Allegro: The Historical IPO Summit and the Inevitable Descent

Synopsis: If you are in some European country, looking up stuff to buy online, you would most probably be browsing Amazon. Right! But if you happen to be in Poland, there’s a very good chance that Amazon won’t be your choice. Enters Allegro (www.allegro.pl): the leading e-commerce company in Poland and one of the most trusted Polish online marketplaces today. Allegro is 12x larger than the next online player in Poland and Poland’s current figure for e-commerce penetration stands at only 8%. Needless to say, a vast, untapped market awaits. The market’s anticipation of a public offering from Allegro lasted many years until final coming to fruition in September 2020. On 12th October 2020, the shares started trading at the Warsaw Stock Exchange in what was the largest IPO in Poland’s history. The bumper listing was expected as the demand from individual investors was at 6.6x that of availability. It was expected that those who missed out on getting the full subscription would be buying more shares immediately post listing, resulting in shares appreciating over the first few hours and days of trading. And, that’s exactly what happened. After listing at almost 50% premium to the issue price, the price was up 15% the next day and within the first few days, the stock price was almost 100 PLN. And as they say, once you reach the summit there’s only one way to go: down. Since flirting with the highs of 100 PLN, the stock price performance has been disappointing. We looked at the daily price movement and focused on the days when the movement was much higher than normal. EMAlpha AI has analysed information flow on Allegro very actively since the IPO talks started and the EMAlpha Research team tried to figure out as to what happened with the stock and why? On the basis of EMAlpha AI-ML research, the important events linked to significant stock price reactions include, a) The strong build-up for the IPO, b) Bumper listing because of the unmet demand, c) Oversubscription, the primary reason for excellent stock price performance initially, d) Markets looking for a reason to sell and using the results for the same, and, e) The Amazon Launch that spooked the market. With all these points to consider, how can EMAlpha’s analysis of unstructured data help Investors in these kinds of cases? In order to answer that, there are some interesting questions that need to be raised: a) Can the local news flow pick up issues efficiently? The build-up before the IPO was an indication that there would be strong demand resulting in good enough listing gains. But this was also going to be followed by underperformance, b) Can regular analysis of social media be used as an input before taking an investment decision? If yes, then how to do it in the most efficient manner? And it is here that EMAlpha’s analysis of unstructured data becomes a much-needed tool for investors. Events like Amazon’s entry impacting Allegro is a good example to put our point across.

Allegro, The Amazon of Poland

Allegro is one of the leading e-commerce trading companies in Poland. Allegro was founded in 1999 and today, the Allegro platform is one of the most trusted online Polish marketplaces. According to the report “E-commerce in Poland 2019” conducted by Gemius, 80% of respondents identified Allegro platform as their preferred brand in the e-commerce industry. There is massive opportunity for Allegro to grow because it is the market leader by a significant margin in an industry which is still underpenetrated.

As per OC&C analysis 2019, referred to in the company presentation from December 2020, Allegro is 12x larger than the next online player in Poland and the current figure for e-commerce penetration in Poland, stands at only 8%. As per the company, Allegro has more than 125,000 merchants and each month, about 20 million customers visit their platform, equivalent to 80% of all Internet users in Poland. Allegro is the largest non-food retailer by Gross Merchandise Value (GMV) in Poland, and it is also one of the world’s top ten e-commerce player.

Figure 1: Allegro Webpage

Source: https://allegro.pl/ (Accessed on 24th April 2021)

The Allegro IPO and Aftermath – Exuberance followed by Disappointment

For many years, the market was anticipating a public offering and finally, in September 2020, it came to fruition. Allegro’s shares started trading at the Warsaw Stock Exchange on 12th October 2020. It was the largest IPO in Poland’s history as the shares were listed at a price of 65 PLN, much higher than the price which was set at 43 PLN per share during subscription. The bumper listing was expected as the demand from individual investors exceeded the availability of shares. While 9.2 million shares were available, raising 400 million PLN, the demand was for 2.65 billion PLN worth of shares.

This meant that there was a 6.6x oversubscription, with investors who had sought 1,000 shares receiving only 151 shares each. So high was the demand that the exchange had to delay Allegro’s opening by 15 minutes to ensure that its systems could cope. It was expected that people who missed out on getting the full subscription would be vying for more shares immediately after listing and that this would lead to shares appreciating over the first few hours and days of trading. And, that’s exactly what happened. After listing at almost 50% premium to the issue price, the price was up 15% the next day and within the first few days, the stock price was almost 100 PLN. (Please note that the 52-wk high for the stock is 98.78). But since caressing the initial highs, the stock price performance has been disappointing, with its 52-wk low being 51.90.

