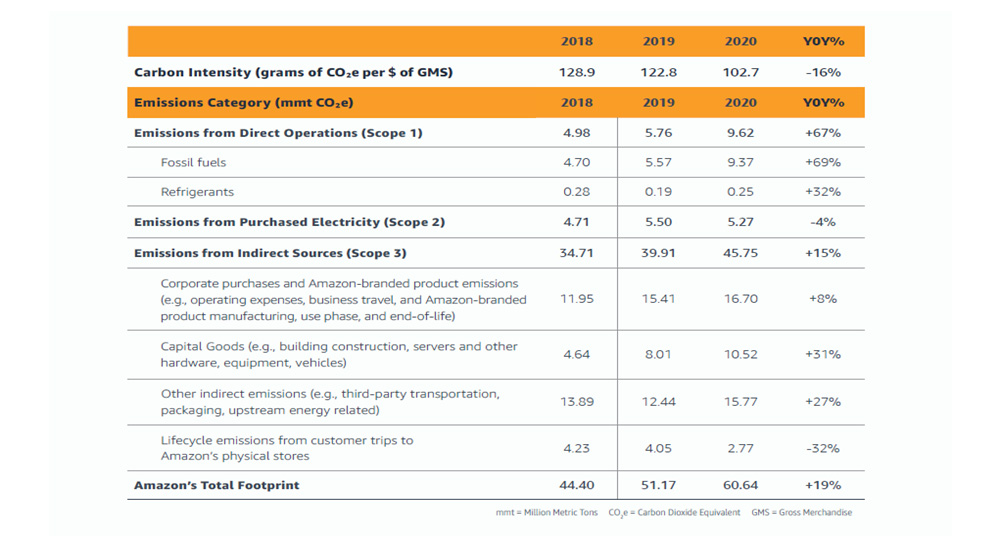

Figure 2: Amazon’s 2020 Sustainability Report

Source: Amazon Sustainability Report 2020

That the pandemic increased Amazon’s revenues and profits by a good margin is old news now. The company posted record revenue of US $ 386 billion in 2020. The new fact is that the increased revenues drove Amazon’s emissions higher. So while profits could be a cause of cheer for the company, the rising emissions sure don’t bode well with its nascent sustainability pledges.

As can be seen from Figure 2, Amazon’s absolute carbon emissions increased 19%, from 51.17 mmt CO₂e in 2019 to 60.64 mmt CO₂e in 2020. While this might be fodder for critics to claim that Amazon is putting profits over sustainability commitments, a careful look at the above table shows that Amazon’s carbon intensity decreased 16%, from 122.8 grams of CO₂e per dollar of GMS in 2019 to 102.7 grams of CO₂e per dollar of GMS in 2020. Carbon intensity is a metric that quantifies total carbon emissions, measured in grams of carbon dioxide equivalent, per dollar of gross merchandise sales. It essentially measures the amount of carbon dioxide emitted for every dollar earned in revenue. In simple terms, carbon intensity is the classic “good penny worth”. So a reduction in carbon intensity means that Amazon is emitting less greenhouse gas for each dollar it earns.

Amazon also mentions in the report that “We will continue to rapidly scale our investments in carbon reduction solutions that have large, long-term impacts that will move us forward on our path to net-zero carbon by 2040”.

Amazon 401k: The pebble in the shoe

While the Sustainability Report is very wide, precise, and neatly structured, news emerged in recent days that while Jeff Bezos public stand on sustainability is commendable, Amazon employees may be unaware that the retirement money that is being saved in their employee 401(k) plan is being invested in the very companies that are contributing most heavily to climate change. On the first read, this may not mean much. But if unaddressed, this could potentially boil up into a PR crisis for Amazon.

As You Sow, a non-profit foundation chartered to promote corporate social responsibility released a corporate 401(k) sustainability scorecard grading companies on their retirement plan investments. For Amazon, it found that 52% of plan assets were invested in Vanguard Target Retirement Funds Series, which was the default option. The fund has significant investments in weapons companies. The report further showed that Amazon’s retirement plans had millions of dollars invested in fossil fuels and deforestation risk agribusiness. It won’t be a stretch to say that most of the employees would be unaware of where their retirement funds are invested in. As such knowledge of the same could draw a backlash on Amazon, as people today are increasingly advocating sustainability in many aspects of their life.

Bedding controversies through the pandemic

Amazon has been, in the past, called upon to improve its working conditions by its very own employees. Workers have urged Amazon to increase the bathroom break time, citing the heavy workload and expected high level of efficiency. In a stunning New York Times reveal, it came to light as to the tactics used by Amazon to curb unions. From trying to put its employees under surveillance to retaliating against employees who protested against supposed inadequate pandemic safety measures, the report shows the harsh behind-the-scenes reality of the behemoth company.