Figure 2: Allegro Stock Price since IPO

Source: Google (Accessed on 26th April 2021)

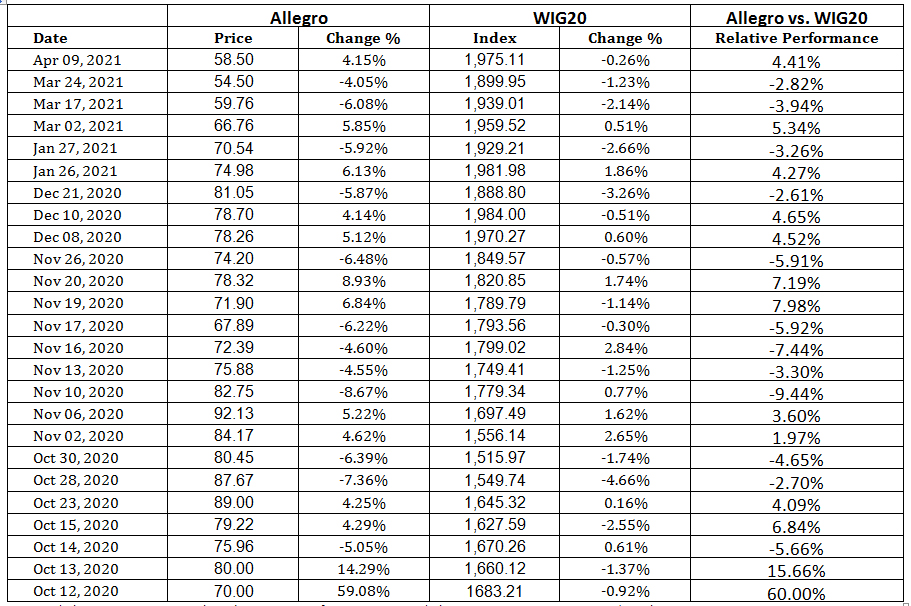

Apart from the bumper listing that Allegro commanded, we have also looked at its daily price movement and in the following table, we have listed the days when the movement was more than 4% in either direction. We have also looked at the relative price performance by comparing the stock price change with the change in WIG20, the most relevant and popular index at Warsaw Stock Exchange.

Table 1: Allegro Stock Price (More than 4% change) – Absolute and Relative Price Performance

Note: 1) The price comparison is based on issue price for Oct 12, 2020. 2) The price comparison is up to 16th April 2021.

Source: www.investing.com

The News flow Analysis by EMAlpha AI

EMAlpha AI has focussed on and analysed information flow on Allegro very actively since the time the IPO talks started doing the rounds and the EMAlpha Research team tried to figure out as to what happened with the stock and why? On the basis of EMAlpha AI-ML research, we have compiled the following important events and resulting stock price reaction;

August and September 2020 – The strong build-up for the IPO

- 13th August 2020 – Polish e-commerce giant Allegro’s IPO now expected in October: Link

- 14th September 2020 – Polish e-commerce giant Allegro files for IPO, seeks to raise €225 million at a reported $10 billion+ valuation: Link

- 22nd September 2020 – E-Commerce Site Allegro Ranks Among Poland’s Largest-Ever IPOs: Link

- 29th September 2020 – Allegro Raises About $2.3 Billion in Largest-Ever Warsaw IPO: Link

12th October 2020 – The Bumper listing because of the unmet demand

- 12th October 2020 – Poland’s Allegro Triumphs As Stock Takes Off In Public Debut: Link

13th October 2020 – Oversubscription primary reason for excellent stock price performance

- 13th October 2020 – Oversubscribed Allegro IPO a big win for the Warsaw Stock Exchange: Link

1st November 2020 – Positive coverage continues

- 1st November 2020 – Allegro IPO Boon for E-Commerce: Link

26th November 2020 – Markets looking for a reason to sell and used the results for the same

- 26th November 2020 – Allegro.eu records continued high growth of key financial and operating results in Q3 2020: Link

- 26th November 2020 – E-commerce group Allegro to pilot own parcel lockers, Polish media has speculated that Allegro plans to buy InPost: Link

21st December 2020 – Analysts like THG more than Allegro

- 21st December 2020 – E-Commerce Boom Propels THG, Allegro to Europe’s Benchmark Index, THG, Allegro will join Europe’s Stoxx 600 Index today, Analysts see more share price upside for THG than Allegro: Link

27th January 2021 – The Amazon Launch spooks the market

- 27th January 2021 – Amazon set to launch in Poland, shares in local Allegro fall: Link

Other Major News flow

- 1. 25th February 2021 – Allegro’s transactions-led move to take on dominant Prosus in Poland: Link

- 3rd March 2021 – Emerging Europe.Com Bolsters Defences As Amazon Enters Poland, Allegro has a 33% share of the e-commerce market, with Alibaba Group’s AliExpress at 3.6% and Amazon at 1.3%: Link

- 4th March 2021 – Record financial results of Allegro.eu in Q4 2020, clearly above the Group’s earlier expectations: Link

- 12th March 2021 – Amazon versus Allegro – the beginning of a battle for Polish e-commerce market: Link

- 16th March 2021 – Allegro Holders Sell up to $1.3 Billion Stake in Placement: Link

- 17th March 2021 – Investors line up to buy $1.2bn Allegro block, Z4.59bn block in the Polish e-commerce company, met with strong demand: Link

- 24th March 2021 – Allegro.eu SA (WSE:ALE) Is About To Turn The Corner: Link

Has the stock found its bottom?