The issue of union has been going on for some time now and Amazon has a history of triumphing over unionization efforts. As recently as of April, so-called unhappy warehouse workers in Alabama voted against unionizing, giving Amazon yet another victory. Amazon had hired the country’s top anti-union lawyers to get the workers to vote against forming a union.

While it may be a victory for the company, it must not be lost on Amazon that Alphabet (parent company of Google) workers, in early 2021, formed a minority union comprising of independent contractors as well as high tech workers. There are only as many times that Amazon can curb union efforts. But eventually, there is a high chance that workers will unionize and make a stronger demand to the management.

Considering a company of the size of Amazon, it is natural that there will be some controversy lingering in the periphery. But for Amazon, which portrays itself as a sustainable leader, it will be in its best interest to address the union issues as well as take care of the 401(k) discrepancy. Failing which, it could be very well blamed for greenwashing the masses. The hard but necessary want of sustainability is that: You are either all in or you are unsustainable.

How EMAlpha can help

There is, undoubtedly, a profound ESG movement going all over the globe right now. From countries to asset managers, from millennial investors to the old school stalwarts, everybody’s counting on the ESG chip for a better future and a better return on investment. It is here that EMAlpha with its proprietary AI-ML techniques becomes useful for investors to gauge companies on the ESG front.

The changes in perception on the ESG track record of a company and reactions from institutional investors have become an important driver of stock prices, and especially in cases where the volatility is high, it matters even more. The EMAlpha sentiment and ESG scores have been reasonably accurate and there is a strong linkage between stock price performance and these scores. Asset managers are increasingly incorporating ESG factors into investment decisions.

The recent ExxonMobil vs Engine No 1 case shows that even the giants can’t get leeway if they default on ESG. As such, for Amazon, it is necessary to address these issues. While the ESG deliberation is appreciable, one can’t deny the challenges facing the ESG movement and asset managers are naturally worried. Be it greenwashing, lack of proper metrics, frameworks, or quality of ESG information, ESG still has plenty of hurdles to overcome for it to be a sustainable investment instrument. It is here that EMAlpha with its proprietary AI-ML techniques becomes a much-needed tool for investors.

References

- Making the grade- Amazon 2020 sustainability report shows progress towards environmental goals https://www.forbes.com/sites/patrickmoorhead/2021/06/30/making-the-gradeamazon-2020-sustainability-report-shows-progress-towards-environmental-goals/?sh=68febd1949e0 (Accessed on 31st July 2021)

- Amazon’s climate pledge gains crucial momentum https://www.forbes.com/sites/moorinsights/2020/06/30/amazons-climate-pledge-gains-crucial-momentum/?sh=5c1da17f2c82 (Accessed on 31st July 2021)

- Is your 401(k) plan using your retirement money to fund fossil fuel companies? https://www.fastcompany.com/90658947/is-your-401k-plan-using-your-retirement-money-to-fund-fossil-fuel-companies (Accessed on 31st July 2021)

- Amazon sustainability report: Carbon emissions rose 19% in 2020 as pandemic drove huge revenue https://www.geekwire.com/2021/amazon-sustainability-report-carbon-emissions-rose-19-2020-pandemic-drove-record-revenue/ (Accessed on 31st July 2021)

- Amazon sustainability 2020 report https://sustainability.aboutamazon.com/about/report-builder (Accessed on 31st July 2021)

- Amazon’s 401(k) https://investyourvalues.org/retirement-plans/amazon-com (Accessed on 31st July 2021)

- Jeff Bezos is finally ending secrecy over Amazon’s role in carbon emissions https://www.cnbc.com/2019/03/08/jeff-bezos-to-end-secrecy-over-amazons-role-in-carbon-emissions.html (Accessed on 31st July 2021)

- Amazon employees are invested in companies burning down the Amazon https://patch.com/michigan/farmington-mi/amazon-employees-are-invested (Accessed on 31st July 2021)

- Global Sustainability report: Amazon commits to sustainability https://thecsrjournal.in/sustainability-report-amazon-csr-corporate-social-responsibility/ (Accessed on 31st July 2021)

- ‘I am not a robot’: Amazon workers condemn unsafe, gruelling conditions at warehouse https://www.theguardian.com/technology/2020/feb/05/amazon-workers-protest-unsafe-grueling-conditions-warehouse (Accessed on 31st July 2021)

- Amazon warehouse workers in Alabama vote against unionizing https://fortune.com/2021/04/09/amazon-union-vote-alabama-warehouse-voted-against-forming-labor-union-update/ (Accessed on 31st July 2021)

- Amazon workers can still fight for better conditions even if union efforts fail. Here’s how. https://fortune.com/2021/04/13/amazon-workers-union-efforts-collective-power-working-conditions-activism/ (Accessed on 31st July 2021)

- Amazon fight with workers: ‘You’re a cog in the system’ https://www.bbc.com/news/business-55927024 (Accessed on 31st July 2021)

- How Amazon crushes unions https://www.nytimes.com/2021/03/16/technology/amazon-unions-virginia.html (Accessed on 31st July 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.