The news flow analysis suggests that the developments and the saga that has unfolded over the last six months in the Allegro stock have several interesting components:

- A lot of investor expectation built up was after the oversubscription and that led to irrational exuberance and unrealistic ROI (return on investment) assumptions.

- The market was disappointed with the results in November 2020 and March 2021. The results as such were not bad but the market was not content. A clear case of expectations and delivery mismatch.

- The news on entry of Amazon was a trigger for a sell-off. While the market was reasonably convinced about strong fundamentals of Allegro, the entry of a strong, global competitor with deep pockets was a concern.

- The stock is still more than 30% up from its issue price and the management can’t be blamed for portraying a wrong picture on its business prospects. We would even say that considering the circumstances over the last twelve months, the company has done very well in its business.

- The variance between post listing performance of a couple of weeks and then the stock price trajectory from November onwards is a case of disconnect between the short term speculators and long-term investors.

We think the PLN 50 level zone is not a bottom and the Allegro stock is still exploring the floor. Any major dip in financial performance, trajectory of Covid-19 cases and economic impact, traction for Amazon in Poland and broader market sentiment could be the major factors over the next six months. But one thing is clear: the IPO pricing was fair and there was enough that the management left on the table for those investors, lucky enough to get an allocation.

How EMAlpha’s analysis of Unstructured data can help Investors

There are interesting titbits on how the stock price movement in Allegro was linked to the local developments and how this can be incorporated into investment decisions:

- Can the local news flow collection pick up issues efficiently? The build-up before the IPO was an indication that there would be strong demand resulting in good enough listing gains. And that it would also be followed by underperformance.

- Can regular analysis of social media be used as an input before taking an investment decision? If yes, then how to do it in the most efficient manner?

It is here that EMAlpha’s analysis of unstructured data becomes a much-needed tool for investors. Events like impact of Amazon’s entry on Allegro are a good example of utilisation of EMAlpha’s analysis.

The following are four major components wherein EMAlpha can aid investors.

- The local language along with English news analysis can be tracked for companies experiencing increased competition. Considering the sensitivities involved, these issues could escalate quickly, thus impacting the stock price performance.

- The unstructured data analysis in other geographies can also be used to assess the potential impact on some of the larger companies. Case in point being Amazon in Poland which is very similar to the impact it had on Flipkart in India.

- Predicting the behaviour of large institutional investors can help forecast the stock price impact. This is one of the key features of EMAlpha product as it combines technology with domain expertise. There are cases when fears are unfounded and that creates opportunity.

- The social media analysis provided by EMAlpha is useful in picking up the signals when the views change for retail investors as compared to the stand of institutional investors. In many cases across markets, this plays a crucial role.

References

- https://allegro.pl/ (Accessed on 11th April 2021)

- https://about.allegro.eu/who-we-are/at-a-glance (Accessed on 11th April 2021)

- https://ecommercegermany.com/blog/allegro-all-you-need-to-know-about-the-best-polish-online-marketplace (Accessed on 11th April 2021)

- https://about.allegro.eu/static-files/224d8822-6552-4258-86d9-71fd066c95fd (Accessed on 12th April 2021)

- https://about.allegro.eu/static-files/e2ad6532-a96a-4991-9827-0c9aeb837be9 (Accessed on 13th April 2021)

- https://www.thefirstnews.com/article/allegrow-e-trader-giant-allegro-becomes-largest-ipo-in-polands-history-16581# (Accessed on 13th April 2021)

EMAlpha Products and Services

In most Emerging Markets, information discovery is a major challenge. For example, even if global investors do show interest, how do they solve the problem of timely access to information? The world’s largest capital allocators hold USD 60 trillion and they include GPIF (Japan), GPF (Norway), ADIA (Abu Dhabi), GIC (Singapore) etc. However, only 10% of the capital gets allocated to EMs and ~90% goes to G10. The big hurdle for EMs is: Foreign investors cannot access relevant local information in a timely fashion.

Most market participants and investors from across the world realise that the low rates in G10 makes EM attractive for investors. But, a) Information access is usually a cost and time intensive process for investors, and b) In many EMs, language is a big barrier and because of multiple regional languages, there is a significant delay before news makes it to the mainstream English language. To address these issues, you need solutions like, a) Real time news collection from multiple languages and, b) Instantaneous machine translation and text analytics leading to actionable recommendations for investors.

There are further challenges such as ensuring that companies behave responsibly and that they adopt sustainable business practices. There is a need to ensure that the investors are contributing towards making the world a better place by making investment decisions which reward responsible behaviour of companies. Case in point, ESG (Environmental, Social & Governance) which is increasingly being used as a filter for investment decisions. There are other issues as well such as which data to use and a lack of a standardized framework for evaluation.

Some of these issues are too important to be postponed to a later date and it is in this regard that EMAlpha is making its contribution. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

EMAlpha also has solutions for Multilingual data collection and real time targeted information which are based on proprietary processes to collect relevant data across multiple markets. The coverage expands across emerging market equity, currencies and commodities and the work has also been very successful in testing the signals in some key markets for live trading strategies. This is a continuous cycle and a virtuous loop that allows for iterative improvement through AI-human feedback.

With developments in AI and technology in areas like NLP, there are considerable new possibilities to bridge the gap in information between Emerging Markets and the more Developed Markets. This is an area which is turning out to be very exciting because some of the tools mentioned were not available even a couple of years ago. This implies that the evolution in the field will only get faster as time goes on. While the Emerging Markets and the Capital Flow Conundrum is a complex one, there is now much more hope and optimism that with the usage of technology, things will only get better.

At EMAlpha, the ESG team is doing further research on why some issues like Social get more prominence as compared to others like Environmental or Governance issues. To look at specific cases in the context of ESG is a very intense yet interesting exercise and this has been an incredible learning experience for the EMAlpha Research team. The data, information and ratings are a humongous challenge for ESG and it takes time to reach to the depth of the issues as the field is evolving very quickly.

EMAlpha is making a solid contribution in tackling these challenges. EMAlpha has solutions for ESG which are practical, user friendly and although not too simplistic yet easy to use. EMAlpha has developed a Flexible ESG Framework Management System which is a proprietary technology that makes ESG scores framework agnostic, thus allowing for quick adaptation. In addition, the users decide what matters to them and the EMAlpha system does a classification into E, S, G and more granular categories.

We strongly believe that the entire ESG ecosystem requires multiple stakeholders to pull in the right direction in order to make it operational and that will be the most critically determining factor for ESG’s success in making the corporate responsibility actually work. Most importantly, the investors should view ‘E’, ‘S’ and ‘G’ individually and should not confound issues when it comes to the comprehensive ESG evaluation. It is important to understand the right reasons behind ESG investing because this bias could hurt their investment decision making and portfolio performance.

Research Team

EM Alpha LLC

For more EMAlpha Insights on Emerging Markets, please visit https://emalpha.com/insights/. To know how you can use EMAlpha’s unstructured data and ESG (Environmental, Social and Governance) solutions for better investment decisions, please email us at [email protected].

About EMAlpha:

EMAlpha, a data analytics and investment management firm focused on making Emerging Markets (EMs) more accessible to global investors and unlocking EM investing using machines. EMAlpha’s focus is on Unstructured Data as the EMs are particularly susceptible to swings in news flow driven investor sentiment. EMAlpha works on information discovery and ESG solutions for Investors in Emerging Markets, using AI and NLP tech. Our mission is: “To help increase capital flow, in terms of FDI and FPI, to Emerging Markets by lowering information barriers using AI/NLP”. EMAlpha Products help achieve both alpha and ESG solutions and the idea is to help asset allocators, asset managers, banks and hedge funds along with companies with cost and time efficient access to relevant information. We use thoroughly researched machine learning tools to track evolving sentiment specifically towards EMs and EMAlpha pays special attention to the timely measurement of news sentiment for investors as these markets can be finicky and sentiment can be capricious. Our team members have deep expertise in research and trading in multiple Emerging Markets and EMAlpha’s collaborative approach to combining machine learning tools with a fundamental approach help us understand these markets better.

Disclaimer:

This insight article is provided for informational purposes only. The information included in this article should not be used as the sole basis for making a decision as to whether or not to invest in any particular security. In making an investment decision, you must rely on your own examination of the securities and the terms of the offering. You should not construe the contents of these materials as legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. The information included in this article is based upon information reasonably available to EMAlpha as of the date noted herein. Furthermore, the information included in this site has been obtained from sources that EMAlpha believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. Information contained in this insight article does not purport to be complete, nor does EMAlpha undertake any duty to update the information set forth herein. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained herein, by EMAlpha, its members, partners or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of certain investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting the operations of the companies identified herein, any or all of which could cause actual results to differ materially from projected results.